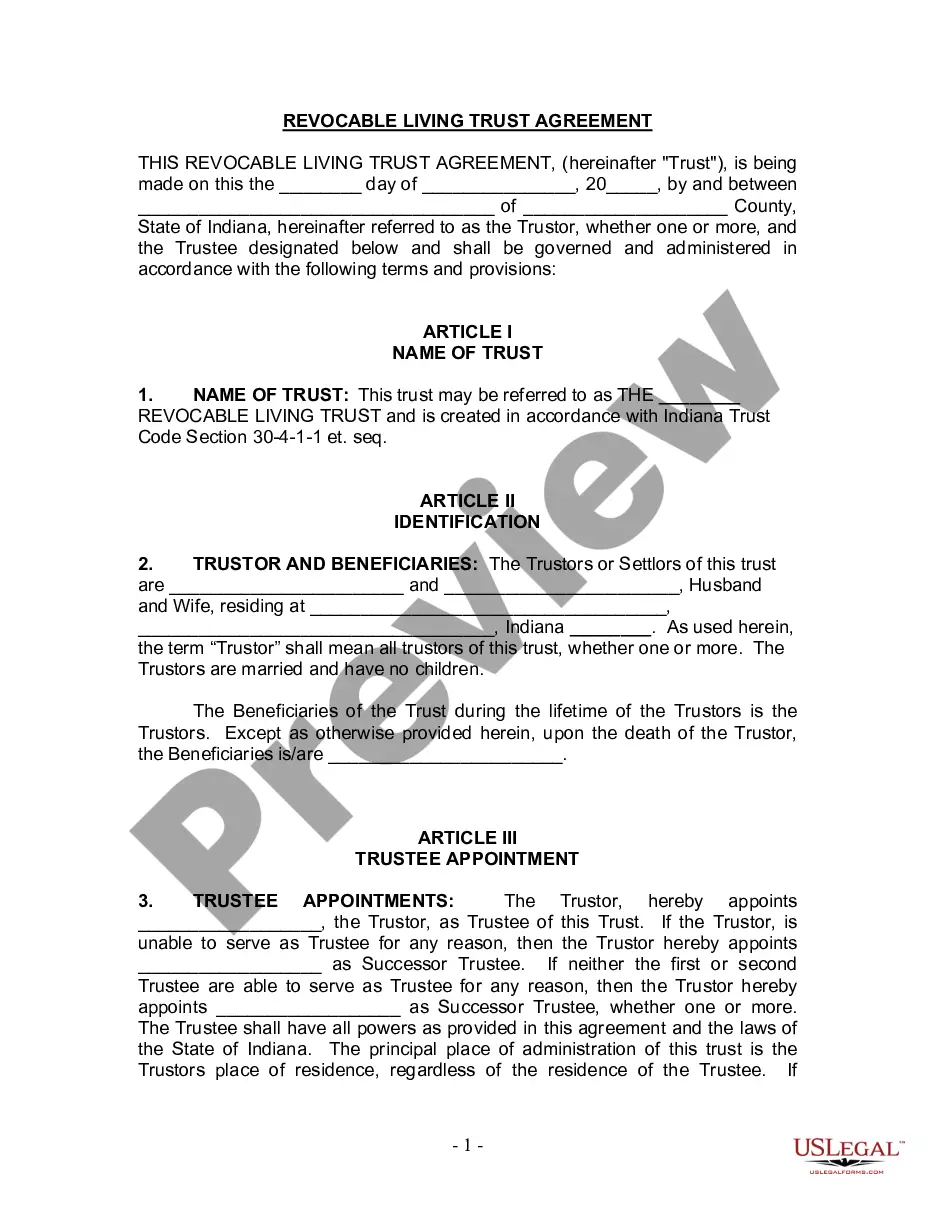

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Fort Wayne Indiana Living Trust for Husband and Wife with No Children

Description

How to fill out Indiana Living Trust For Husband And Wife With No Children?

Utilize the US Legal Forms and gain instant access to any form template you need.

Our helpful website, featuring thousands of document templates, simplifies the process of locating and acquiring nearly any document sample you seek.

You can download, complete, and validate the Fort Wayne Indiana Living Trust for Husband and Wife with No Children swiftly, rather than spending hours browsing the Internet for a suitable template.

Employing our collection is an excellent way to enhance the security of your document submissions. Our qualified attorneys consistently review all documents to ensure they are pertinent to a specific state and adhere to current laws and regulations.

Initiate the downloading procedure. Click Buy Now and select your preferred pricing plan. Then, register for an account and complete your order using a credit card or PayPal.

Export the document. Choose the format to obtain the Fort Wayne Indiana Living Trust for Husband and Wife with No Children and modify and fill it, or sign it according to your requirements.

- How can you obtain the Fort Wayne Indiana Living Trust for Husband and Wife with No Children.

- If you possess a subscription, simply sign in to your account. The Download option will be available for all the documents you review.

- Additionally, you can access all previously saved files from the My documents section.

- If you haven’t created an account yet, follow the steps provided below.

- Access the page containing the form you need. Confirm that it is the template you were looking for: check its title and description, and use the Preview feature if it’s available. Otherwise, use the Search bar to find the suitable one.

Form popularity

FAQ

To set up a Fort Wayne Indiana Living Trust for Husband and Wife with No Children, begin by deciding on the trust's terms and the assets you want to include. Next, draft the trust document, ensuring it meets Indiana's legal requirements. Consider using a reliable platform like uslegalforms, which can guide you through the process and provide necessary templates. Finally, fund the living trust by transferring your assets into it, while consulting with an attorney if you have questions or specific needs.

Yes, you can establish a trust in your own name under a Fort Wayne Indiana Living Trust for Husband and Wife with No Children framework. The trust can be revocable, allowing you to maintain control over the assets during your lifetime. Keep in mind that proper management and documentation are crucial for the trust's effectiveness in estate planning.

While it is possible to draft your own trust in Indiana, it's advisable to use a professional service like uslegalforms to ensure accuracy. Creating a Fort Wayne Indiana Living Trust for Husband and Wife with No Children involves specific legal language and requirements that must be met. Utilizing a reliable platform can help guide you through the process, reducing the risk of errors and ensuring your trust is enforceable.

While this question targets parents, it's relevant for couples considering a Fort Wayne Indiana Living Trust for Husband and Wife with No Children. One common mistake is not reviewing and updating the trust as circumstances change, such as marriage or asset accumulation. Failing to clearly define beneficiaries can also lead to confusion and disputes later, undermining the trust's purpose.

To establish a Fort Wayne Indiana Living Trust for Husband and Wife with No Children, you must be of legal age and mentally competent. The trust document should clearly state its purpose, designate a trustee, and outline the distribution of assets. Additionally, Indiana law requires that the trust be signed in front of a notary to ensure its validity.

Setting up a Fort Wayne Indiana Living Trust for Husband and Wife with No Children typically costs between $1,000 and $3,000, depending on complexity. The fees may vary based on the attorney or service you choose to work with. It’s wise to consider your specific needs, as a more straightforward trust may incur lower costs. Remember, investing in a solid trust setup can provide peace of mind for your future.

A husband and wife may consider separate trusts for various reasons, such as protecting individual assets or addressing specific financial goals and responsibilities. Separate trusts can provide greater flexibility in terms of asset management, especially if one spouse has significant debts or wishes to maintain control of certain assets. Evaluating your shared and individual needs will guide your decision toward either joint or separate trusts.

The best option for a married couple often is a comprehensive Fort Wayne Indiana Living Trust for Husband and Wife with No Children. This type of trust allows both spouses to manage assets collectively while addressing their unique needs effectively. When considering your choices, it's essential to assess factors such as asset distribution and tax implications for a personalized trust solution.

To place your house in a trust in Indiana, you typically need to create the Fort Wayne Indiana Living Trust for Husband and Wife with No Children and then prepare a deed transferring ownership of the property to the trust. This process often involves filing the deed with the county recorder's office. For guidance on creating and managing your trust, you may find uslegalforms helpful, as they provide resources tailored to your needs.

While many couples benefit from a joint Fort Wayne Indiana Living Trust for Husband and Wife with No Children, separate trusts may be advantageous in specific situations. Separate trusts can help address individual financial concerns or specific assets that should remain controlled by one spouse. By evaluating your unique circumstances, you can determine the best approach to trust management together.