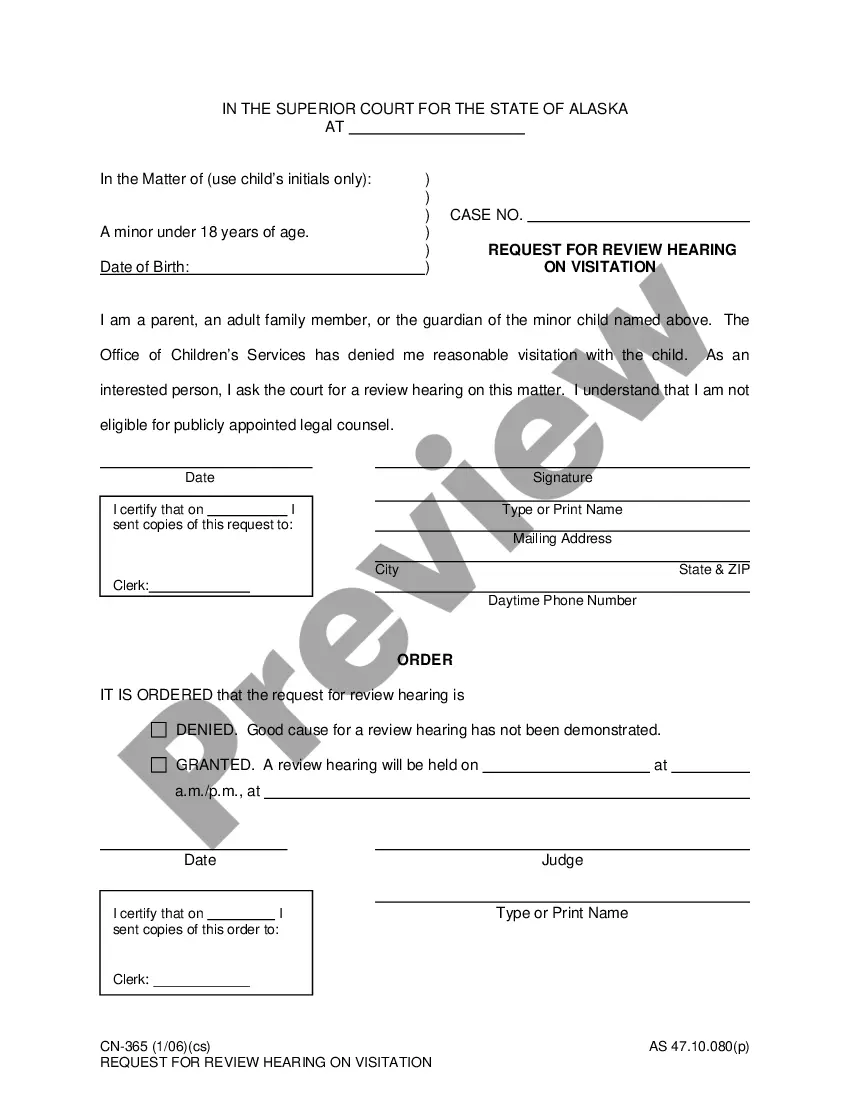

This is a Dissolution Package to Dissolve a Corporation in the State of Indiana. This package contains all forms necessary in the dissolution of the corporation including, step by step instructions, forms and other information.

Indianapolis Indiana Dissolution Package to Dissolve Corporation

Description

How to fill out Indiana Dissolution Package To Dissolve Corporation?

If you have previously utilized our service, Log In to your account and download the Indianapolis Indiana Dissolution Package for Dissolving Corporation to your device by clicking the Download button. Ensure your subscription is active. If it isn’t, renew it as per your payment plan.

If this is your initial engagement with our service, follow these straightforward steps to acquire your document.

You have continuous access to all the documents you have acquired: you can access them in your profile under the My documents section whenever you need to reuse them. Take advantage of the US Legal Forms service to swiftly find and download any template for your personal or professional requirements!

- Confirm you have found the correct document. Browse through the description and use the Preview feature, if available, to verify if it suits your requirements. If it doesn’t align with your needs, use the Search tab above to obtain the right one.

- Acquire the template. Click the Buy Now button and select either a monthly or yearly subscription plan.

- Create an account and process your payment. Input your credit card information or opt for the PayPal method to finalize the transaction.

- Download your Indianapolis Indiana Dissolution Package for Dissolving Corporation. Choose the file type for your document and save it to your device.

- Complete your form. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Voluntary dissolution is generally a two-step process: Obtaining written consent from the Tax Department1 (which will check to see if the corporation owes back taxes and if it has filed all its returns)2; and. Filing paperwork with the New York Department of State, including a Certificate of Dissolution.

A corporation seeking voluntary dissolution shall submit a verified request signed by its duly authorized representatives containing the corporate name, SEC registration number, principal office, a statement requesting for the dissolution, and reason for the dissolution.

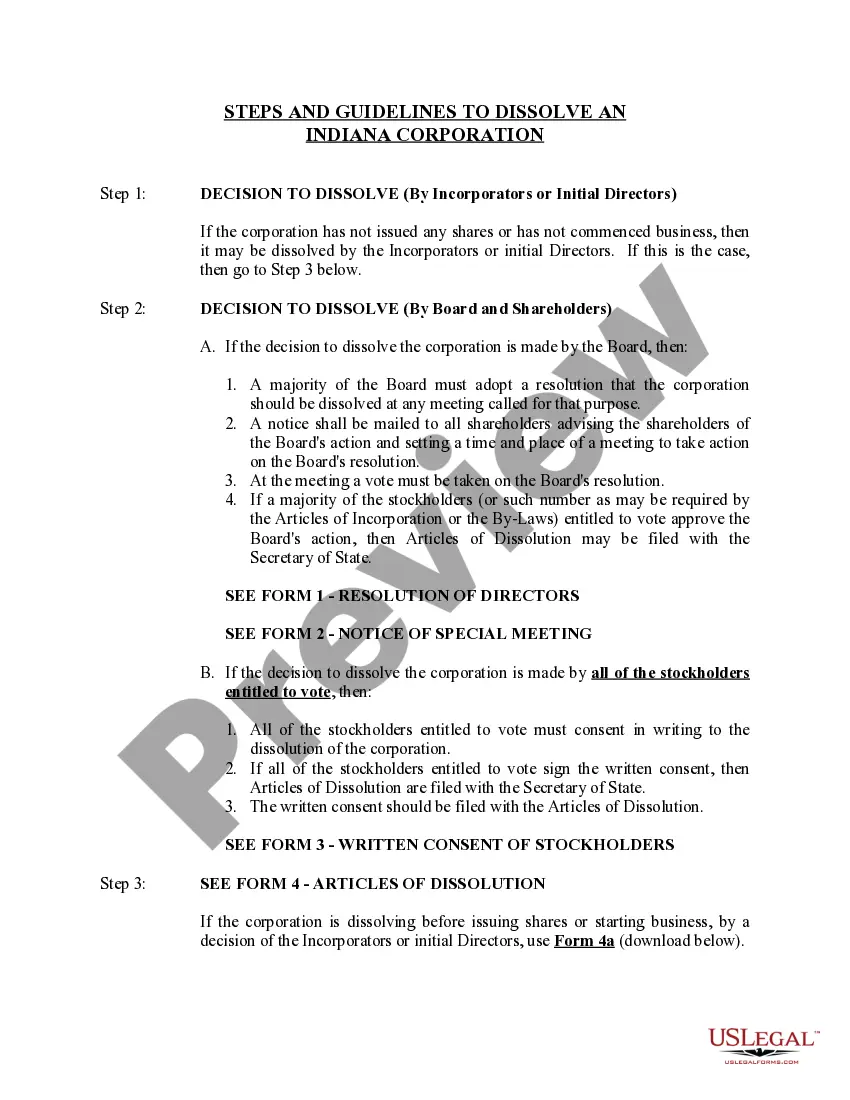

In most cases, a simple majority vote is sufficient to pass the resolution for corporate dissolution. The Board needs to develop a plan of dissolution once the shareholders approve the dissolution.

Modes of dissolution A corporation may be dissolved voluntarily or involuntarily. Voluntary dissolution could be done by (1) shortening the corporate term, (2) filing a request for dissolution (where no creditors are affected), and (3) filing a petition for dissolution (where creditors are affected).

A corporate dissolution may be ordered by the Court of Common Pleas to protect shareholders' investments. This may happen when three conditions exist: The directors of the company have engaged in illegal or fraudulent activities. Assets of the company have been spent unwisely or otherwise wasted.

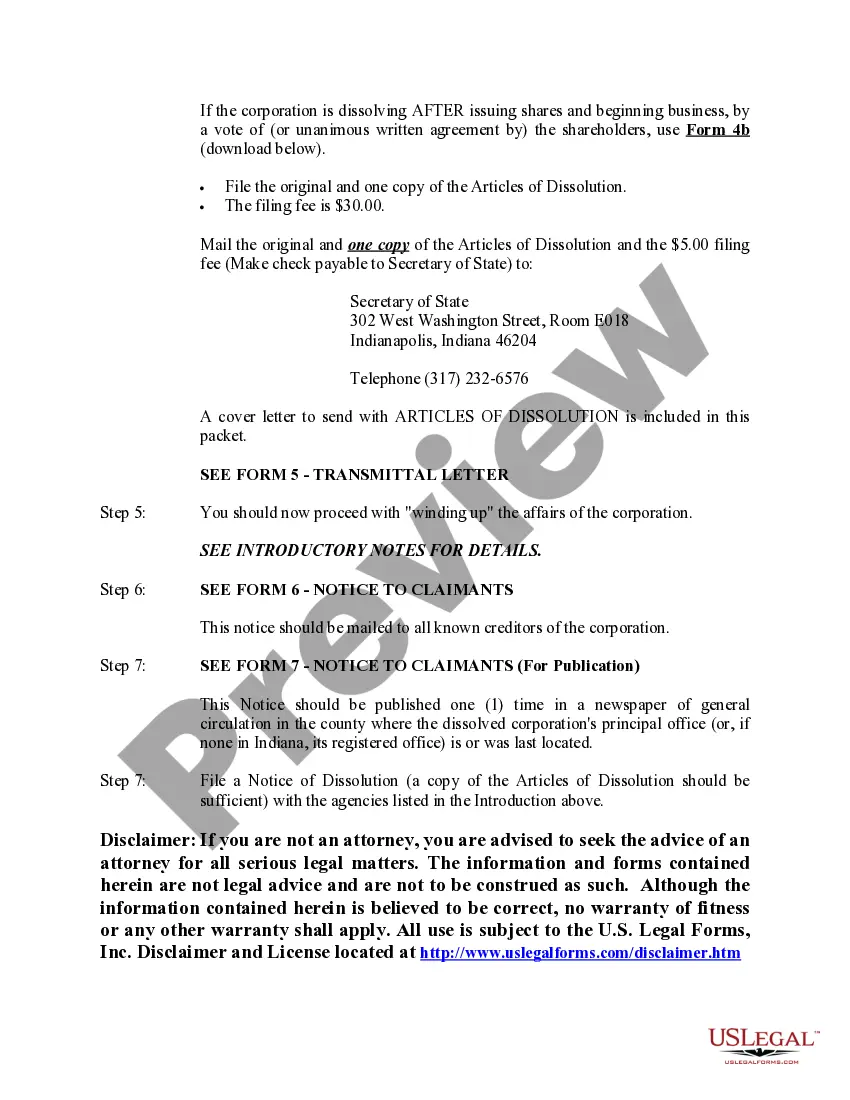

There is a $30 filing fee to dissolve your Limited Liability Company in Indiana. The fee is only $20 if you file the dissolution online. There is a small additional credit card fee for online filing. Your Indiana registered agent may be able to help with the dissolution process.

How to dissolve a business in 7 steps Step 1: Get approval of the owners of the corporation or LLC.Step 2: File the Certificate of Dissolution with the state.Step 3: File federal, state, and local tax forms.Step 4: Wind up affairs.Step 5: Notify creditors your business is closing.Step 6: Settle creditors' claims.

To formally dissolve, businesses must file with the Indiana Secretary of State first. Please note that closing your business in INBiz will only end your obligations to the Secretary of State's office. You are responsible for properly closing the business with all other agencies in which your business is registered.