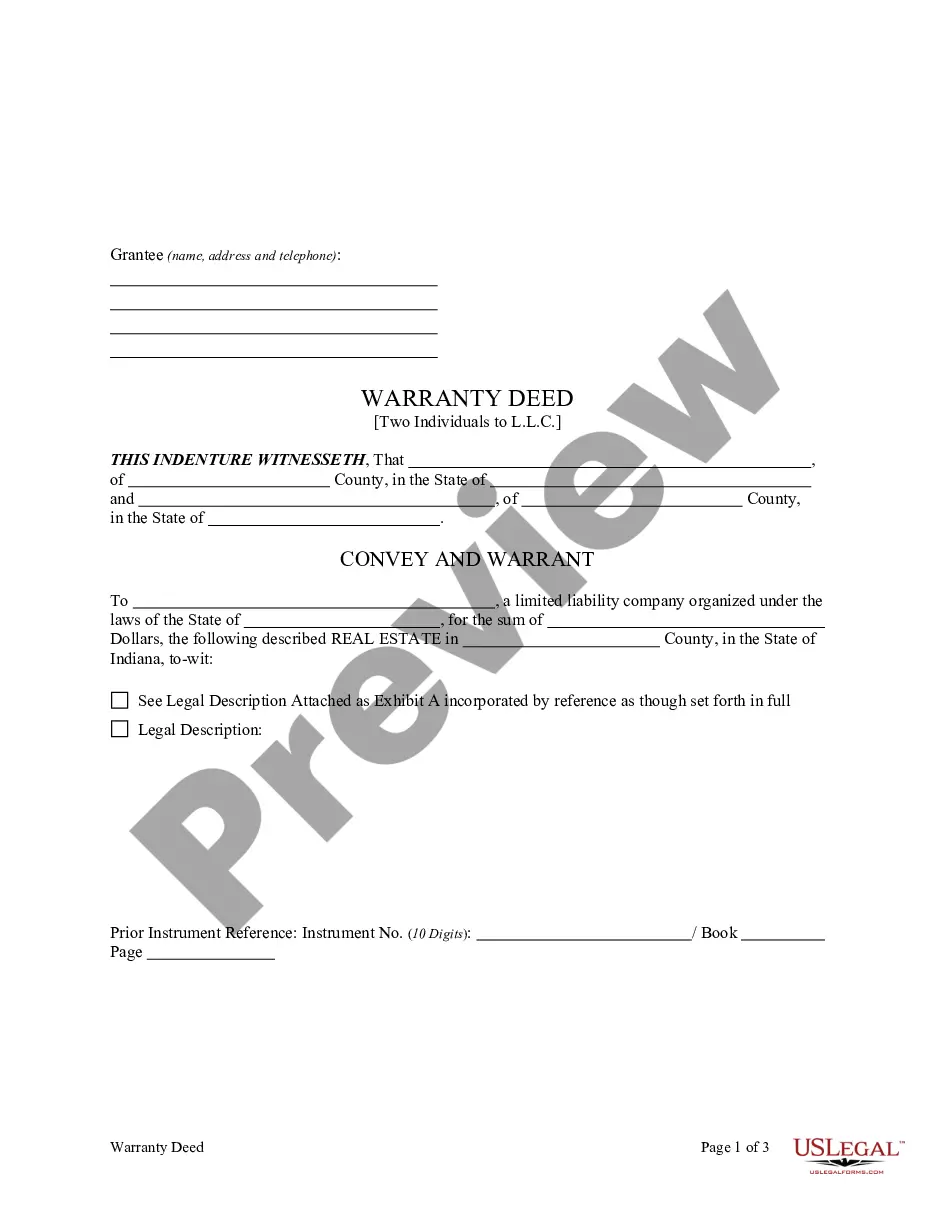

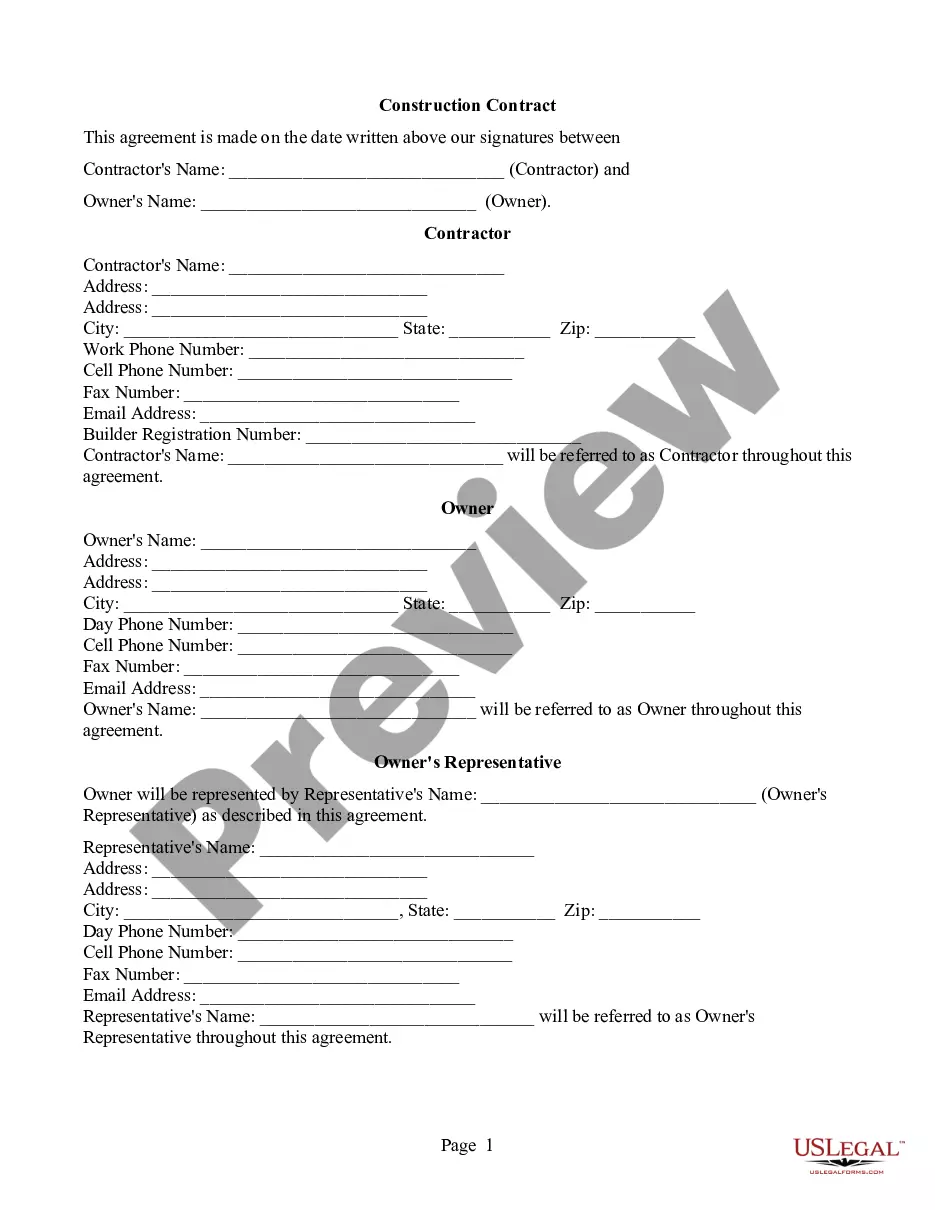

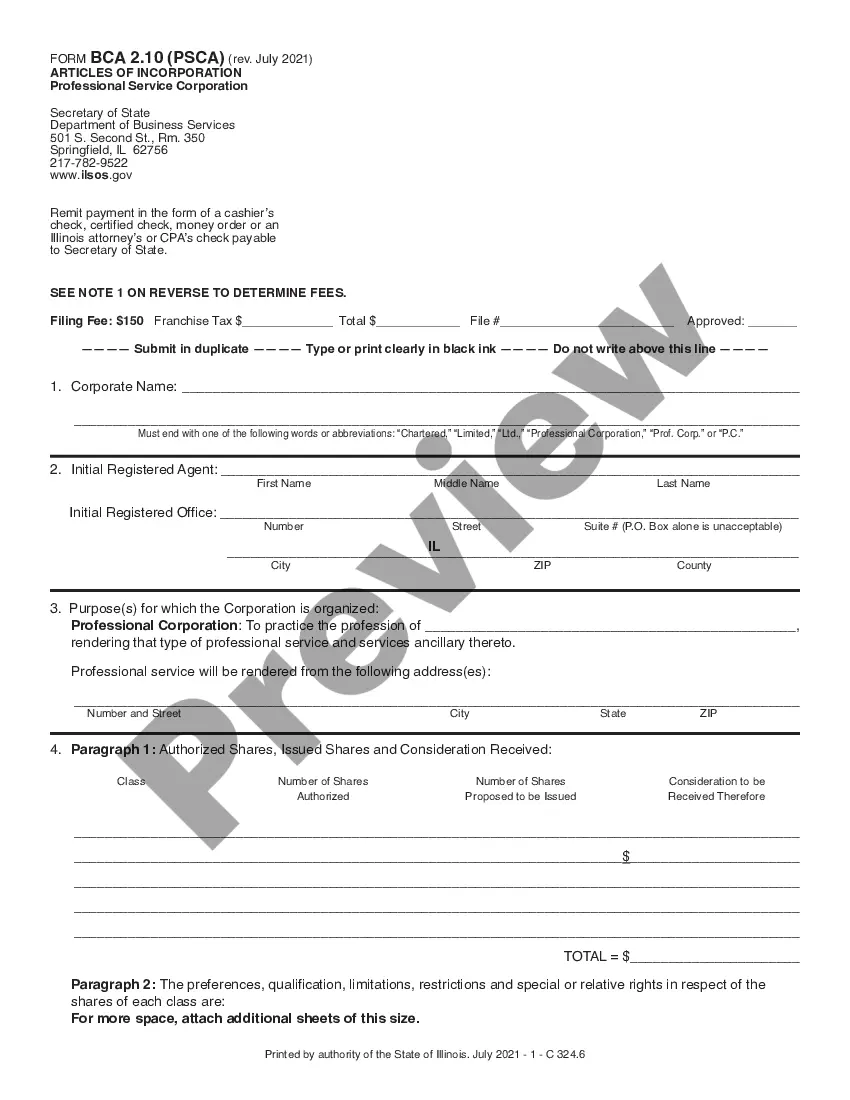

This form is a Warranty Deed where the grantor is an unmarried individual and the grantee is a limited liability company. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

Indianapolis Indiana Warranty Deed from Individual to LLC

Description

How to fill out Indiana Warranty Deed From Individual To LLC?

If you have previously used our service, Log In to your account and download the Indianapolis Indiana Warranty Deed from Individual to LLC onto your device by clicking the Download button. Ensure your subscription is current; otherwise, renew it in line with your payment plan.

If this is your inaugural interaction with our service, follow these straightforward steps to acquire your file.

You retain perpetual access to all documents you have acquired: they can be found in your profile under the My documents section whenever you wish to reuse them. Utilize the US Legal Forms service to efficiently find and save any template for your personal or business requirements!

- Confirm you’ve found an appropriate document. Review the description and utilize the Preview feature, if available, to ensure it satisfies your needs. If it doesn’t suit you, use the Search tab above to find the correct one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Register for an account and make a payment. Provide your credit card information or use the PayPal option to finalize the transaction.

- Receive your Indianapolis Indiana Warranty Deed from Individual to LLC. Select the file format for your document and save it to your device.

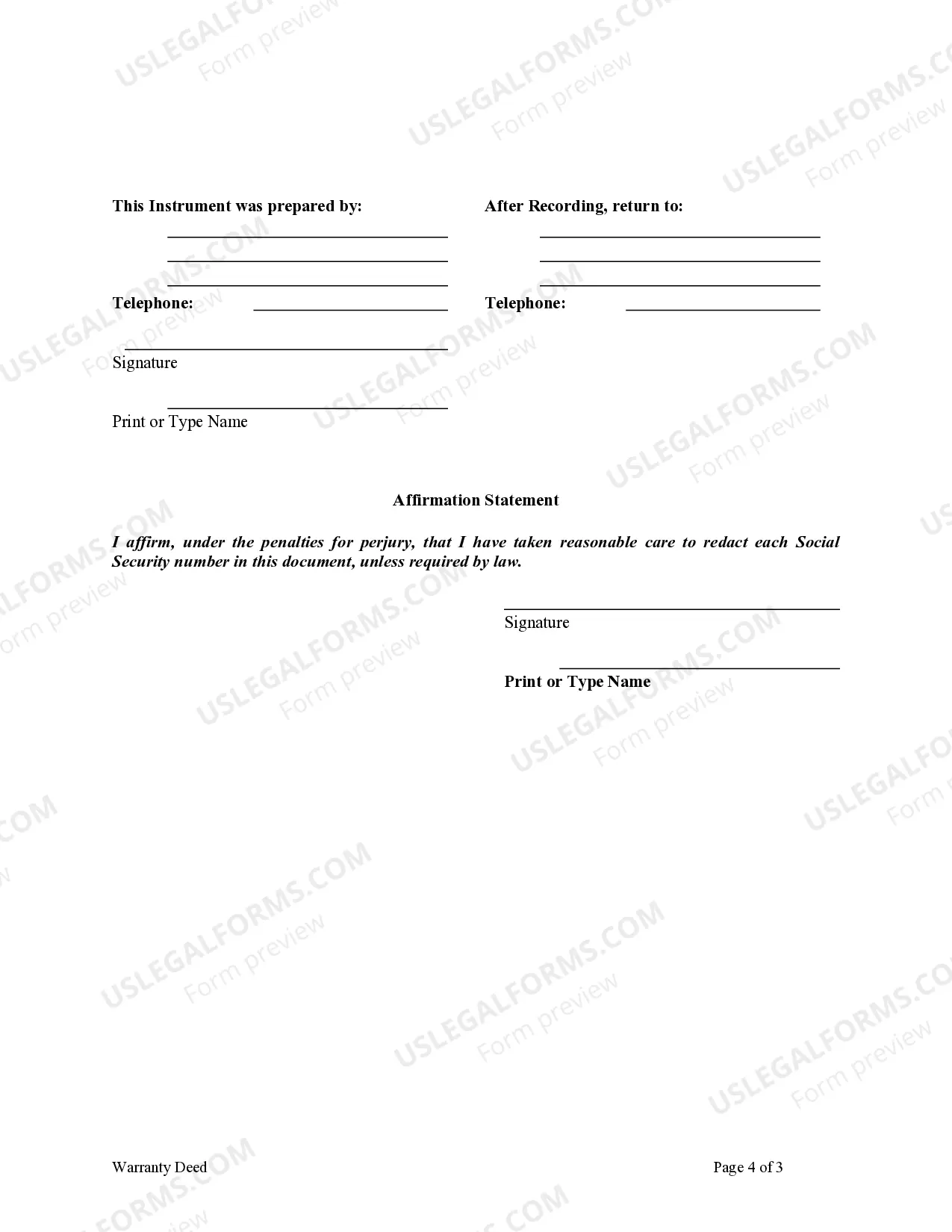

- Complete your form. Print it out or use professional online editors to fill it out and electronically sign it.

Form popularity

FAQ

A special warranty deed guarantees two things: The grantor owns, and can sell, the property; and the property incurred no encumbrances during his ownership. A special warranty deed is more limited than the more common general warranty deed, which covers the entire history of the property.

Updated . An Indiana special warranty deed is similar to a warranty deed in that it guarantees a seller has a title to sell to a buyer, though it only provides a limited guarantee. The guarantee is limited to the grantor's ownership of the property and not any previous ownership.

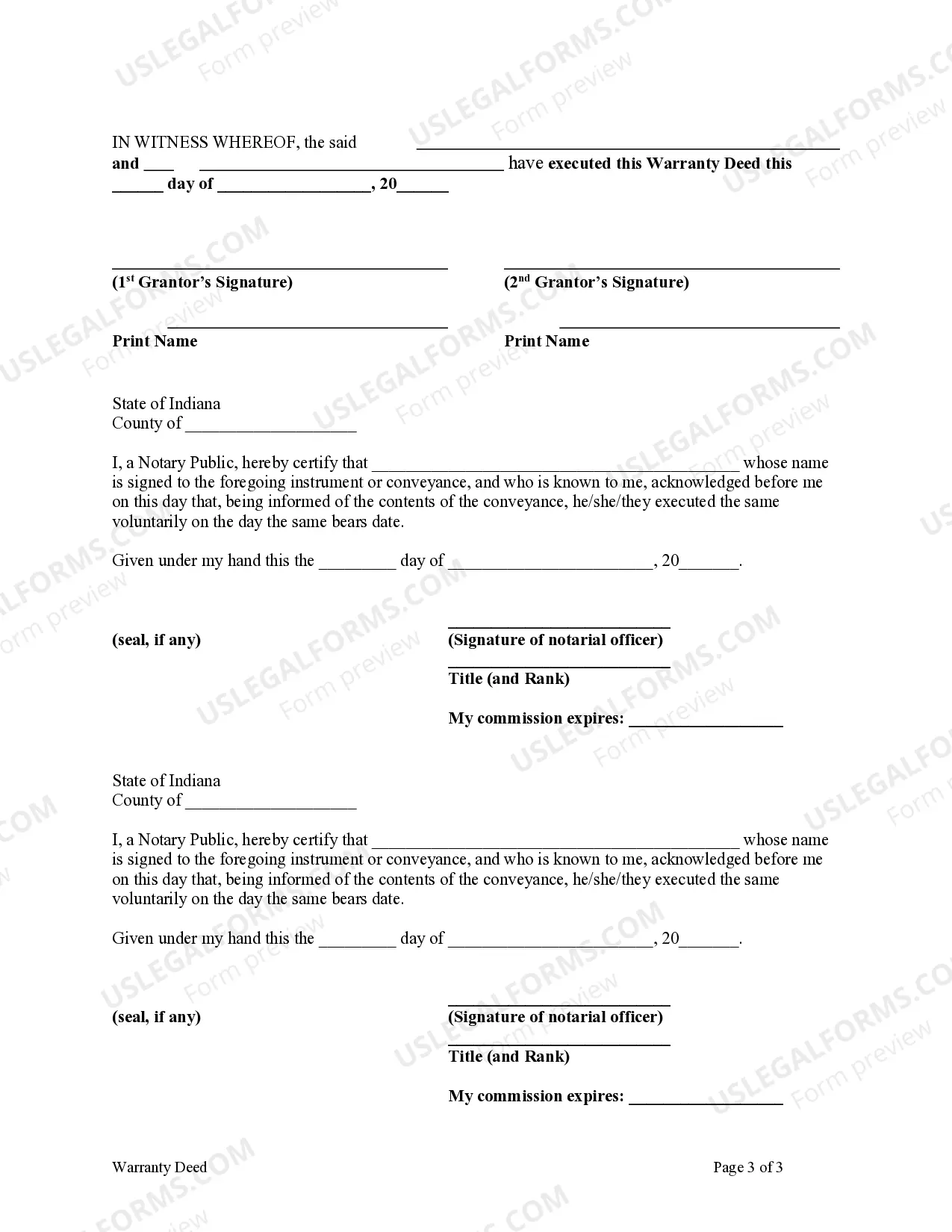

Signing (IC § 32-21-2-3) ? All deed must be executed by one of the following: judge, clerk of a court of record, county auditor, county recorder, notary public, mayor of a city in Indiana or any other state, commissioner appointed in a state other than Indiana by the governor of Indiana, clerk of the city county

The buyer, or grantee, of a property benefits the most from obtaining a warranty deed. Through the recording of a warranty deed, the seller is providing assurances to the buyer should anything unexpected happen.

It usually takes four to six weeks to complete the legal processes involved in the transfer of title.

All parties just need to sign the transfer deed (TR1 form) and file it with the land registry. This needs to be accompanied by the land registry's AP1 form, and if the value of the transaction amounts to more than £40,000, then a stamp duty land tax certificate may also be required.

Signing (IC § 32-21-2-3) ? All deed must be executed by one of the following: judge, clerk of a court of record, county auditor, county recorder, notary public, mayor of a city in Indiana or any other state, commissioner appointed in a state other than Indiana by the governor of Indiana, clerk of the city county

Transferring Indiana real estate usually involves four steps: Locate the prior deed to the property.Create the new deed.Sign the new deed.Record the original deed.

Submit your document Marion County Assessor: $10.00 per parcel per document; AND $20.00 for each Sales Disclosure, if required. Marion County Recorder: $35.00 per document. The Assessor is responsible for transferring property in Marion County. The transfer stamp from their office is required before it can be recorded.