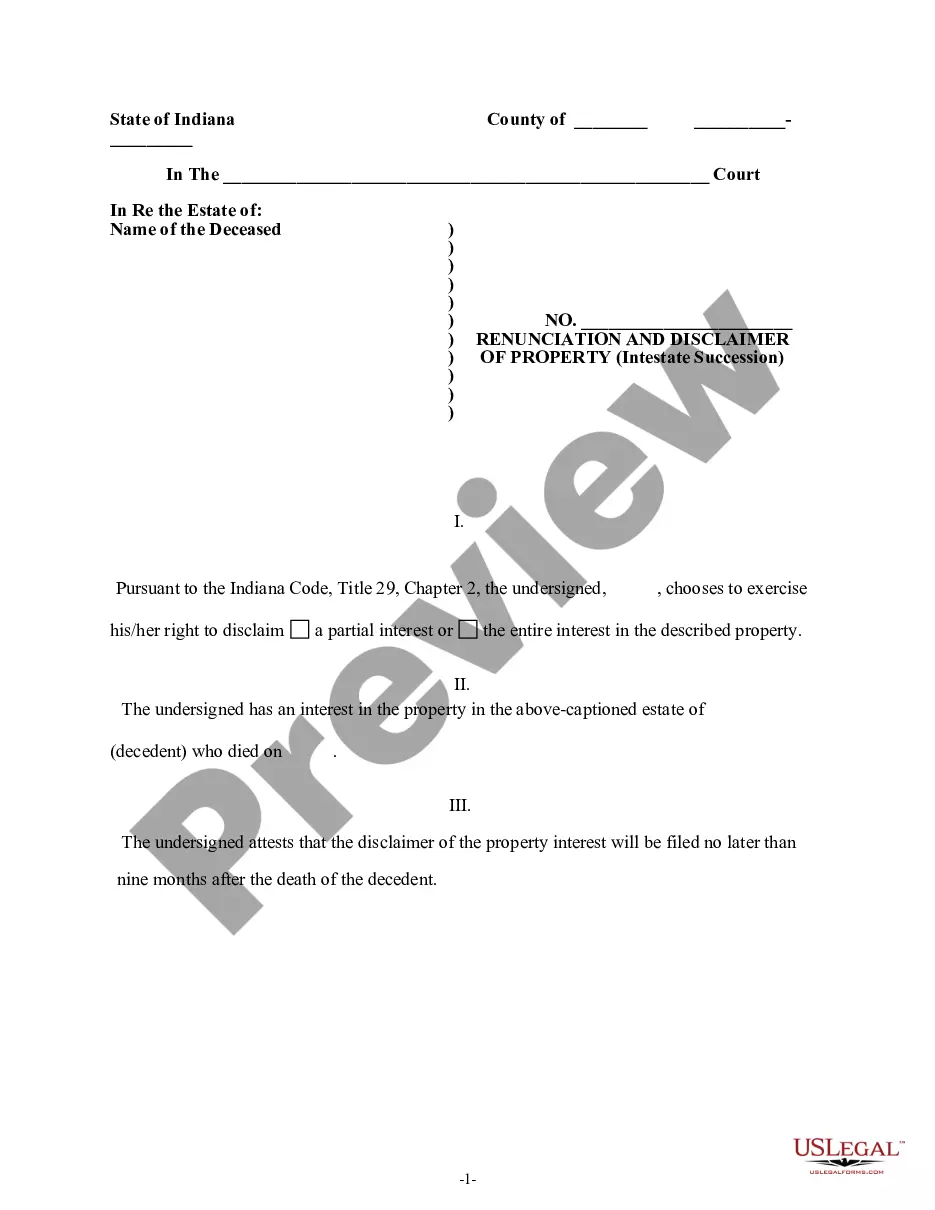

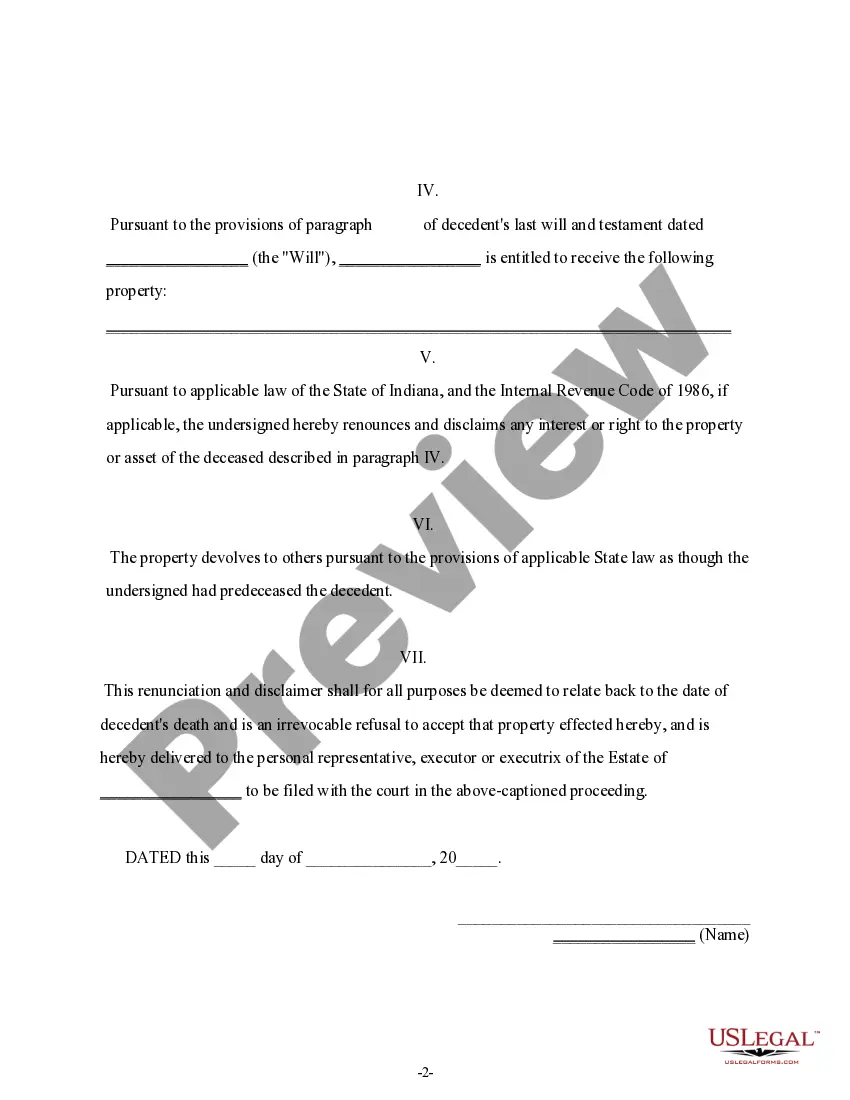

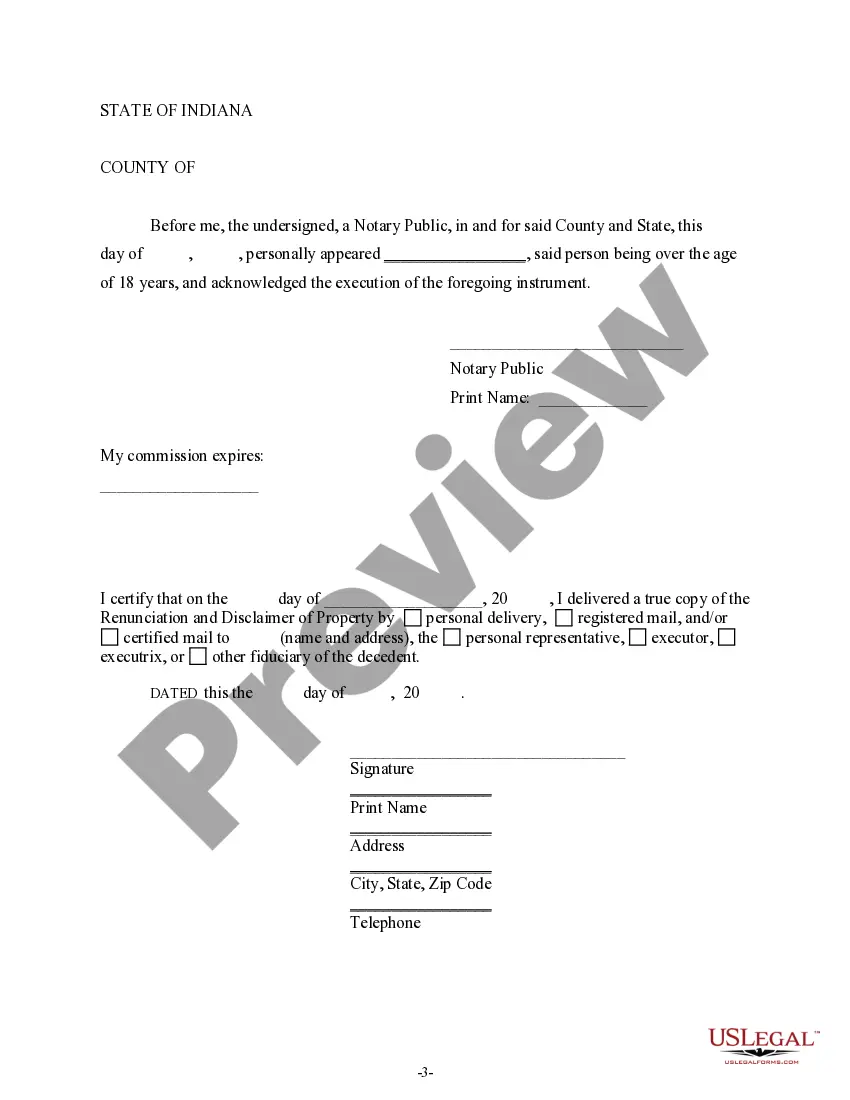

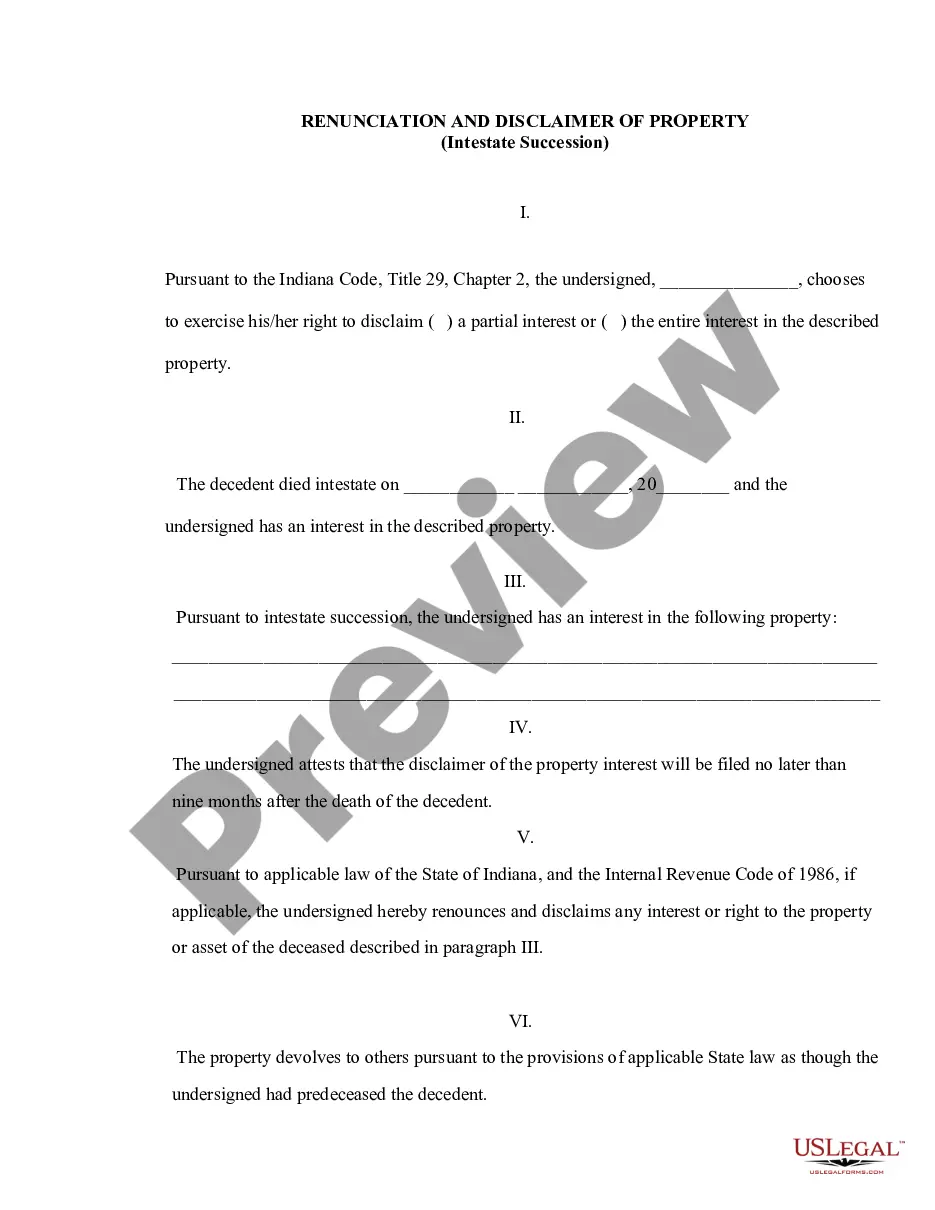

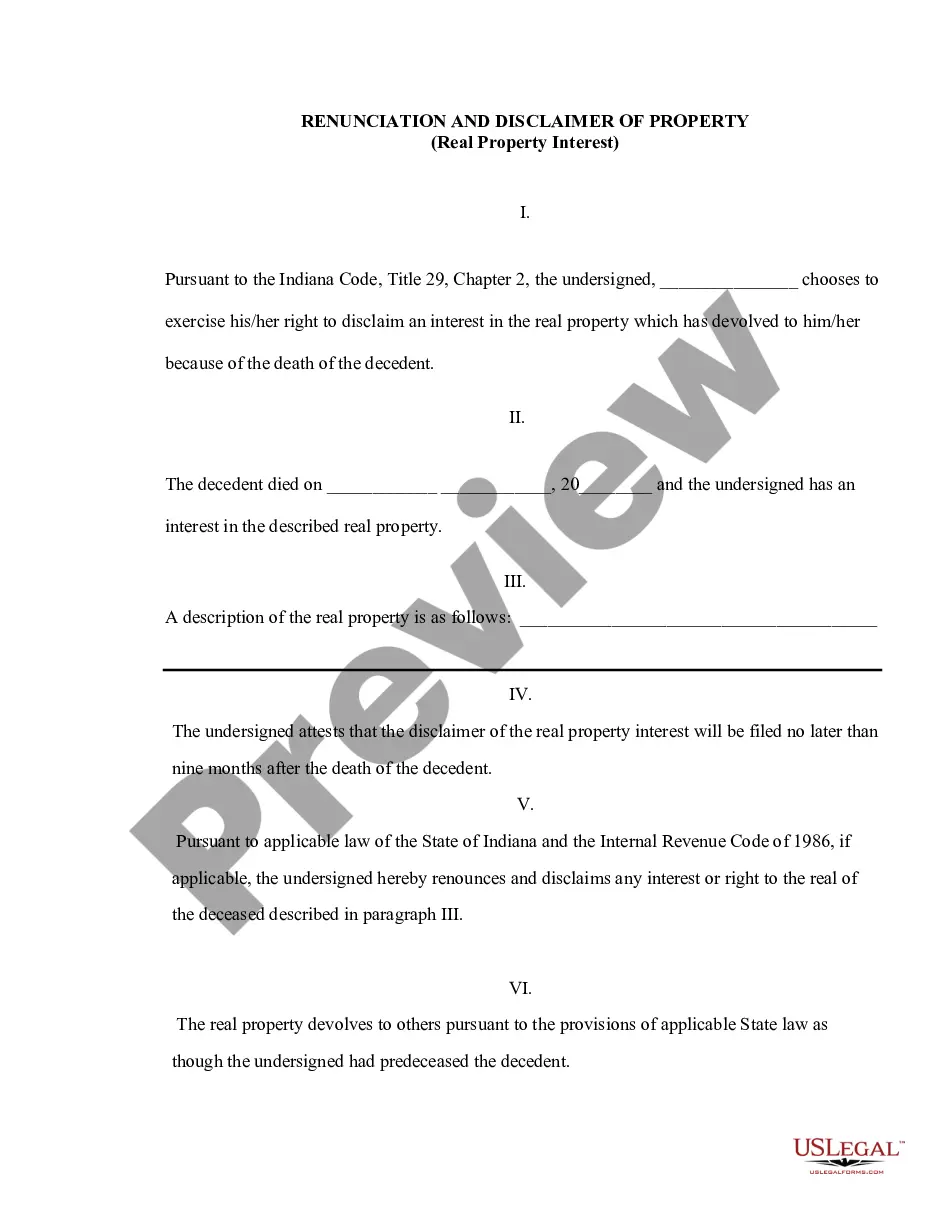

This form is a Renunciation and Disclaimer of Property acquired by intestate succession. The decedent died intestate (without a will) and the beneficiary gained an interest in the property. However, according to the Indiana Code, Title 29, Chapter 2, the beneficiary wishes to disclaim a portion of, or the entire interest in the property. The beneficiary attests that the disclaimer will be filed no later than nine months after the death of the decedent. The form also contains an acknowledgment and a certificate to verify delivery.

Fort Wayne Indiana Renunciation and Disclaimer of Property received by Intestate Succession

Description

How to fill out Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession?

If you have previously utilized our service, sign in to your account and download the Fort Wayne Indiana Renunciation and Disclaimer of Property acquired through Intestate Succession onto your device by clicking the Download button. Ensure your subscription remains active. If it is not, renew it based on your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to obtain your document.

You will have continuous access to every document you have acquired: you can find it in your profile within the My documents section whenever you need to use it again. Utilize the US Legal Forms service to seamlessly find and save any template for your personal or business requirements!

- Ensure you’ve found the right document. Review the details and use the Preview feature, if available, to see if it fits your requirements. If it does not fulfill your needs, utilize the Search option above to find the correct one.

- Acquire the document. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the transaction.

- Retrieve your Fort Wayne Indiana Renunciation and Disclaimer of Property received through Intestate Succession. Choose the file format for your document and save it to your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

To disclaim inherited property, you must provide a written statement of renunciation and file it with the appropriate estate executor or court. This document should outline your details and explicitly state your refusal of the inheritance. For individuals in Fort Wayne, Indiana, utilizing resources like US Legal Forms can provide you with templates and guidance to ensure your disclaimer complies with state law.

Writing a disclaimer of inheritance involves creating a clear, concise document stating your intention to renounce any interest in the property. Include essential details such as your name, relationship to the deceased, and a specific declaration of your intention. US Legal Forms offers templates that simplify the process for you in Fort Wayne, Indiana, making it easier to craft a legally acceptable disclaimer.

To obtain heir property in your name without a will, you may need to go through the intestate succession process. This usually involves filing paperwork in Indiana to prove your relationship to the deceased and the rightful claim to the property. Using platforms like US Legal Forms can guide you through this process effectively, ensuring you meet all legal requirements in Fort Wayne.

In Indiana, the time limit for disclaiming an inheritance is typically nine months from the date of the inheritance. This is important for ensuring that your disclaimer is recognized legally. Keeping track of these deadlines can significantly affect your ability to manage your estate in Fort Wayne, Indiana.

When an individual dies without a will in Indiana, their house and other assets enter intestate succession laws. This means the property will pass to the deceased's heirs according to state laws. Understanding these processes is crucial to navigate your rights regarding Fort Wayne, Indiana, renunciation and disclaimer of property received by intestate succession.

To disclaim an inheritance in relation to the IRS, you must notify the estate's executor and file a written disclaimer. The disclaimer should clearly express your decision not to accept the property. Adhering to IRS guidelines helps avoid tax implications and ensures proper management of your estate, especially in Fort Wayne, Indiana.

In Fort Wayne, Indiana, a disclaimer of inheritance typically needs to be in writing, but it does not always have to be notarized. However, notarization can lend added credibility to the document. It is wise to consult legal advice to ensure compliance with state laws regarding disclaimers in cases of intestate succession.

Probing an intestate estate starts by gathering important documents, including the deceased's assets and debts. Then, you will need to file a petition with the probate court in Fort Wayne, Indiana. The court will appoint an administrator to manage the assets and settle any debts. Utilizing the Fort Wayne Indiana Renunciation and Disclaimer of Property received by Intestate Succession can simplify this process, ensuring a smoother transition of rightful ownership.

In Indiana, when a spouse dies, the surviving partner typically receives ownership of the home, especially if the property was jointly held. If children or other heirs exist, the distribution may involve their share as well. Understanding the nuances of the Fort Wayne Indiana Renunciation and Disclaimer of Property received by Intestate Succession can simplify this process for survivors.

Title transfers occur when a person dies without a valid will, leading their estate to follow the intestate succession laws. Property transfers according to the state's laws, which consider familial relationships. Engaging with resources like the Fort Wayne Indiana Renunciation and Disclaimer of Property received by Intestate Succession can better prepare you for these circumstances.