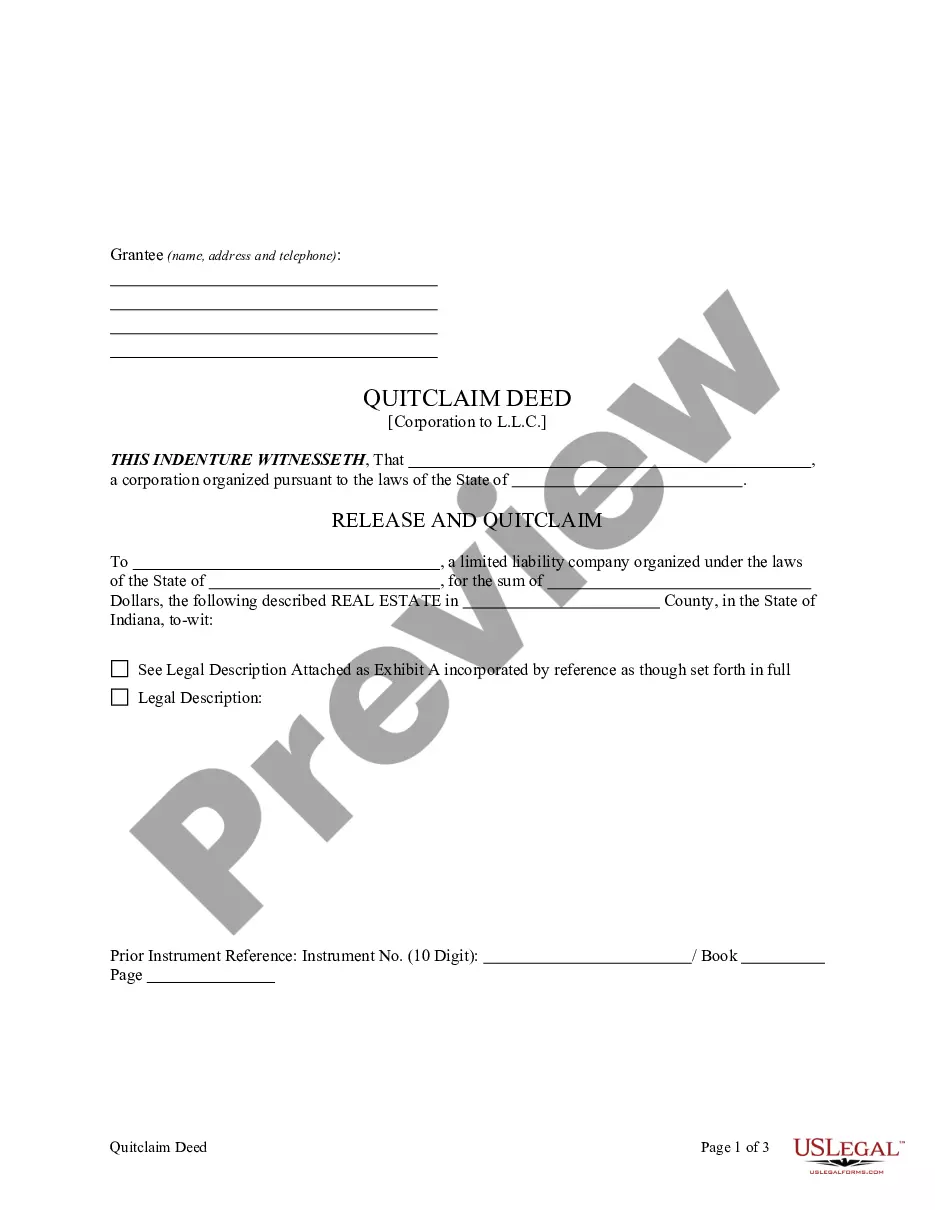

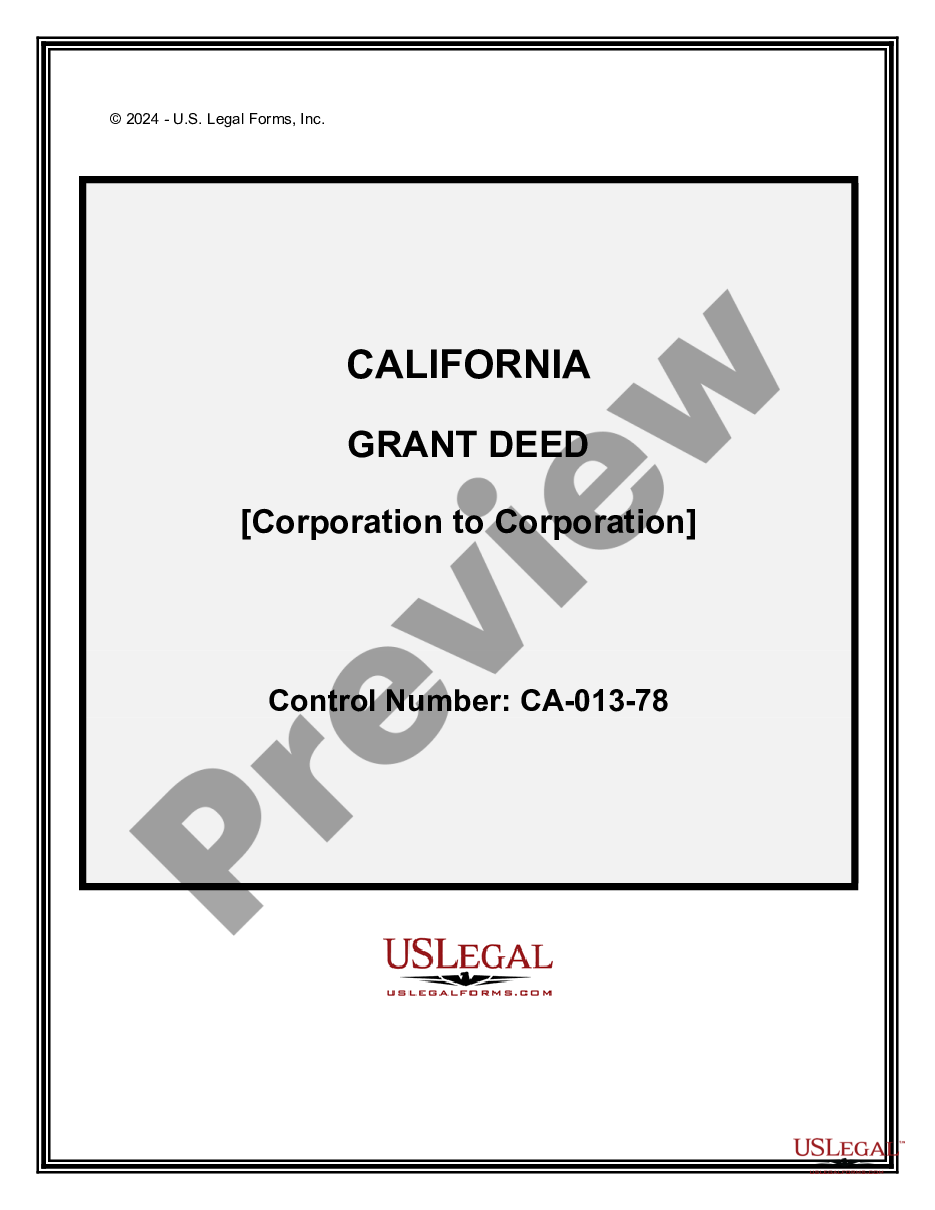

This form is a Quitclaim Deed where the grantor is a corporation and the grantee is a limited liability company. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

Indianapolis Indiana Quitclaim Deed from Corporation to LLC

Description

How to fill out Indiana Quitclaim Deed From Corporation To LLC?

If you are searching for a pertinent form template, it’s challenging to discover a more suitable location than the US Legal Forms website – one of the largest collections on the web.

Here you can obtain countless form samples for corporate and personal purposes categorized by types and regions, or keywords.

With our superior search tool, acquiring the latest Indianapolis Indiana Quitclaim Deed from Corporation to LLC is as simple as 1-2-3.

Confirm your choice. Click the Buy now button. Then, select the preferred pricing option and provide details to register for an account.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

- Moreover, the significance of each document is confirmed by a team of professional attorneys who regularly assess the templates on our site and update them according to the latest state and county requirements.

- If you are familiar with our platform and possess an account, all you need to get the Indianapolis Indiana Quitclaim Deed from Corporation to LLC is to Log In to your profile and click the Download button.

- If you are using US Legal Forms for the first time, just follow the instructions below.

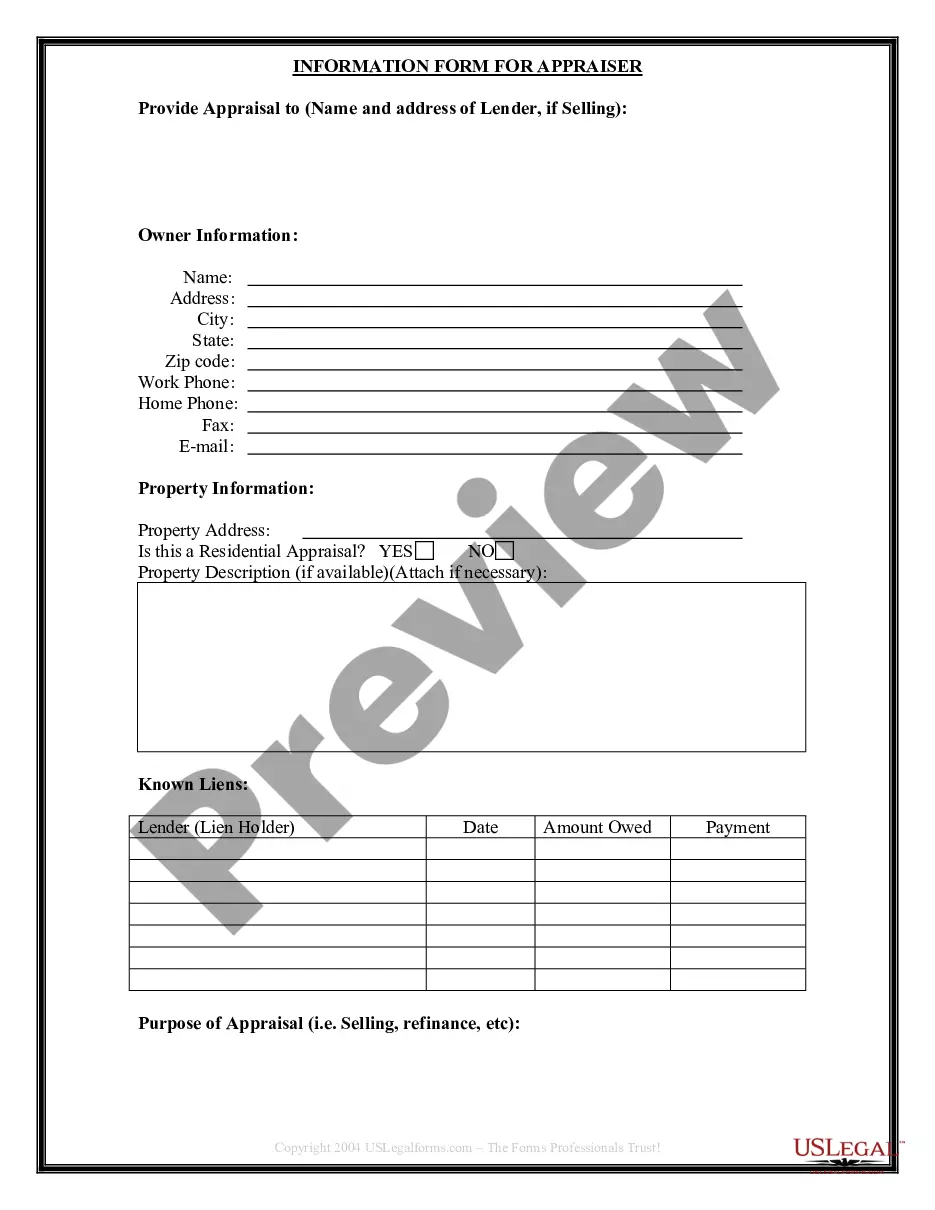

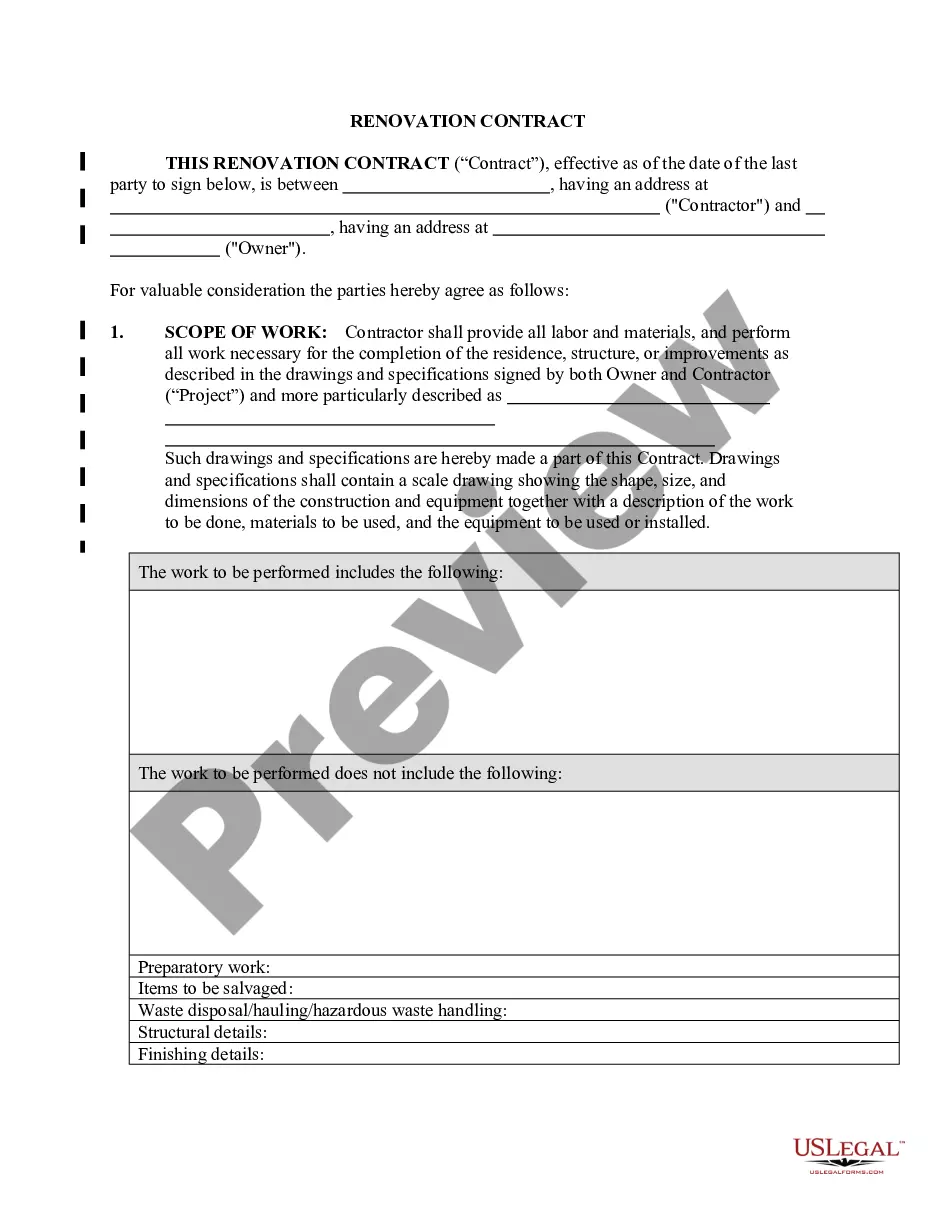

- Ensure you have selected the sample you desire. Review its description and utilize the Preview feature to inspect its content.

- If it doesn’t fit your needs, employ the Search option at the top of the screen to find the required document.

Form popularity

FAQ

A quitclaim deed transfers the title of a property from one person to another, with little to no buyer protection. The grantor, the person giving away the property, gives their current deed to the grantee, the person receiving the property. The title is transferred without any amendments or additions.

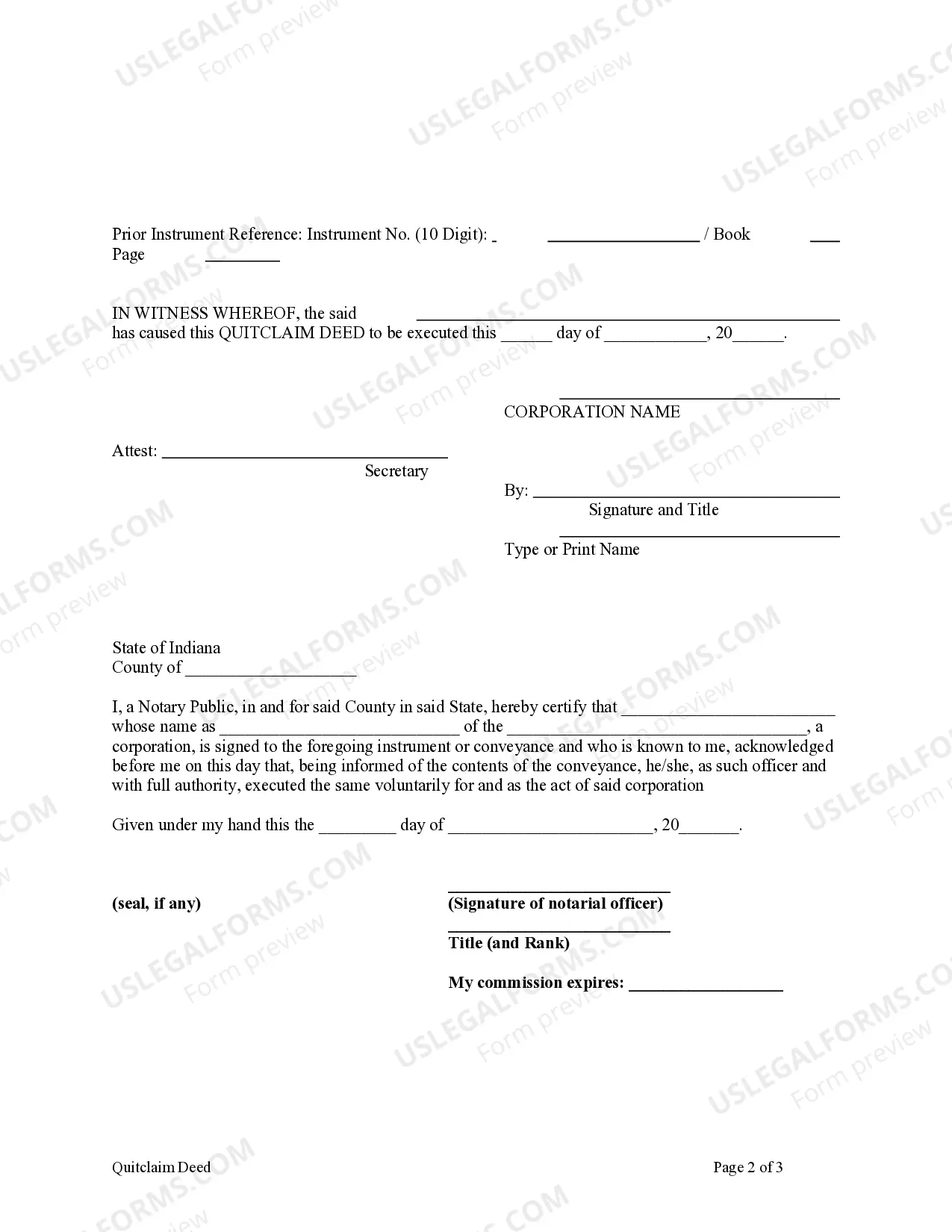

Submit your document Marion County Assessor: $10.00 per parcel per document; AND $20.00 for each Sales Disclosure, if required. Marion County Recorder: $35.00 per document. The Assessor is responsible for transferring property in Marion County. The transfer stamp from their office is required before it can be recorded.

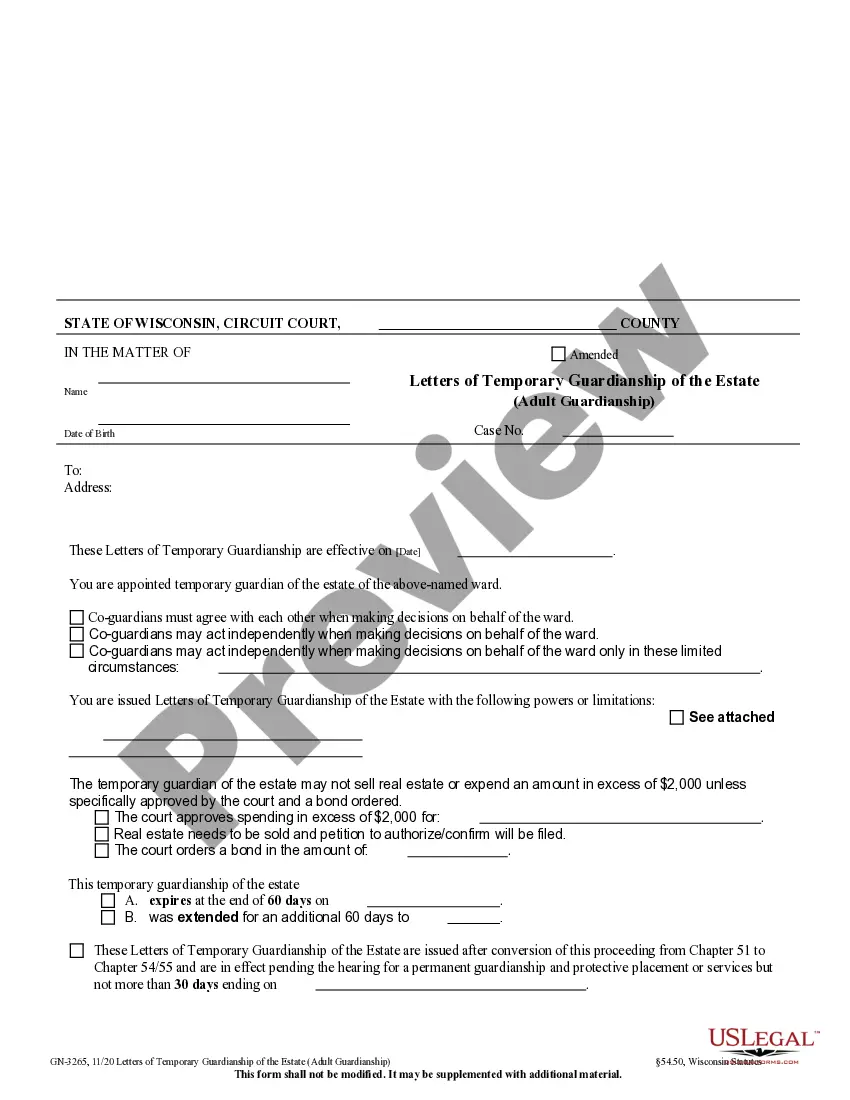

Recording ? Must be filed at the County Recorder's Office where the real estate is located. Signing (§ 32-21-2-3) ? All quitclaim deeds that are recorded in Indiana are to be signed in front of a Notary Public (Grantor(s) only).

Indiana Quit Claim Deed Form ? Summary The Indiana quit claim deed form gives the new owner whatever interest the current owner has in the property when the deed is signed and delivered. It makes no promises about whether the current owner has clear title to the property.

Signing (IC § 32-21-2-3) ? All deed must be executed by one of the following: judge, clerk of a court of record, county auditor, county recorder, notary public, mayor of a city in Indiana or any other state, commissioner appointed in a state other than Indiana by the governor of Indiana, clerk of the city county

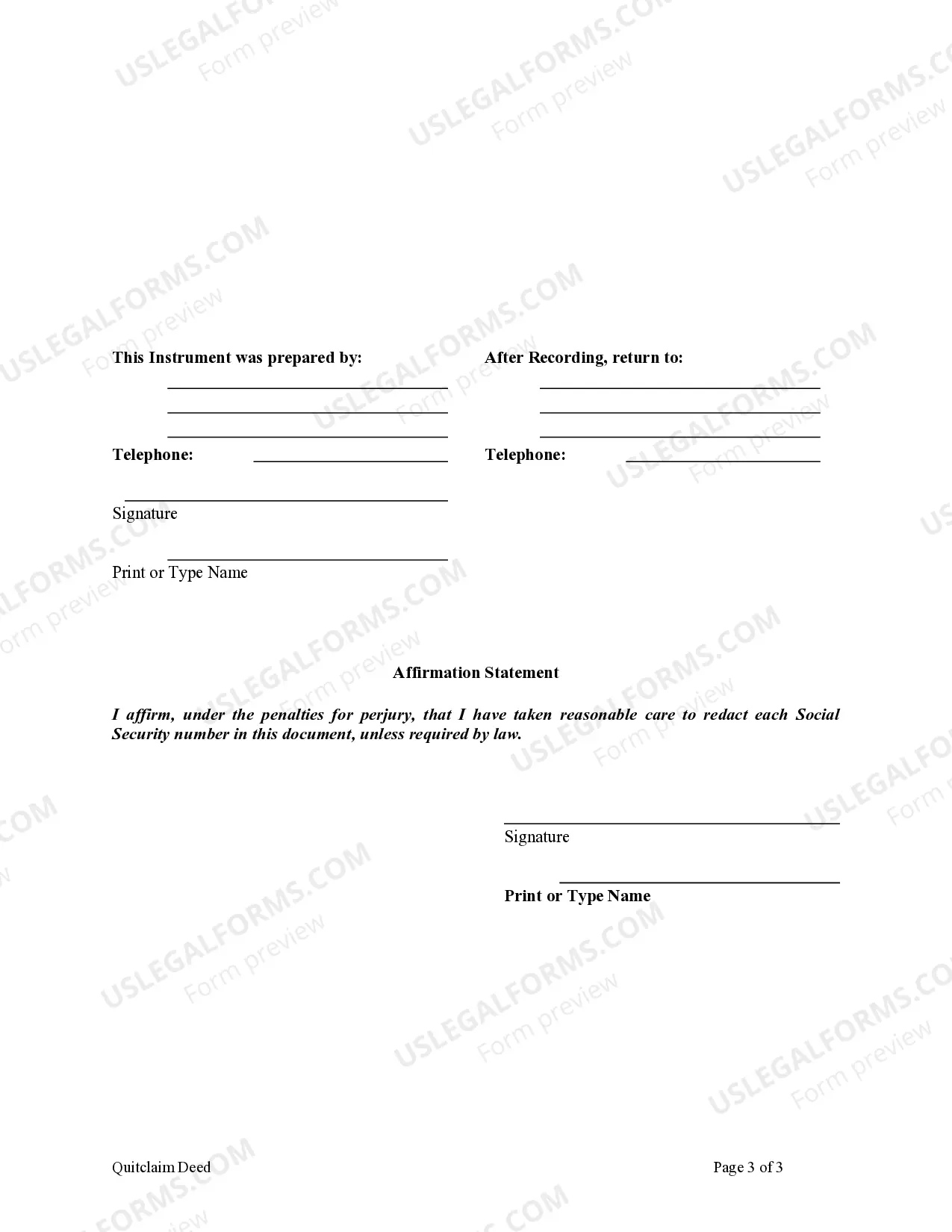

Documents may be submitted for recording by mail, through our e-recording partners, or in the office during normal business hours. Deeds or other property transfer documents must be stamped by the Assessor's Office in Room 1360 before being recorded.

All parties just need to sign the transfer deed (TR1 form) and file it with the land registry. This needs to be accompanied by the land registry's AP1 form, and if the value of the transaction amounts to more than £40,000, then a stamp duty land tax certificate may also be required.

Transferring Indiana real estate usually involves four steps: Locate the prior deed to the property.Create the new deed.Sign the new deed.Record the original deed.

A Quitclaim Deed transfers only whatever ownership in property the person doing the Quitclaim Deed has. For example, if someone has no legal ownership in a house, and that person signs a Quitclaim Deed saying you now have ownership, you have nothing.