This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

Chicago Illinois Last Will and Testament for a Married Person with No Children

Description

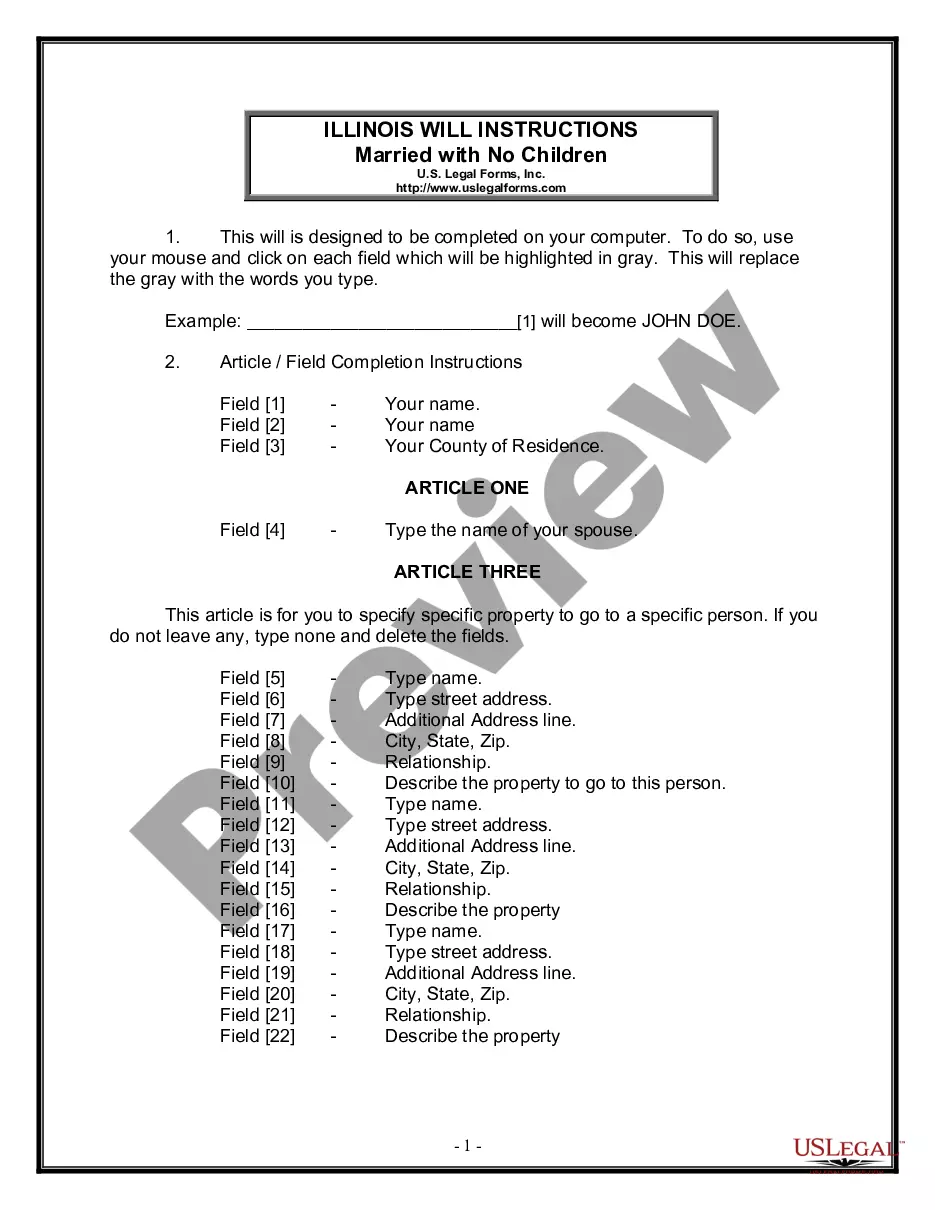

How to fill out Illinois Last Will And Testament For A Married Person With No Children?

If you’ve previously employed our service, Log In to your account and store the Chicago Illinois Legal Last Will and Testament Form for a Married Individual with No Children on your device by clicking the Download button. Ensure your subscription is active. If it’s not, renew it according to your payment plan.

If this is your initial use of our service, adhere to these straightforward steps to acquire your document.

You have continual access to all documents you have acquired: you can find it in your profile under the My documents menu whenever you wish to access it again. Make the most of the US Legal Forms service to swiftly find and store any template for your personal or professional requirements!

- Ensure you’ve located an appropriate document. Review the description and utilize the Preview option, if available, to determine if it fulfills your requirements. If it doesn’t fit your needs, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and complete a transaction. Use your credit card information or the PayPal option to finalize the payment.

- Obtain your Chicago Illinois Legal Last Will and Testament Form for a Married Individual with No Children. Choose the file format for your document and save it to your device.

- Finalize your document. Print it out or utilize professional online editors to complete it and sign it digitally.

Form popularity

FAQ

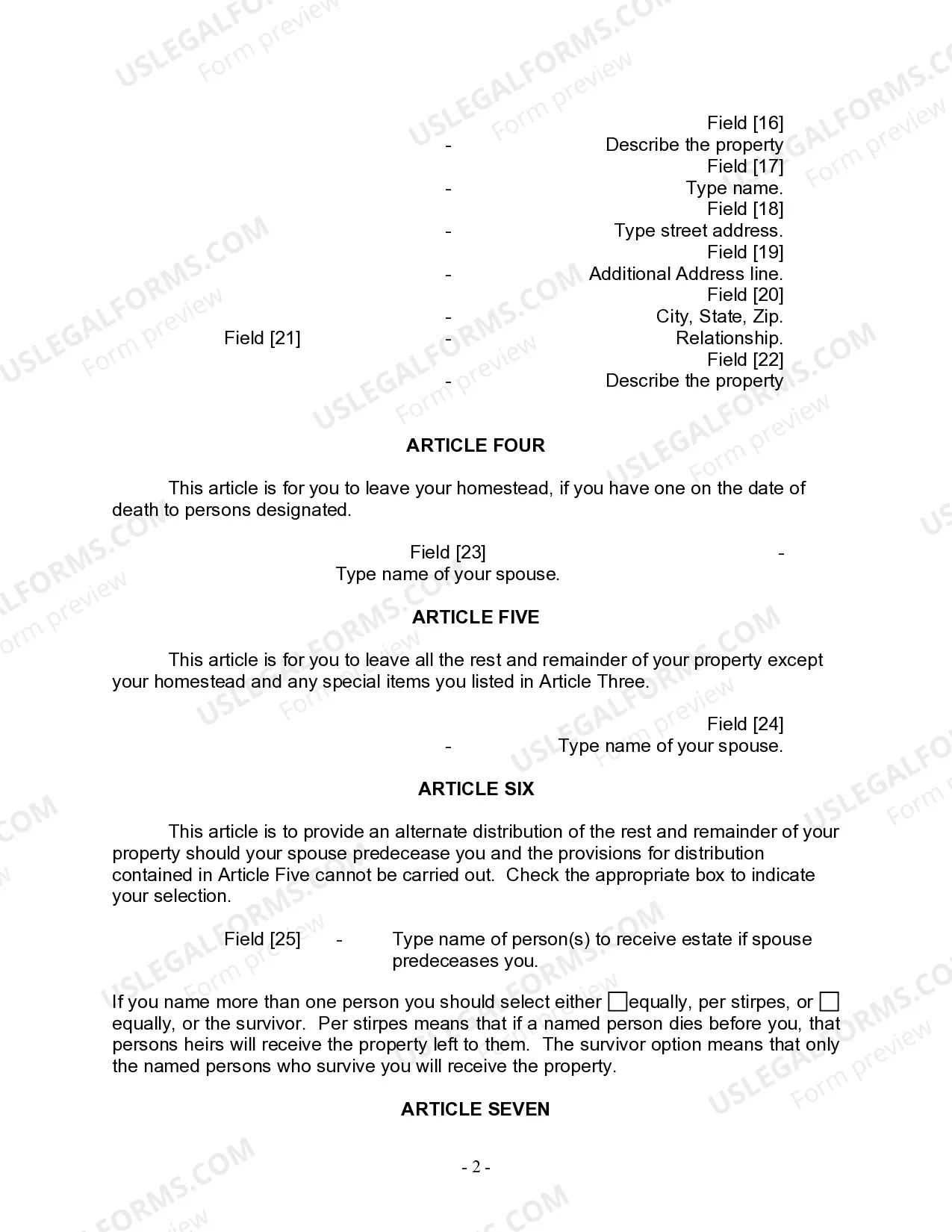

Spouses in Illinois Inheritance Law If you have no living descendants, your spouse gets all of the intestate property. If you have living descendants, your spouse will get half of the inheritance, and your descendants will get the other half of the inheritance.

Spouses in Illinois Inheritance Law If you have living descendants, your spouse will get half of the inheritance, and your descendants will get the other half of the inheritance. However, grandchildren will only receive a share if their parents are not alive to receive their share.

A handwritten will meets the definition of a written will as far the law is concerned. This means that any will that is appropriately signed and witnessed is a valid will. A handwritten will that is not witnessed is known as a holographic will and is not valid under Illinois law.

Only the final divorce or annulment order or a revised will can revoke bequests to the surviving spouse. Surviving spouses who are disinherited will still have the option to renounce the decedent's will and claim a portion of the estate.

If the decedent dies leaving descendants, but no spouse, the entire estate goes to the descendants per stirpes. If the decedent dies leaving both a spouse and descendants, the estate goes 1/2 to the spouse and 1/2 to the descendants per stirpes.

In Illinois, the intestate laws are as follows: Deceased person is survived by spouse and descendants: the spouse receives half the property and the children split the remaining half. Deceased person is survived by spouse and no descendants: the spouse receives the entire probate property.

The Grounds for Contesting a Will The grounds for invalidating wills in Illinois include undue influence, lack of testamentary capacity, and fraud or forgery. Undue influence occurs when something or someone prevents people from exercising their own rights and wishes when crafting their wills.

You can make your own will in Illinois, using Nolo's Quicken WillMaker & Trust. However, you may want to consult a lawyer in some situations. For example, if you think that your will might be contested or if you want to disinherit your spouse, you should talk with an attorney.

Signing and attestation. (a) Every will shall be in writing, signed by the testator or by some person in his presence and by his direction and attested in the presence of the testator by 2 or more credible witnesses.