Cook Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

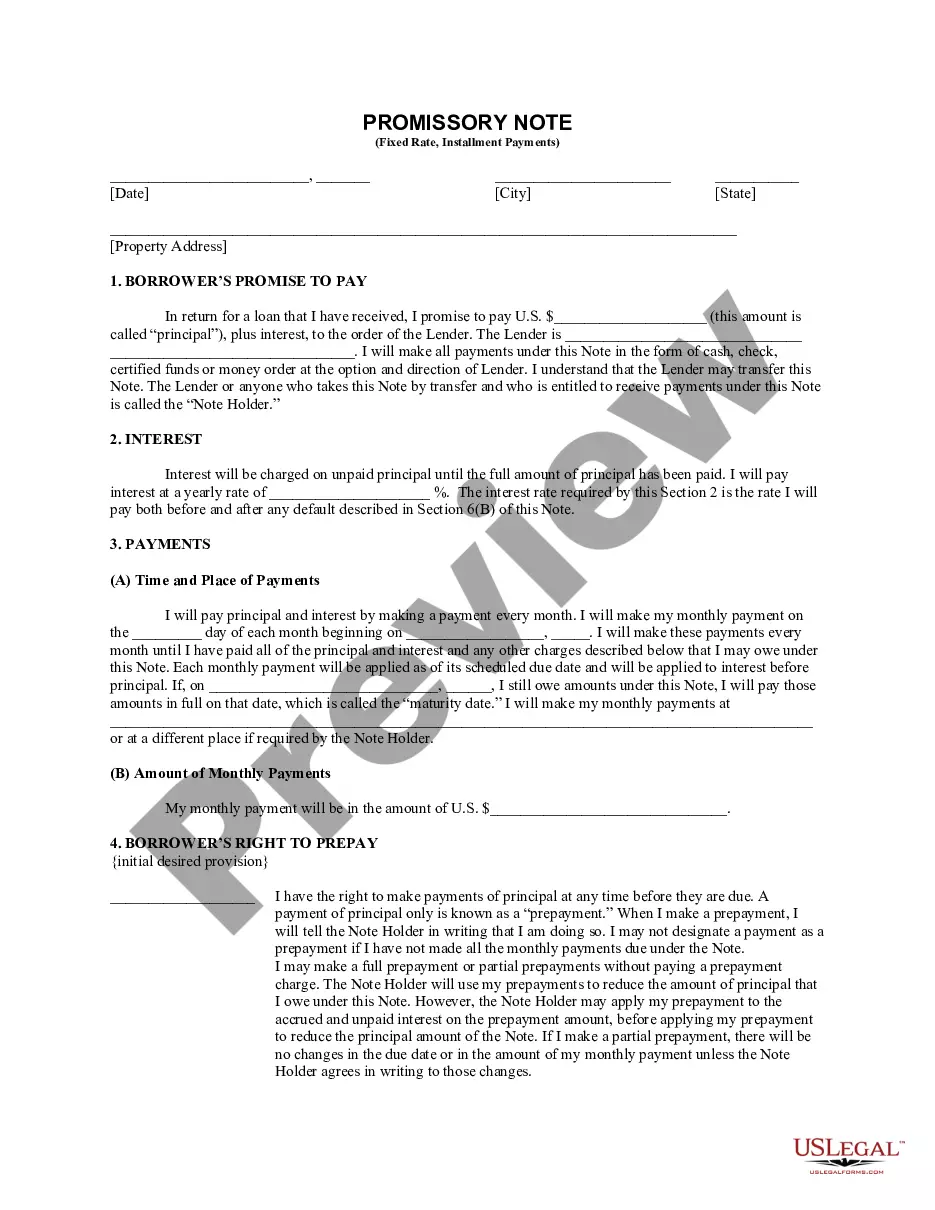

How to fill out Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Regardless of one's social or professional position, completing law-related documents is a regrettable requirement in the modern professional landscape.

Frequently, it is nearly impossible for an individual without a legal background to generate such paperwork from scratch, primarily due to the intricate terminology and legal nuances they entail.

This is where US Legal Forms steps in to assist.

Ensure the document you have selected is tailored to your area since the laws of one state or county are not applicable to another.

Review the document and consult a brief overview (if available) of the scenarios for which the document can be utilized.

- Our service offers an extensive library of over 85,000 state-specific templates that are applicable for almost any legal situation.

- US Legal Forms also serves as an excellent tool for associates or legal advisors looking to save time using our DIY documents.

- Regardless of whether you need the Cook Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate or another document valid in your jurisdiction, US Legal Forms has everything available.

- Here’s how to obtain the Cook Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate swiftly using our reliable service.

- If you're already a member, simply Log In to access your account and download the required form.

- If you are a newcomer to our platform, make sure to follow these instructions before downloading the Cook Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

Form popularity

FAQ

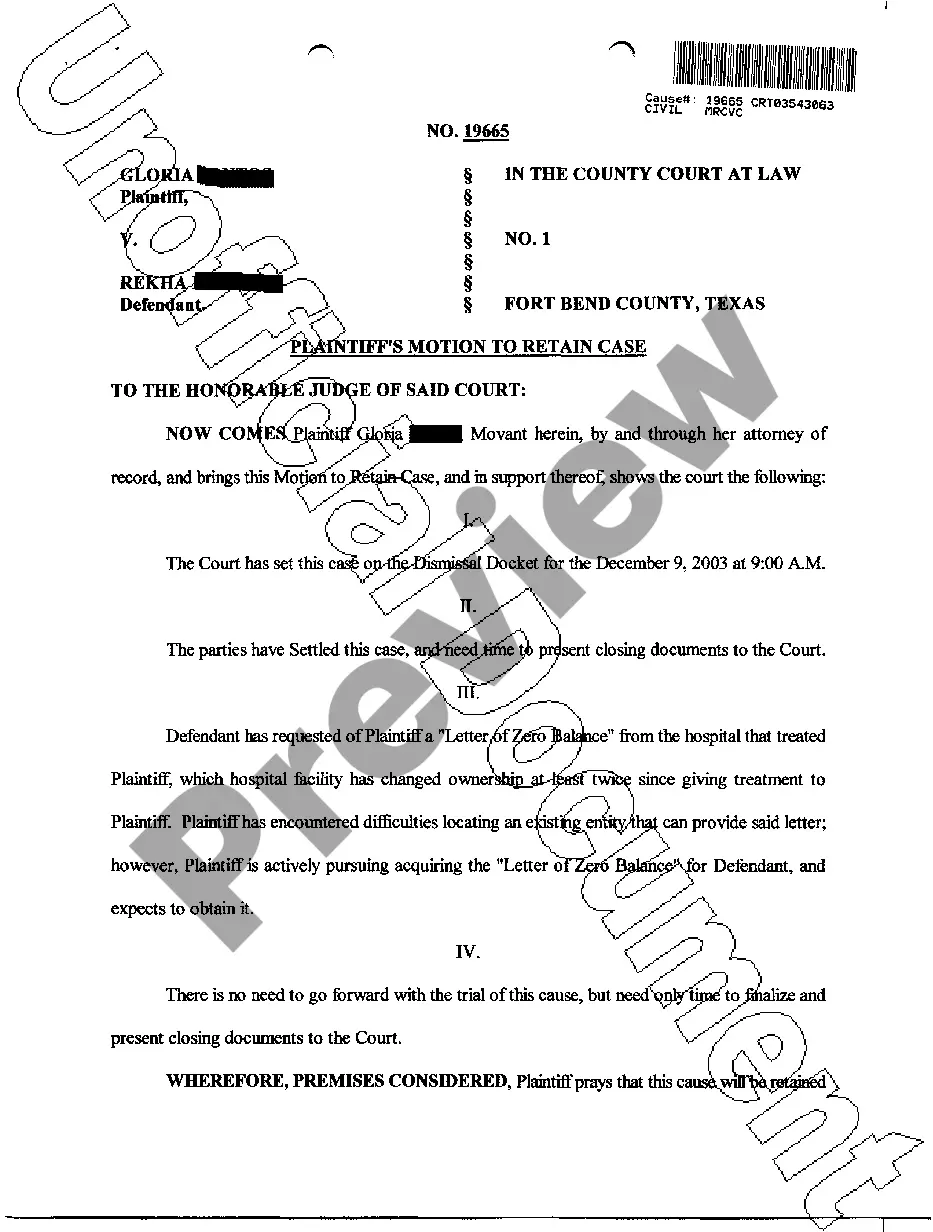

For a promissory note to be valid, it must include the names of both the borrower and lender, the principal amount, repayment terms, and signatures. Additionally, it should specify any interest rates and the date of repayment. When dealing with the Cook Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate, ensuring that all these elements are present will provide a solid legal foundation for the agreement. This diligence can protect your interests in any future transactions.

In Illinois, promissory notes do not require notarization to be valid; however, notarizing the document can add an extra layer of security. Notarization confirms the identities of the parties involved and their agreement to the terms. For the Cook Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate, having a notary can help avoid disputes later on. It’s always wise to check specific local requirements to ensure compliance.

You can obtain a promissory note for your mortgage through various sources, including banks, credit unions, and legal document services. Platforms like uslegalforms provide customizable templates for the Cook Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Using professionally crafted documents helps to ensure that your promissory note meets all legal requirements. This approach saves you time and helps avoid mistakes.

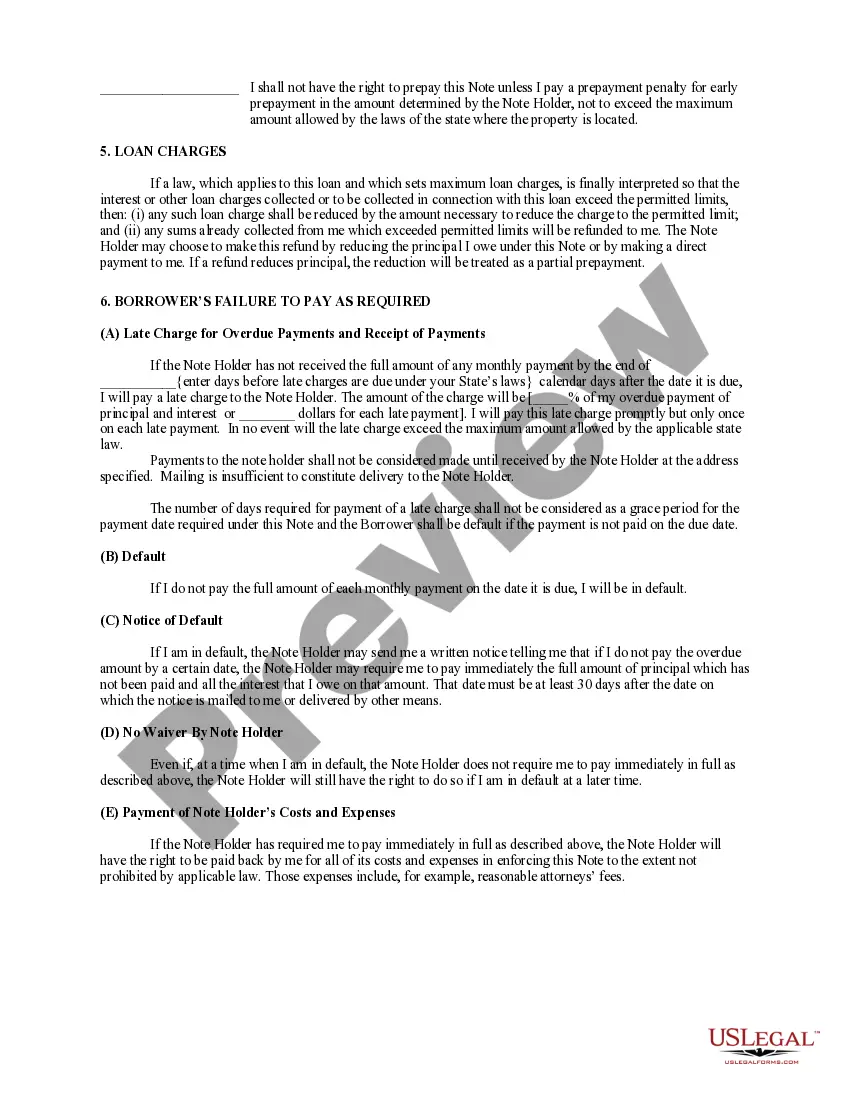

To secure a promissory note with real estate, you must create a mortgage agreement linking the note to the property. This process involves legally documenting that the real estate serves as collateral for the debt. In the case of Cook Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate, this ensures that if you default, the lender has rights to the property. Making your mortgage terms clear and thorough can protect both parties involved.

Yes, a promissory note can create a lien on a property when it is backed by a security agreement. In the case of a Cook Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the note itself acts as the promise to repay, while the lien secures the lender's interest in the property. This dual structure provides protection for both parties involved in the transaction.

A lien on real estate is created when a legal claim is placed on a property, often as security for debt repayment. This can arise from a mortgage, tax assessment, or a Cook Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate when the underlying obligation is not met. To ensure everything is correctly set up, consult platforms like uslegalforms for guidance and proper documentation.

The enforceability of a promissory note largely depends on certain legal criteria being met, including clarity in terms and proper documentation. Generally, a Cook Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate is highly enforceable in a court of law, provided it is signed by the borrower and contains all necessary details. Understanding these requirements can enhance your confidence in using such notes for financial transactions.

A promissory note itself does not create a lien. However, when it is secured by collateral, such as residential real estate, it can lead to the creation of a lien. In the context of a Cook Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the lien is established through a mortgage or security agreement associated with the note.

To secure a promissory note with real property, you typically need to execute a mortgage or deed of trust. This legal process involves recording the document with the local government to make the lender's claim on the property official. When using the Cook Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate, this step ensures the lender has a security interest in the property. Working with professionals can simplify the process and ensure it meets all legal requirements.

Several factors can render a promissory note invalid. For example, if it lacks a clear agreement on the terms or is not signed by both parties, it may be problematic. Additionally, if it does not comply with state laws governing the Cook Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it can become ineffective. Ensuring compliance with legal standards is crucial for maintaining the validity of the note.