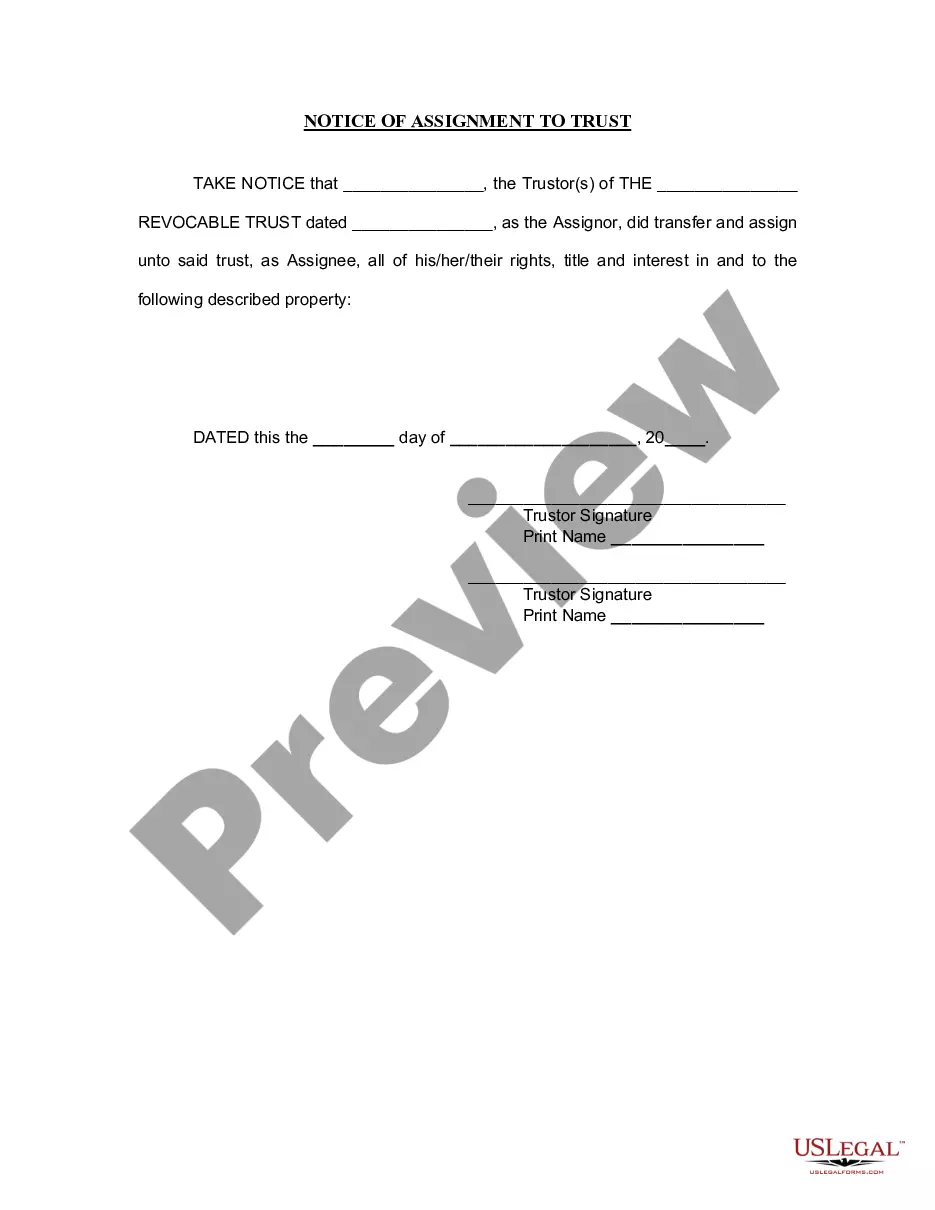

Chicago Illinois Notice of Assignment to Living Trust

Description

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out Illinois Notice Of Assignment To Living Trust?

Finding validated templates tailored to your local laws can be challenging unless you utilize the US Legal Forms repository.

It’s a digital collection of over 85,000 legal documents for both personal and business needs, along with various real-world scenarios.

All the files are appropriately categorized by usage area and jurisdiction, making it as simple and quick as ABC to locate the Chicago Illinois Notice of Assignment to Living Trust.

Maintaining documentation organized and compliant with legal requirements is crucial. Leverage the US Legal Forms library to always have vital document templates available at your fingertips!

- Review the Preview mode and form description. Ensure you’ve chosen the appropriate one that satisfies your needs and fully aligns with your local jurisdiction criteria.

- Look for alternative templates, if necessary. If you notice any discrepancies, use the Search tab above to find the correct one. If it works for you, proceed to the next step.

- Purchase the document. Click on the Buy Now button and choose your preferred subscription plan. You will need to create an account to access the resources of the library.

- Complete your payment. Enter your credit card information or utilize your PayPal account to pay for the subscription.

- Retrieve the Chicago Illinois Notice of Assignment to Living Trust. Download the template to your device so you can fill it out, and access it later in the My documents section of your profile whenever needed.

Form popularity

FAQ

Every estate does not have to go through probate. Probate is the legal process to make sure that a deceased person's debts and taxes are paid. In Illinois, a lawyer is required for probate unless the estate is valued at or less than $100,000 and does not have real estate.

What Types of Assets are Not Subject to Probate in Illinois? Retirement accounts (such as 401Ks or IRAs) or life insurance policies, as long as a beneficiary has been named; Property held in a living trust; U.S. savings bonds that are co-owned or registered in pay-upon-death (POD) form. Pension plan distribution;

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

The beneficiary can (where there is one beneficiary or if there are several beneficiaries and all of them agree) direct the trustee to transfer the trust property to him (if there are several beneficiaries to all of them) or to such other person as the beneficiary (or the beneficiaries may desire).

Mechanism of Transfer Real estate is transferred through the execution of the appropriate deed transferring the real estate property to the Trust. You or your attorney must then record the deed with the Recorder of Deeds for your county.

To make a living trust in Illinois, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

Living Trusts In Illinois, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

To make a living trust in Illinois, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

A living trust in Illinois provides a variety of benefits that can't be obtained from a will. Trusts are private documents and are not public record or reviewed by any court. No one will know who your beneficiaries are, what your assets are, and what the terms of your trust are. This is very appealing to many people.

The settlor establishes the trust by transferring the property. The trustee is the person in charge of managing the trust. The beneficiary is the one who will benefit from the trust. As the new legal owner of the property, the trustee manages it according to the settlor's wishes outlined in the deed.