Cook Illinois Assignment to Living Trust

Description

How to fill out Illinois Assignment To Living Trust?

Regardless of social or occupational rank, finalizing legal documents is an unfortunate obligation in today's society.

Frequently, it’s nearly unfeasible for an individual without any legal experience to create such documents from scratch, primarily due to the intricate language and legal subtleties they entail.

This is where US Legal Forms can be beneficial.

Ensure the document you've located is appropriate for your area, as the laws of one state or county may not be applicable to another.

Review the document and check a brief overview (if available) of scenarios for which the form can be utilized.

- Our service provides a vast library containing over 85,000 ready-to-use state-specific forms applicable to nearly any legal circumstance.

- US Legal Forms also acts as a valuable resource for associates or legal advisors wishing to save time by using our DIY documents.

- Whether you seek the Cook Illinois Assignment to Living Trust or any other form suitable for your state or region, US Legal Forms has everything you need.

- Here's how to acquire the Cook Illinois Assignment to Living Trust in moments using our reliable service.

- If you are already a member, feel free to Log In to your profile to download the required form.

- However, if you are new to our platform, make sure to follow these instructions prior to downloading the Cook Illinois Assignment to Living Trust.

Form popularity

FAQ

While a Cook Illinois Assignment to Living Trust offers many benefits, it also has some disadvantages. One key concern is the potential loss of control over property, as the trust’s terms will dictate its management. Additionally, setting up and maintaining a trust may incur legal and administrative fees. Understanding these aspects can help you make an informed decision about whether to place property in a trust.

Filing a living trust in Illinois typically involves creating a trust document that outlines your terms and beneficiaries clearly. Although the Cook Illinois Assignment to Living Trust does not require court approval, it is essential to execute the document correctly. Store your trust document in a safe location and provide copies to trusted family members or attorneys. Platforms like USLegalForms can provide the necessary templates and guidance.

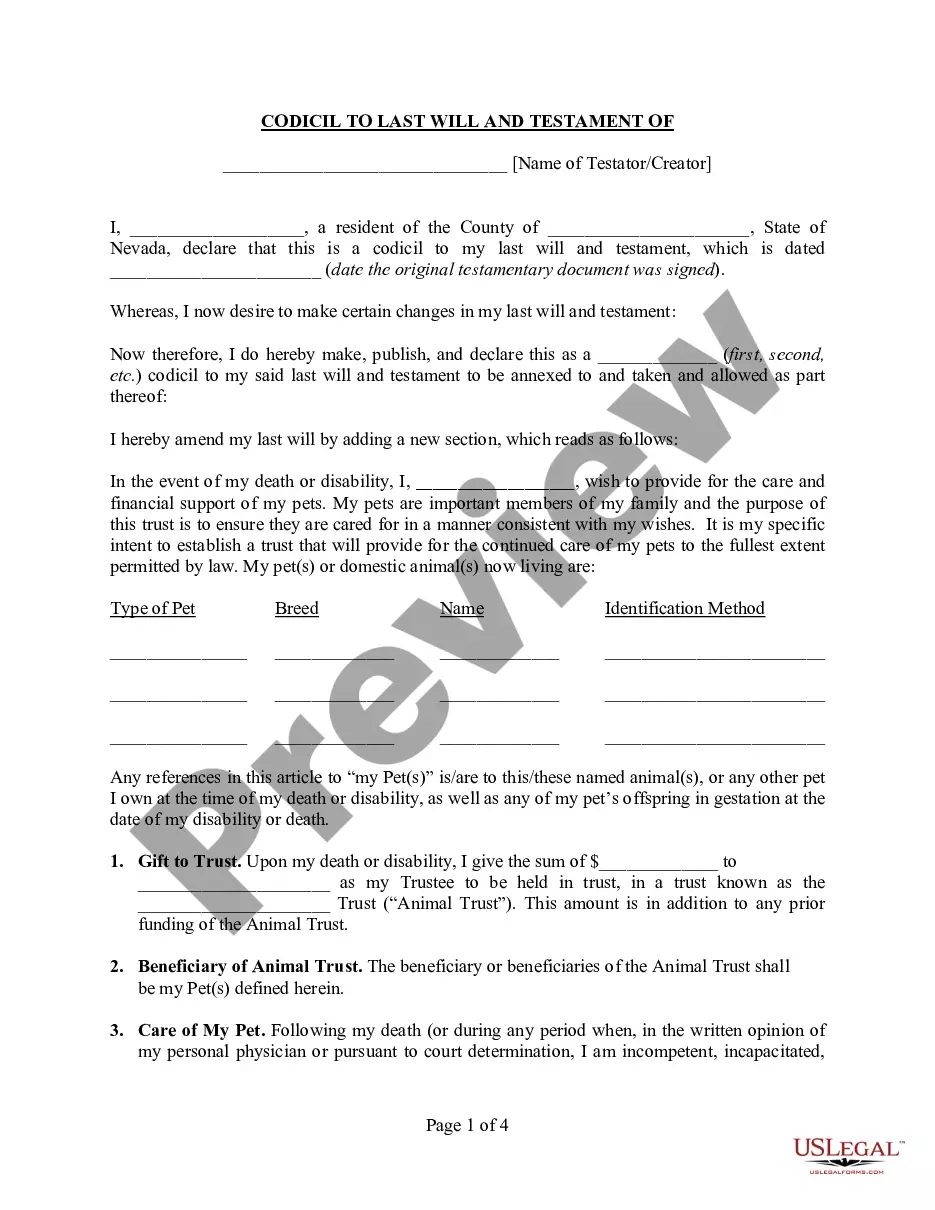

One of the most common mistakes parents make when setting up a Cook Illinois Assignment to Living Trust is failing to properly fund the trust. It’s crucial to transfer assets into the trust so that they are protected and managed as intended. Furthermore, neglecting to update the trust after major life changes can lead to complications. Always ensure the trust reflects your current wishes and assets.

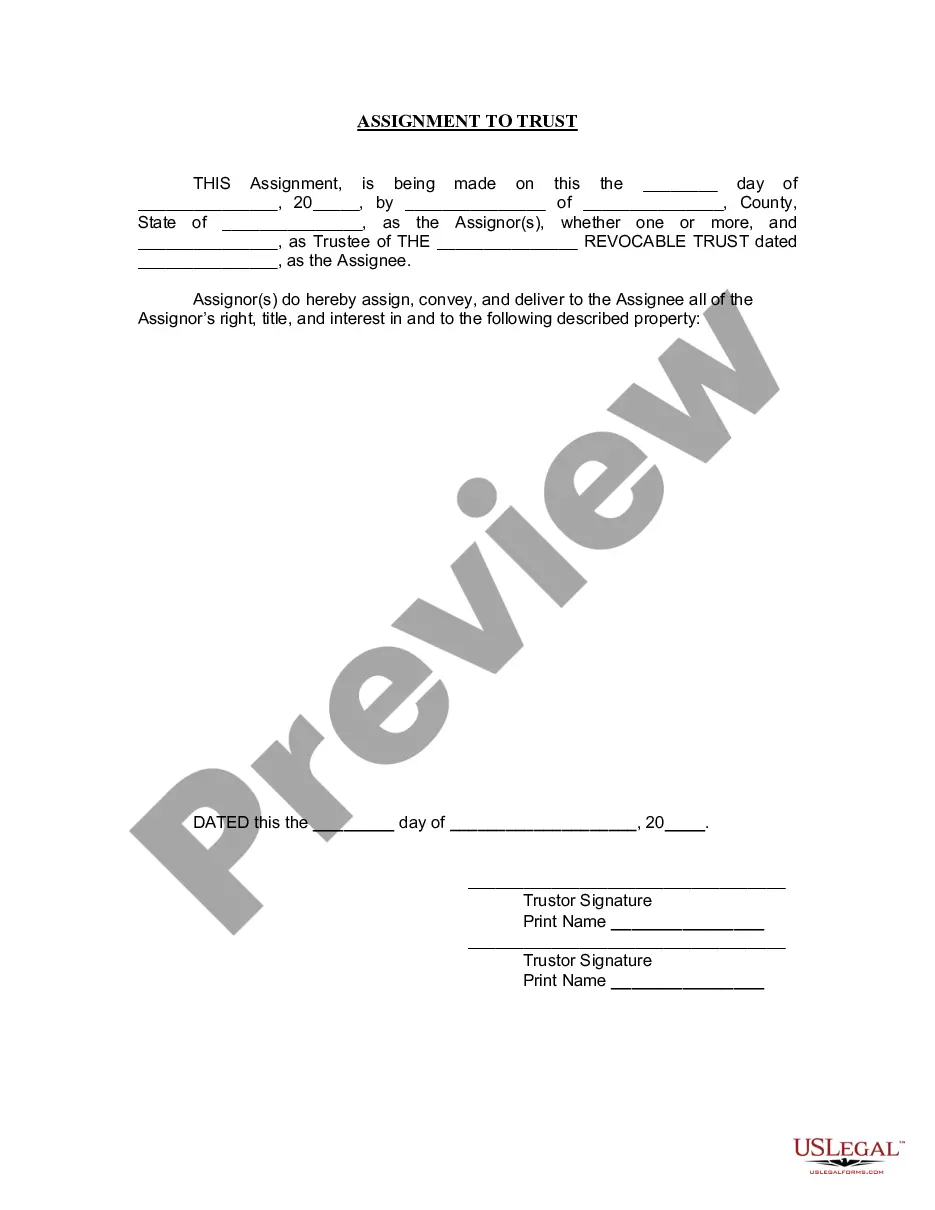

Transferring your property into a trust in Illinois involves a series of clear steps. First, you must create a trust document, specifying the terms and the trustee. Next, you will need to execute a Cook Illinois Assignment to Living Trust, which legally changes the ownership of the property to the trust. Finally, recording the trust document and the assignment with the county ensures that your property is officially held in the trust, providing peace of mind and protection for your assets.

Property is often transferred into a trust as part of inheritance tax planning however the trust needs to meet certain conditions and to be set up correctly by a solicitor. By putting a property into trust rather than making an outright gift, you are able to control how the property is used after it is given away.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

Living Trusts In Illinois, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

You can choose to use a program on the internet, which will likely run a few hundred dollars or less. If you choose to use an attorney, the attorney's fees will determine the price you'll pay. You could end up paying more than $1,000 to create a living trust with the help of an attorney.

3 Ways To Avoid Probate in Illinois Set up a Revocable Living Trust. In a living trust, your assets are transferred during your lifetime.Establish Joint Ownership of Property. After someone dies, jointly owned property passes to the surviving owner.Name Beneficiaries on Your Accounts.