Cook Illinois Amendment to Living Trust

Description

How to fill out Illinois Amendment To Living Trust?

We continually aim to lessen or avert legal harm when engaging with intricate legal or financial matters.

To achieve this, we enlist legal services that are generally quite expensive.

Nonetheless, not every legal concern is equally intricate.

The majority of them can be managed by ourselves.

Take advantage of US Legal Forms whenever you need to obtain and download the Cook Illinois Amendment to Living Trust or any other document swiftly and securely.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and power of attorney to articles of incorporation and petitions for dissolution.

- Our platform enables you to take control of your affairs without the necessity of hiring an attorney.

- We offer access to legal document templates that may not always be readily available.

- Our templates are tailored to specific states and areas, significantly easing the search process.

Form popularity

FAQ

One of the biggest mistakes parents make when setting up a trust fund is failing to clearly outline the terms and beneficiaries. Without proper details, the intent behind the Cook Illinois Amendment to Living Trust can be lost, leading to confusion among family members. It is crucial to ensure that all assets are included and that your wishes are clearly documented. US Legal Forms can assist you in creating a comprehensive trust that reflects your goals and protects your legacy.

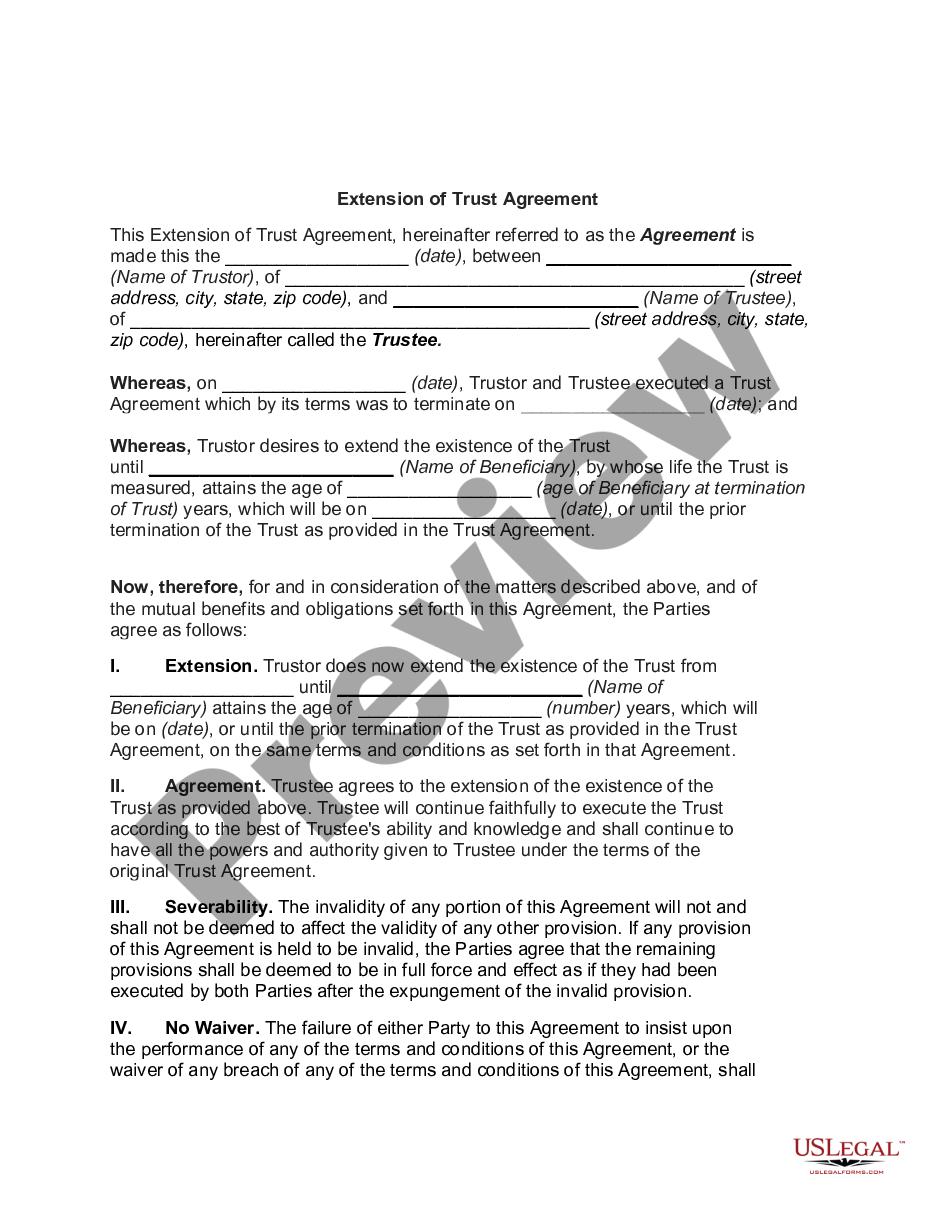

The new Illinois trust law introduces significant changes to existing trust regulations, making it easier for individuals to create and manage trusts. This law directly impacts how the Cook Illinois Amendment to Living Trust operates, allowing for more flexibility in asset management and distribution. By understanding this law, you can better utilize your trust to meet your family's needs. Consider using US Legal Forms to navigate these changes smoothly and set up your trust correctly.

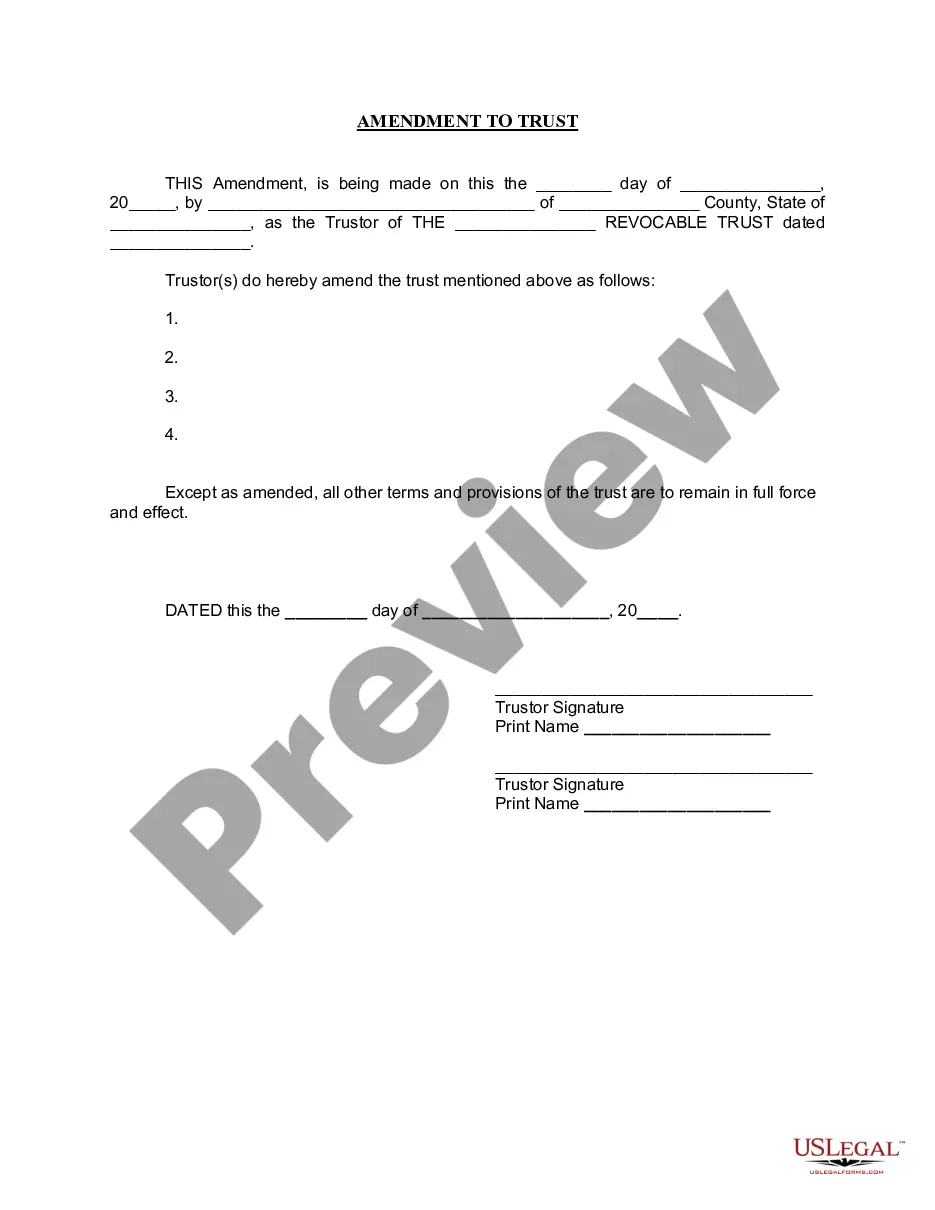

To write an amendment to a living trust in Cook, Illinois, begin by drafting a document that clearly states your intention to modify the existing trust. Include specific details about the changes you wish to make, such as adding or removing beneficiaries or altering asset allocations. It is essential to sign the amendment in the presence of a notary to ensure its validity. For a seamless experience, consider using the US Legal Forms platform, which provides templates and guidance tailored to the Cook Illinois Amendment to Living Trust.

While trust funds can provide security and manage wealth effectively, they come with certain drawbacks. For instance, beneficiaries may feel entitled to their inheritance, leading to misunderstandings or resentment. Additionally, the management involved, especially with the Cook Illinois Amendment to Living Trust, can incur administrative fees and taxes that reduce the overall benefit of the fund.

Determining whether your parents should place their assets in a trust depends on their unique circumstances. The Cook Illinois Amendment to Living Trust can offer protection and streamline the transfer of assets, but it may not be necessary for everyone. It is important to discuss their specific goals, financial situation, and potential needs with a qualified attorney or advisor to make the best decision.

A family trust, while offering many benefits, can have disadvantages too. One notable drawback is the complexity involved in managing the trust, especially when it comes to the Cook Illinois Amendment to Living Trust. Moreover, any disputes among family members regarding the trust can lead to conflicts, making it essential to communicate openly before establishing one.

One downside of placing assets in a trust, especially when considering the Cook Illinois Amendment to Living Trust, is that it may limit your control over those assets during your lifetime. Once you transfer assets into a trust, you cannot freely take them back without specific procedures. Additionally, there are costs associated with creating and maintaining a trust that may not be necessary for everyone.

Amending a living trust in Illinois involves drafting an amendment that details the changes you want to make. You must sign it and have it witnessed or notarized according to Illinois law. It's wise to consult with an attorney or use services from US Legal Forms to ensure compliance, particularly for a Cook Illinois Amendment to Living Trust.

A codicil is a legal document that modifies a will, while an amendment pertains directly to a trust. In the context of a Cook Illinois Amendment to Living Trust, an amendment updates or alters specific provisions of the trust itself without rewriting the entire document. Understanding this distinction is crucial when planning your estate.

To amend a trust in Illinois, you must prepare a formal amendment document that specifies the changes to the original trust. This document should be signed and dated by you, as the trustmaker. Make sure to keep the amendment with the original trust document for reference. Consider utilizing the tools from US Legal Forms for clear guidance on a Cook Illinois Amendment to Living Trust.