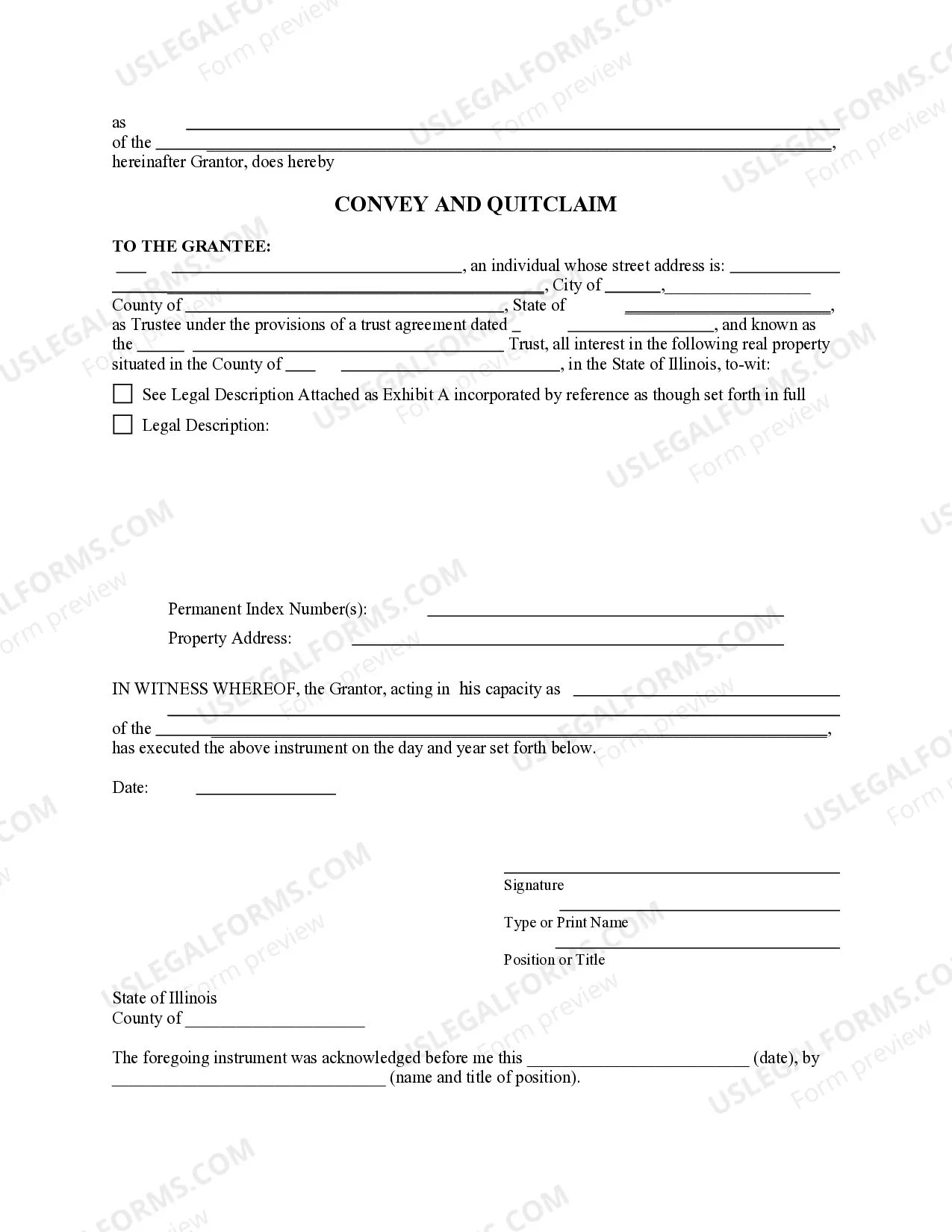

This form is a Quitclaim Deed for an individual Fiduciary as Grantor transferring real property to a Trust as Grantee. Grantor conveys the described property to the Grantee. This deed complies with all state statutory laws.

Naperville Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust

Description

How to fill out Illinois Fiduciary Quitclaim From An Individual Fiduciary To A Trust?

Locating authenticated templates that align with your regional regulations can be difficult unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world scenarios.

All documents are appropriately categorized by their usage and jurisdiction, making it as straightforward as ABC to find the Naperville Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust.

Maintaining documentation orderly and in accordance with legal requirements is highly significant. Leverage the US Legal Forms library to always have crucial document templates for any needs right at your fingertips!

- Verify the Preview mode and document description.

- Ensure you have picked the correct one that fulfills your requirements and conforms exactly to your local jurisdiction guidelines.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, employ the Search tab above to locate the appropriate one. If it meets your expectations, continue to the next step.

- Finalize the document purchase.

Form popularity

FAQ

Choosing between gifting a house or placing it in a trust depends on your specific goals. Gifting a house may incur tax implications, whereas putting it in a trust can provide benefits like asset protection and avoiding probate. If you are uncertain, the Naperville Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust may offer the ideal path for effective estate planning.

Yes, you can execute a quitclaim deed from a trust, allowing the trust to transfer the property to another party. This process typically requires the trustee to sign the quitclaim deed, following the same guidelines as other transfers. If you want to ensure the process goes smoothly, consider consulting with a platform like uslegalforms.

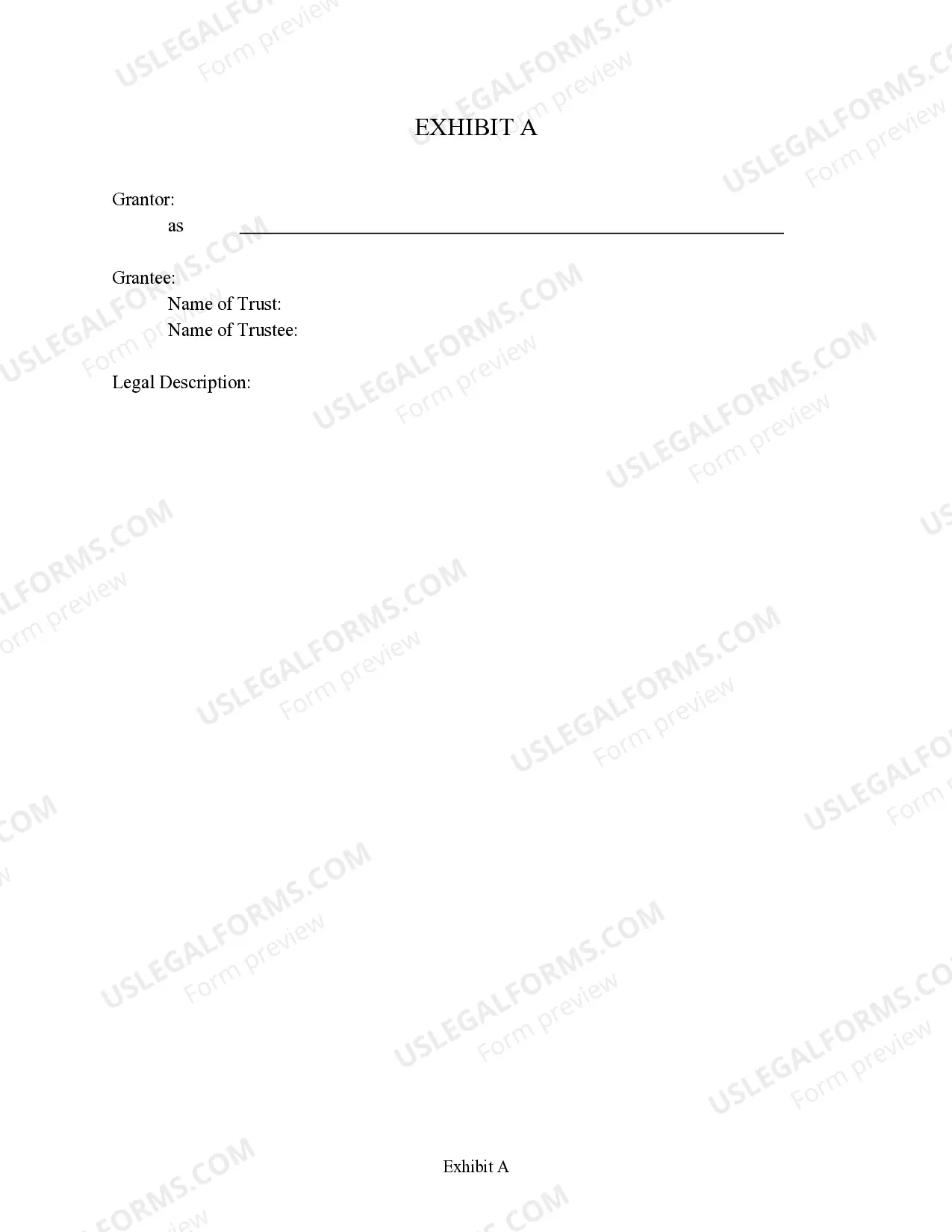

To quitclaim a deed to a trust, start by drafting a quitclaim deed that names the trust as the grantee. Clearly identify the property being transferred and both the grantor and trustee's names. Sign the document in front of a notary public and file it with the appropriate county office. This method is crucial for those looking at the Naperville Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust.

Filling out a quitclaim form involves entering the grantor’s name, the grantee’s name, and describing the property accurately. Ensure you also include information about the nature of the transfer. Once completed, sign the form before a notary public, and remember to keep a copy for your records. Utilizing a service like uslegalforms can streamline this process and provide valuable guidance.

A quitclaim deed offers no warranty on the title, which means you may inherit unknown liens or legal issues with the property. Additionally, it does not guarantee the seller’s ownership, leading to potential risks for the buyer. If you are considering using a quitclaim deed in your estate planning, especially with the Naperville Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust, be sure to weigh these disadvantages carefully.

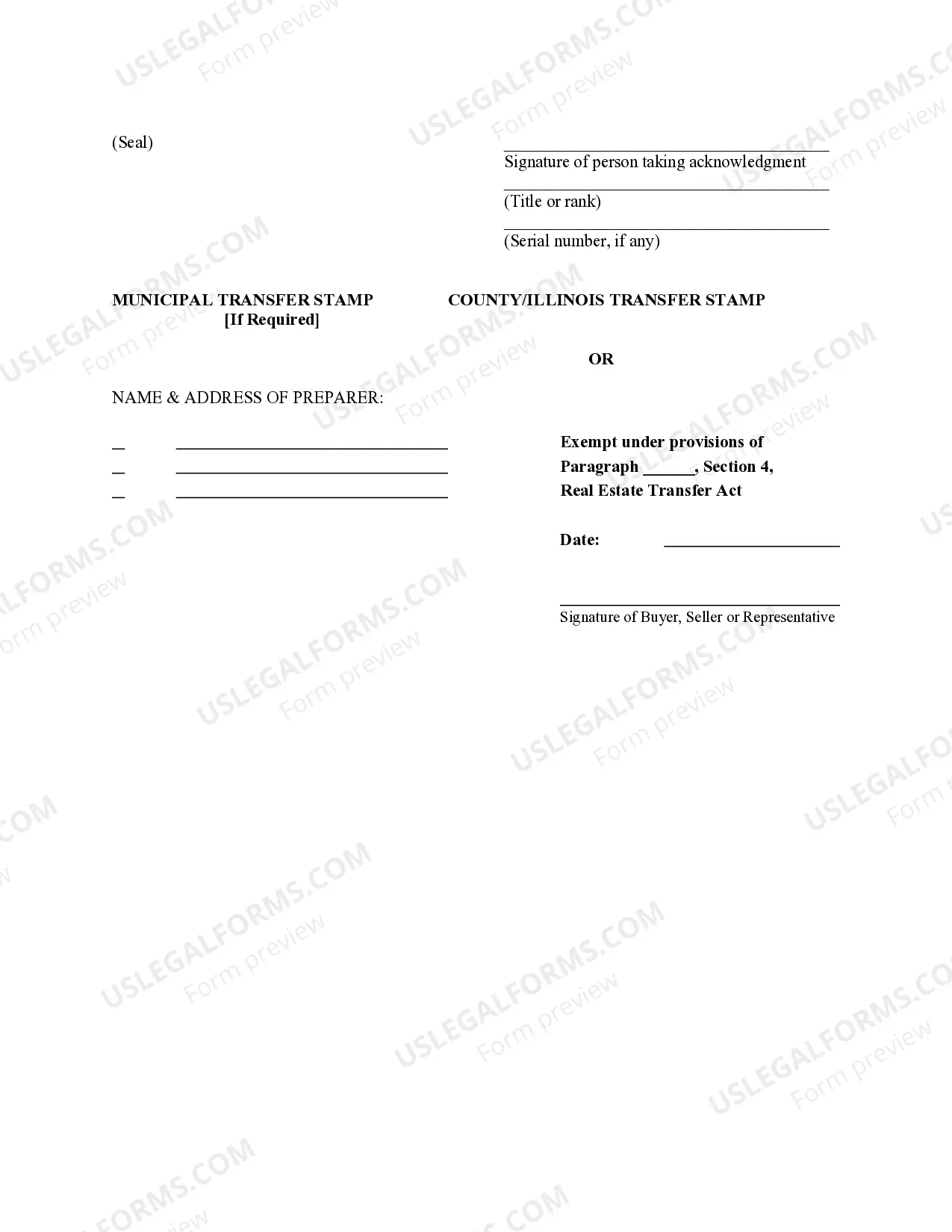

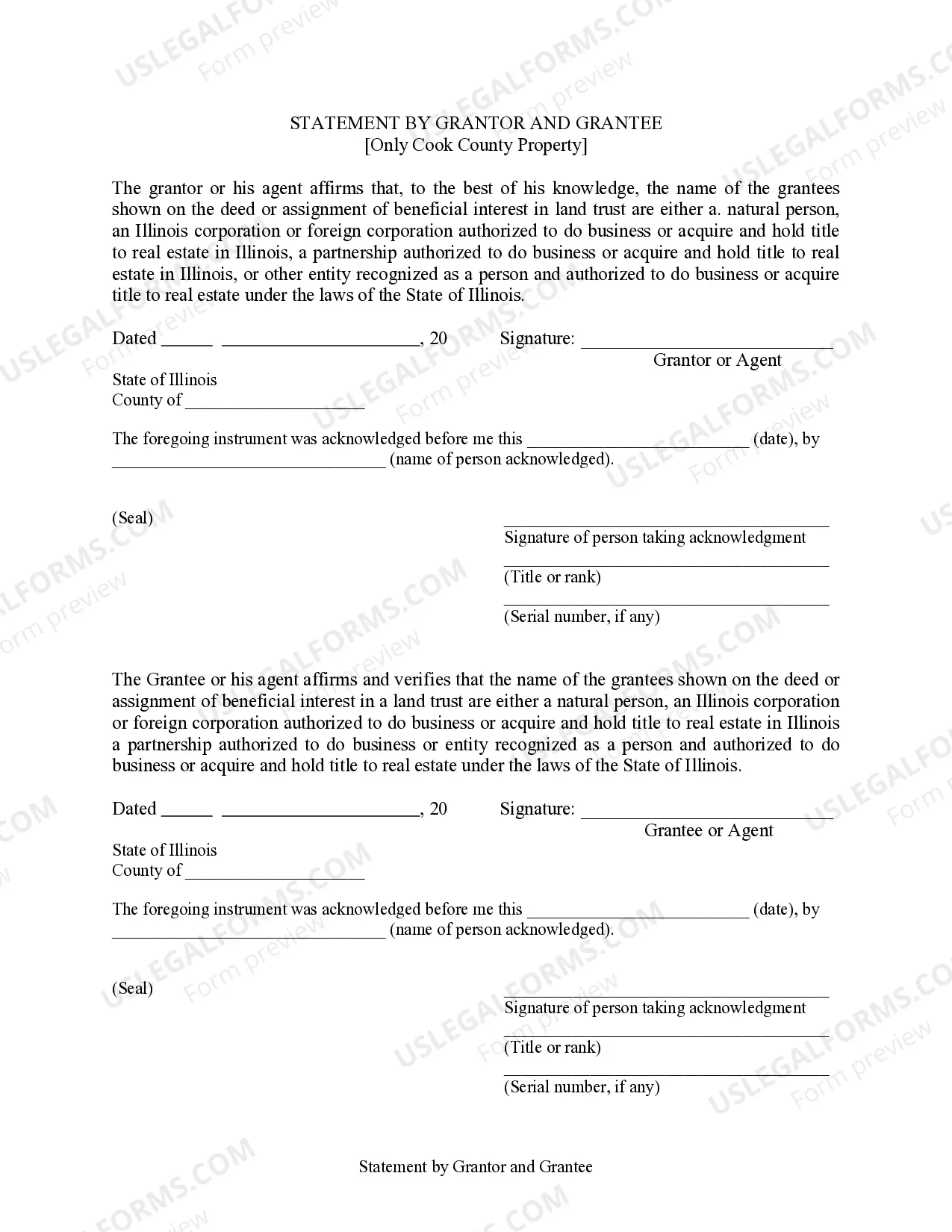

To transfer a deed to a trust in Illinois, you first need to prepare a new deed that specifically names the trust as the grantee. Next, sign the deed in front of a notary public, ensuring all requirements are met. Afterward, file the deed with the local county recorder’s office. This process can solidify your goals, especially when utilizing the Naperville Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust.

One significant disadvantage of a quitclaim deed is the lack of title warranties, which means the new owner assumes the risk of any title problems. This can include hidden claims or liens against the property. When executing a Naperville Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust, it's crucial to understand that this transaction does not protect the new owner from past ownership issues.

A quitclaim deed is commonly used when the property owner wishes to transfer title quickly and easily, often to family members or trusts. In the context of a Naperville Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust, this type of deed facilitates swift property transfers for estate planning purposes. People often turn to quitclaim deeds to eliminate the potential for unnecessary delays and additional costs typically associated with standard property transfers.

It is important to note that a quitclaim deed may not be suitable in disputes over property ownership or when significant debts are involved. For example, you cannot use a quitclaim deed to transfer title if the property has a mortgage unless all parties consent. When considering a Naperville Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust, ensure that you address all legal and financial issues beforehand.

Individuals who wish to transfer property ownership without formal consideration typically benefit the most from a quitclaim deed. In the case of a Naperville Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust, the trust can gain immediate ownership of the property, making asset management simpler. This process can help streamline estate planning and simplify the transfer of family assets for beneficiaries.