Chicago Illinois Warranty Deed from Individual to a Trust

Description

How to fill out Illinois Warranty Deed From Individual To A Trust?

If you are looking for a pertinent form template, it’s unattainable to discover a more user-friendly service than the US Legal Forms site – arguably the most comprehensive collections on the internet.

Here you can find a vast array of form examples for both organizational and personal purposes categorized by types and states, or by keywords.

Utilizing our superior search option, acquiring the latest Chicago Illinois Warranty Deed from Individual to a Trust is as straightforward as 1-2-3.

Process the payment. Use your credit card or PayPal account to finalize the registration procedure.

Retrieve the template. Specify the format and download it to your device. Modify. Complete, edit, print, and sign the acquired Chicago Illinois Warranty Deed from Individual to a Trust.

- Moreover, the relevance of each document is verified by a team of qualified attorneys who routinely review the templates on our site and update them in accordance with the latest state and county laws.

- If you are already familiar with our service and have an established account, all you need to obtain the Chicago Illinois Warranty Deed from Individual to a Trust is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions below.

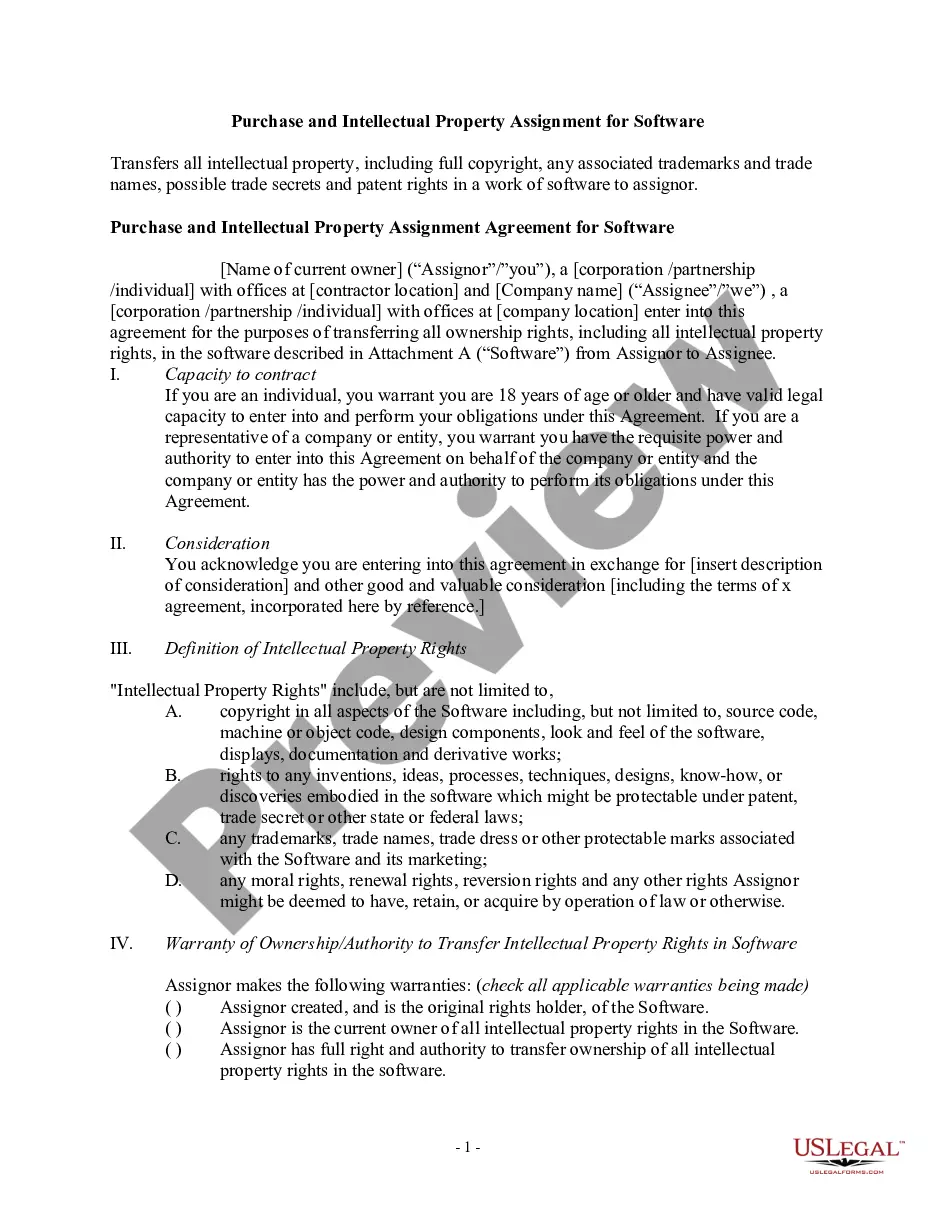

- Ensure you have found the example you need. Review its details and use the Preview function (if available) to check its content. If it does not satisfy your needs, utilize the Search field at the top of the page to find the correct document.

- Verify your selection. Click the Buy now button. After that, choose the desired pricing plan and provide information to register for an account.

Form popularity

FAQ

Trust deeds are common in Alaska, Arizona, California, Colorado, Idaho, Illinois, Mississippi, Missouri, Montana, North Carolina, Tennessee, Texas, Virginia, and West Virginia.

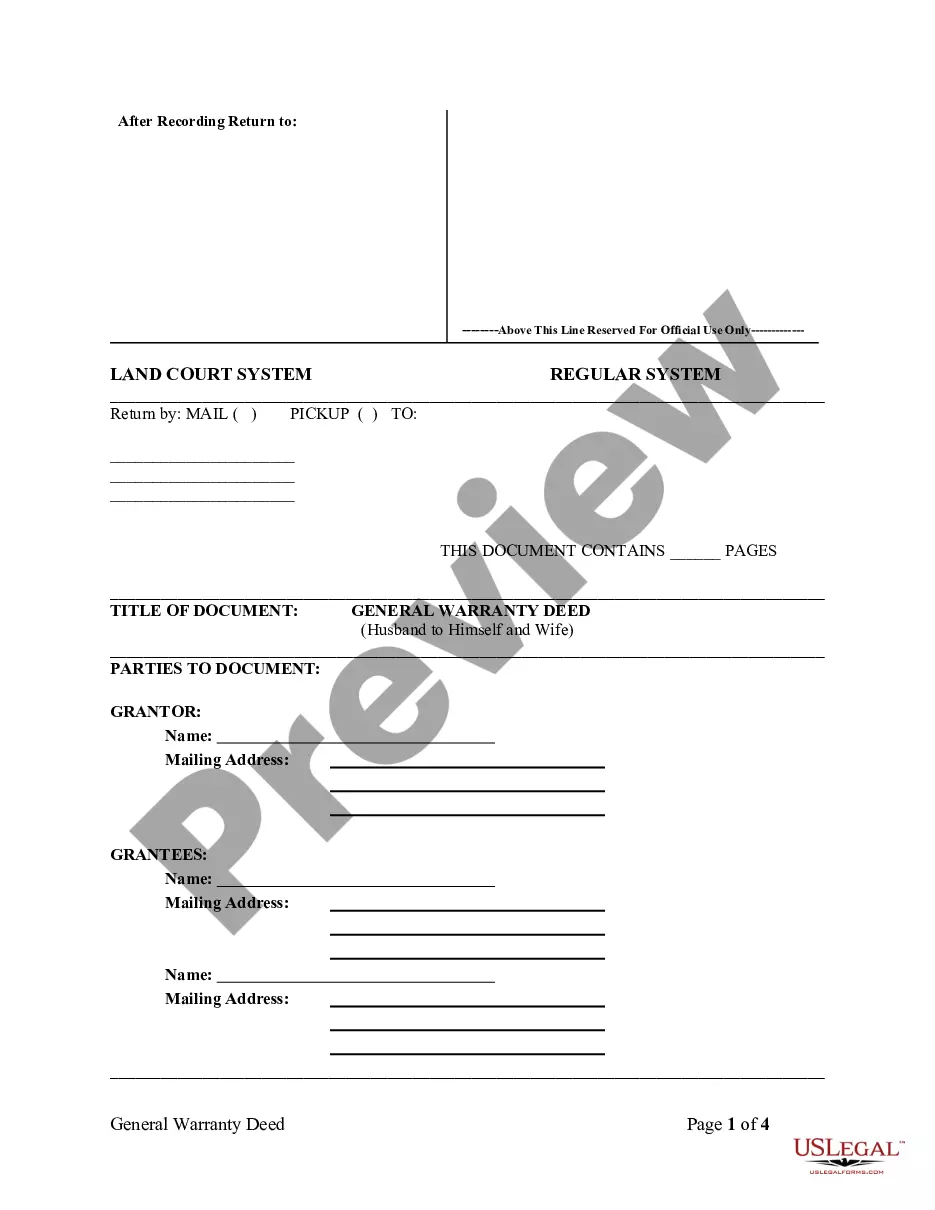

All parties just need to sign the transfer deed (TR1 form) and file it with the land registry. This needs to be accompanied by the land registry's AP1 form, and if the value of the transaction amounts to more than £40,000, then a stamp duty land tax certificate may also be required.

Start Deed of Trust StateMortgage allowedDeed of trust allowedHawaiiYIdahoYIllinoisYYIndianaY47 more rows

If you want to transfer real estate in Illinois to a relative or a friend, you might consider doing this yourself by using a quitclaim deed. A quitclaim deed in Illinois is often used to transfer property between close family members or trusted friends.

A living trust in Illinois provides a variety of benefits that can't be obtained from a will. Trusts are private documents and are not public record or reviewed by any court. No one will know who your beneficiaries are, what your assets are, and what the terms of your trust are. This is very appealing to many people.

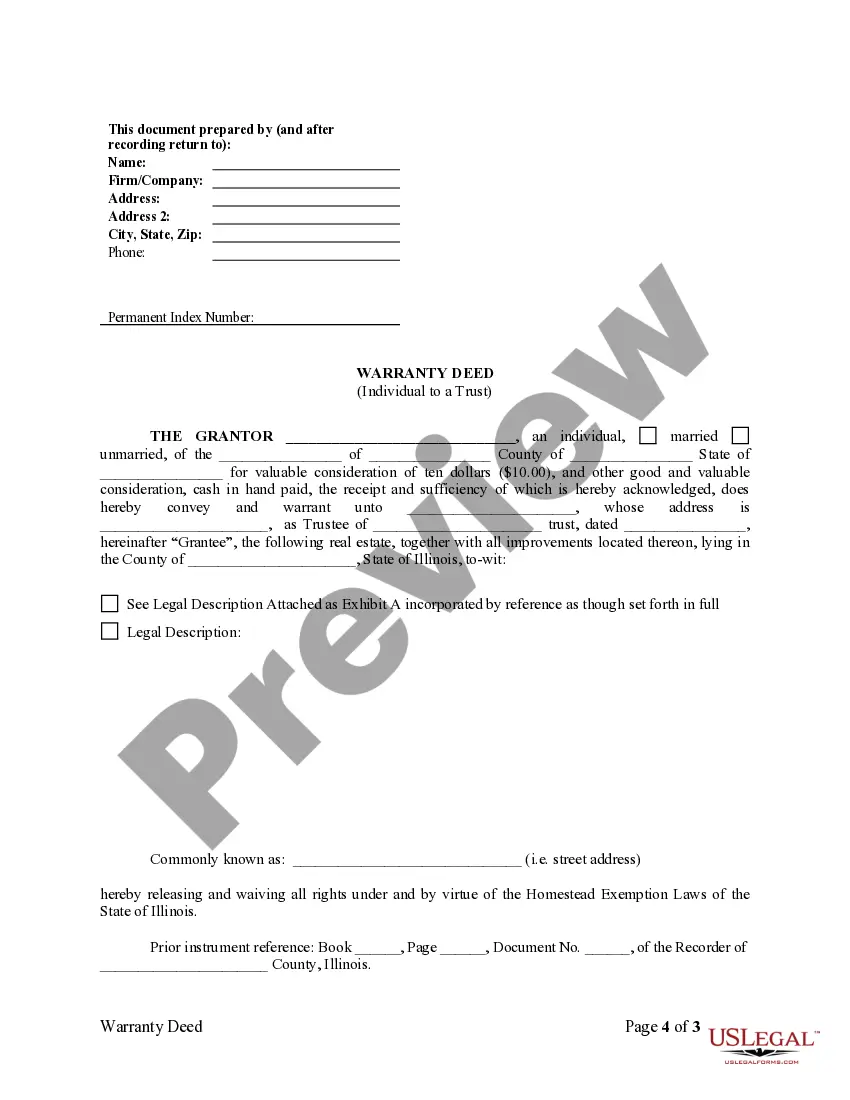

Signing a warranty deed guarantees that the property being sold is legally yours to transfer, that it's in the same condition as advertised, and that there are no undisclosed mortgages or liens tied to it.

In Illinois, the real estate transfer process usually involves four steps: Locate the most recent deed to the property.Create the new deed.Sign and notarize the new deed.Record the deed in the Illinois land records.

It usually takes four to six weeks to complete the legal processes involved in the transfer of title.

Overview of Illinois Real Estate Transfer Tax State real estate transfer tax are imposed at a rate of $0.50 per $500 of value stated in the Transfer Tax Return. County real estate transfer tax are imposed at a rate of $0.25 per $500 of value stated in the Transfer Tax Return.

Mechanism of Transfer Real estate is transferred through the execution of the appropriate deed transferring the real estate property to the Trust. You or your attorney must then record the deed with the Recorder of Deeds for your county.