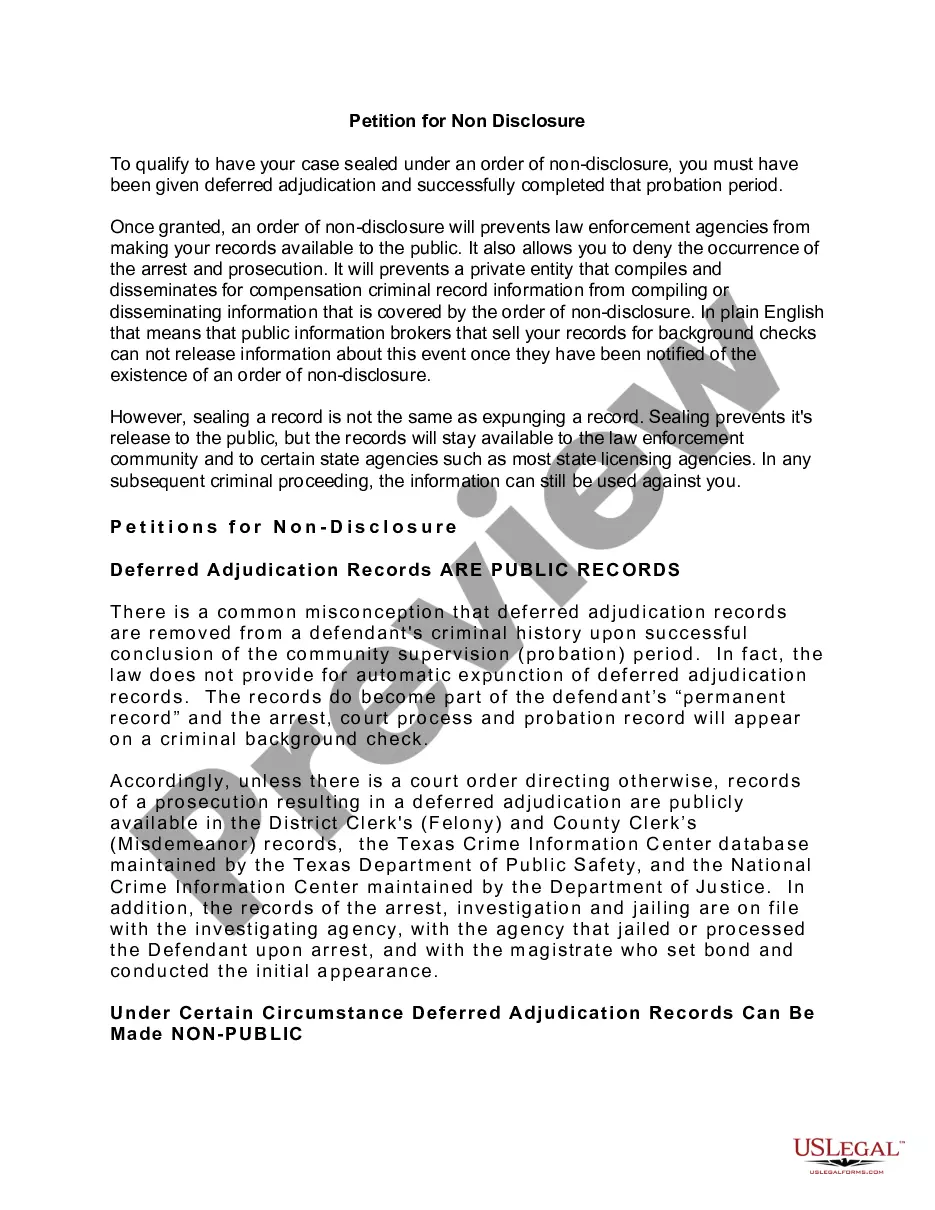

There are two basic types of deeds: a warranty deed, which guarantees that the grantor owns title, and the quitclaim deed, which transfers only that interest in the real property which the grantor actually has. The only type of deed that creates "liability by reason of covenants of warranty" as to matters of record is a general warranty deed. A quit claim deed contains no warranties and the grantor does not have liability to the grantee for other recorded claims on the property. The grantee takes the property subject to existing taxes, assessments, liens, encumbrances, covenants, conditions, restrictions, rights of way and easements of record.

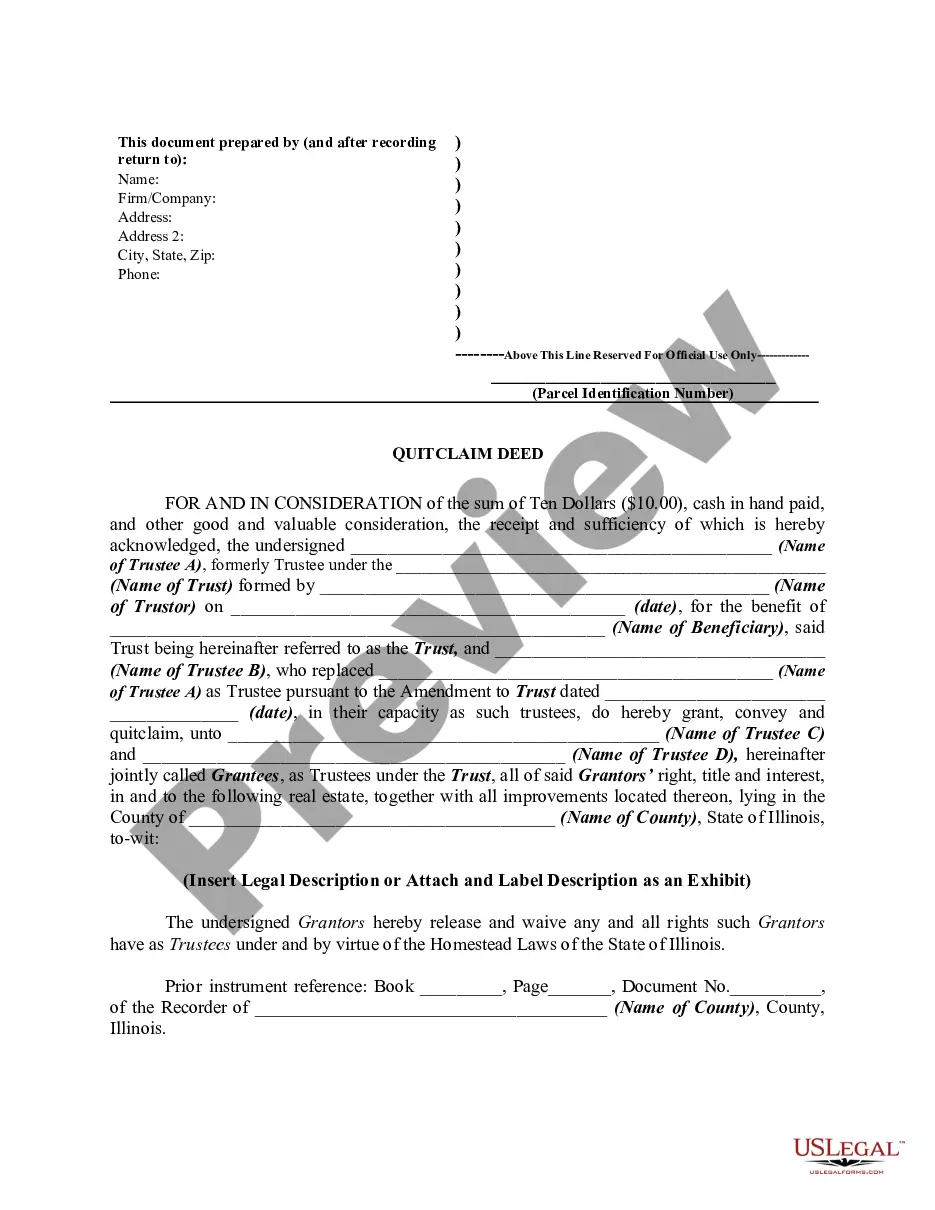

Cook Illinois Quitclaim Deed from Trustee and Former Trustee to New Trustees

Description

How to fill out Illinois Quitclaim Deed From Trustee And Former Trustee To New Trustees?

Utilize the US Legal Forms to gain instant access to any document you desire.

Our helpful website, featuring numerous document templates, makes it easy to find and obtain nearly any document sample you require.

You can save, complete, and endorse the Cook Illinois Quitclaim Deed from Trustee and Former Trustee to New Trustees in just minutes instead of spending hours navigating the Internet in search of the appropriate template.

Utilizing our catalog is an excellent method to enhance the security of your document filing.

If you do not have an account yet, follow the instructions below.

Locate the template you require. Ensure it is the document you were looking for: verify its title and description, and utilize the Preview feature when available. Otherwise, use the Search bar to find the required one.

- Our expert legal professionals routinely review all the documents to ensure that the templates are suitable for a specific region and conform to current laws and regulations.

- How can you access the Cook Illinois Quitclaim Deed from Trustee and Former Trustee to New Trustees.

- If you already possess a subscription, simply Log In to your account.

- The Download option will be available on all the documents you view.

- Additionally, you can retrieve all the previously saved files in the My documents menu.

Form popularity

FAQ

A Cook Illinois Quitclaim Deed from Trustee and Former Trustee to New Trustees does not inherently override a trust. Instead, it acts as a vehicle for property transfer based on the trust’s terms. If a quitclaim deed conflicts with the provisions of a trust, the trust's terms generally take precedence. Understanding how these documents interact is essential for effective property management.

While a Cook Illinois Quitclaim Deed from Trustee and Former Trustee to New Trustees is straightforward, it has drawbacks. This deed does not guarantee clear title, meaning buyers may assume hidden liabilities. Additionally, it provides less protection for the grantee compared to other types of deeds. It's important to weigh these concerns based on your situation.

Several factors can void a Cook Illinois Quitclaim Deed from Trustee and Former Trustee to New Trustees. If the deed was signed under duress, fraud, or by an individual who lacked legal capacity, it may be invalid. Additionally, failing to follow proper recording procedures can impact the deed's legality. Always ensure that your deed meets legal standards to avoid issues.

Yes, a Cook Illinois Quitclaim Deed from Trustee and Former Trustee to New Trustees can transfer property from a trust. This deed is a legal tool that allows the current trustee to convey property interest from the trust to another party. However, it's crucial to follow the trust's terms to ensure the transfer is compliant. Always consult a legal expert to confirm the process.

Choosing between a quitclaim deed and a trust depends on your specific needs. A Cook Illinois Quitclaim Deed from Trustee and Former Trustee to New Trustees is often simpler for transferring property. It provides a quick way to change ownership without complex legal procedures. Trusts may offer more benefits for estate planning, but they also require more administration.

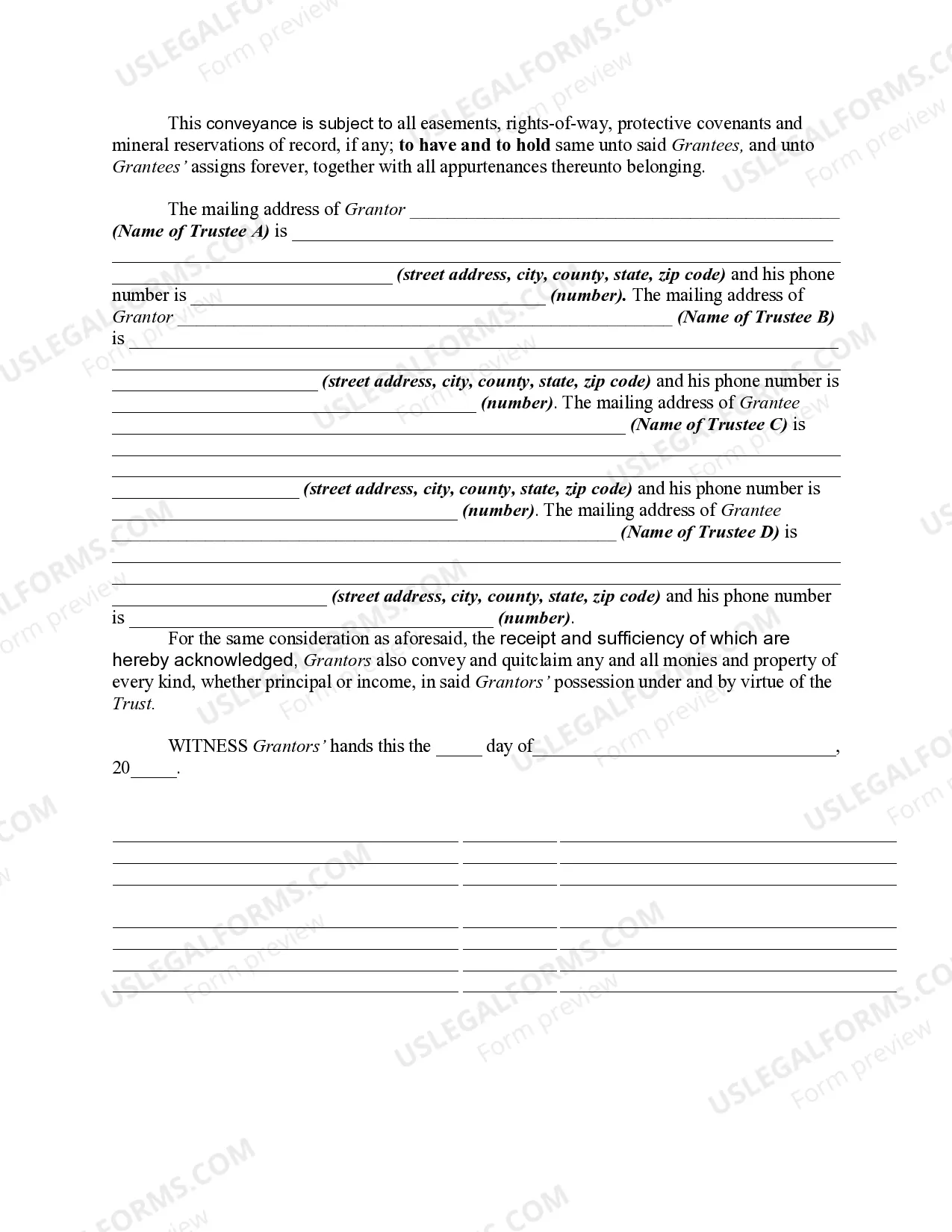

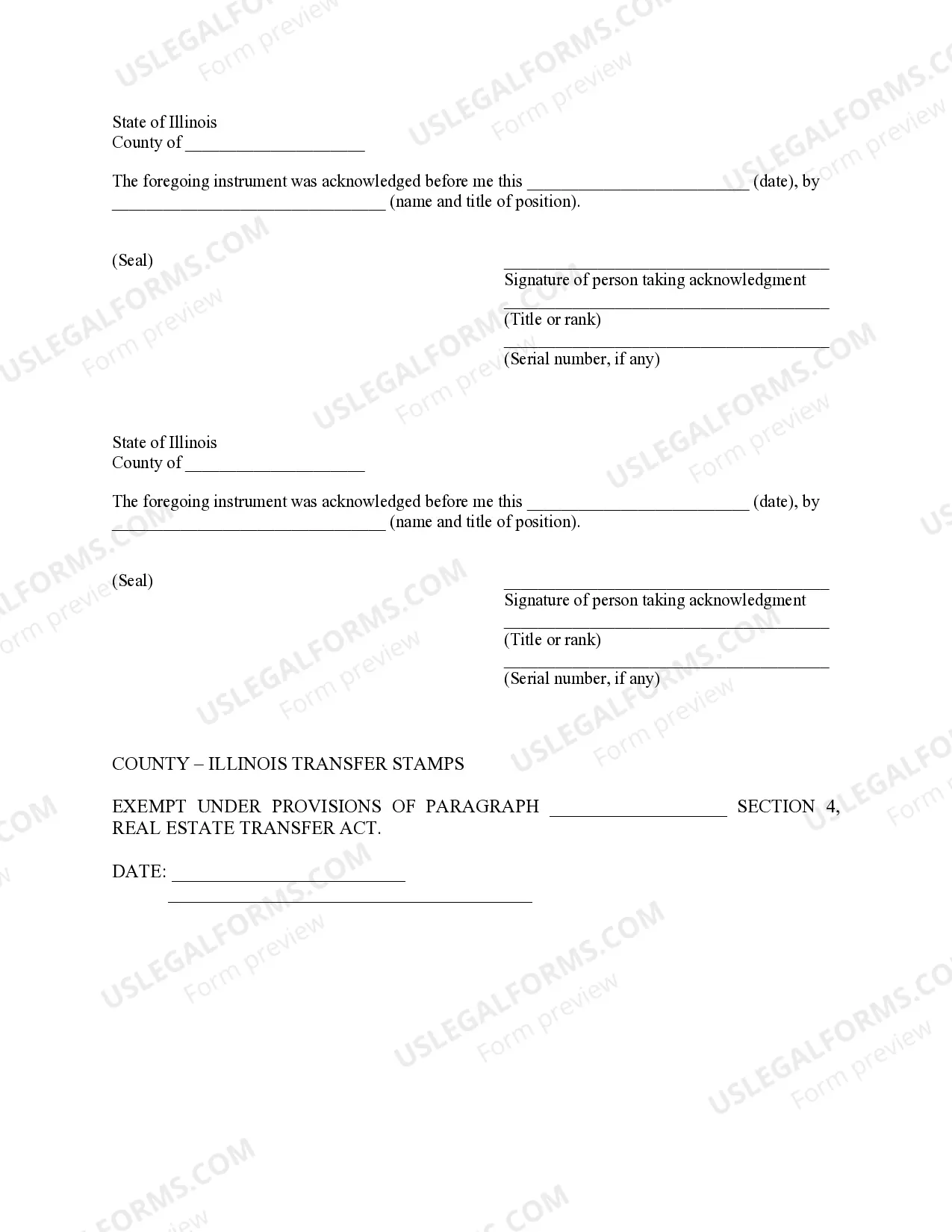

Filling out a quitclaim deed in Illinois involves several straightforward steps. Start with the Cook Illinois Quitclaim Deed from Trustee and Former Trustee to New Trustees form, ensuring you enter the names, addresses, and legal description of the property clearly. Be sure to indicate the grantor and grantee accurately, as this information is vital for the deed's validity. After completing the form, sign it in front of a notary public and file it with the local county recorder.

Transferring a deed to a trust in Illinois requires filing a Cook Illinois Quitclaim Deed from Trustee and Former Trustee to New Trustees. First, gather the necessary documentation, including the current deed and trust agreement. Next, complete the quitclaim deed form with accurate details of the property and the parties involved. Finally, file the deed with the county recorder's office to ensure proper documentation.

The easiest way to transfer ownership of a house is to use a simple deed, like the Cook Illinois Quitclaim Deed from Trustee and Former Trustee to New Trustees. Complete and sign the deed, and then record it with the appropriate county office. For a straightforward process, consider platforms like uslegalforms, which offer templates and guidance for creating your deed with ease.

Transferring ownership of property in Illinois typically requires preparing a deed, such as the Cook Illinois Quitclaim Deed from Trustee and Former Trustee to New Trustees, to officialize the change. After drafting the deed, both parties must sign it, and it must be recorded with the county clerk. Following these steps will ensure that the transfer is legally recognized.

To transfer ownership of property in Illinois, you generally need a deed, like the Cook Illinois Quitclaim Deed from Trustee and Former Trustee to New Trustees. This involves drafting and executing the deed, then filing it with the county recorder’s office. Additionally, make sure to clear any outstanding liens or claims on the property to avoid complications.