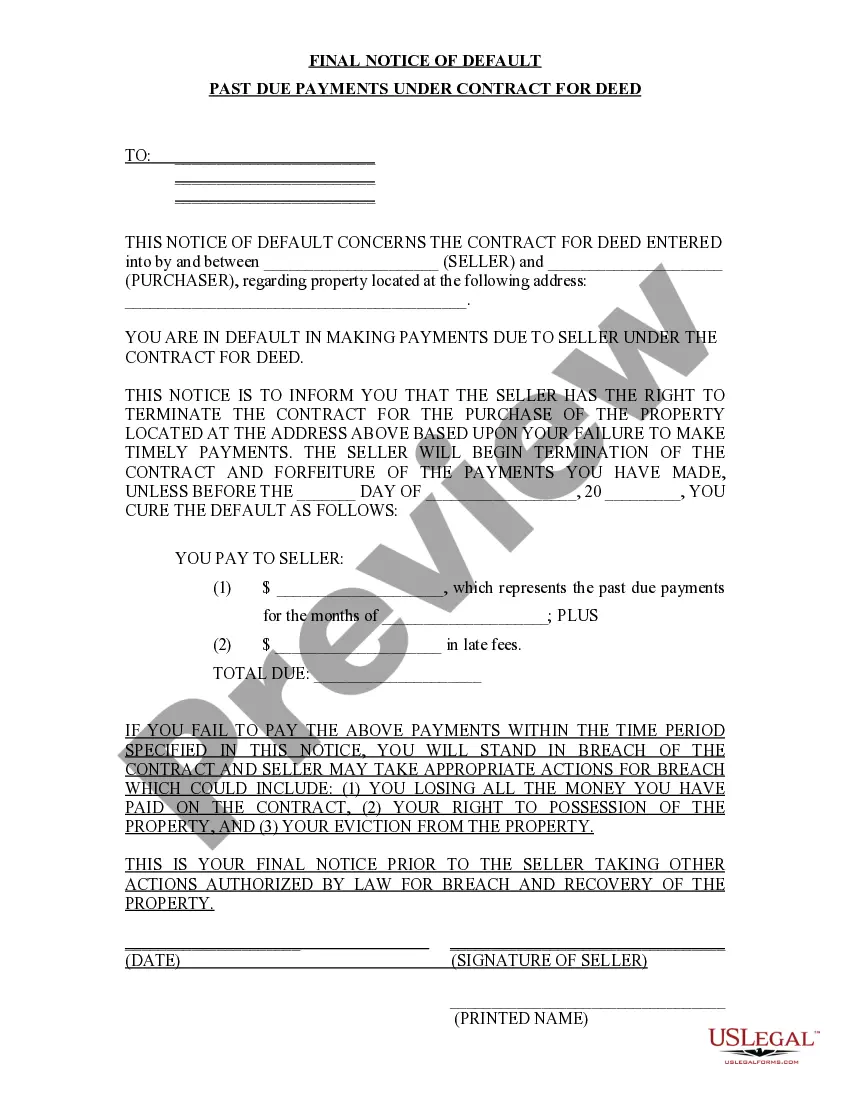

Chicago Illinois Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Illinois Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

If you have previously used our service, Log In to your account and download the Chicago Illinois Final Notice of Default for Past Due Payments related to the Contract for Deed onto your device by clicking the Download button. Ensure that your subscription is active. If it isn't, renew it as per your payment plan.

If this is your first encounter with our service, follow these straightforward steps to acquire your document.

You have lifelong access to every document you have acquired: you can find it in your profile under the My documents section whenever you need to use it again. Utilize the US Legal Forms service to swiftly find and save any template for your personal or professional requirements!

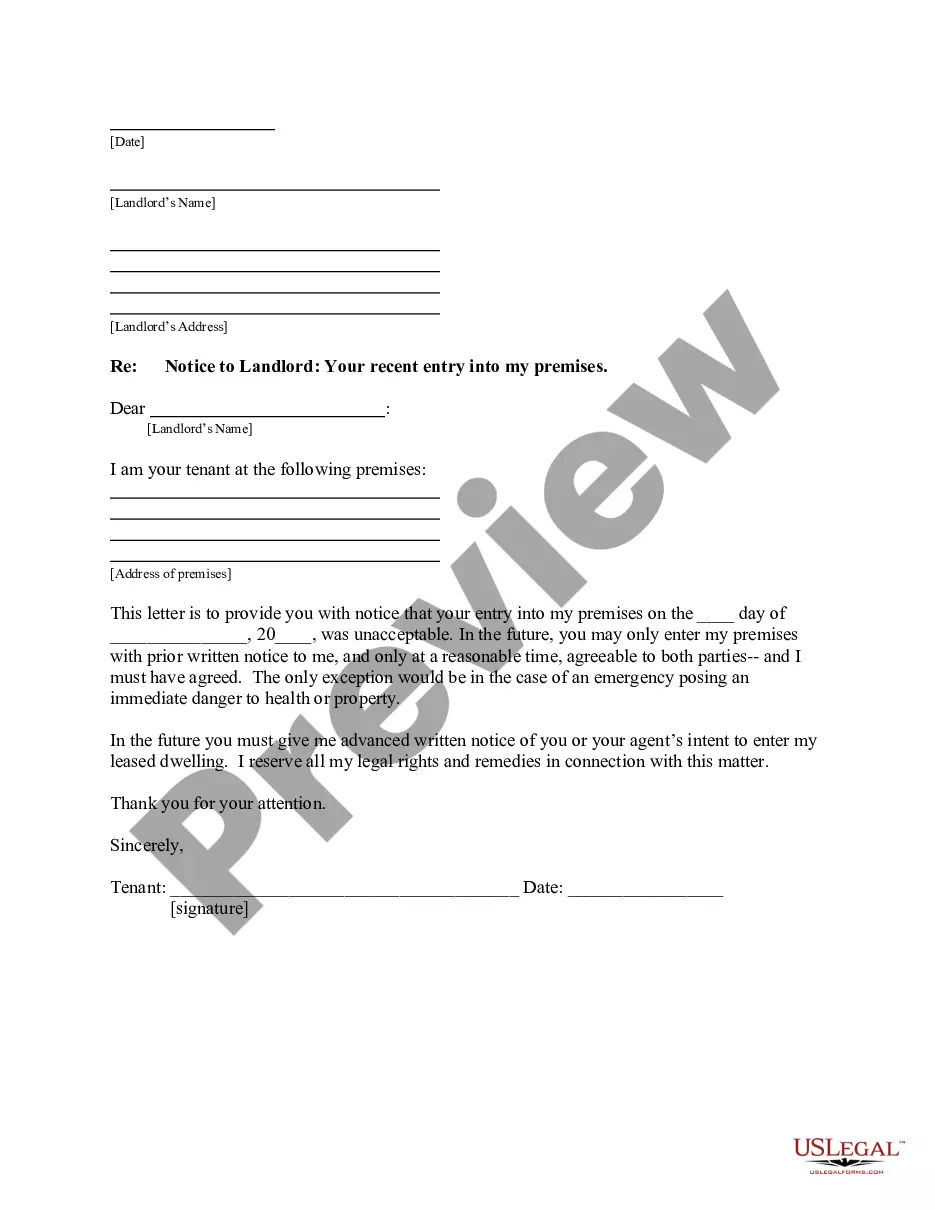

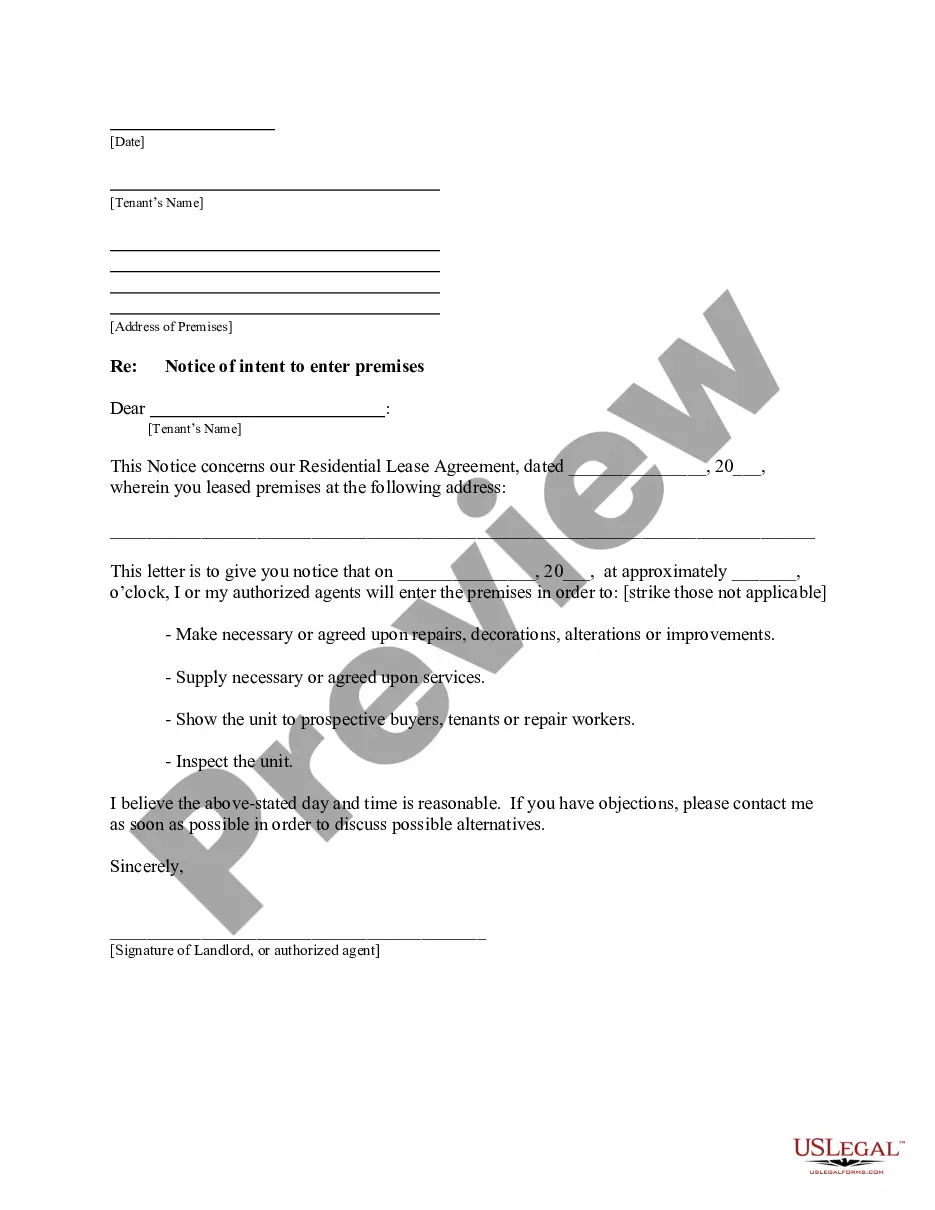

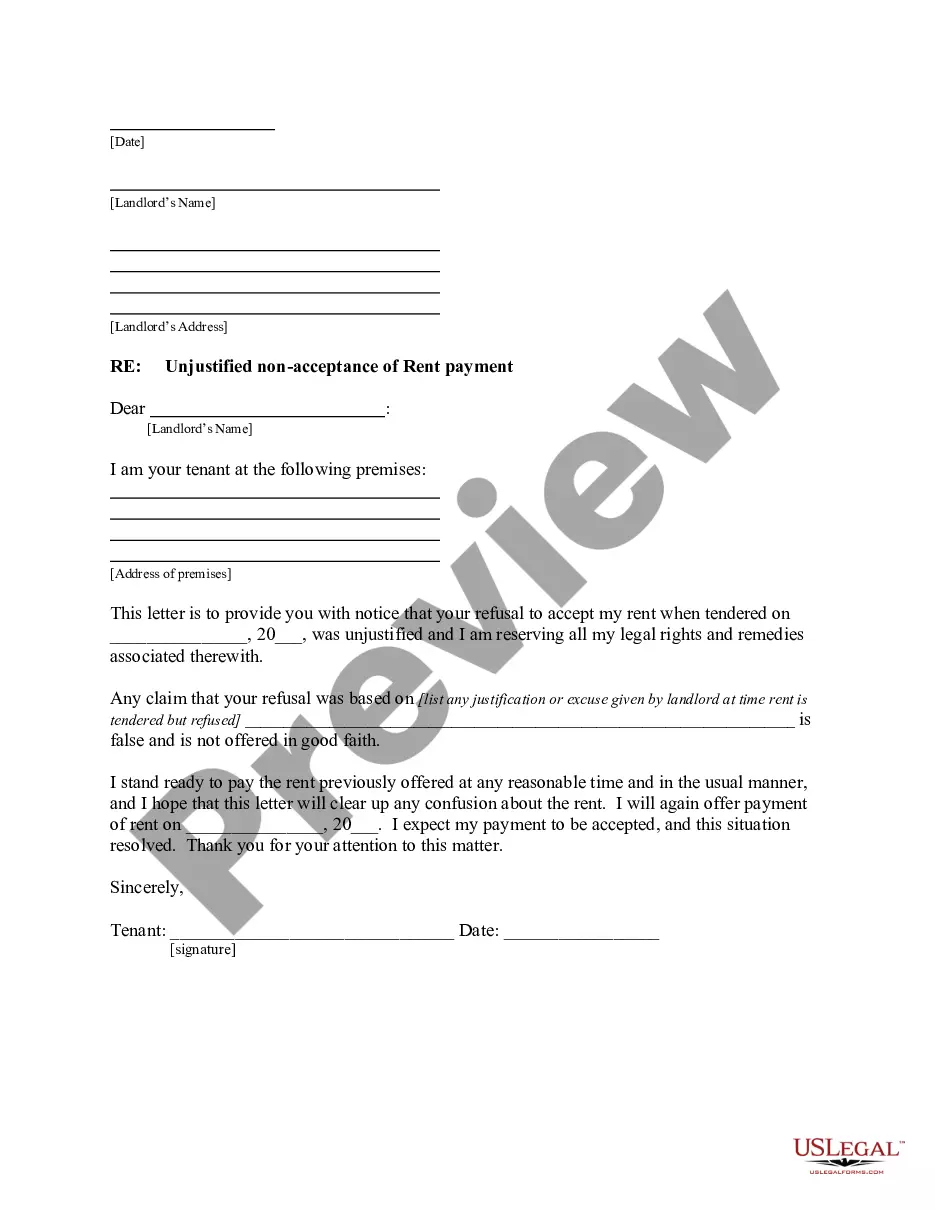

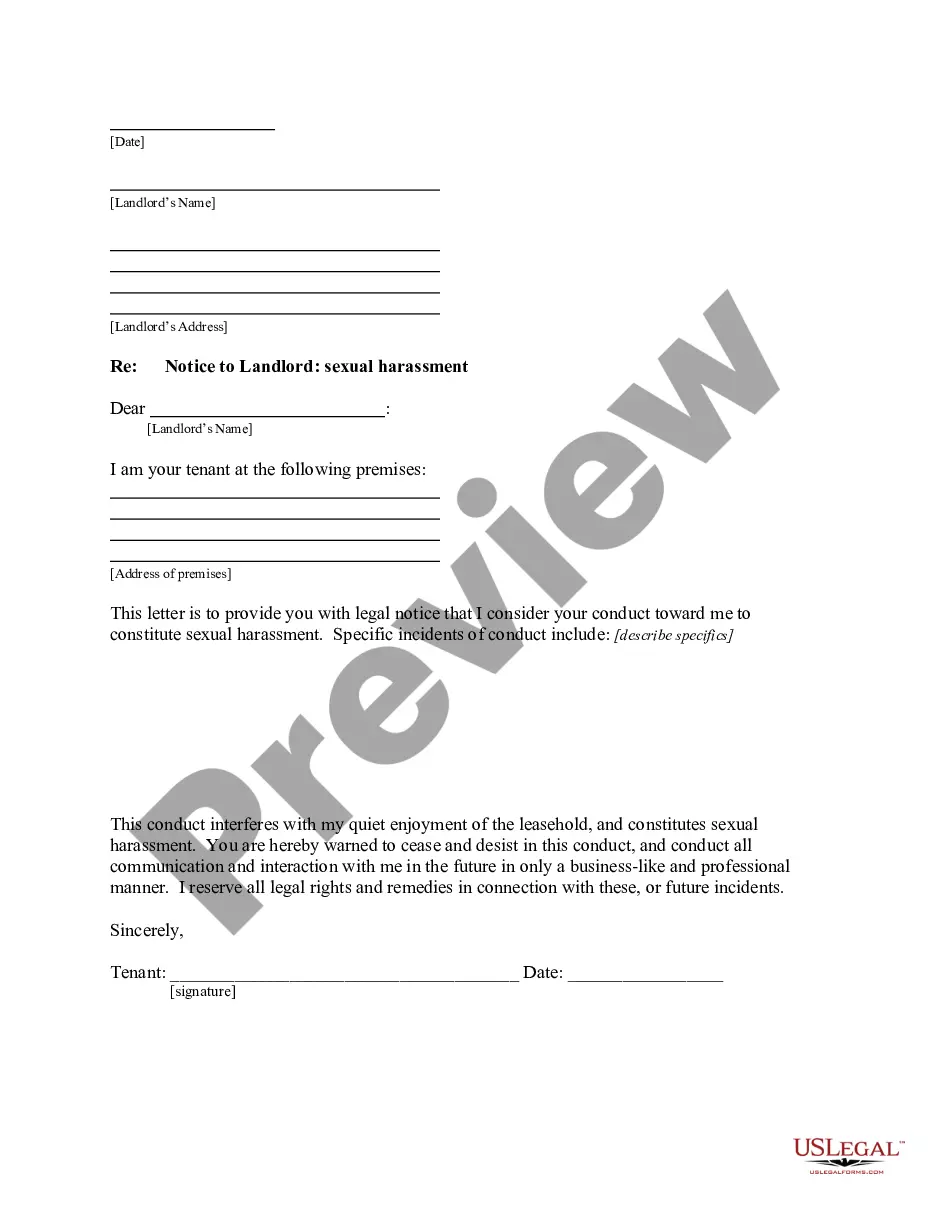

- Ensure you’ve located an appropriate document. Browse through the description and utilize the Preview option, if available, to verify if it meets your needs. If it doesn’t fit, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Chicago Illinois Final Notice of Default for Past Due Payments related to the Contract for Deed. Select the file format for your document and store it on your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

If you fail to make payments under a Contract for Deed, the seller can end the contract. The seller must tell you that they want to end the contract. The seller must wait 30 days before trying to go to court to evict you.

(b) If the seller fails to record the contract or the memorandum of the contract as required by subsection (a) of this Section, the buyer has the right to rescind the contract until such time as the seller records the contract.

In Illinois, a seller can get out of a real estate contract if the buyer's contingencies are not met?these include financial, appraisal, inspection, insurance, or home sale contingencies agreed to in the contract. Sellers might have additional exit opportunities with unique situations also such as an estate sale.

In Illinois, a seller can get out of a real estate contract if the buyer's contingencies are not met?these include financial, appraisal, inspection, insurance, or home sale contingencies agreed to in the contract. Sellers might have additional exit opportunities with unique situations also such as an estate sale.

The buyer is the real owner of the property) to the property and makes installment payments to the Seller. When the Buyer has paid the full contract price, the Seller conveys a deed to the Buyer and the transaction is at an end. Articles of Agreement are legal and enforceable in Illinois.

It is not necessary for the seller to go to court to cancel the contract. In order to cancel a contract for deed, a seller needs to complete a form called a notice of cancellation of contract for deed, and have the notice personally served on the buyer.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.