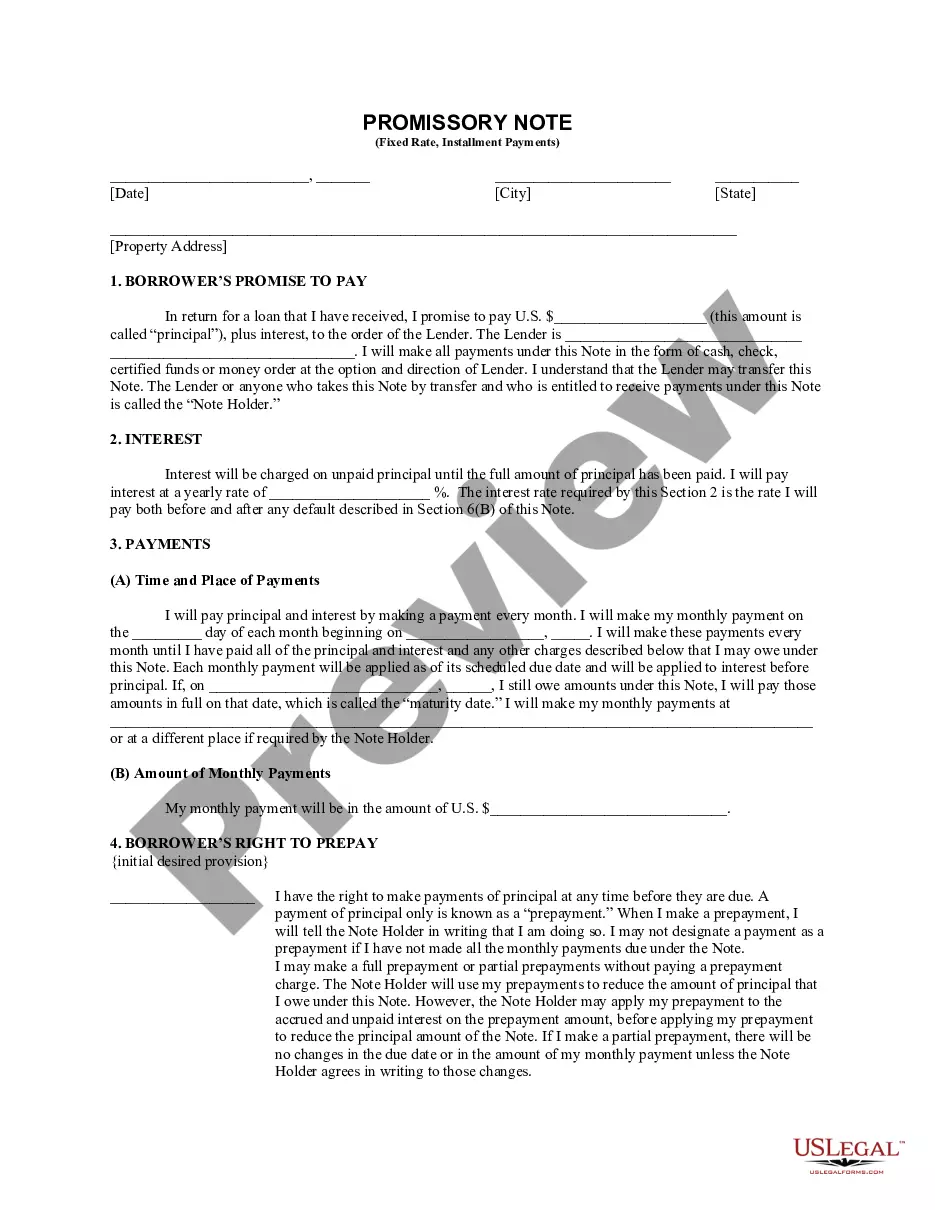

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Nampa Idaho Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Idaho Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Are you searching for a dependable and affordable legal documents provider to obtain the Nampa Installments Fixed Rate Promissory Note Secured by Commercial Real Estate for Idaho? US Legal Forms is your ideal option.

Whether you need a simple agreement to establish guidelines for living together with your partner or a collection of forms to expedite your divorce through the judicial system, we have you covered. Our platform offers over 85,000 current legal document templates for individual and business needs. All templates we provide are specific and tailored according to the requirements of specific states and counties.

To retrieve the document, you must Log In to your account, locate the desired template, and click the Download button adjacent to it. Please note that you can download your previously acquired form templates at any time in the My documents section.

Is this your first time visiting our site? No problem. You can set up an account in just a few minutes, but before proceeding, ensure you do the following.

Now you can create your account. Then select the subscription option and proceed to payment. Once the payment is finalized, download the Nampa Installments Fixed Rate Promissory Note Secured by Commercial Real Estate for Idaho in any offered format. You can revisit the website at any time and redownload the document at no additional cost.

Finding current legal forms has never been more straightforward. Try US Legal Forms now, and say goodbye to wasting your precious time searching for legal documents online for good.

- Verify that the Nampa Installments Fixed Rate Promissory Note Secured by Commercial Real Estate for Idaho aligns with your state and local regulations.

- Review the specifics of the form (if available) to understand who and what the document is meant for.

- Begin the search anew if the template does not fit your legal circumstances.

Form popularity

FAQ

In Idaho, promissory notes are governed by both state and federal laws. The law requires the note to include essential details such as the borrower's information, repayment terms, and any collateral involved. It's important to comply with these regulations to ensure the enforceability of your Nampa Idaho Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Consulting resources or legal aid can guide you through these legal requirements.

A reasonable interest rate for a promissory note generally falls between 5% to 10%, but this can differ based on the specific agreement and market conditions. For the Nampa Idaho Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, these rates may reflect the property's value and the borrower's creditworthiness. It is essential to evaluate these factors to ensure you find an equitable rate that meets your financial objectives.

The market rate for commercial loans varies based on economic conditions, the type of property, and borrower qualifications. Typically, lenders consider factors such as credit history and current market trends when determining rates. If you are looking for a solution tailored to your needs, consider the Nampa Idaho Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. This option offers predictable payments and can align with your financial goals.

A handwritten promissory note can indeed be legal, provided it contains all the necessary elements. It's crucial for the note to be clear, without ambiguity, and signed by both parties. If you're drafting a Nampa Idaho Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, ensure it includes specific terms to avoid future conflicts.

Yes, in most cases, a secured promissory note must be notarized to enhance its legal standing. Notarization helps verify the identities of the parties involved and confirms that they executed the document willingly. If you are creating a Nampa Idaho Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, having it notarized adds extra security.

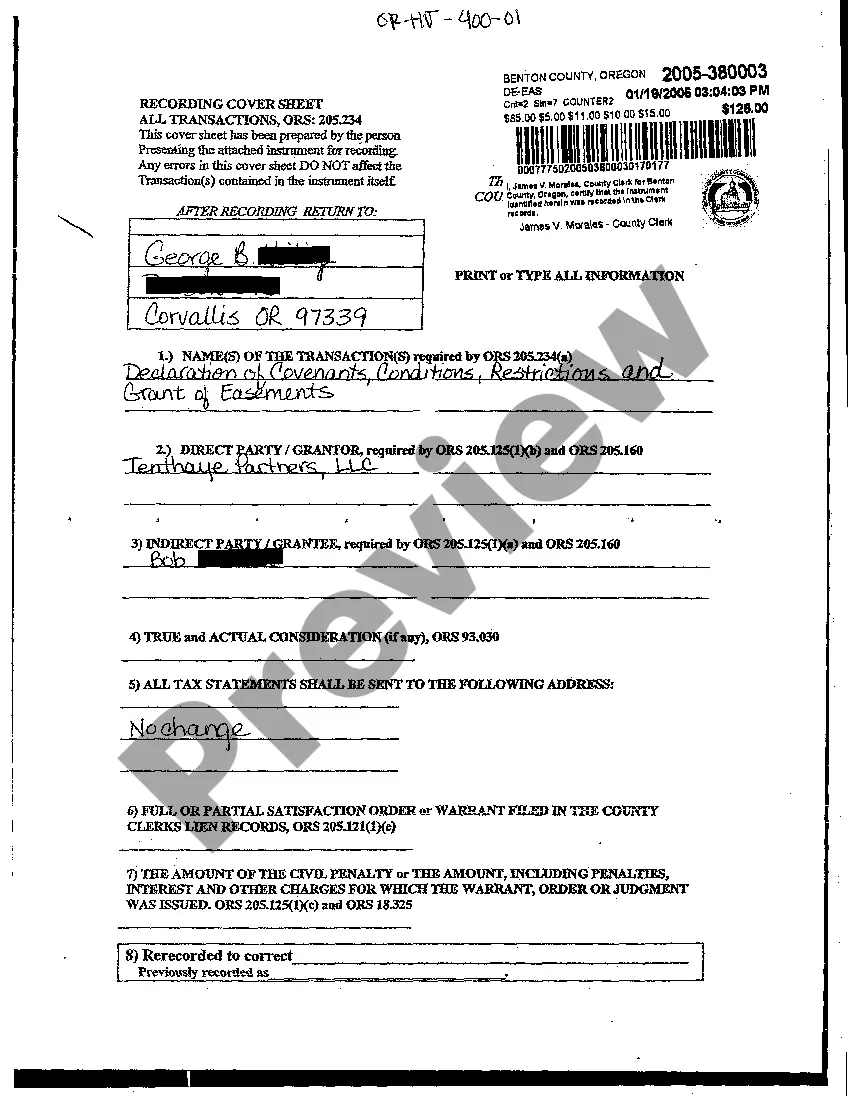

Yes, in order to protect the lender's interest effectively, a secured promissory note should be recorded along with the mortgage or deed of trust. This recording establishes a legal claim to the property outlined in the Nampa Idaho Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Recording these documents enhances transparency and secures the lender's rights in case of any disputes.

Promissory notes are typically not filed with a government office; instead, they are kept securely among the parties involved in the transaction. However, the mortgage or deed of trust associated with a Nampa Idaho Installments Fixed Rate Promissory Note Secured by Commercial Real Estate should be filed with the local county recorder's office to establish a public record of the security interest. This helps protect the lender's rights to the property.

A promissory note can become invalid if it lacks essential elements such as a clear repayment schedule, signatures from the involved parties, or if it fails to meet state laws governing secured transactions. For a Nampa Idaho Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it is crucial that all required details are properly included to avoid legal challenges. Familiarizing yourself with local regulations will help in validating your note.

Promissory notes can indeed be backed by collateral, which enhances the lender's position. When a Nampa Idaho Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is backed by real property, it provides the lender with a claim to that asset in case of default. This added layer of security helps both parties feel more confident in the transaction.

The document that secures a promissory note to the real property is known as a mortgage or deed of trust. This legal instrument allows the lender to take possession of the property if the borrower defaults on the Nampa Idaho Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. It essentially links the promissory note to the actual real estate, giving the lender a claim to the property.