This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

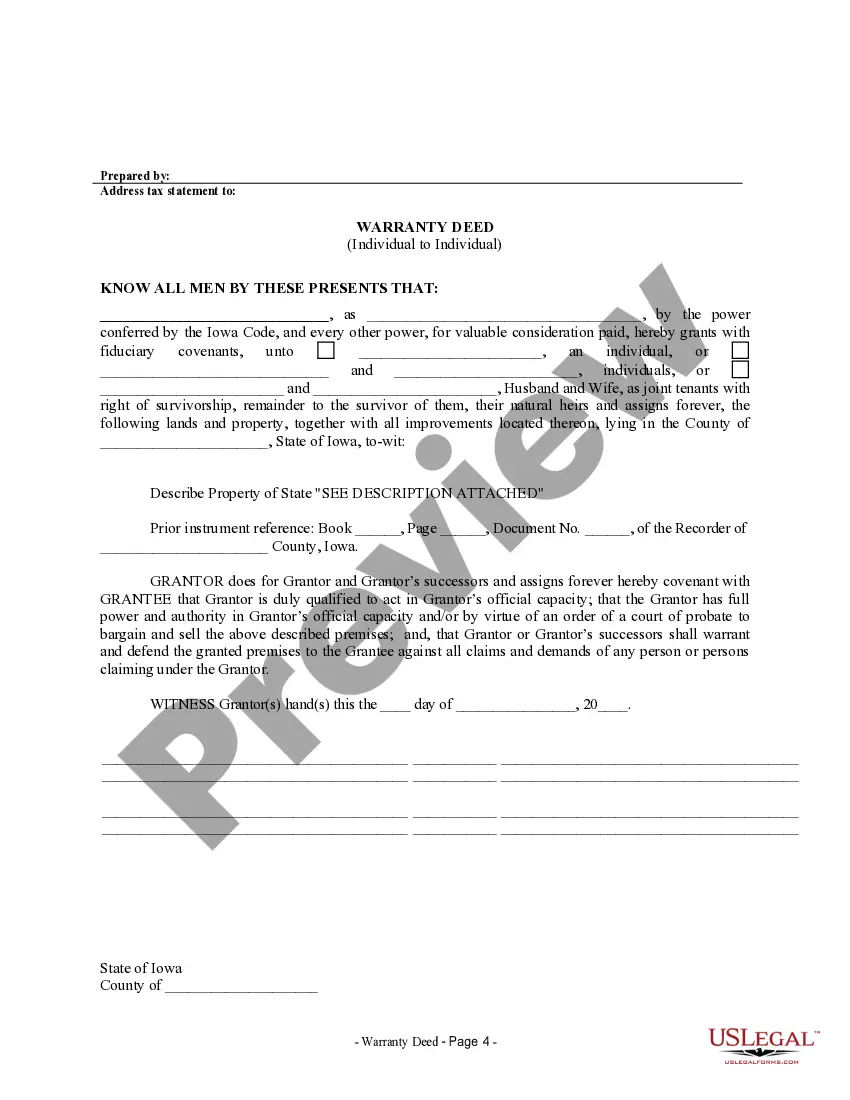

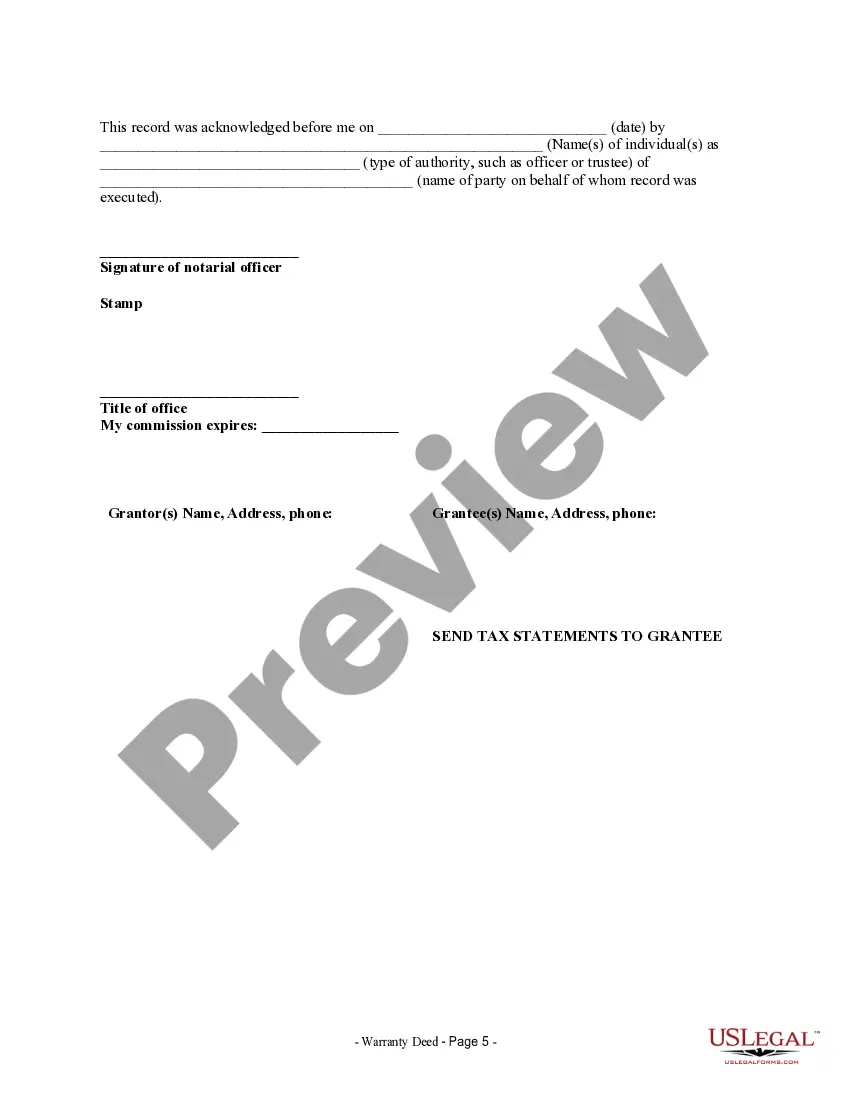

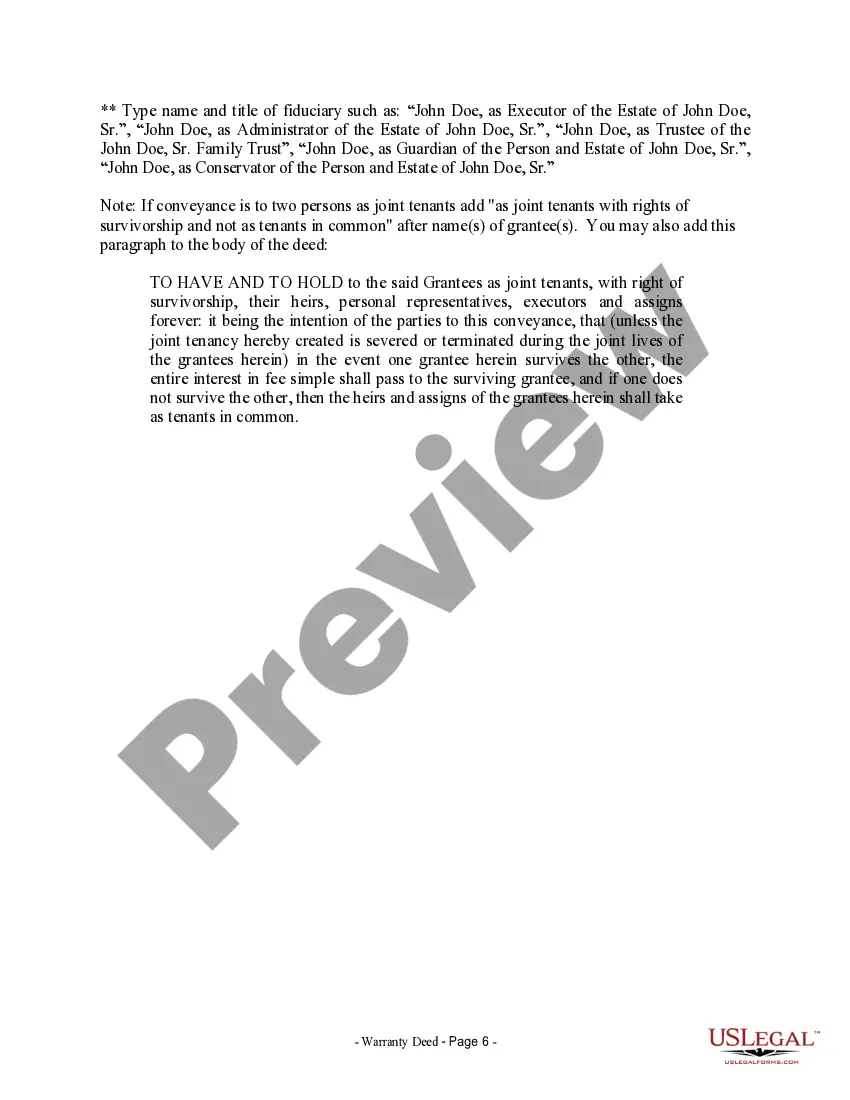

Cedar Rapids Iowa Fiduciary Deed: A Comprehensive Guide for Executors, Trustees, Trustees, Administrators, and other Fiduciaries Introduction: The Cedar Rapids Iowa Fiduciary Deed is a legal document widely used by various fiduciaries, including Executors, Trustees, Trustees, Administrators, and other individuals entrusted with managing and distributing property in Cedar Rapids, Iowa. This detailed guide aims to provide essential information about the purpose, types, and key considerations related to Cedar Rapids Iowa Fiduciary Deed, empowering fiduciaries to navigate this process with confidence and accuracy. 1. What is a Cedar Rapids Iowa Fiduciary Deed? A Cedar Rapids Iowa Fiduciary Deed is a legal instrument used to transfer real estate or property from a fiduciary to a buyer or beneficiary. It serves as a formal means of conveying ownership and ensuring the legality and validity of the property transfer. 2. Who can utilize a Cedar Rapids Iowa Fiduciary Deed? The Cedar Rapids Iowa Fiduciary Deed is primarily intended for use by different fiduciaries who are responsible for managing estates, trusts, wills, or other assets on behalf of others. Some fiduciaries who frequently employ this document include: — Executors: Individuals specifically named in a will to carry out the deceased person's wishes and manage the estate's distribution. — Trustees: Individuals entrusted with managing and distributing assets according to a trust document's terms. Trusteesrs: Individuals who create a trust and appoint Trustees to manage their assets for the benefit of beneficiaries. — Administrators: Individuals appointed by the court to handle the estate of someone who has passed away without leaving a will. — Other Fiduciaries: Individuals participating in a fiduciary relationship, such as guardians, conservators, or agents acting under a power of attorney. 3. Types of Cedar Rapids Iowa Fiduciary Deed: a. Executor's Deed: Used when an Executor transfers property as instructed in a will. b. Trustee's Deed: Employed when a Trustee transfers property from a trust to a beneficiary or third-party. c. Court-Appointed Administrator's Deed: Utilized by an Administrator to transfer property in the absence of a will through court proceedings. d. Conservator's Deed: Used by a court-appointed Conservator to transfer property on behalf of an incapacitated individual. e. Guardian's Deed: Employed by a court-appointed Guardian to transfer property for a minor or legally incapacitated person. f. Power of Attorney Deed: Utilized when a Fiduciary acting under a power of attorney transfers property on behalf of the principal. 4. Considerations when filing a Cedar Rapids Iowa Fiduciary Deed: — Validity of Fiduciary Appointment: Ensure the fiduciary holds a legally valid appointment in the respective capacity. — Accuracy and Completeness: The deed must contain accurate information regarding the property, granter, and grantee to avoid potential complications. — Compliance with Iowa Laws: Familiarize yourself with the specific legal requirements and procedures prescribed by Iowa laws governing fiduciary deeds. — Proper Execution: It is crucial to follow the required formalities while signing and notarizing the document to ensure its legal effect. Conclusion: In conclusion, the Cedar Rapids Iowa Fiduciary Deed serves as a vital legal instrument for multiple fiduciaries involved in property transfers in Cedar Rapids, Iowa. Executors, Trustees, Trustees, Administrators, and other fiduciaries can utilize various types of fiduciary deeds depending on their specific roles and scenarios. By understanding the purpose, types, and considerations related to Cedar Rapids Iowa Fiduciary Deeds, fiduciaries can ensure the smooth and lawful transfer of property, effectively fulfilling their duties in managing and distributing assets.