This Complex Will with Credit Shelter Trust for Large Estates form is a complex Will designed to enable a couple to maximize the amount of property that can pass free of estate taxes. The Will leaves the maximum tax free amount allowed (i.e. 1,000,000.00 as of 2001) to a trust and the remainder of property to the surviving spouse. All of the property passing to the Spouse is estate tax free. Therefore, no estate taxes are due at the death of the first Spouse. Since the trust has 1 million dollars that can pass to the children tax free, the surviving spouse can also leave 1 million to a similar trust or children and thereby enable 2 million dollars instead of 1 to pass to the children estate tax free. Income from the trust can be disbursed to the surviving spouse and children.

Cedar Rapids Iowa Complex Will with Credit Shelter Marital Trust for Large Estates

Description

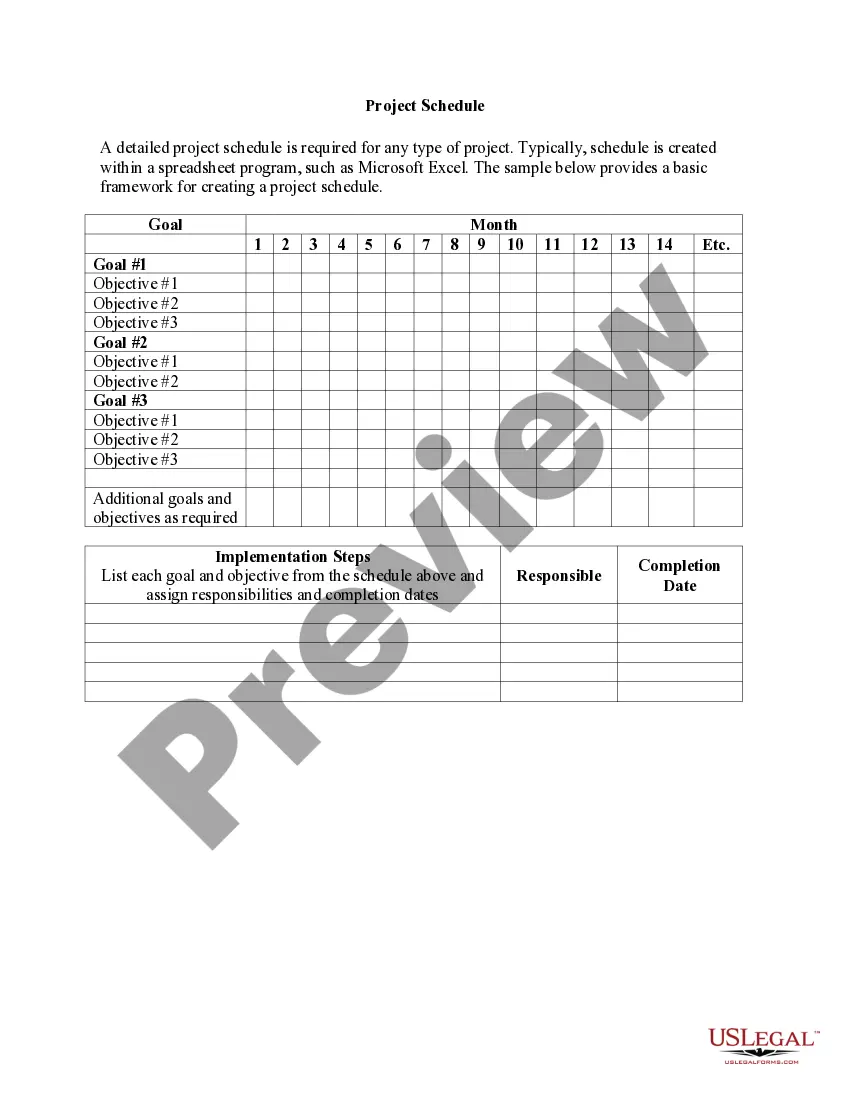

How to fill out Iowa Complex Will With Credit Shelter Marital Trust For Large Estates?

If you’ve previously utilized our service, sign in to your account and store the Cedar Rapids Iowa Complex Will with Credit Shelter Marital Trust for Large Estates on your device by clicking the Download button. Ensure that your subscription is current. If not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have continual access to each document you have purchased: you can locate it in your profile within the My documents menu whenever you need to utilize it again. Make the most of the US Legal Forms service to swiftly find and save any template for your personal or business requirements!

- Ensure you’ve located an appropriate document. Browse the description and use the Preview option, if available, to verify if it satisfies your needs. If it doesn’t suit you, utilize the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription option.

- Create an account and submit a payment. Use your credit card information or the PayPal method to finalize the transaction.

- Receive your Cedar Rapids Iowa Complex Will with Credit Shelter Marital Trust for Large Estates. Select the file format for your document and store it on your device.

- Complete your document. Print it or use professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

A credit shelter trust is not classified as a marital trust. Although both trusts can be part of an effective estate strategy, their functions differ significantly. A credit shelter trust protects assets from estate taxes and benefits heirs directly, while a marital trust prioritizes the needs of a surviving spouse. For those considering a Cedar Rapids Iowa Complex Will with Credit Shelter Marital Trust for Large Estates, understanding these distinctions can enhance your estate planning.

No, a credit shelter trust is not the same as a marital trust. While both trusts serve important roles in estate planning, a marital trust is designed to provide for the surviving spouse, allowing unlimited transfers without estate taxes. In contrast, a credit shelter trust focuses on preserving wealth for heirs and limiting taxes, making it a key component in a Cedar Rapids Iowa Complex Will with Credit Shelter Marital Trust for Large Estates.

A credit shelter trust is also known as a bypass trust. This type of trust allows you to reduce estate taxes by passing assets to your heirs without them being included in your taxable estate. When utilized in a Cedar Rapids Iowa Complex Will with Credit Shelter Marital Trust for Large Estates, it enables married couples to maximize their estate plans and provide financial security for their family.

Choosing the right trust depends on your financial situation and intentions for your estate. A credit shelter trust is often recommended for large estates to protect assets from taxes, while a marital trust ensures that the surviving spouse has access to income. The Cedar Rapids Iowa Complex Will with Credit Shelter Marital Trust for Large Estates effectively integrates both, offering flexibility and protection for married couples. Consulting with the uslegalforms platform can further clarify which trust best meets your family's unique needs.

While both types of trusts serve significant roles in estate planning, they are not the same. A marital trust primarily benefits a surviving spouse and provides income for their lifetime, while a credit shelter trust preserves a portion of the estate from taxes. The Cedar Rapids Iowa Complex Will with Credit Shelter Marital Trust for Large Estates combines aspects of both to cater to diverse family needs. Using both trusts strategically can ensure your estate reaches the loved ones you intend to support.

A credit trust, also known as a credit shelter trust, allows married couples to maximize estate tax benefits by using one spouse's exemption limit to shelter assets. In contrast, a marital trust holds assets for the benefit of a surviving spouse, deferring taxes until their death. The Cedar Rapids Iowa Complex Will with Credit Shelter Marital Trust for Large Estates optimally combines these trusts to preserve wealth and minimize tax burdens for families. Understanding these differences can guide you in effective estate planning.

When the surviving spouse passes away, the assets in the credit shelter trust are subject to the terms outlined in the trust agreement. Typically, the assets may be distributed to the designated beneficiaries, and the trust will be settled accordingly. Understanding this process is essential, especially when integrating a Cedar Rapids Iowa Complex Will with Credit Shelter Marital Trust for Large Estates into your estate planning.

Generally, the credit shelter trust is responsible for its tax obligations, identified through income generated by the trust's assets. The trust itself files tax returns, and any taxes owed are deducted from the income it produces. Engaging with professionals from uslegalforms can provide clarity on tax responsibilities surrounding a Cedar Rapids Iowa Complex Will with Credit Shelter Marital Trust for Large Estates.

The maximum amount that can be placed in a credit shelter trust often aligns with the federal estate tax exemption limit, which varies over time. For large estates, having an experienced attorney can help you navigate these limits effectively. With a Cedar Rapids Iowa Complex Will with Credit Shelter Marital Trust for Large Estates, you can maximize your benefits and ensure proper funding.

After death, a credit shelter trust remains intact to manage and protect the deceased's assets. The trust continues to operate, providing benefits to the beneficiaries without triggering an immediate estate tax. This continuity is advantageous when using a Cedar Rapids Iowa Complex Will with Credit Shelter Marital Trust for Large Estates, ensuring that your financial legacy endures.