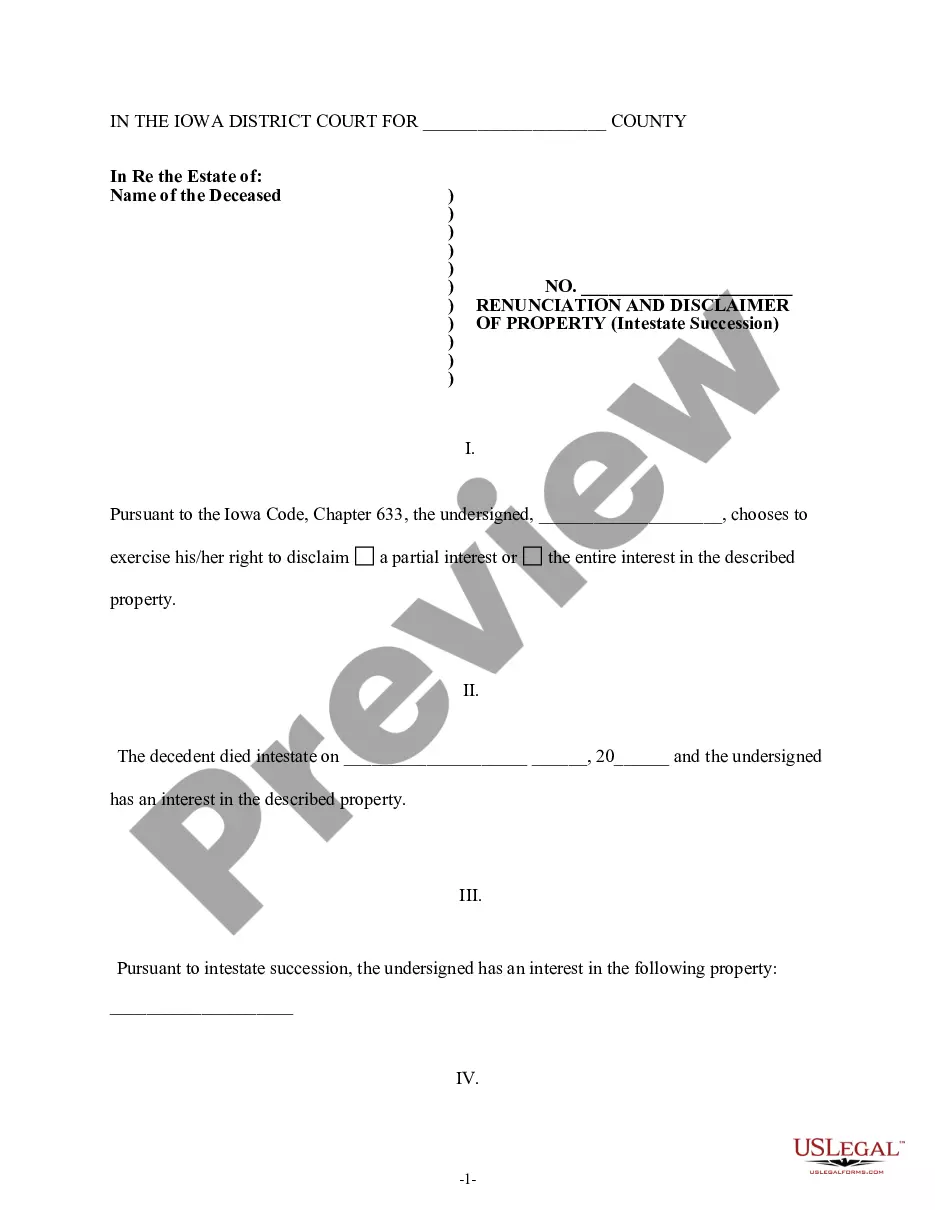

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through intestate succession. The decedent died intestate (without a will) and the beneficiary gained an interest in the property of the decedent. However, upon learning that he/she has an interest in the decedent's property, the beneficiary has decided to disclaim a portion of or the entire interest in the property. The form also includes a state specific acknowledgment and a certificate to verify delivery.

Cedar Rapids Iowa Renunciation and Disclaimer of Property received by Intestate Succession

Description

How to fill out Iowa Renunciation And Disclaimer Of Property Received By Intestate Succession?

Regardless of one's social or career standing, completing legal documents is a regrettable requirement in today’s society.

Far too frequently, it’s almost impossible for an individual without a legal background to draft such documents from scratch, primarily due to the intricate language and legal nuances they involve.

This is where US Legal Forms comes to the aid.

- Our platform provides a vast library of over 85,000 ready-to-use state-specific documents suitable for nearly any legal situation.

- US Legal Forms is also an excellent resource for associates or legal advisors looking to enhance their efficiency using our DIY forms.

- If you require the Cedar Rapids Iowa Renunciation and Disclaimer of Property received by Intestate Succession or any other document applicable in your local area, with US Legal Forms, everything is readily accessible.

- Here’s how to obtain the Cedar Rapids Iowa Renunciation and Disclaimer of Property received by Intestate Succession in just minutes using our reliable platform.

- If you’re already a subscriber, you may simply Log In to access and download the desired form.

Form popularity

FAQ

An executor in Iowa typically has one year to settle an estate, although complex estates may take longer. The timeline can fluctuate based on the estate's assets, debts, and whether there are disputes among heirs. Understanding the Cedar Rapids Iowa Renunciation and Disclaimer of Property received by intestate succession can play a critical role in this process. To navigate these complexities, consider using US Legal Forms to simplify your experience.

Not all estates are required to go through probate in Iowa. Small estates, typically valued below a certain threshold, may qualify for simplified handling. If property received by intestate succession is involved, the Cedar Rapids Iowa Renunciation and Disclaimer of Property helps clarify the process. It may be wise to turn to platforms like US Legal Forms for effective solutions.

Yes, Iowa allows transfer on death deeds for real estate. This legal tool enables property owners to designate beneficiaries who will receive the property upon their passing, avoiding probate. Utilizing the Cedar Rapids Iowa Renunciation and Disclaimer of Property received by intestate succession can be beneficial in these situations. For more insight on this topic, explore resources available on US Legal Forms.

In Iowa, the duration an estate can remain open varies based on the complexity of the estate and any pending legal matters. Generally, the estate should be settled within one to two years after death, especially if there are no disputes. However, if property received by intestate succession is involved, understanding Cedar Rapids Iowa Renunciation and Disclaimer of Property can influence this timeline. You may find it beneficial to consult with legal platforms like US Legal Forms for guidance.

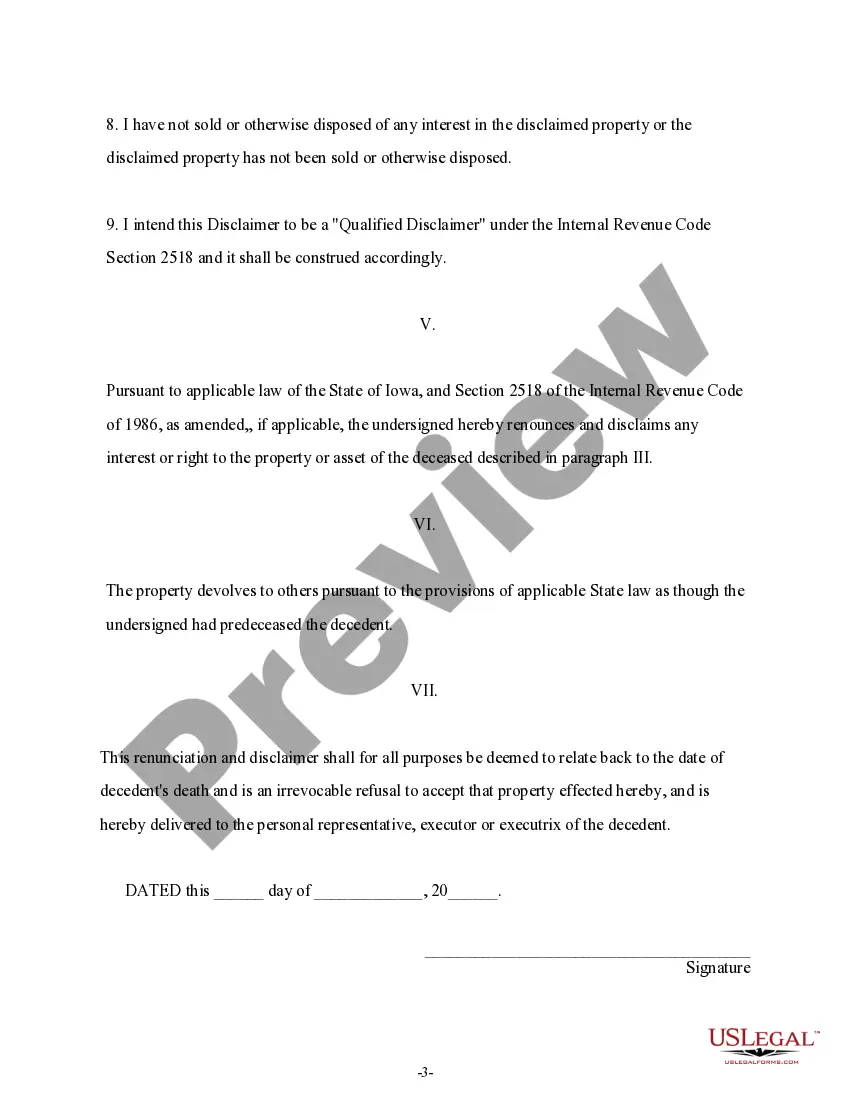

A disclaimer affects how an estate is administered by renouncing your right to certain property. When you disclaim an inheritance, it passes to the next eligible heir according to Iowa law, which can streamline the estate distribution process. This action can also have tax implications, and understanding these is vital. For comprehensive assistance, consider using USLegalForms, which guides you through the necessary steps for disclaiming property in an estate.

Yes, in most cases, inherited property must be declared for tax purposes. However, the specific requirements can vary depending on the situation and laws in Cedar Rapids, Iowa. If you are unsure, it’s best to consult with a tax professional or legal advisor. Utilizing services like USLegalForms can also provide reasons for declarations and help simplify the process.

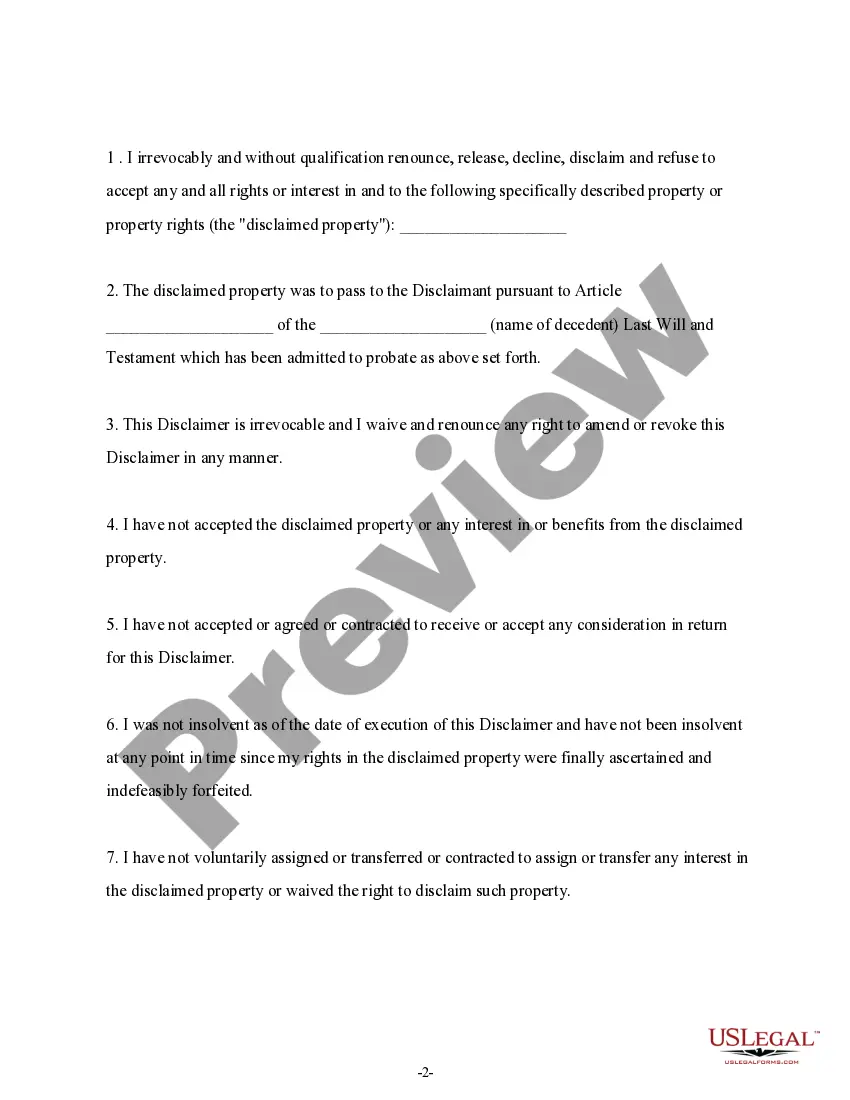

Disclaiming an inheritance in Iowa involves following specific state laws, which require that the disclaimer be in writing and filed within a certain timeframe. The disclaimant cannot accept any benefits from the inheritance before renouncing it. Moreover, the disclaimer must clearly describe the property being renounced. For detailed guidance, consider using resources from USLegalForms to ensure you comply with these regulations.

In Iowa, intestate succession is governed by the Iowa Code, specifically Chapters 633. Distribution of assets occurs based on the decedent's relationships, typically favoring spouses and children. If no immediate family exists, the property may pass to more distant relatives. It’s crucial to understand these laws, especially when considering a Cedar Rapids Iowa Renunciation and Disclaimer of Property received by Intestate Succession.

A sample disclaimer of inheritance generally includes a clear declaration of your intention to renounce inherited property. Start with your full name and address, then state the deceased individual's name and the nature of the property. It's helpful to include information about how the property was received through intestate succession. Utilizing USLegalForms can provide you with formatting guidelines and examples to assist in crafting this document.

To write a disclaimer letter for inheritance in Cedar Rapids, Iowa, clearly state your intent to renounce the property received through intestate succession. Begin with your name and contact details, followed by a statement indicating your relationship to the deceased. Make sure to include specific details about the inheritance and sign the letter. You may benefit from using platforms like USLegalForms to access templates and ensure compliance with local laws.