Miami-Dade Florida Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out Florida Last Will And Testament With All Property To Trust Called A Pour Over Will?

Utilize the US Legal Forms and gain immediate access to any form you require.

Our helpful site with countless documents streamlines the process of locating and acquiring nearly any document sample you might require.

You can save, complete, and authenticate the Miami-Dade Florida Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will in merely a few minutes rather than searching online for hours to discover the correct template.

Using our repository is an excellent tactic to enhance the security of your document submission.

If you do not have an account yet, follow the instructions provided below.

Access the page with the template you need. Ensure that it is the template you were looking for: confirm its title and description, and utilize the Preview feature if available. Otherwise, use the Search field to find the required one.

- Our knowledgeable attorneys consistently review all records to verify that the templates are suitable for a specific area and comply with current laws and regulations.

- How can you obtain the Miami-Dade Florida Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will.

- If you already possess a subscription, simply Log In to your account.

- The Download button will be activated for all documents you review.

- Additionally, you can access all previously saved files in the My documents section.

Form popularity

FAQ

over will in Florida is a special type of last will and testament that directs your assets to a preexisting trust after your death. This type of will ensures that any property not placed in the trust during your lifetime is still transferred to it. In MiamiDade, this can simplify your estate administration, helping to avoid probate for assets covered by the trust. For a comprehensive understanding and completion of your MiamiDade Florida Last Will and Testament with All Property to Trust called a Pour Over Will, consider utilizing uslegalforms to streamline your documentation.

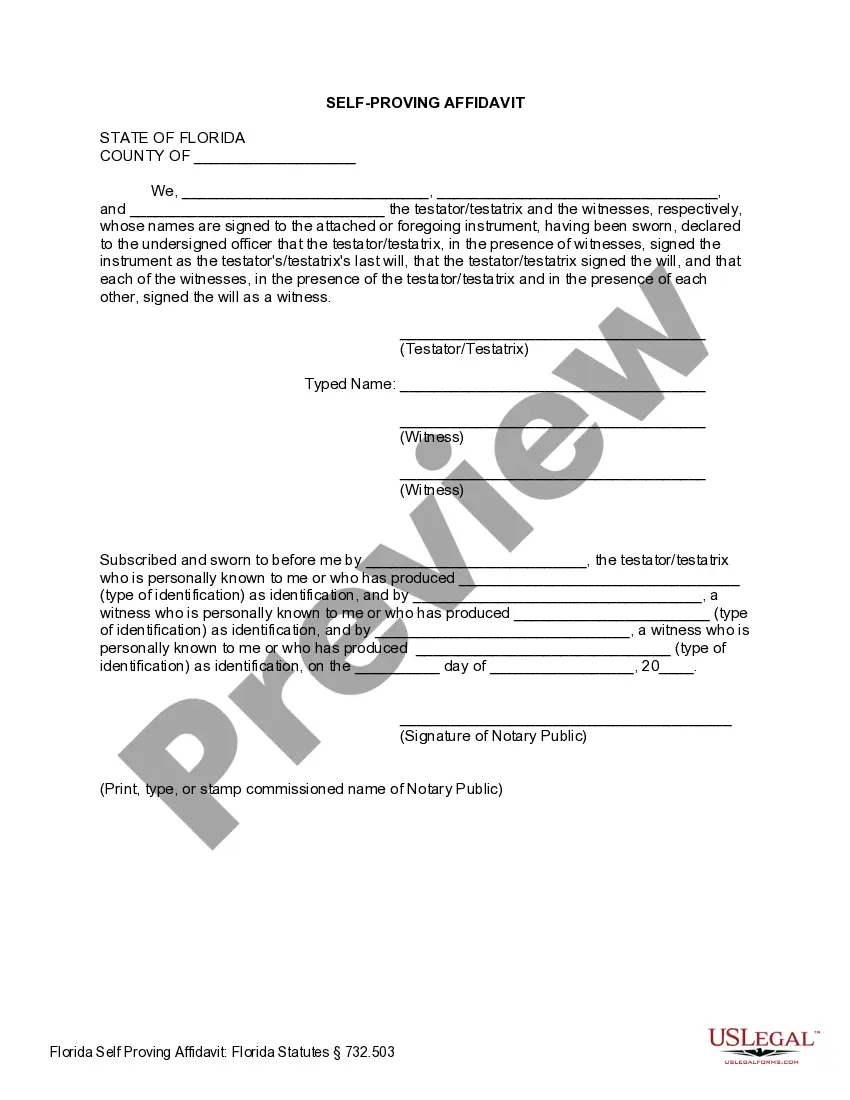

To create a pour-over will in Miami-Dade, Florida, first ensure that you have a trust set up to receive your assets. Next, draft your pour-over will, clearly stating that all your property should go to the trust upon your passing. It is important to follow Florida laws for wills, including having two witnesses sign your document. Using a reliable platform like uslegalforms can simplify the process and provide guidance tailored for your Miami-Dade Florida Last Will and Testament with All Property to Trust called a Pour Over Will.

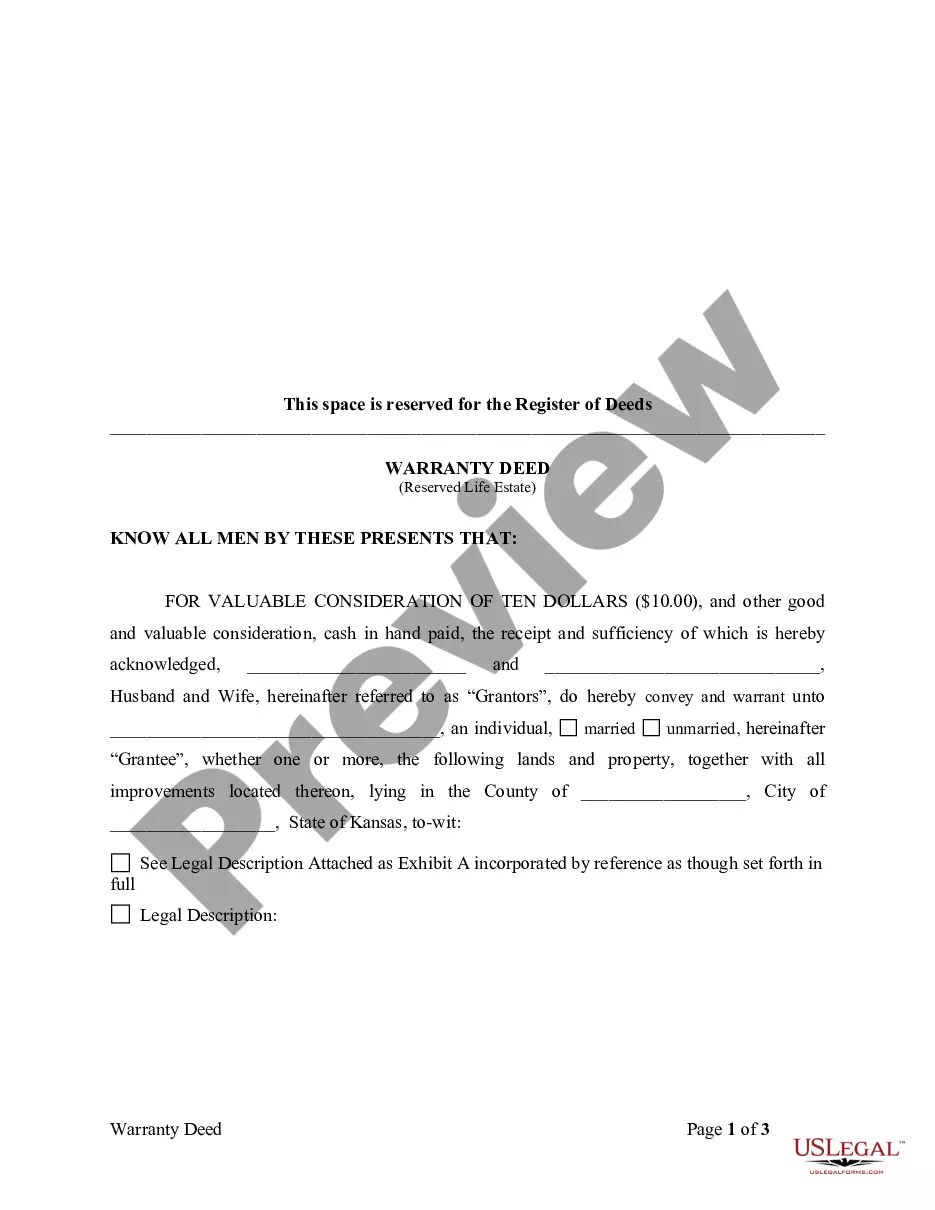

Typically, a last will and testament does not override a deed. If a property is titled in your name, it may not automatically transfer through a will. Instead, ownership is generally dictated by the deed itself. In Miami-Dade Florida, utilizing a Last Will and Testament with All Property to Trust called a Pour Over Will can ensure your wishes are honored, provided that the property is properly included in the estate planning documents.

Pour-over wills, while effective, do have some disadvantages. For instance, they may require probate to transfer assets from the will to the trust, which can delay the distribution process. Additionally, if the trust isn't properly funded during your lifetime, your estate may face unexpected taxes or fees. However, using a Miami-Dade Florida Last Will and Testament with All Property to Trust called a Pour Over Will can minimize such issues when managed correctly through platforms like uslegalforms.

While a pour-over will is a type of last will and testament, they are not identical. A standard last will directs how your assets will be distributed directly to your beneficiaries, whereas a pour-over will directs any assets not already included in a trust to 'pour over' into that trust upon your death. This mechanism is particularly effective in Miami-Dade Florida, as it consolidates your estate management under a Last Will and Testament with All Property to Trust called a Pour Over Will.

The primary distinction lies in how assets are managed after your passing. A last will and testament is a legal document that outlines how your assets should be distributed. In contrast, a pour-over will functions to transfer any remaining assets into a trust, ensuring that those assets are managed according to the terms of that trust. This process is especially beneficial in Miami-Dade Florida, where a Last Will and Testament with All Property to Trust called a Pour Over Will can streamline the distribution of your estate.

Dade Florida Last Will and Testament with All Property to Trust called a Pour Over Will functions as a safety net for your trust. It ensures that any assets not specifically assigned to the trust are transferred to it after your death. This method provides reassurance that your entire estate will be governed by the terms of the trust, thereby achieving your intended distribution of assets. For those using this approach, platforms like uslegalforms can provide convenient resources to create these important documents.

One significant disadvantage of a will, like a Miami-Dade Florida Last Will and Testament with All Property to Trust called a Pour Over Will, is that it typically goes through probate. Probate can be a lengthy and public process, which may delay asset distribution and expose your estate to potential legal challenges. On the other hand, assets in a trust can bypass probate, leading to a more seamless and private transfer of your belongings. This factor often leads people to prefer trusts for their estate planning needs.

Yes, a Miami-Dade Florida Last Will and Testament with All Property to Trust called a Pour Over Will is designed to work in conjunction with a trust. This type of will directs that any assets not placed in the trust during your lifetime will be transferred into the trust upon your passing. Therefore, it helps to simplify the transfer of your assets and ensures they are managed according to your wishes. It’s a smart way to ensure your estate plan remains cohesive.

In general, a Miami-Dade Florida Last Will and Testament with All Property to Trust called a Pour Over Will can override a trust if it includes clear instructions. However, if the trust is properly funded and maintained, it often governs the distribution of assets upon death. It’s essential to ensure both documents work together effectively to achieve your estate planning goals. Consulting with legal professionals can provide clarity on this matter.