Hillsborough Florida Revocation of Living Trust

Description

How to fill out Florida Revocation Of Living Trust?

Do you require a dependable and cost-effective supplier of legal forms to obtain the Hillsborough Florida Revocation of Living Trust? US Legal Forms is your ideal choice.

Whether you need a simple agreement to establish rules for living with your partner or a collection of documents to advance your divorce through the judiciary, we have you covered. Our platform features over 85,000 current legal document templates for personal and business use. All templates we provide are not generic and tailored based on the requirements of individual states and locales.

To download the form, you must Log In to your account, find the necessary form, and click the Download button beside it. Please remember that you can download your previously acquired form templates at any time in the My documents section.

Are you unfamiliar with our platform? No problem. You can create an account in a matter of minutes, but first, ensure to do the following.

Now, you can register your account. Then select the subscription plan and proceed with payment. Once the payment is complete, download the Hillsborough Florida Revocation of Living Trust in any available format. You can return to the website whenever needed and redownload the form without incurring any additional charges.

Acquiring current legal documents has never been simpler. Try US Legal Forms today, and stop wasting your valuable time searching for legal papers online.

- Verify if the Hillsborough Florida Revocation of Living Trust aligns with the regulations of your state and locality.

- Examine the form’s description (if available) to understand who and what the form is designed for.

- Initiate a new search if the form isn’t appropriate for your specific situation.

Form popularity

FAQ

The 5 year rule for trusts refers to a provision in Florida law that allows trusts to avoid certain tax implications if they distribute assets and terminate within five years of the creation of the trust. This rule is crucial for individuals aiming to manage their estate efficiently while minimizing tax burdens. However, if you have a complex trust situation, understanding these nuances becomes essential. Using a reliable platform like uslegalforms can guide you through the Hillsborough Florida Revocation of Living Trust process, making it easier to comply with this rule.

In Florida, a trust can remain open for as long as necessary to wind up its affairs, which often depends on the complexity of the assets and debts involved. Typically, many trusts are designed to be distributed within a few months to a few years after the grantor's passing. However, if the trust includes ongoing income-generating assets, it may remain active longer. It's important to consult with an experienced attorney specializing in Hillsborough Florida Revocation of Living Trust for tailored advice.

A revocable trust offers a degree of security, but it remains subject to change at any time by the grantor. This flexibility can be a double-edged sword in Hillsborough Florida since revocable trusts can be vulnerable to creditor claims and legal challenges. However, they also serve as a useful tool for asset management, reducing probate complications. To further enhance your security, consider consulting with a legal expert who understands the nuances of the Hillsborough Florida Revocation of Living Trust.

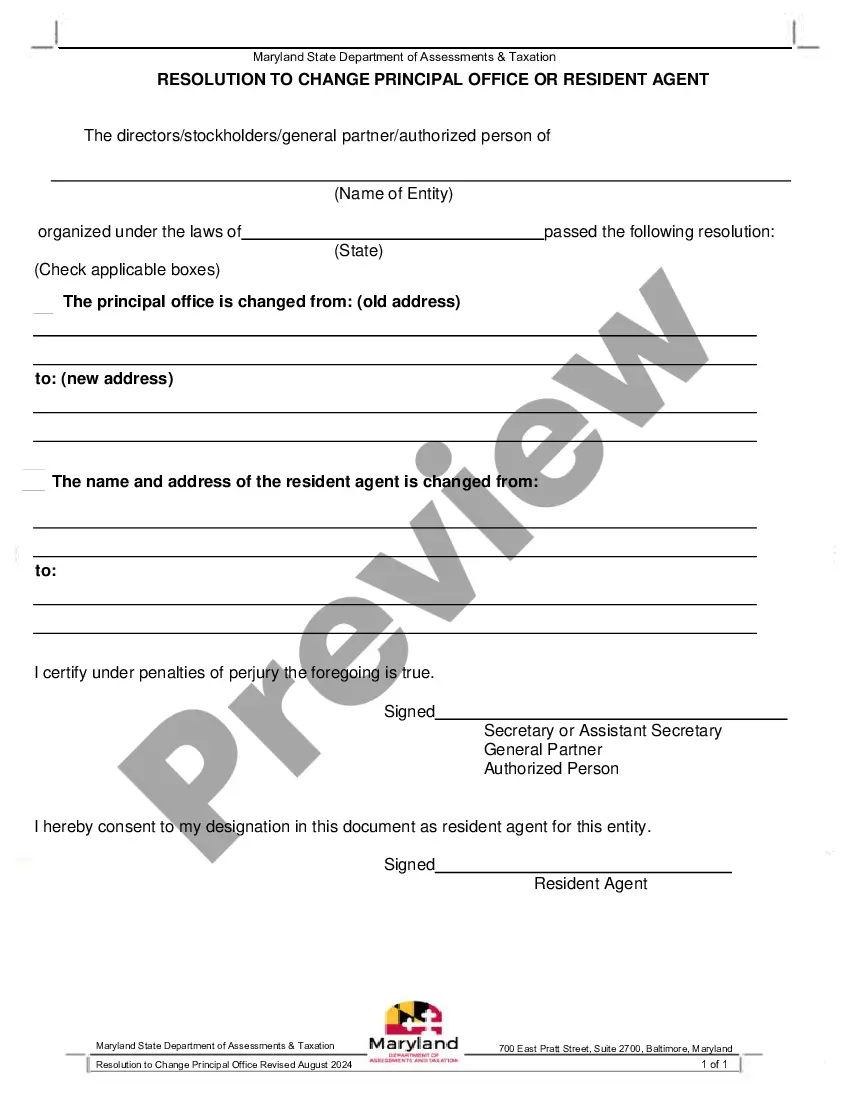

To revoke a revocable trust, you must follow the specific guidelines outlined in the trust document. Generally, this involves providing a written notice of revocation to the trustee and ensuring proper handling of the assets within the trust. In Hillsborough Florida, legal considerations may vary, so consulting with an expert in the Hillsborough Florida Revocation of Living Trust is wise. Our platform, US Legal Forms, offers resources to help you draft the necessary documents effectively.

A revocable trust typically becomes irrevocable upon the death of the grantor. In Hillsborough Florida's context, this transition is significant as it affects how assets are managed and distributed. Once the trust turns irrevocable, modifications become impossible without court intervention. Understanding this process is crucial for ensuring your estate plan aligns with your intentions.

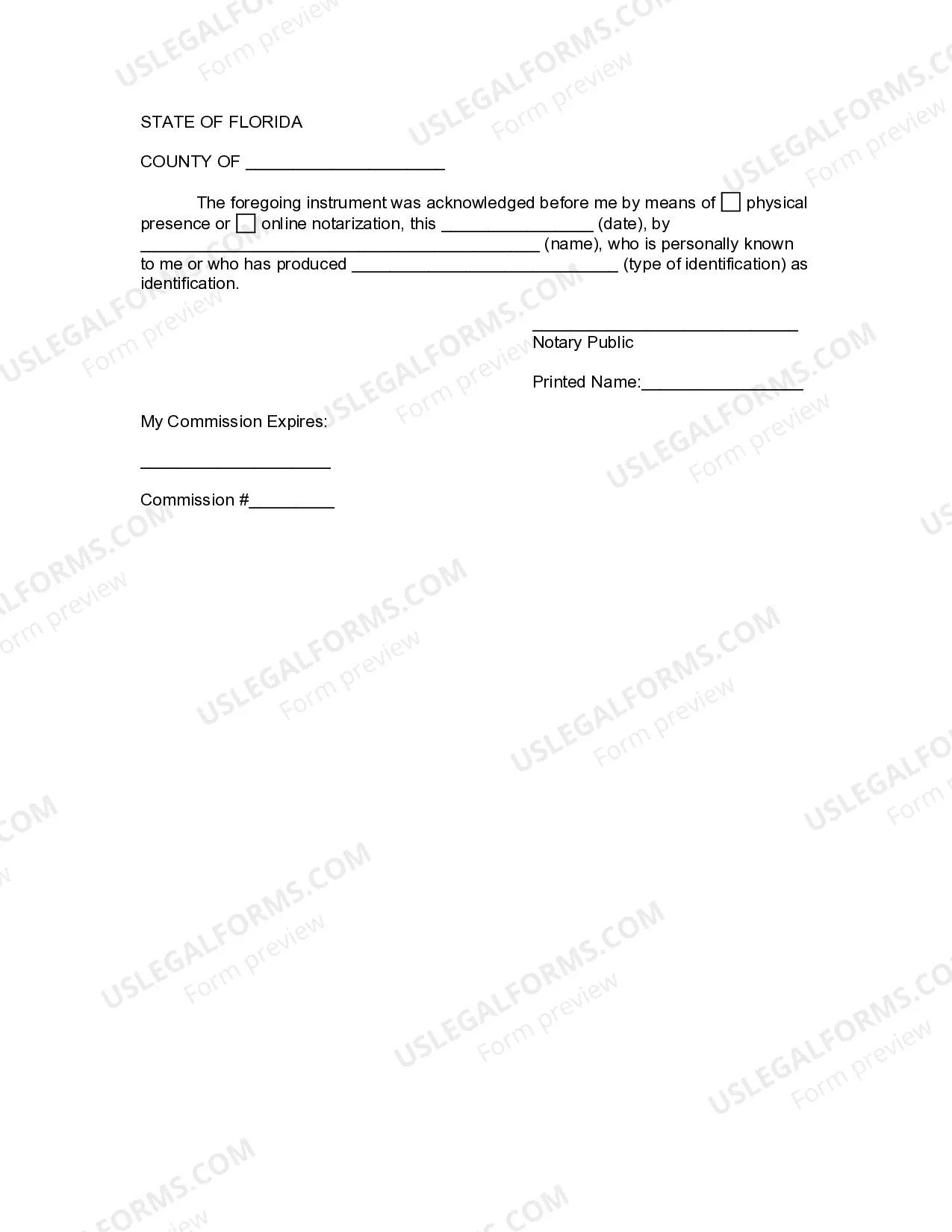

To revoke a living trust in Florida, you must create a formal revocation document that states your intention clearly, and then sign it before a notary. Additionally, you should notify all beneficiaries of the trust about the revocation. Using a platform like USLegalForms can simplify creating and filing the required documents, making your Hillsborough Florida Revocation of Living Trust process easier and more efficient.

Revoking a revocable trust is typically straightforward, especially in Florida. The trustor can follow a few simple steps, such as drafting a revocation document and notifying all relevant parties. This process ensures that your Hillsborough Florida Revocation of Living Trust reflects your current intentions and needs without unnecessary complications.

Generally, a trust can be terminated through revocation, when the trust creator decides to end it; through completion of its purpose, once all assets have been distributed; or by operation of law, such as the death of the trustor in certain cases. Knowing these termination methods offers clarity when considering the Hillsborough Florida Revocation of Living Trust process. Always consult with legal experts to understand which method fits your situation best.

A trust can become null and void due to several factors, such as improper creation, lack of clear intent, or failure to meet legal requirements. For instance, if a trust fails to name a beneficiary or doesn't have the required signatures, it may be rendered invalid. Understanding the nuances of the Hillsborough Florida Revocation of Living Trust is crucial to ensure your assets are protected according to your wishes.

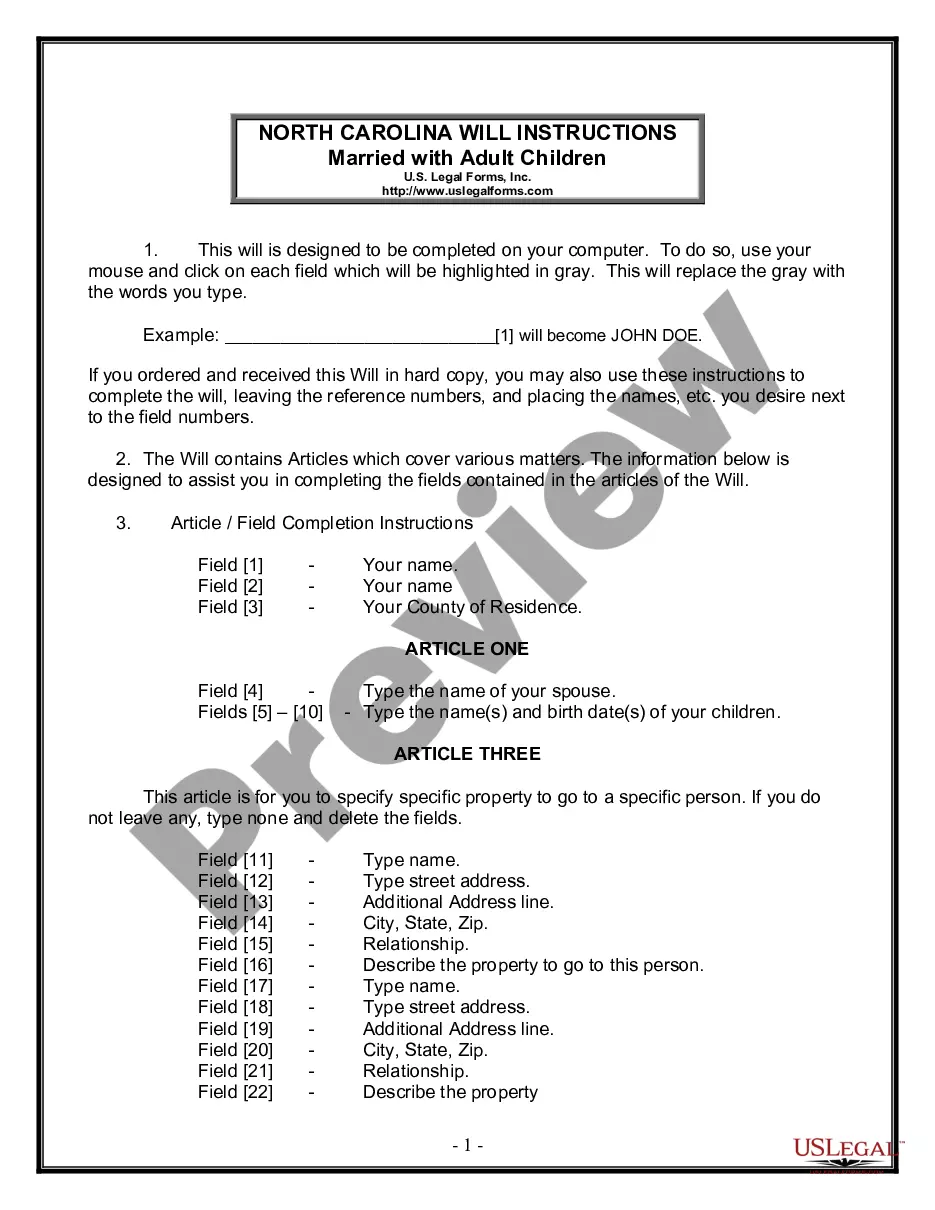

Filling out a revocable living trust involves providing essential information about your assets, beneficiaries, and your wishes for asset distribution. You will need to name a trustee, identify who will receive your assets, and provide detailed instructions on the management of the trust. For those interested in Hillsborough Florida Revocation of Living Trust, using a service like uslegalforms can help guide you through this process efficiently.