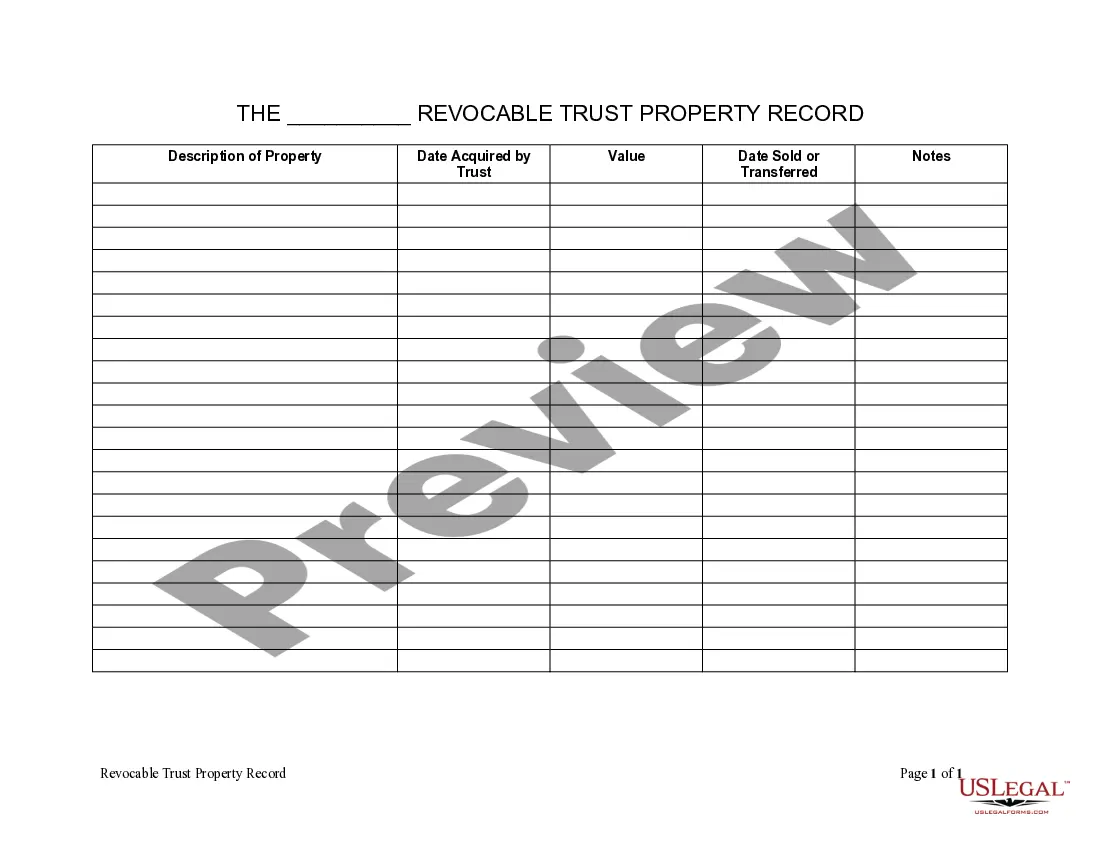

Jacksonville Florida Living Trust Property Record

Description

How to fill out Florida Living Trust Property Record?

If you are searching for a suitable form template, it’s incredibly challenging to discover a more user-friendly site than the US Legal Forms website – one of the largest online collections.

With this collection, you can obtain a vast array of document examples for business and personal use categorized by type and region, or keywords.

With the sophisticated search feature, locating the latest Jacksonville Florida Living Trust Property Record is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the file format and download it to your device.

- Additionally, the relevance of each document is verified by a team of experienced attorneys who routinely assess the templates on our site and update them based on the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to obtain the Jacksonville Florida Living Trust Property Record is to Log In to your account and press the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the steps outlined below.

- Ensure you have selected the template you desire. Review its description and utilize the Preview function (if available) to examine its content. If it does not fulfill your requirements, use the Search feature at the top of the page to find the correct record.

- Confirm your choice. Click the Buy now button. After that, select your preferred pricing plan and submit your details to create an account.

Form popularity

FAQ

The Florida Land Trust Act allows a revocable trust to own real property. The trust, then, is owned by its beneficiaries. In fact, the beneficiary or beneficiaries have full control of the property and may even add additional property to the trust. There's no firm deadline for when the trust ends.

Trusts are not public record, and for some, privacy is a key consideration when creating a trust. Unlike a last will and testament, a revocable trust does not get deposited with the probate court in the State of Florida upon the death of the Grantor or Settlor (i.e. person who created the trust).

How to Get a Copy of a Trust Make a written demand for a copy of the Trust and its amendments, if any; Wait 60 days; and. If you do not receive a copy of the Trust within 60 days of making your written demand, file a petition with the probate court.

In a Florida land trust, a trustmaker appoints another person to serve as trustee to hold legal title to real estate property for the benefit of the beneficiary (typically the trustmaker). The prospective real property owner can be both the trustmaker and a beneficiary of a land trust.

Florida is a ?mortgage-only? state. Florida does not recognize deeds of trust in its state law.

As long as the trust allows it, and the trustee avoids self-dealing and conflicts of interest, the trustee can sell trust property to whomever he or she chooses, as long as it is sold for market value.

In a trust, assets are held and managed by one person or people (the trustee) to benefit another person or people (the beneficiary). The person providing the assets is called the settlor.

The short answer is no.

It is a private document which, unlike a Will, is not entered into public record. You should be aware that if you own any interest in real property, your deed should be filed as a matter of public record. However, this is the case with all real property, whether or not you place it in a Living Trust.