This form is a Personal Representative's Deed of Distribution where the Grantor is an Individual appointed as personal representative of the estate and the Grantee is the beneficiary entitled to receive the property from the estate. Grantor conveys the described property to Grantee and only covenants that the transfer is authorized by the Court and that the Grantor has done nothing while serving as personal representative to encumber the property. This deed complies with all state statutory laws.

Palm Beach Florida Personal Representative's Deed of Distribution

Description

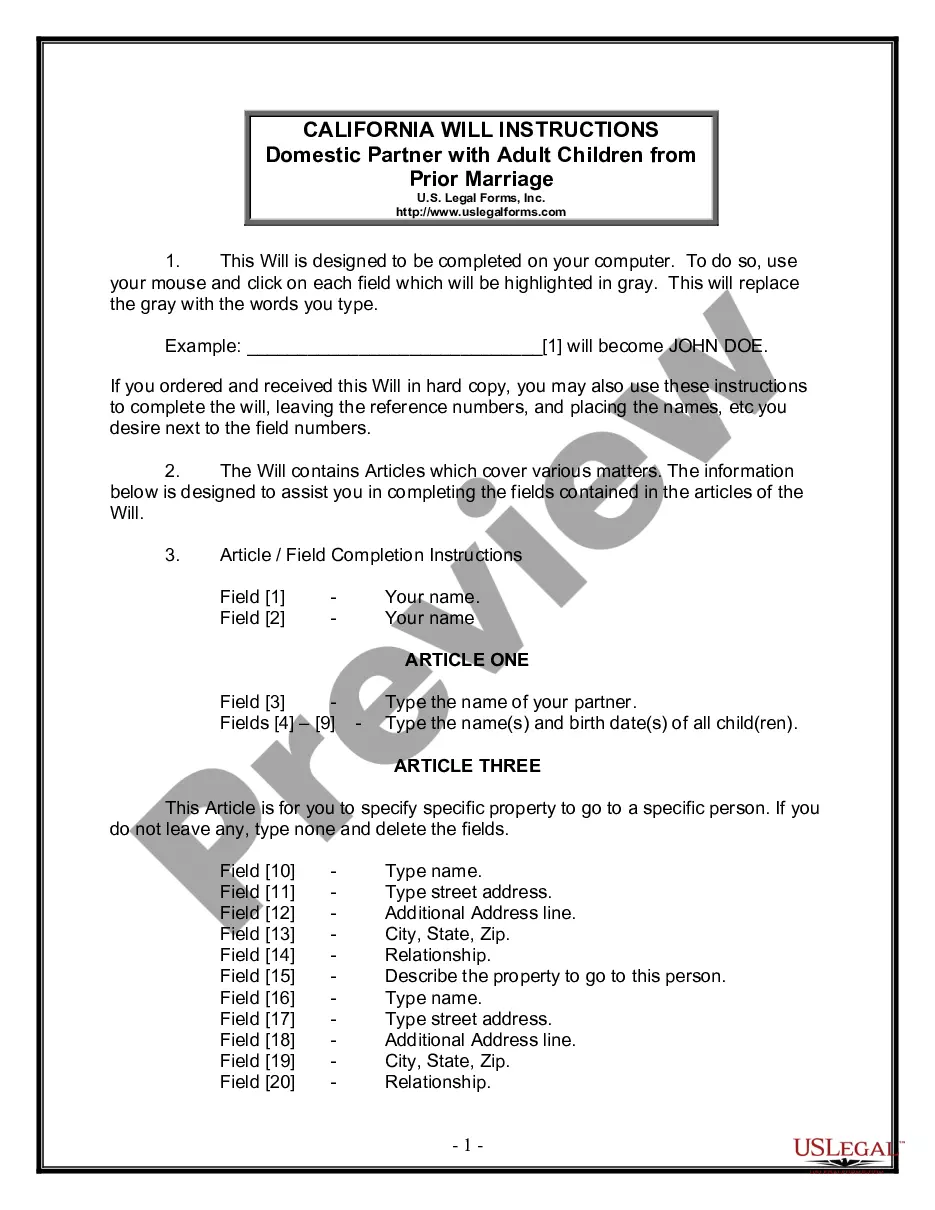

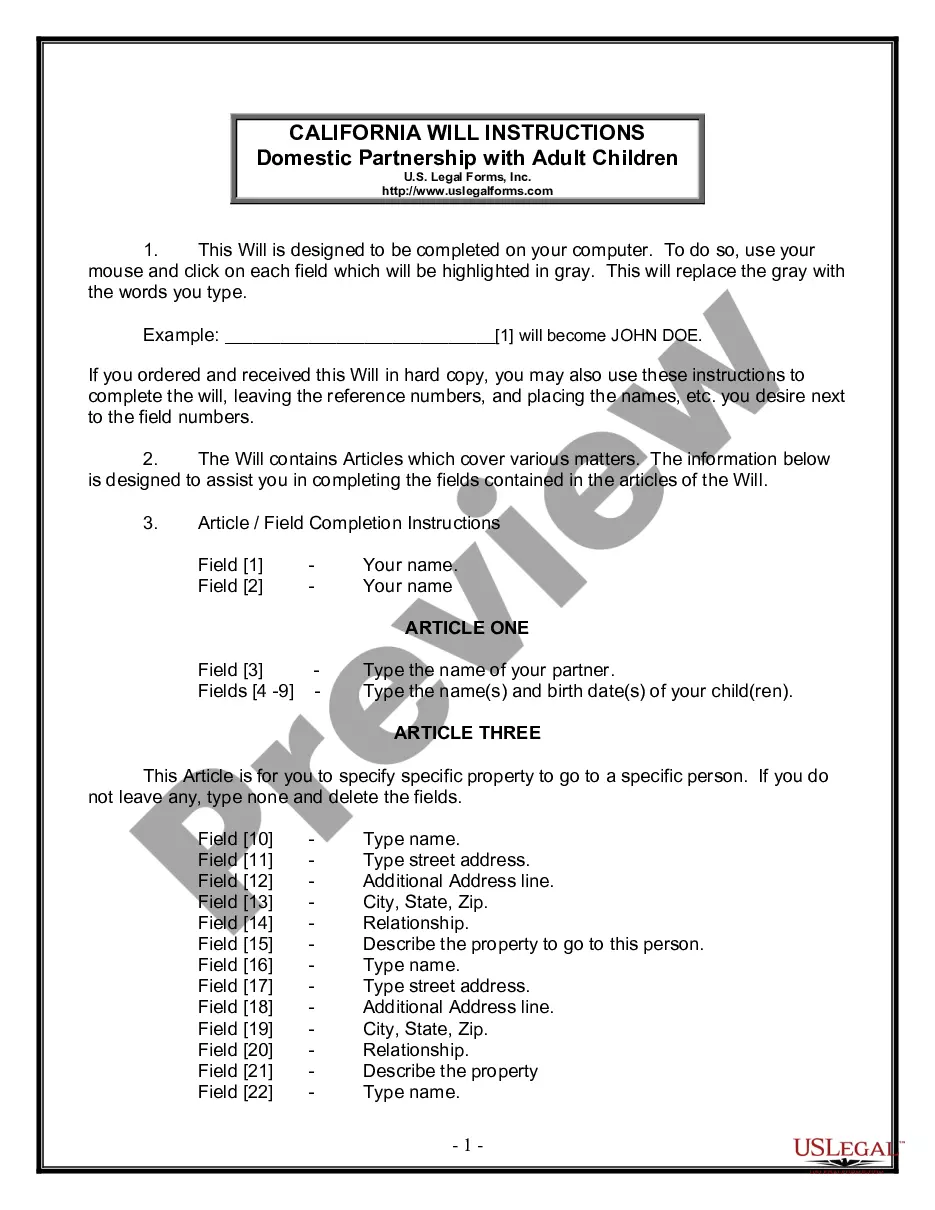

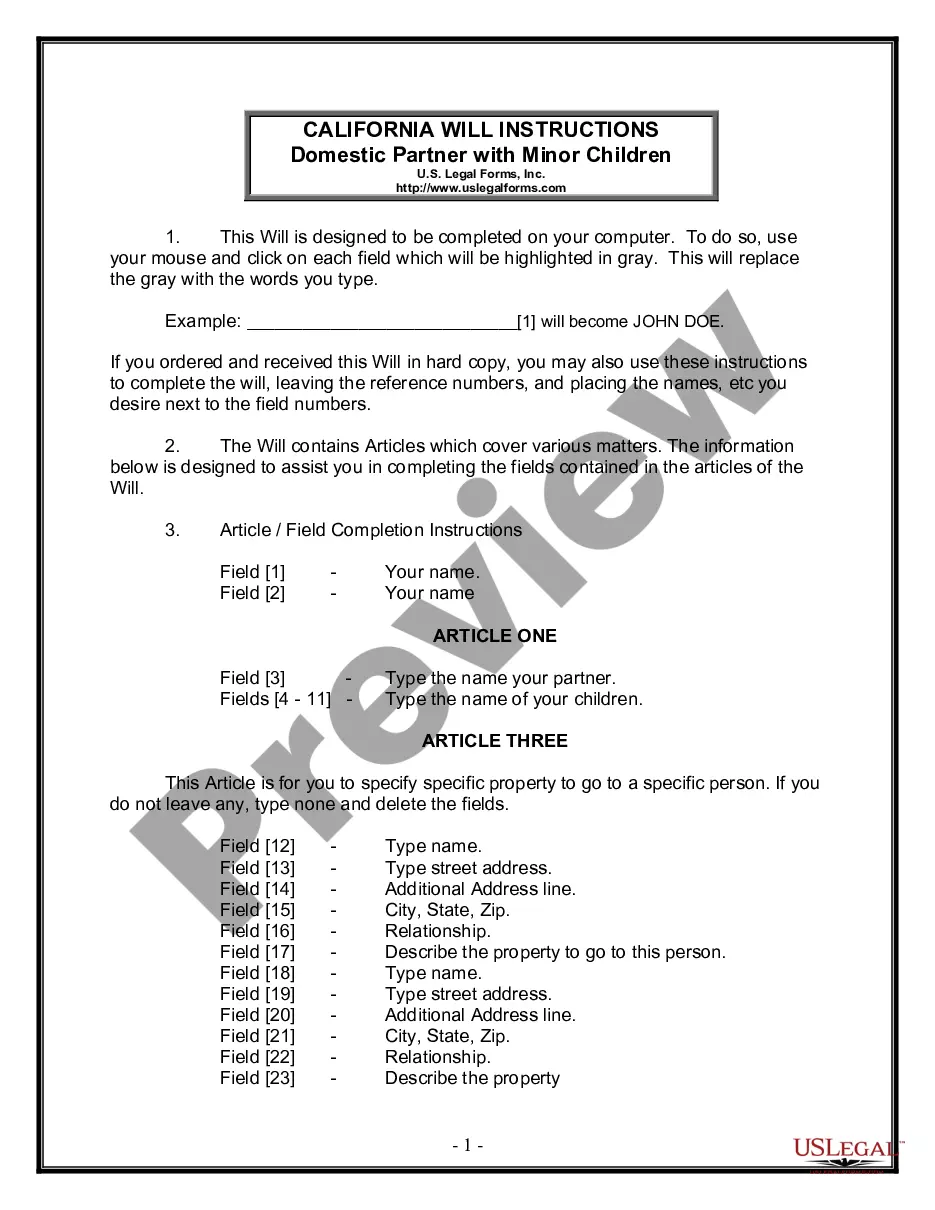

How to fill out Florida Personal Representative's Deed Of Distribution?

Finding authenticated templates tailored to your local laws can be challenging unless you utilize the US Legal Forms database.

It's a digital collection of over 85,000 legal documents for both personal and professional requirements, as well as various real-life scenarios.

All the forms are appropriately categorized by usage area and jurisdictional differences, making the search for the Palm Beach Florida Personal Representative's Deed of Distribution as swift and straightforward as 123.

Offer your credit card information or utilize your PayPal account to cover the cost of the service. Once you have completed your purchase, download the Palm Beach Florida Personal Representative's Deed of Distribution. Save the document on your device to complete it and have access to it in the My documents section of your profile whenever you need it again. Maintaining documentation organized and adhering to legal standards is of utmost importance. Take advantage of the US Legal Forms database to always have crucial document templates readily available for any requirements!

- Ensure to check the Preview mode and form description.

- Verify that you've selected the correct document that meets your criteria and aligns perfectly with your local jurisdiction regulations.

- Look for another template, if necessary.

- If you spot any discrepancies, use the Search tab above to find the correct version. If it satisfies you, proceed to the following step.

- Make the payment for the document.

Form popularity

FAQ

When someone dies without a will they are said to have died 'intestate' and no one has immediate authority to act as their personal representative. Instead, one of their relatives needs to apply to the Probate Registry for a grant of letters of administration.

The Duties of the Personal Representative in Florida Notifying all heirs and other interested parties that the will is being submitted to probate. Identifying and taking control of any estate assets. Filing tax returns and paying taxes. Paying creditors claims.

If the estate value is $1 million or less, your fee is 3% of the estate assets. If the estate value is between $1 million and $5 million, your fee is 2.5% of the estate assets. If the estate value is between $5 million and $10 million, your fee is 2% of the estate assets.

If one heir wishes to mortgage, sell, or rent out the entire property, they must obtain consent from all of the other heirs, yet an heir can sell their individual interest, even to an outsider, without the consent of other heirs.

Your surviving spouse inherits everything. If you die with children or other descendants from you and the surviving spouse, and your surviving spouse has descendants from previous relationships. Your surviving spouse inherits half of your intestate property and your descendants inherit the other half.

Over 18 years of age and ? The surviving spouse of the decedent, ? An adult child of the decedent, ? A parent of the decedent, ? A brother or sister of the decedent, ? A person entitled to property of the decedent, ? A person who was named as personal representative by will, or ? You are a creditor and 45 days have

Florida Personal Representative's Distributive Deed (intestate) This form is for use by the personal representative of an individual who died without a will. Wills, or last wills and testaments, are estate planning documents used to organize and record how people wish to distribute their assets after death.

A distribution deed is another way in which to legally transfer real property when the party who is supposed to receive the property cannot be determined from the decedent's will.

(2) Exempt property shall consist of: (a) Household furniture, furnishings, and appliances in the decedent's usual place of abode up to a net value of $20,000 as of the date of death. (b) Two motor vehicles as defined in s.(c) All qualified tuition programs authorized by s.(d) All benefits paid pursuant to s.

Any individual who is at least 18 years old who is a resident of Florida at the time of the decedent's death, is qualified to act as the personal representative.