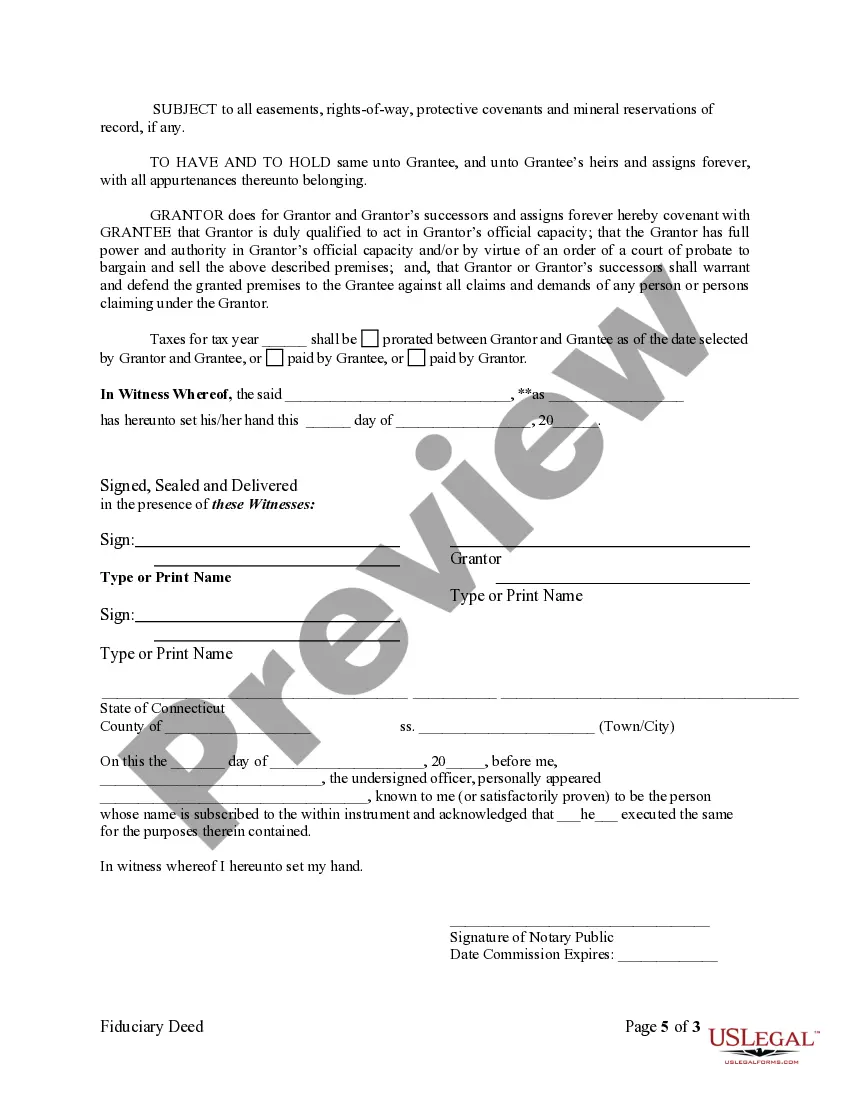

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

Bridgeport Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries

Description

How to fill out Connecticut Fiduciary Deed For Executors, Trustees, And Other Fiduciaries?

We consistently endeavor to minimize or evade legal complications when engaged in intricate legal or financial matters.

To achieve this, we enlist attorney services that, generally speaking, are exceedingly costly.

Nevertheless, not every legal complication is equally intricate.

The majority of them can be resolved by ourselves.

Take advantage of US Legal Forms whenever you wish to obtain and download the Bridgeport Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries or any other form simply and securely.

- US Legal Forms is an online directory of current do-it-yourself legal templates encompassing everything from wills and powers of attorney to articles of incorporation and requests for dissolution.

- Our platform empowers you to manage your affairs autonomously without the need for legal representation.

- We offer access to legal form templates that are not always readily available to the public.

- Our templates are tailored to specific states and regions, significantly simplifying the search process.

Form popularity

FAQ

An executor is held accountable by the probate court and the beneficiaries of the estate. They must provide regular accountings and report on their administration of the estate. If beneficiaries believe the executor is mishandling responsibilities, they may petition the court for accountability. Utilizing the Bridgeport Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries can provide essential guidance to executors to meet their obligations efficiently.

A PC 264 probate form is a document required when filing for probate in Connecticut. It serves to notify the probate court of the pending estate matters and provides vital information about the deceased. Familiarizing yourself with this form can greatly assist executors and fiduciaries during estate management. Resources like the Bridgeport Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries can help clarify the importance of this form.

In Connecticut, co-executors can act independently unless the will states otherwise. However, it is generally better practice for co-executors to collaborate on major decisions to maintain harmony and transparency. Each co-executor must uphold their fiduciary duties, which may be streamlined with the help of resources like the Bridgeport Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries.

The fiduciary on Form 1041 is responsible for submitting the income tax return for an estate or trust. This position typically falls to the executor or administrator managing the estate in Bridgeport, Connecticut. Understanding this role is important to ensure compliance with tax obligations while fulfilling fiduciary duties. Utilizing the Bridgeport Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries can aid in this understanding.

If you have concerns about an executor's actions, you can file a complaint with the probate court in Bridgeport, Connecticut. This process typically involves submitting a detailed petition that outlines your allegations. Being clear and organized in your complaint helps the court address your concerns effectively. Consulting resources like the Bridgeport Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries can offer insight into the proper procedures.

Executors can indeed be held personally liable for mismanagement of estate assets or failure to act in accordance with their fiduciary duties. If an executor engages in self-dealing, mishandles funds, or neglects beneficiaries’ rights, they may face legal actions. Therefore, knowing the parameters of liability is essential, especially in Bridgeport, Connecticut. The Bridgeport Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries can guide executors in preventing such situations.

Yes, executors have a fiduciary duty to the beneficiaries of the estate. Their responsibilities include managing assets, settling debts, and ensuring that all actions benefit the estate and its heirs. In Bridgeport, Connecticut, understanding this duty is crucial for maintaining transparency and trust. Leveraging tools like the Bridgeport Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries can assist executors in fulfilling these obligations.

An executor has a fiduciary duty to manage the estate of the deceased responsibly. This means they must act in the best interest of the beneficiaries while adhering to the terms outlined in the will. In Bridgeport, Connecticut, an accurate understanding of fiduciary duties can help ensure compliance with local laws and principles. Using resources like the Bridgeport Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries can provide clarity on these responsibilities.

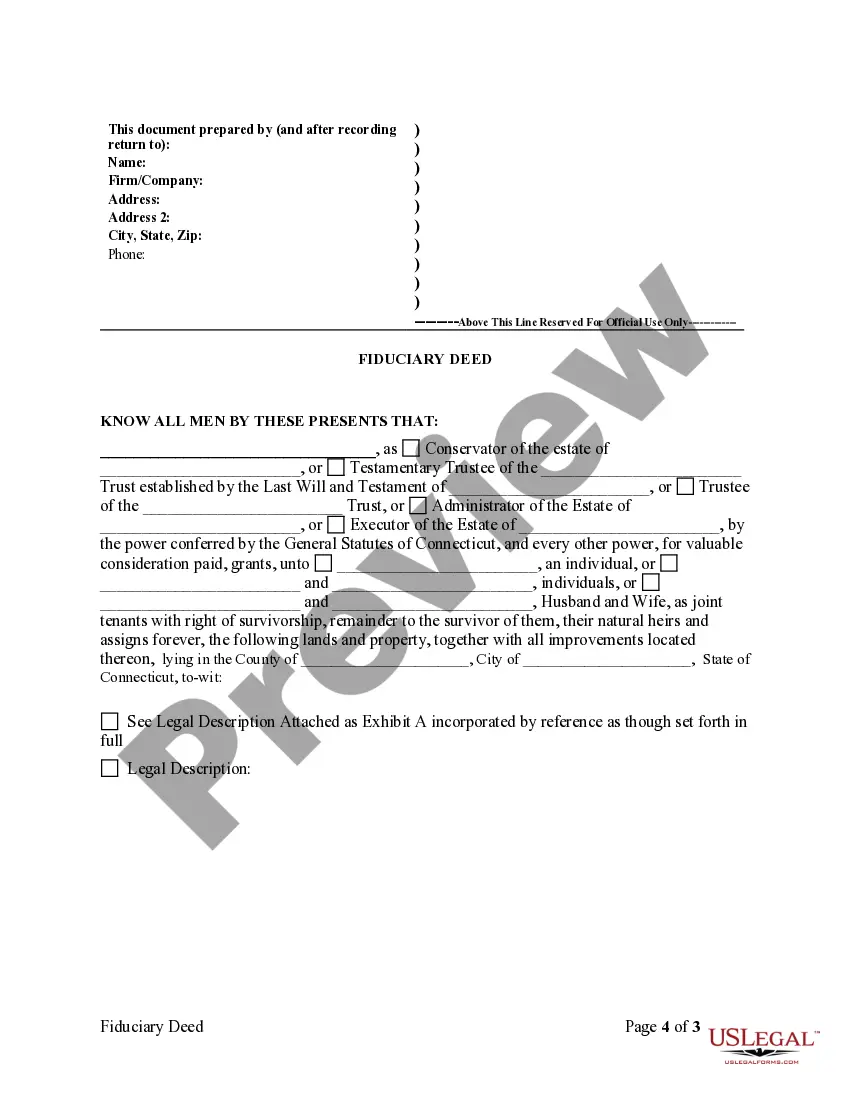

The main difference between a warranty deed and a fiduciary deed lies in their purpose and the parties involved. A warranty deed guarantees clear title from the seller to the buyer, while a fiduciary deed transfers property under the authority of a fiduciary acting on behalf of an estate or trust. Understanding these distinctions is vital for executing a Bridgeport Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries effectively.

A fiduciary is not exactly the same as an executor, though an executor can be a type of fiduciary. An executor specifically refers to someone named in a will to manage the estate of the deceased. In contrast, a fiduciary can include a range of roles, including trustees or guardians, who manage assets responsibly. This distinction is important when navigating a Bridgeport Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries.