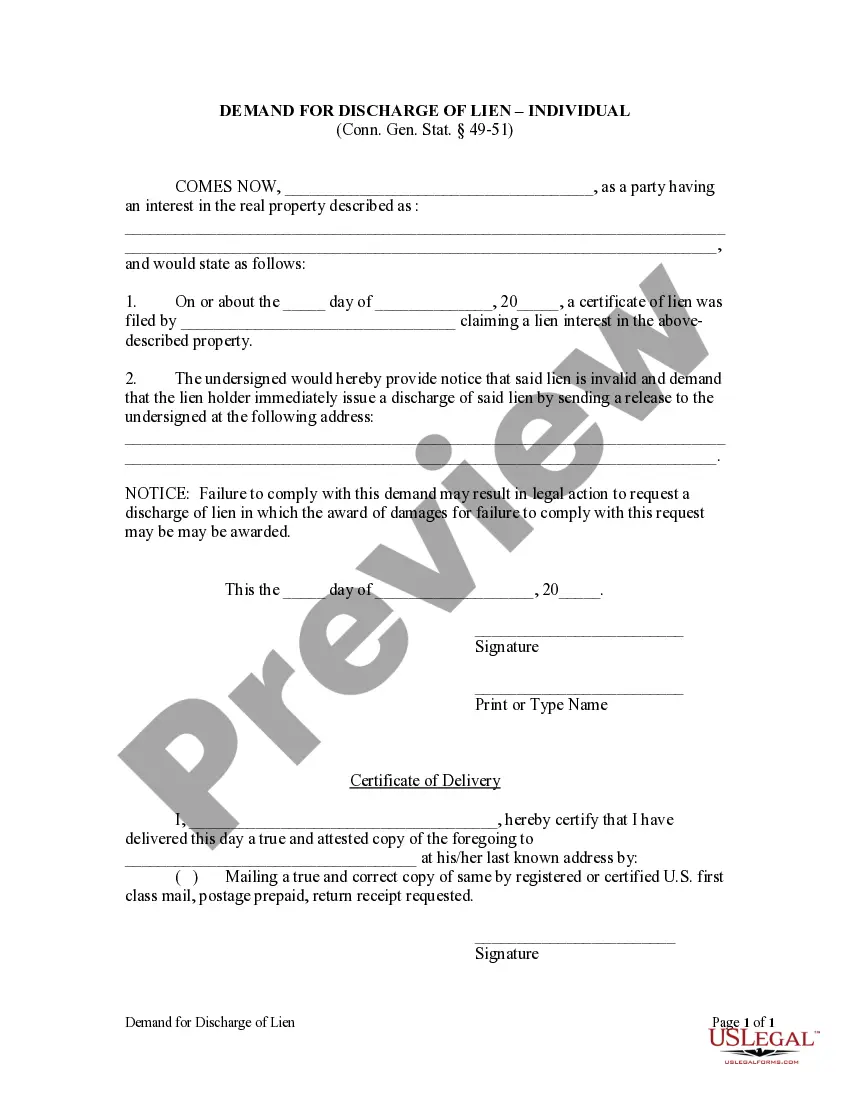

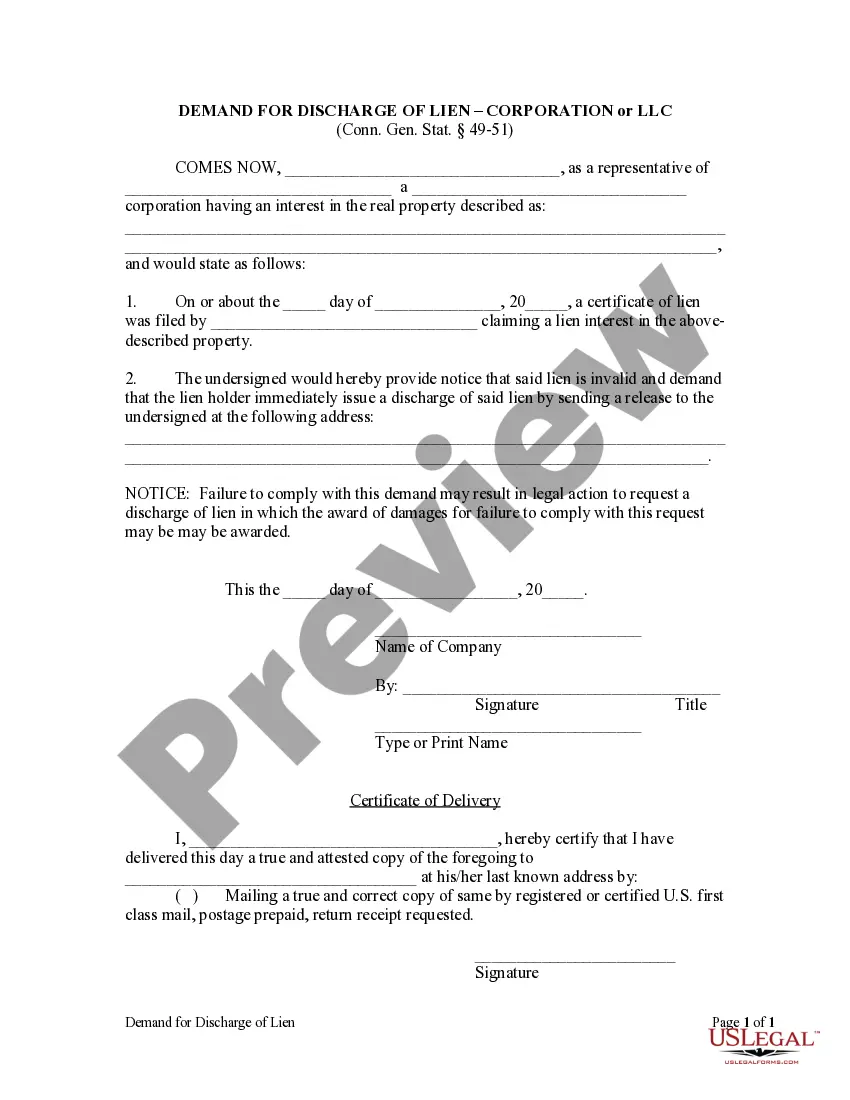

Any person having an interest in any real property described in a certificate of lien, when said lien is invalid but not discharged, may give written notice to the lienor sent to him at his last known address by registered mail or by certified mail. Upon receipt of such a demand for discharge, the lien holder is required to provide a release to the party requesting the discharge. If the lien is not discharged within thirty (30) days of receipt of the demand for discharge, the person with an interest in the property may apply to the Superior Court for a discharge, with the possibility that the Court may award the plaintiff party damages as a result of the lien holder's refusal to comply.

Stamford Connecticut Demand for Discharge by Corporation or LLC

Description

How to fill out Connecticut Demand For Discharge By Corporation Or LLC?

If you are in search of a pertinent document, there's no better platform than the US Legal Forms website – likely the most extensive repositories online.

Here you can find countless document samples for business and personal use categorized by type and region, or by keywords.

With the enhanced search feature, locating the latest Stamford Connecticut Demand for Discharge by Corporation or LLC is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration procedure.

Acquire the document. Choose the format and download it onto your device.

- Additionally, the validity of each document is confirmed by a team of specialized attorneys who regularly examine the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our platform and have an active account, all you need to obtain the Stamford Connecticut Demand for Discharge by Corporation or LLC is to Log In to your user account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions outlined below.

- Ensure you have accessed the template you require. Review its description and utilize the Preview option (if available) to assess its content. If it does not meet your needs, leverage the Search function at the top of the page to find the suitable document.

- Validate your choice. Hit the Buy now button. Afterwards, select your desired subscription plan and enter your details to register for an account.

Form popularity

FAQ

Once you submit your dissolution paperwork in Stamford, Connecticut, the official dissolution of your LLC can take several weeks. Factors such as the completeness of your documents and state processing times can affect the duration. To avoid delays, consider using the uslegalforms platform to ensure all your forms are filled out correctly from the start.

Exiting an LLC can present some challenges, particularly if there are multiple members or unresolved liabilities. However, if you clearly understand your responsibilities and follow the appropriate steps in Stamford Connecticut, the process can be manageable. Seeking assistance through platforms like uslegalforms can help streamline this exit, ensuring you meet all legal requirements.

The time it takes to dissolve an LLC in Stamford, Connecticut, largely depends on how prepared you are with the required documentation. Typically, the process can take a few weeks if you submit everything correctly. If you choose to utilize the uslegalforms platform, you may expedite the process by ensuring all paperwork is completed accurately.

Dissolving an LLC can be straightforward, especially if you follow the right procedures. However, it requires careful attention to detail to ensure compliance with Stamford Connecticut regulations. Utilizing resources such as the uslegalforms platform can simplify the process, providing you with the necessary forms and guidance.

Dissolving an LLC can lead to challenges, particularly with outstanding debts and obligations. Additionally, the process may involve legal fees and paperwork that can be cumbersome. Moreover, once you dissolve your LLC, your business loses its legal protections and benefits under Stamford Connecticut law, which can be a significant drawback.

Yes, Connecticut has a pass-through entity tax that applies to certain LLCs, S Corporations, and partnerships. This tax, which is calculated based on the entity's income, is mandatory for those that meet defined criteria. Knowing your tax obligations can help you manage business affairs better, especially in the context of a Stamford Connecticut Demand for Discharge by Corporation or LLC.

Form CT 1120 must be filed by corporations that transact business in Connecticut and are not S Corporations or certain exempt organizations. This includes both domestic and foreign corporations earning income within the state. Understanding these requirements can prevent issues down the line, particularly in response to a Stamford Connecticut Demand for Discharge by Corporation or LLC.

Typically, C Corporations are the entities required to file the CT 1120. This includes organizations that are taxed as separate entities from their owners. Familiarity with filing requirements is essential if you navigate the complexities of a Stamford Connecticut Demand for Discharge by Corporation or LLC and want to ensure compliance.

Certain entities are exempt from filing the CT 1120, such as S Corporations, which report income differently. Additionally, non-profit organizations and limited liability companies, unless they elect to be treated as corporations, also do not need this form. If your organization falls into these categories, it is essential to understand your filing responsibilities to avoid confusion, especially during a Stamford Connecticut Demand for Discharge by Corporation or LLC.

The CT 1120 form is typically required for corporations doing business in Connecticut and is necessary for those that are foreign or domestic. If your entity is structured as a C Corporation, or if it has income derived from Connecticut sources, you must file. Knowledge of filing obligations is important, particularly if you receive a Stamford Connecticut Demand for Discharge by Corporation or LLC.