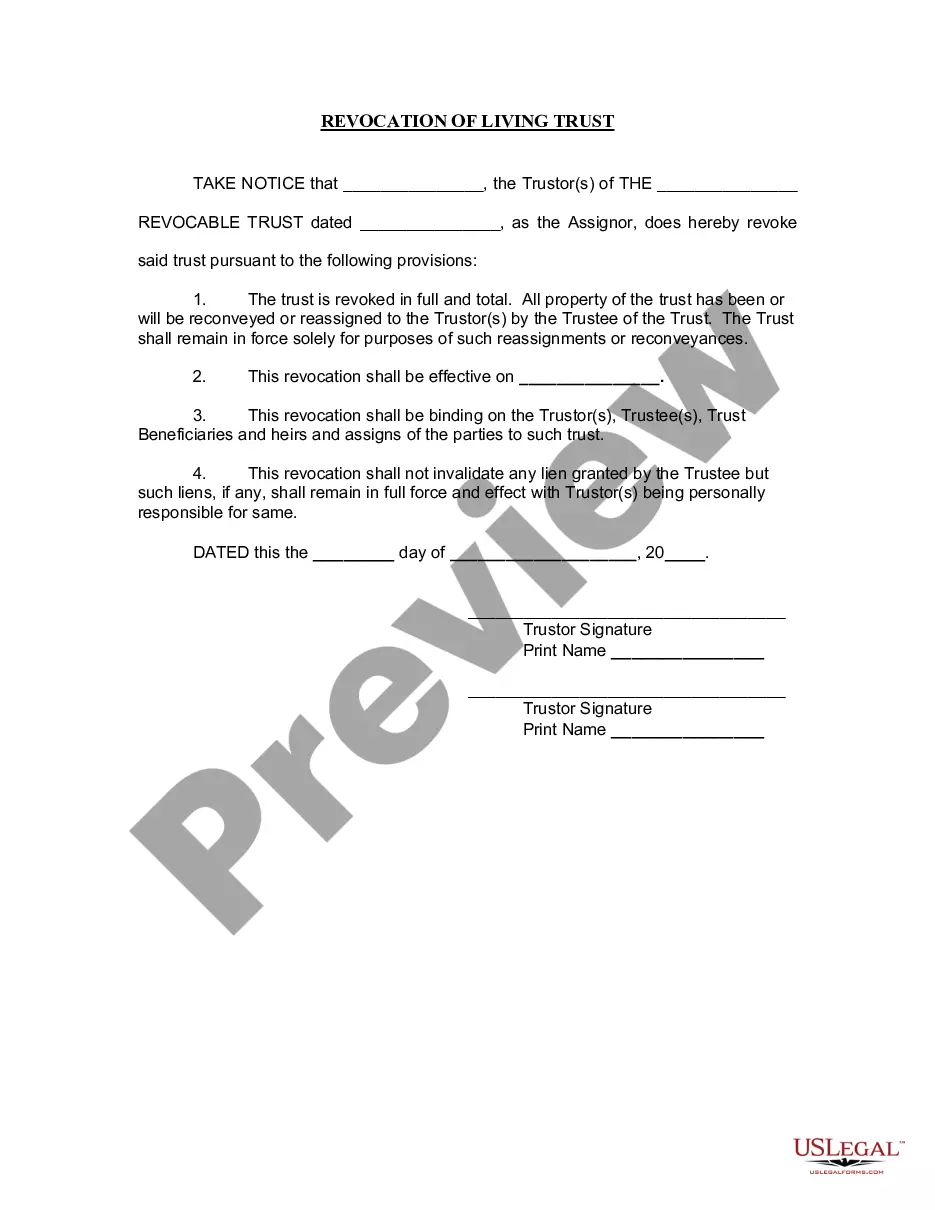

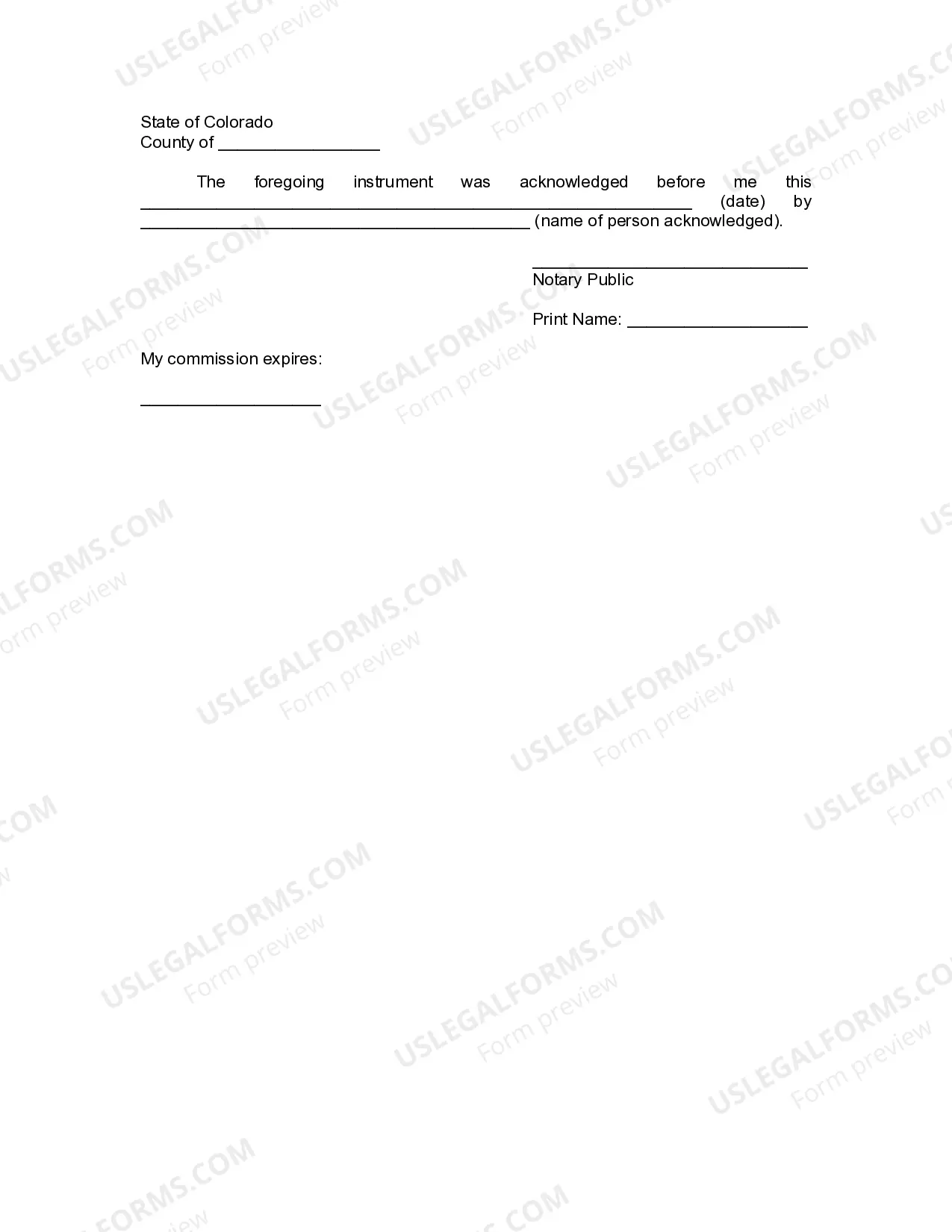

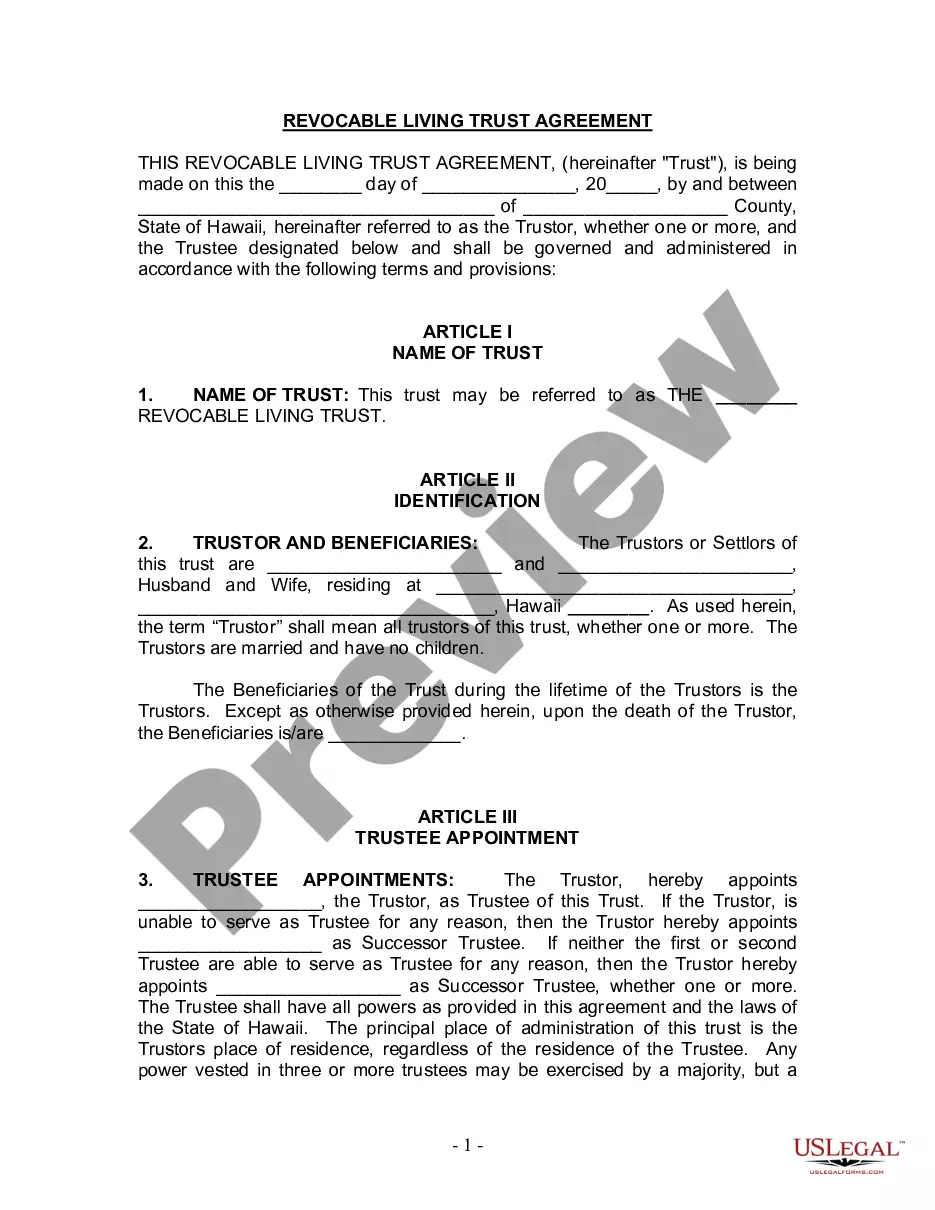

This Revocation of Living Trust form is to revoke a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form declares a full and total revocation of a specific living trust, allows for return of trust property to trustors and includes an effective date. This revocation must be signed before a notary public.

Colorado Springs Colorado Revocation of Living Trust

Description

How to fill out Colorado Revocation Of Living Trust?

We consistently aim to mitigate or avert legal complications when engaging with detailed legal or financial issues.

To achieve this, we seek legal remedies that are typically quite costly.

Nonetheless, not every legal challenge is equally intricate.

The majority of them can be managed independently.

Benefit from US Legal Forms whenever you want to obtain and download the Colorado Springs Colorado Revocation of Living Trust or any other form swiftly and securely. Simply Log In to your account and click the Get button next to it. If you happen to misplace the document, you can always retrieve it again from the My documents section.

- US Legal Forms is an online repository of current DIY legal templates ranging from wills and powers of attorney to incorporation articles and dissolution petitions.

- Our service empowers you to take control of your issues without needing to consult a lawyer.

- We provide access to legal form models that aren't always easily found in public sources.

- Our templates are tailored to state and local specifications, which greatly streamlines the search process.

Form popularity

FAQ

As discussed above, irrevocable trusts are not completely irrevocable; they can be modified or dissolved, but the settlor may not do so unilaterally. The most common mechanisms for modifying or dissolving an irrevocable trust are modification by consent and judicial modification.

You can completely undo the trust if you decide the arrangement isn't working for you after all. But all a revocable trust can do for you is avoid probate of the property it holds when you die. You can name a successor trustee to take over management of the trust for you if you should become incompetent.

(1) An irrevocable trust may be modified or terminated upon consent of the settlor and all beneficiaries, even if the modification or termination is inconsistent with a material noncharitable purpose of the trust. Modification or termination of a charitable trust requires the consent of the attorney general.

An irrevocable trust cannot be revoked or changed. But the difference goes far beyond that fact. Revocable trusts and irrevocable trusts serve very different purposes in estate planning.

Trust agreements usually allow the trustor to remove a trustee, including a successor trustee. This may be done at any time, without the trustee giving reason for the removal. To do so, the trustor executes an amendment to the trust agreement.

Getting consent from all parties Section A provides that so long as the settlor (who made the trust) and all the beneficiaries give consent and that they are all competent to give consent, the trust can be terminated or modified with a simple petition to the relevant probate court.

(a) A noncharitable irrevocable trust may be terminated upon consent of all of the beneficiaries if the court concludes that continuance of the trust is not necessary to achieve any material purpose of the trust.

With living trusts, probate can be avoided and trustees can distribute assets without needing approval from the court. Living trusts offer many other perks, including: Protecting privacy, since living trusts do not become public record. Avoiding the probate process in other states where the individual owns real estate.

The trust is fully valid. It only comes to an end when the settlor fully revokes it.

A will or trust can be contested if the individual who made it lacked the capacity to do so or was unduly influenced by another. It may also be challenged if the signature on the document is invalid.