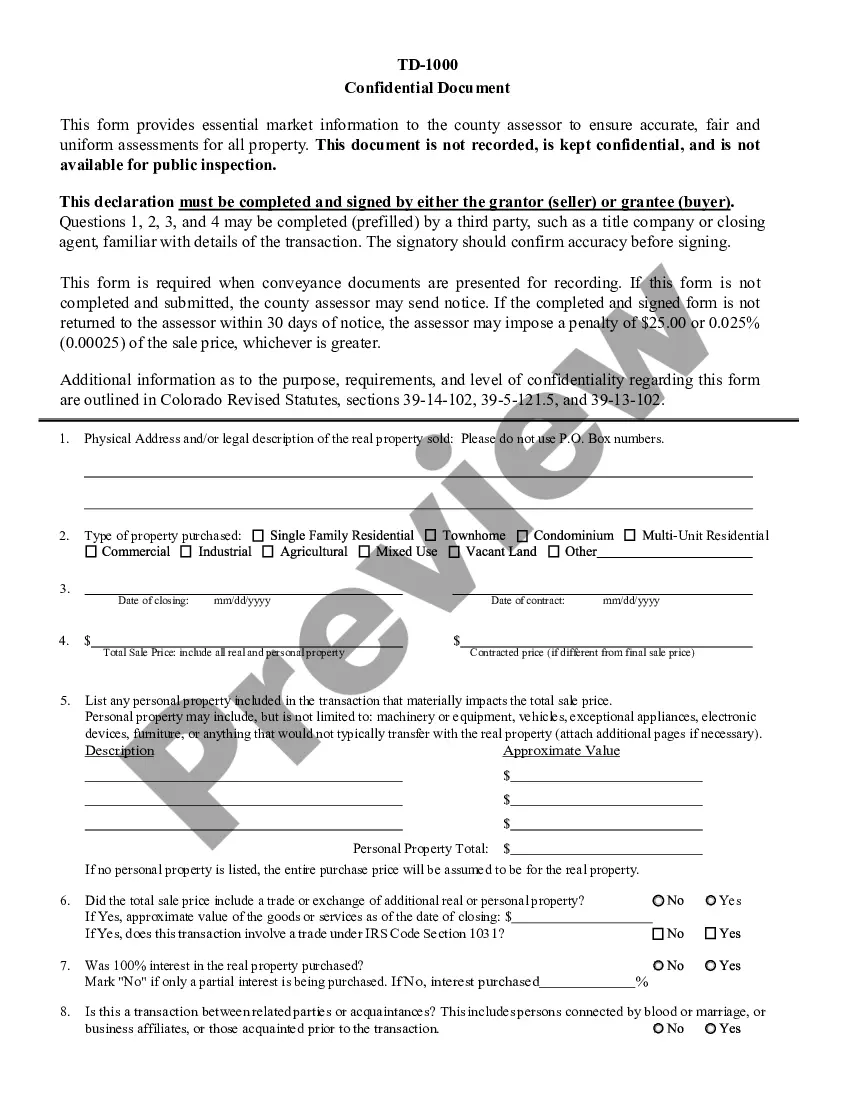

Colorado Real Property Transfer Declaration:

Westminster Colorado Real Property Transfer Declaration

Description

How to fill out Colorado Real Property Transfer Declaration?

Are you seeking a reliable and budget-friendly provider of legal documents to obtain the Westminster Colorado Real Property Transfer Declaration? US Legal Forms is your preferred selection.

Whether you require a basic agreement to establish guidelines for living together with your significant other or a collection of papers to facilitate your separation or divorce in court, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business needs. All templates we present are not generic and are tailored according to the stipulations of particular states and regions.

To acquire the form, you must Log In to your account, locate the required form, and click the Download button adjacent to it. Please remember that you can access your previously purchased form templates at any time in the My documents section.

Are you unfamiliar with our website? No problem. You can create an account in just a few minutes, but first, ensure to do the following.

Now you can set up your account. Then select the subscription option and proceed to payment. Once the payment is finalized, download the Westminster Colorado Real Property Transfer Declaration in any available file format. You can return to the website whenever needed and redownload the form at no additional cost.

Locating current legal documents has never been more straightforward. Try US Legal Forms today, and put an end to wasting your precious time searching for legal paperwork online permanently.

- Verify if the Westminster Colorado Real Property Transfer Declaration adheres to the laws of your state and locality.

- Review the form’s description (if available) to understand who and what the form is beneficial for.

- Start your search again if the form does not align with your legal needs.

Form popularity

FAQ

To transfer a property deed in Colorado, you need to complete a property transfer declaration, also known as the Westminster Colorado Real Property Transfer Declaration. Start by gathering the necessary documents, including the original deed and identifying information about the property and the parties involved. Next, fill out the declaration accurately and ensure all details are correct. Finally, submit the completed declaration to the local county clerk's office for recording, which is an essential step to finalize the transfer.

Certain properties in Colorado may qualify for exemptions from real estate taxes. These include properties owned by nonprofit organizations, religious institutions, and some government-owned properties. To ensure you meet the necessary criteria, refer to the Westminster Colorado Real Property Transfer Declaration for guidance on exemptions and eligibility requirements.

To avoid or minimize realty transfer tax in Colorado, consider structuring your property transfers strategically. For example, gifting property to family members instead of selling can help reduce tax liabilities. Additionally, using the Westminster Colorado Real Property Transfer Declaration allows you to understand the tax implications and identify effective strategies to minimize these costs.

In Colorado, individuals aged 65 and older may qualify for property tax relief programs, which can help reduce their tax burden. However, there is no universal age at which property taxes cease completely. Programs related to the Westminster Colorado Real Property Transfer Declaration can help seniors navigate their options and access potential benefits.

Transferring a property title to a family member in Colorado involves completing a deed, such as a quitclaim deed or a warranty deed. You will need to provide details about the property and the family member receiving it. Utilizing the Westminster Colorado Real Property Transfer Declaration helps streamline this process and ensures you meet all legal requirements effortlessly.

In Colorado, some individuals may qualify for property tax exemptions. These include seniors aged 65 and older, certain veterans, and individuals with disabilities. The Westminster Colorado Real Property Transfer Declaration plays a crucial role in ensuring that eligible residents understand their exemption status and navigate the property tax process smoothly.

Transfer of property in real estate refers to the process of conveying ownership rights from one individual or entity to another. This can involve various legal documents and procedures, notably the Westminster Colorado Real Property Transfer Declaration, which helps document all relevant details for the transaction. Understanding this process helps both buyers and sellers engage confidently in their property dealings.

To transfer ownership of a property in Colorado, you must complete a set of legal documents, including a deed and a Westminster Colorado Real Property Transfer Declaration. It is advisable to ensure all forms are filled out correctly and submitted to the necessary county office. Consulting with a real estate professional can further simplify the ownership transfer process.

In Colorado, certain transactions may qualify for exemptions from the real property transfer tax. Common exemptions include transfers between immediate family members, as well as specific government-related transactions. Knowing the nuances of these exemptions can help you navigate the Westminster Colorado Real Property Transfer Declaration process more efficiently.

A declaration document in real estate serves as a formal statement regarding the details of a property transaction. It outlines critical information such as the value of the property and any relevant legal obligations. Understanding the Westminster Colorado Real Property Transfer Declaration is essential, as it provides transparency for both buyers and sellers during the property transfer process.