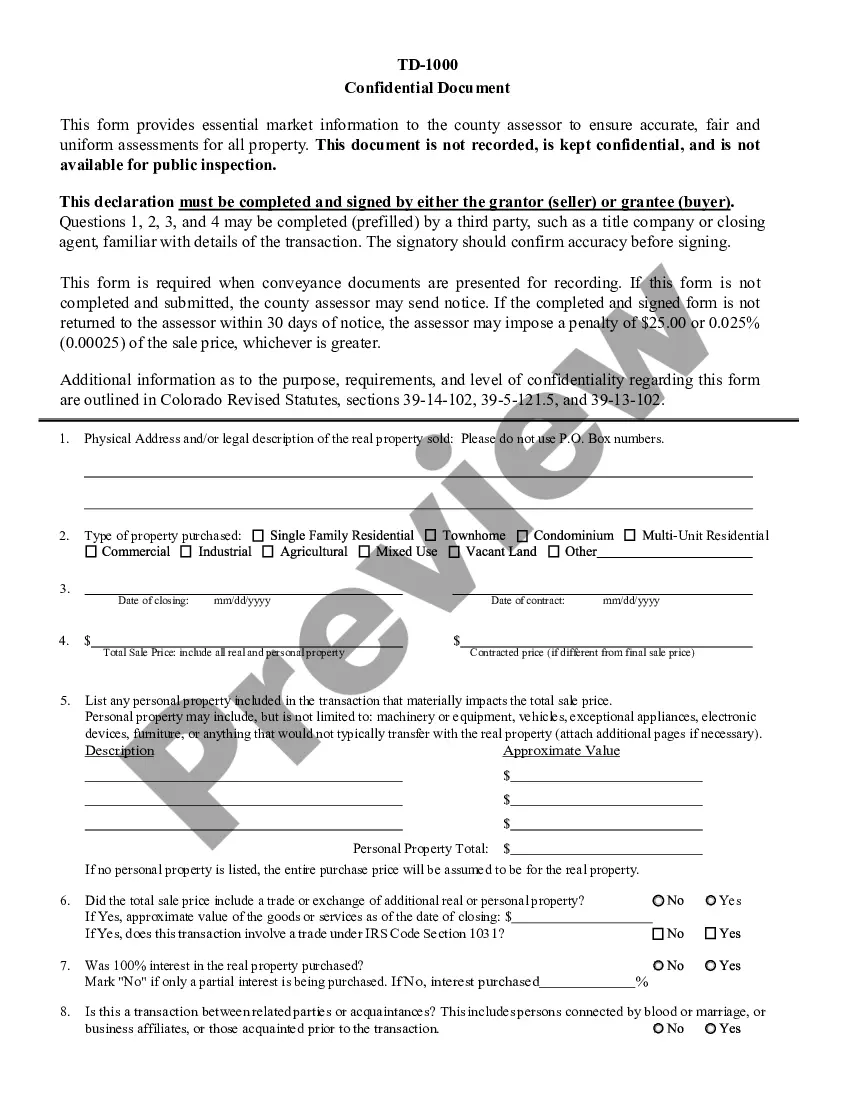

Colorado Real Property Transfer Declaration:

Aurora Colorado Real Property Transfer Declaration

Description

How to fill out Colorado Real Property Transfer Declaration?

If you have previously used our service, Log In to your account and download the Aurora Colorado Real Property Transfer Declaration to your device by selecting the Download button. Ensure your subscription is active. If it is not, renew it according to your payment schedule.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You have ongoing access to all documents you have purchased: you can find them in your profile under the My documents section whenever you need to refer to them again. Utilize the US Legal Forms service to quickly find and download any template for your personal or business requirements!

- Ensure you’ve located a suitable document. Review the description and utilize the Preview option, if available, to verify if it fulfills your requirements. If it doesn’t meet your needs, make use of the Search tab above to find the correct one.

- Purchase the document. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and finalize your payment. Enter your credit card details or select the PayPal option to complete your purchase.

- Retrieve your Aurora Colorado Real Property Transfer Declaration. Choose the file format for your document and save it onto your device.

- Complete your form. Print it out or use professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

To obtain a property transfer affidavit, you can start by checking with your local government office or online resources. An Aurora Colorado Real Property Transfer Declaration may also require specific forms that are easily accessible on platforms like US Legal Forms. Simply select the necessary template, fill in the required details, and ensure it meets all legal standards. This process streamlines your document preparation and helps ensure a smooth property transfer.

A real property transfer declaration is a form required when property changes ownership. It captures essential details about the property and the parties involved in the transaction. In the context of an Aurora Colorado Real Property Transfer Declaration, this declaration ensures that the local government has accurate information for tax assessments and recordkeeping. You can easily prepare this document through US Legal Forms, ensuring you meet all local requirements.

An affidavit of transfer to real estate is a legal document that verifies the transfer of property ownership. This affidavit serves as proof that the transfer has occurred and helps clarify the chain of title. If you are dealing with an Aurora Colorado Real Property Transfer Declaration, this document might be required to ensure compliance with local regulations. Utilizing platforms like US Legal Forms can simplify this process and provide the necessary forms.

Transferring a property deed in Colorado involves preparing the deed, which records the names of the current owner and the new owner, and includes a legal description of the property. Once the deed is correctly filled out and signed, it must be recorded at the county clerk and recorder’s office. The Aurora Colorado Real Property Transfer Declaration is an essential component of this transfer process.

A real property transfer declaration affidavit is a sworn statement that verifies the information provided in the property transfer declaration. This affidavit serves as a legal acknowledgment of the details surrounding the transfer. Using this type of affidavit will fortify your Aurora Colorado Real Property Transfer Declaration and reinforce the accuracy of your property transaction.

To transfer ownership of a property in Colorado, you need to complete a deed, which must include the legal description of the property, the names of both the grantor and grantee, and the signature of the grantor. After completing the deed, you must file it with the county clerk and recorder’s office. Utilizing the Aurora Colorado Real Property Transfer Declaration can streamline this process.

In Colorado, certain transfers are exempt from the real property transfer tax. Common exemptions include transfers between spouses, transfers via a court order, and transfers without consideration. Understanding these exemptions can simplify your experience when dealing with the Aurora Colorado Real Property Transfer Declaration.

The best way to transfer property title between family members involves preparing a new deed, completing the required Aurora Colorado Real Property Transfer Declaration form, and filing it with the county clerk's office. You should ensure that the deed is properly signed and notarized to avoid complications. Using a platform like USLegalForms can help streamline this process, providing you with the necessary forms and guidance to make the transfer smooth and legally compliant.

Yes, you can transfer a deed without an attorney, provided you follow the necessary steps according to state laws. In Aurora, Colorado, you will need to complete a Real Property Transfer Declaration form to document the transfer accurately. While it's possible to handle it on your own, using professional resources, such as USLegalForms, can simplify the process and ensure you meet all legal requirements.

You can avoid real estate transfer tax in Colorado by ensuring that the property transfer fits within specific exceptions. For instance, gifting property to a family member or transferring under certain legal conditions may qualify. Always refer to the Aurora Colorado Real Property Transfer Declaration to navigate these options effectively.