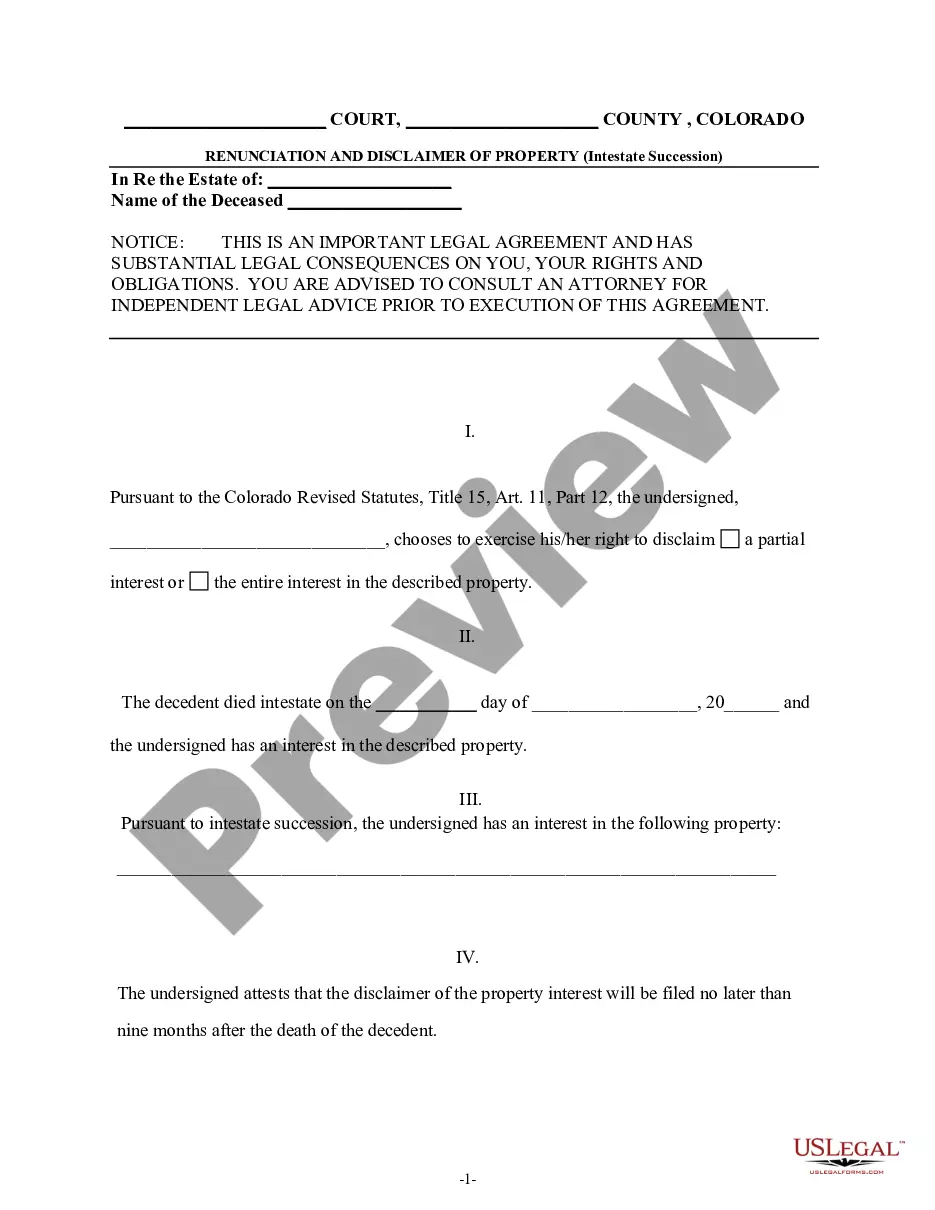

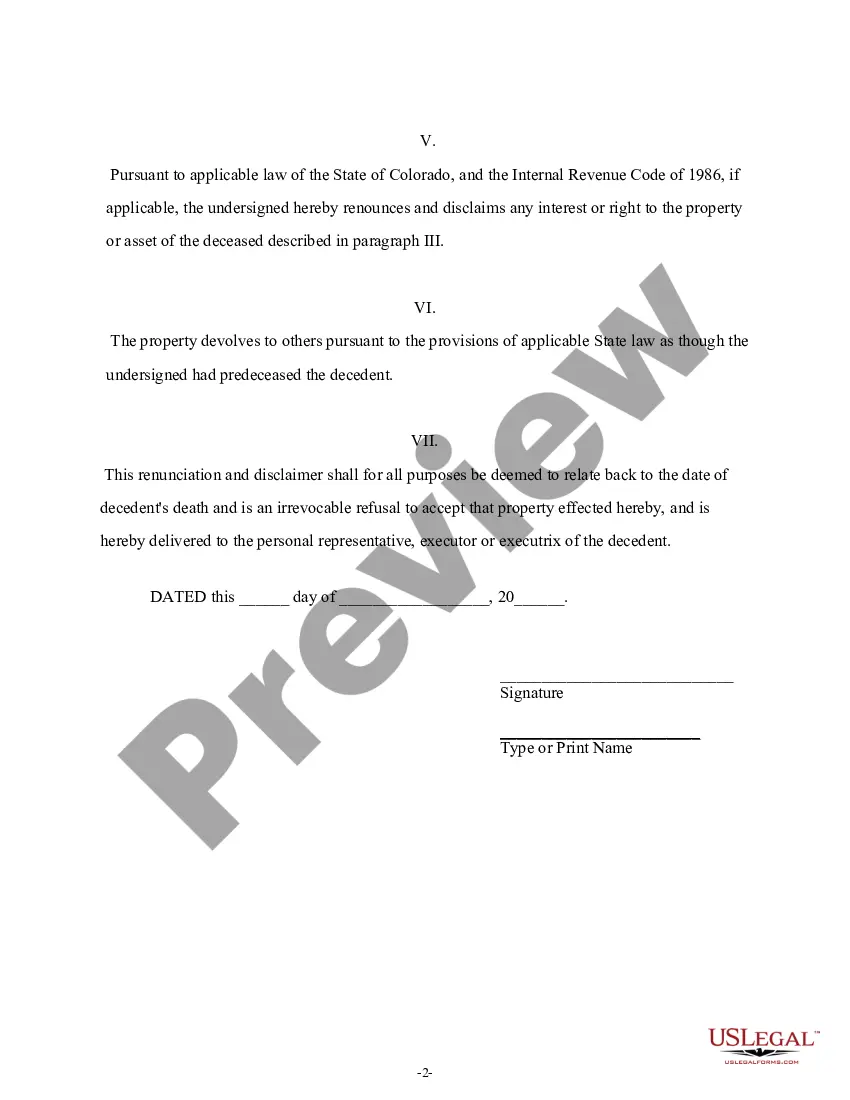

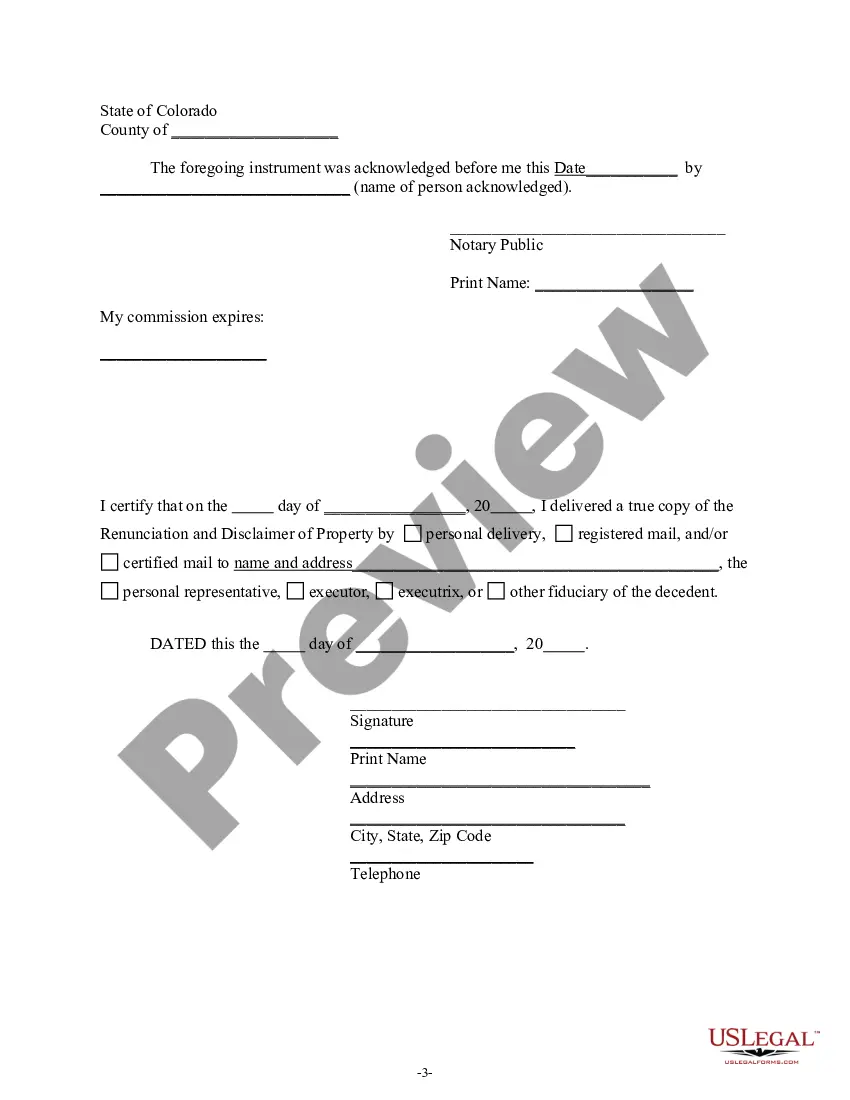

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. Pursuant to the Colorado Revised Statutes, Title 15, Art. 11, Part 8, the beneficiary has chosen to disclaim a portion of or the entire interest in the property. The disclaimer will relate back to the date of death of the decedent and is an irrevocable refusal to accept the property. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Fort Collins Colorado Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Colorado Renunciation And Disclaimer Of Property Received By Intestate Succession?

If you are in search of a pertinent form template, it’s exceedingly challenging to select a superior service than the US Legal Forms website – one of the most exhaustive collections online. With this collection, you can discover thousands of document examples for both business and personal use categorized by type and state, or keywords.

With the top-notch search feature, acquiring the latest Fort Collins Colorado Renunciation And Disclaimer of Property obtained through Intestate Succession is as simple as 1-2-3. Furthermore, the applicability of each document is validated by a team of experienced attorneys who routinely examine the templates on our site and amend them according to the latest state and county laws.

If you are already acquainted with our platform and have a registered account, all you need to do to obtain the Fort Collins Colorado Renunciation And Disclaimer of Property obtained through Intestate Succession is to sign in to your account and select the Download option.

Every single form you add to your account has no expiration date and belongs to you indefinitely. You can conveniently access them through the My documents section, so if you wish to have an additional copy for modification or printing, you can return and save it again whenever needed.

Leverage the extensive collection of US Legal Forms to gain access to the Fort Collins Colorado Renunciation And Disclaimer of Property obtained through Intestate Succession you were searching for and thousands of other professional and state-specific templates in one location!

- Ensure you have located the template you require. Review its details and use the Preview feature (if available) to examine its content. If it does not satisfy your requirements, utilize the Search feature at the top of the page to find the necessary document.

- Verify your choice. Click on the Buy now button. Then, select the desired pricing plan and provide your information to register for an account.

- Complete the payment. Use your credit card or PayPal account to finish the registration process.

- Obtain the document. Specify the format and download it to your device.

- Edit the document. Complete, modify, print, and sign the acquired Fort Collins Colorado Renunciation And Disclaimer of Property obtained through Intestate Succession.

Form popularity

FAQ

To write an inheritance disclaimer letter, start by clearly stating your intent to renounce any property received through intestate succession. Include your name, a description of the property, and your relationship to the deceased. In Fort Collins, Colorado, using a legally structured format is advisable to ensure effectiveness. You can also leverage resources like US Legal Forms to simplify the process and ensure compliance with local regulations.

In the US, the order of inheritance generally prioritizes immediate family members. In Fort Collins, Colorado, a spouse usually inherits first, followed by children, parents, and then more distant relatives if no immediate family exists. Each state may have nuances in their laws, which determine how estates are split. It’s vital to understand these rules to ensure proper distribution of the estate.

An individual inheriting property through intestate succession in Fort Collins, Colorado, gains ownership of their designated share of the deceased's estate. This could include real estate, personal belongings, or financial assets. The specific inheritance can vary according to state laws and the family's structure. Getting familiar with the legalities of intestate succession can help clarify expectations.

When there is no will, the laws of intestate succession determine the heirs. In Fort Collins, Colorado, the estate typically goes to a spouse, children, or other close relatives. These laws vary by state, but they aim to distribute property fairly among surviving family members. Thus, knowing your state's regulations is essential for anyone navigating these situations.

Intestate succession occurs when someone passes away without a valid will. In Fort Collins, Colorado, the law specifies how the deceased's property will be distributed to heirs. Generally, close relatives, such as spouses, children, and parents, have priority in receiving property. Understanding these principles is crucial for anyone involved in estate planning or dealing with the outcomes of intestate succession.

The order of next of kin in Colorado follows a clear hierarchy during the distribution of property when no will exists. Spouses, children, parents, and siblings typically inherit first, followed by more distant relatives. Familiarizing yourself with the Fort Collins Colorado Renunciation And Disclaimer of Property received by Intestate Succession empowers you to navigate these laws and make the most of any property received.

In Colorado, there is generally a 12-month period after death to transfer property through intestate succession. However, timely action is crucial to avoid delays and complications. Utilizing the Fort Collins Colorado Renunciation And Disclaimer of Property received by Intestate Succession can streamline this process and ensure that property transfers are conducted efficiently.

In Colorado, if there is no will, the state's intestate succession laws determine who inherits the deceased's property. Typically, priority is given to the spouse, children, and other close relatives. Understanding the Fort Collins Colorado Renunciation And Disclaimer of Property received by Intestate Succession ensures that heirs can navigate this process with clarity and make informed decisions about the inherited property.

To transfer property after a parent's death without a will, you may need to follow intestate succession laws in Colorado. Generally, the property will pass to the surviving heirs according to a predetermined order established by law. Utilizing the Fort Collins Colorado Renunciation And Disclaimer of Property received by Intestate Succession can help you manage the inheritance effectively and avoid unnecessary complications.

The disclaimer statute in Colorado allows an individual to renounce their interest in property received through intestate succession. By filing a disclaimer, individuals can avoid accepting property that may burden them with debts or responsibilities. It is important to understand the requirements and timelines associated with the Fort Collins Colorado Renunciation And Disclaimer of Property received by Intestate Succession to ensure compliance.