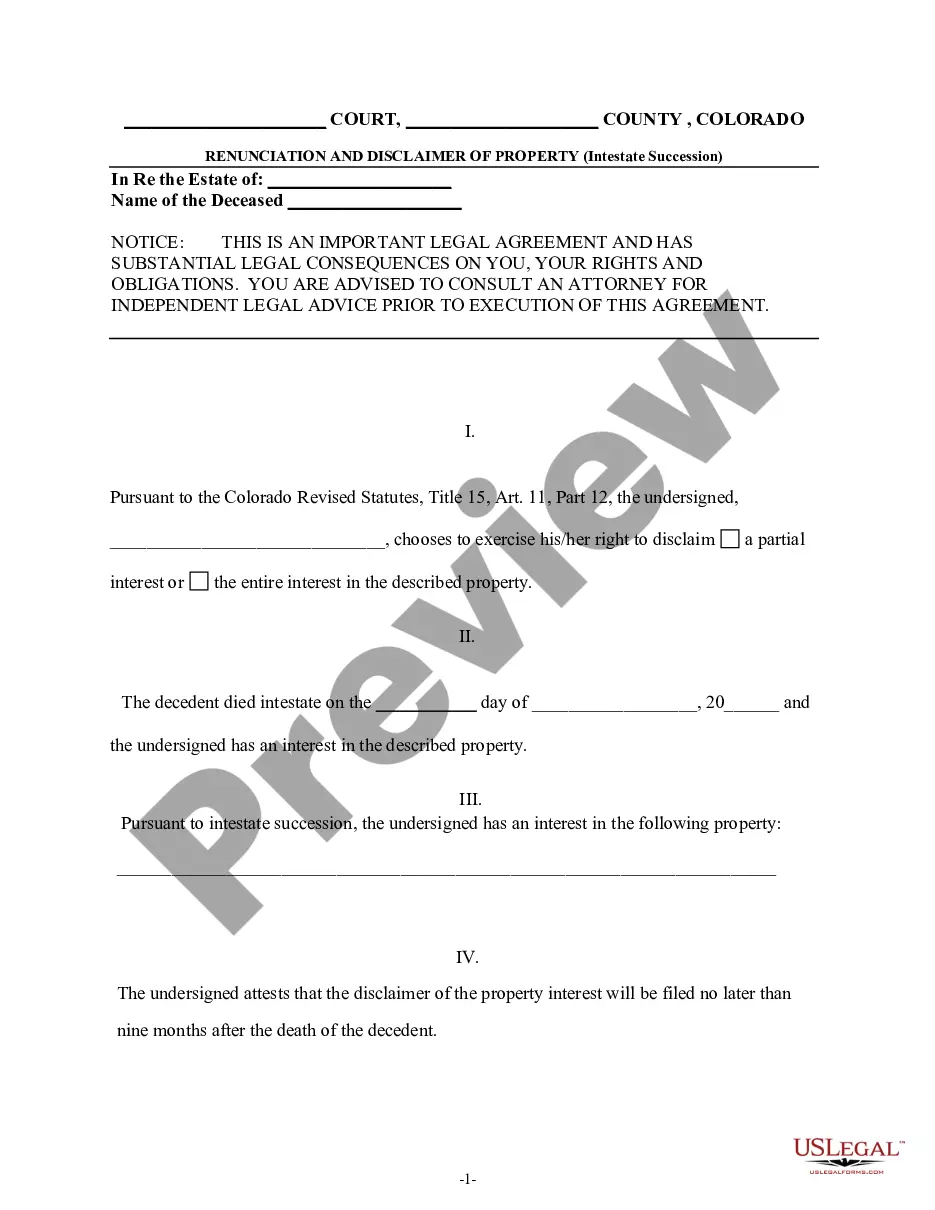

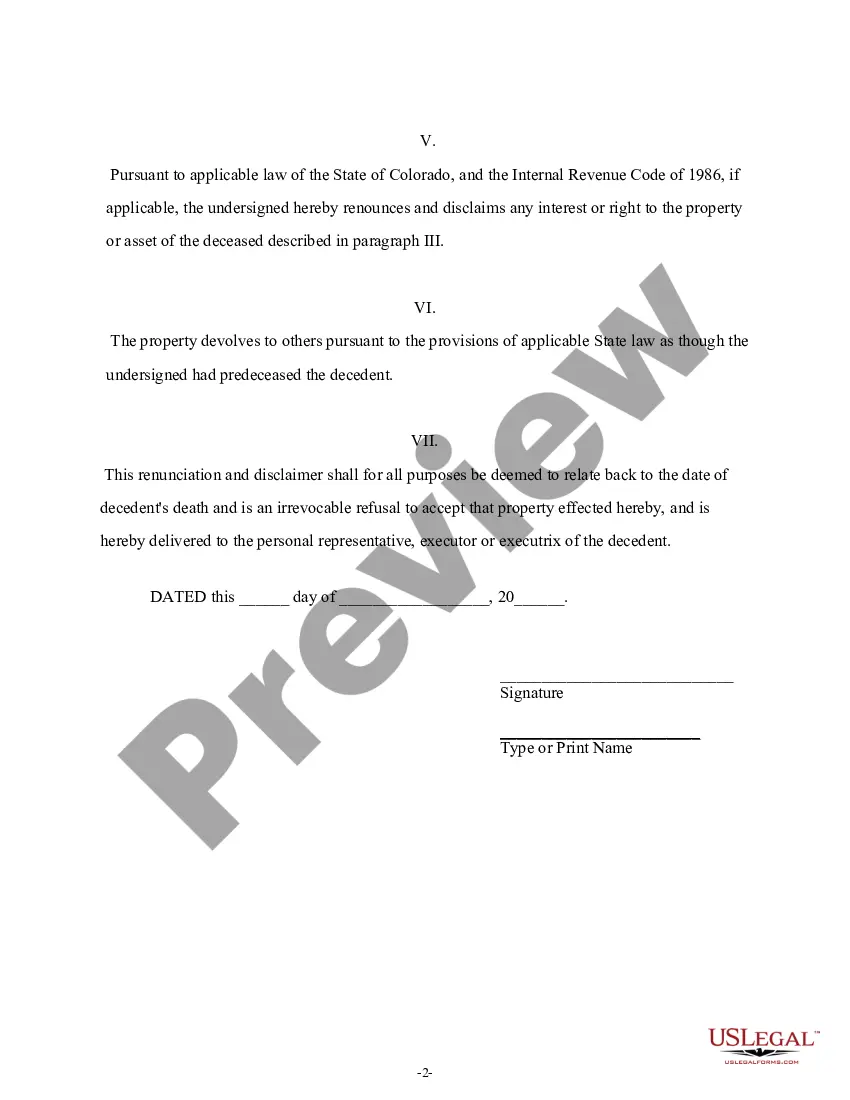

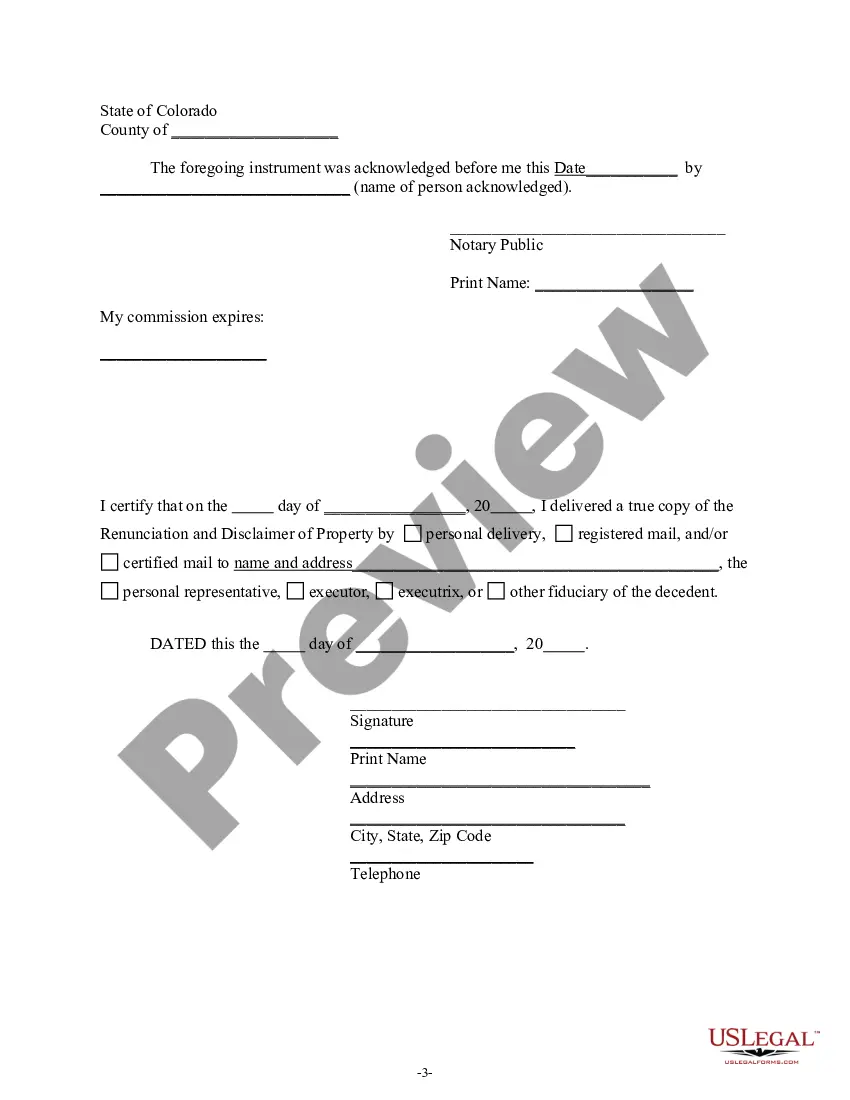

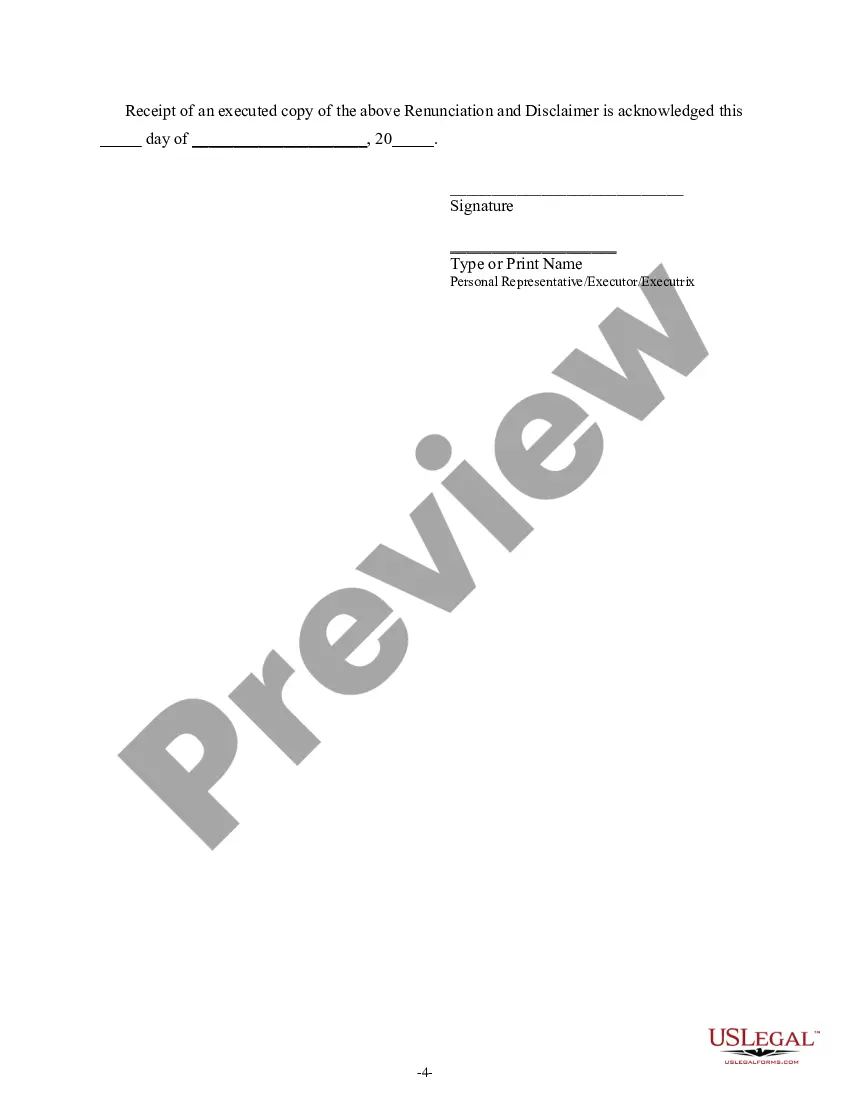

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. Pursuant to the Colorado Revised Statutes, Title 15, Art. 11, Part 8, the beneficiary has chosen to disclaim a portion of or the entire interest in the property. The disclaimer will relate back to the date of death of the decedent and is an irrevocable refusal to accept the property. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Aurora Colorado Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Colorado Renunciation And Disclaimer Of Property Received By Intestate Succession?

If you have previously employed our service, sign in to your account and download the Aurora Colorado Renunciation And Disclaimer of Property received through Intestate Succession onto your device by pressing the Download button. Ensure that your subscription is active. If it is not, renew it according to your payment scheme.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have ongoing access to all documents you have acquired: you can locate them in your profile under the My documents section whenever you wish to use them again. Leverage the US Legal Forms service to easily locate and store any template for your personal or professional purposes!

- Confirm you’ve located a suitable document. Review the description and utilize the Preview feature, if present, to determine if it satisfies your needs. If it doesn’t align with your requirements, use the Search tab above to find the correct one.

- Procure the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Create an account and process your payment. Enter your credit card information or opt for PayPal to finalize the purchase.

- Receive your Aurora Colorado Renunciation And Disclaimer of Property received through Intestate Succession. Choose the file format for your document and save it on your device.

- Complete your form. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Intestate succession in Colorado occurs when a person dies without a valid will. In such cases, the state law governs how the deceased's assets are distributed among their heirs. Typically, a spouse, children, or other close relatives receive the property. If you are considering the Aurora Colorado Renunciation and Disclaimer of Property received by Intestate Succession, you may want to understand how it affects your rights to inherited property.

In most cases, a disclaimer of inheritance does not need to be notarized, especially when dealing with the Aurora Colorado Renunciation And Disclaimer of Property received by Intestate Succession. However, some courts might require notarization to validate the claim. Check with your local requirements or seek assistance from platforms like US Legal Forms to make sure all necessary steps are followed. This helps ensure that your disclaimer is legally recognized and properly processed.

To disclaim an inheritance in the context of Aurora Colorado Renunciation And Disclaimer of Property received by Intestate Succession, you must submit a formal disclaimer in writing. This document should clearly state your intent to renounce the property and include the details of the inheritance. It is important to file this disclaimer with the appropriate court or agency, and make sure you comply with the IRS guidelines to prevent tax implications. Using services like US Legal Forms can help guide you through this process and ensure all paperwork is completed correctly.

To successfully disclaim an inheritance in Colorado, you need to create a written document that clearly states your intention to renounce your claim. This written disclaimer must be filed with the appropriate probate court or with the estate's administrator. Be mindful of the timeframe to ensure your disclaimer is valid. Consider utilizing the Aurora Colorado Renunciation And Disclaimer of Property received by Intestate Succession resources to guide you in this process.

Disclaiming inherited property in Colorado involves submitting a formal disclaimer that articulates your decision to renounce the inheritance. Ensure you include relevant details, such as your identity and description of the property. This process provides a clear path and protects you from potential future claims. Turn to the Aurora Colorado Renunciation And Disclaimer of Property received by Intestate Succession for more information.

To disclaim an inheritance in Colorado, you must submit a written disclaimer to the estate's representative or court. This document should include your intent to renounce the inheritance and a description of the property involved. Additionally, ensure you comply with the required timeframes to validate your disclaimer. For comprehensive assistance, explore resources like the Aurora Colorado Renunciation And Disclaimer of Property received by Intestate Succession.

The disclaimer law in Colorado allows a beneficiary to renounce their interest in inherited property without affecting the rights of other beneficiaries. This process must adhere to specific legal requirements, such as filing the disclaimer in writing. Understanding these laws is crucial to ensure compliance and protect your rights. For more information, refer to the Aurora Colorado Renunciation And Disclaimer of Property received by Intestate Succession.

In Colorado, the time limit for disclaiming an inheritance is typically nine months after the decedent’s death. If you delay beyond this period, you may forfeit your right to disclaim. Timely action ensures you can make a decision based on what is best for your situation. Utilize the Aurora Colorado Renunciation And Disclaimer of Property received by Intestate Succession for guidance.

To write a disclaimer of inheritance, start by clearly stating your intent to disclaim the property. Include your name, the decedent's name, and a description of the property. Follow this with a declaration that you are renouncing any claim to the property under the Aurora Colorado Renunciation And Disclaimer of Property received by Intestate Succession. It's advisable to consult legal resources or professionals for accuracy.

In Colorado, when a person dies without a will, their property transfers through intestate succession laws. These laws determine the rightful heirs based on close family relationships, such as children, parents, or siblings. It is essential to understand that this process may not align with the deceased's wishes. Therefore, consider seeking assistance with the Aurora Colorado Renunciation And Disclaimer of Property received by Intestate Succession for clarity.