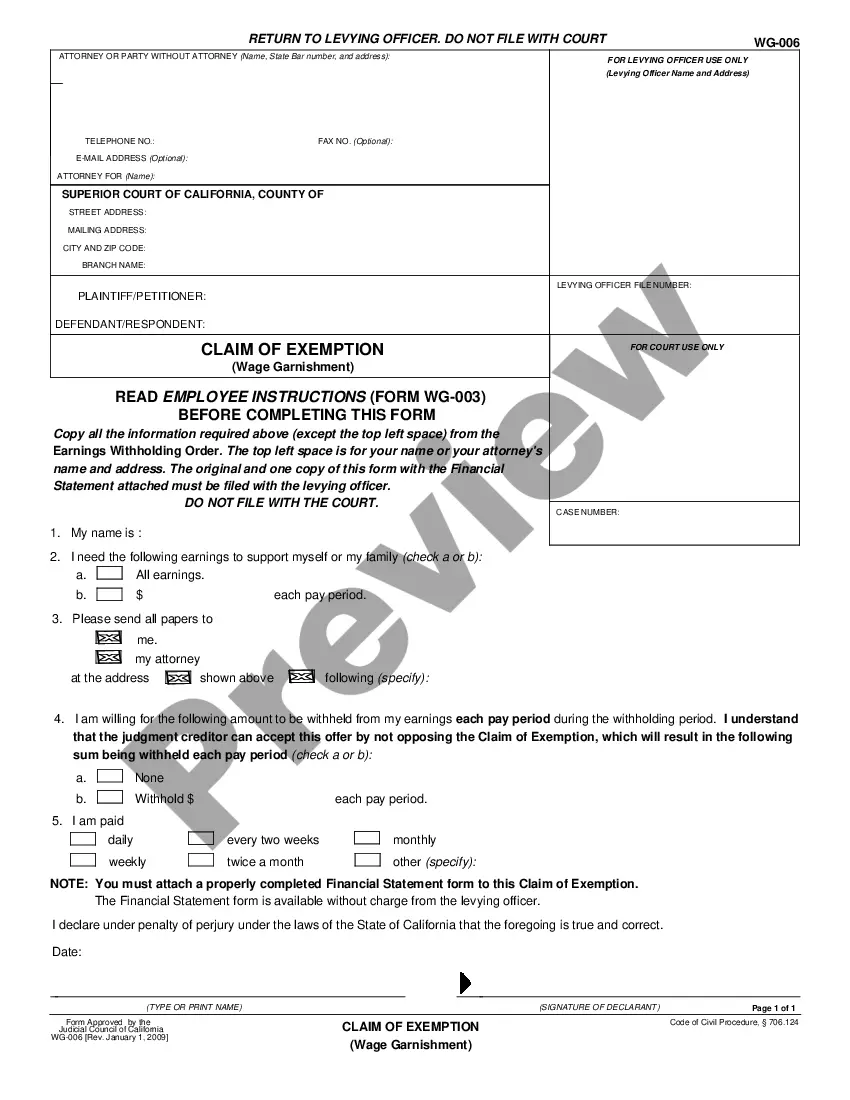

This form is a claim of exemption and financial statement. A garnishment debtor can use this form to explain the resources he or she needs to have exempted from a garnishment in order to pay basic living expenses.

San Bernardino California Claim of Exemption and Financial Declaration

Description

How to fill out California Claim Of Exemption And Financial Declaration?

Are you searching for a reliable and affordable provider of legal forms to obtain the San Bernardino California Claim of Exemption and Financial Declaration? US Legal Forms is your ideal choice.

Whether you require a simple agreement to establish guidelines for living together with your partner or a collection of documents to facilitate your separation or divorce in court, we have you covered. Our site features over 85,000 current legal document templates for both personal and business applications. All templates we provide are not generic and are tailored based on the regulations of specific states and regions.

To download the document, you must Log In to your account, locate the desired template, and click the Download button adjacent to it. Please remember that you can access your previously purchased form templates anytime from the My documents section.

Is it your first time visiting our website? No problem. You can create an account with ease, but before proceeding, ensure that you do the following.

Now you can register for your account. Then choose the subscription option and proceed to payment. Once the payment is finalized, download the San Bernardino California Claim of Exemption and Financial Declaration in any available file format. You are welcome to return to the website at any time and redownload the form at no additional cost.

Acquiring up-to-date legal documents has never been simpler. Give US Legal Forms a try today, and stop wasting your precious time learning about legal paperwork online for good.

- Verify if the San Bernardino California Claim of Exemption and Financial Declaration complies with the rules of your state and locality.

- Review the details of the form (if available) to discern who and what the form is suitable for.

- Restart your search if the template does not fit your particular circumstances.

Form popularity

FAQ

Writing a hardship letter for wage garnishment involves clearly explaining your financial situation and the reasons for your claim of exemption. Begin the letter by stating your understanding of the garnishment and then outline the specific hardships you face, such as necessary living expenses. Make sure to support your claims with relevant details, and consider using templates from platforms like US Legal Forms for guidance. This letter should aim to communicate your genuine need for assistance.

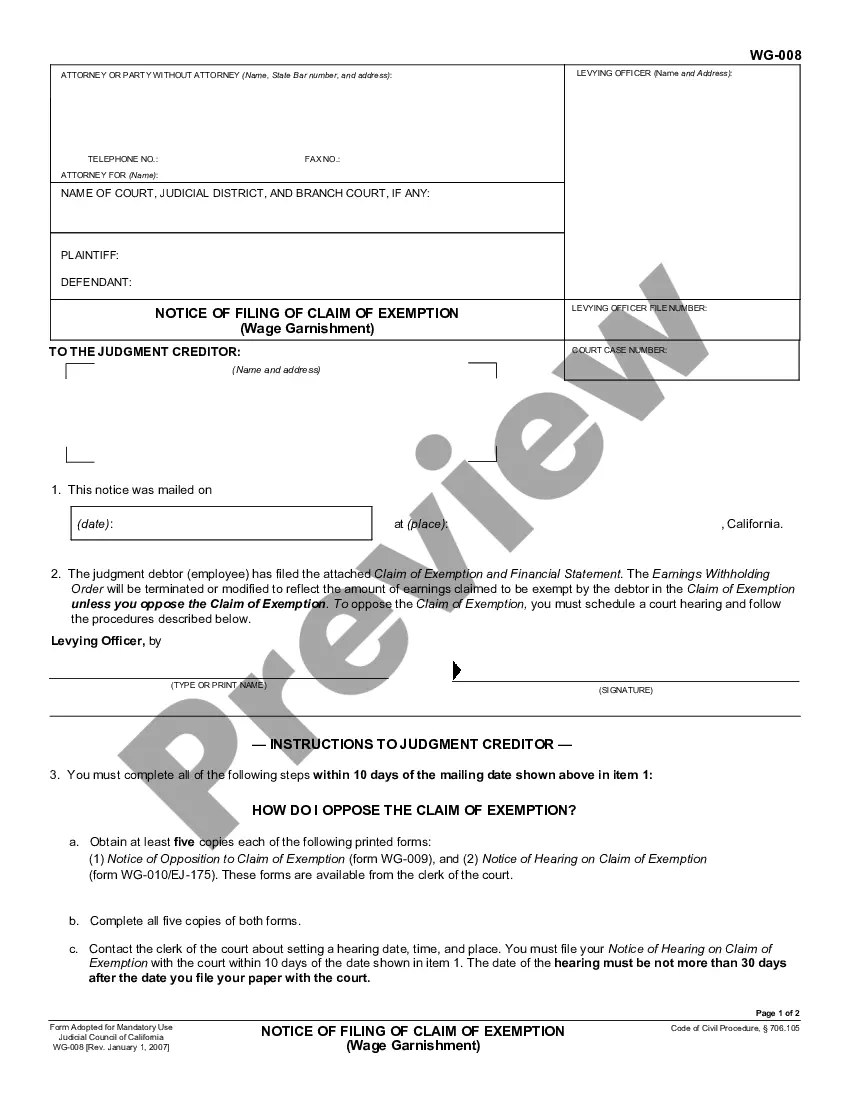

To file a wage garnishment exemption in California, start by completing the relevant forms, ensuring you include accurate and comprehensive details about your finances. Submit these forms to the court and serve them on the creditor to notify them of your claim. You may consider using resources like US Legal Forms to find specific documents and guidance. This process is designed to help protect your earnings from undue garnishment.

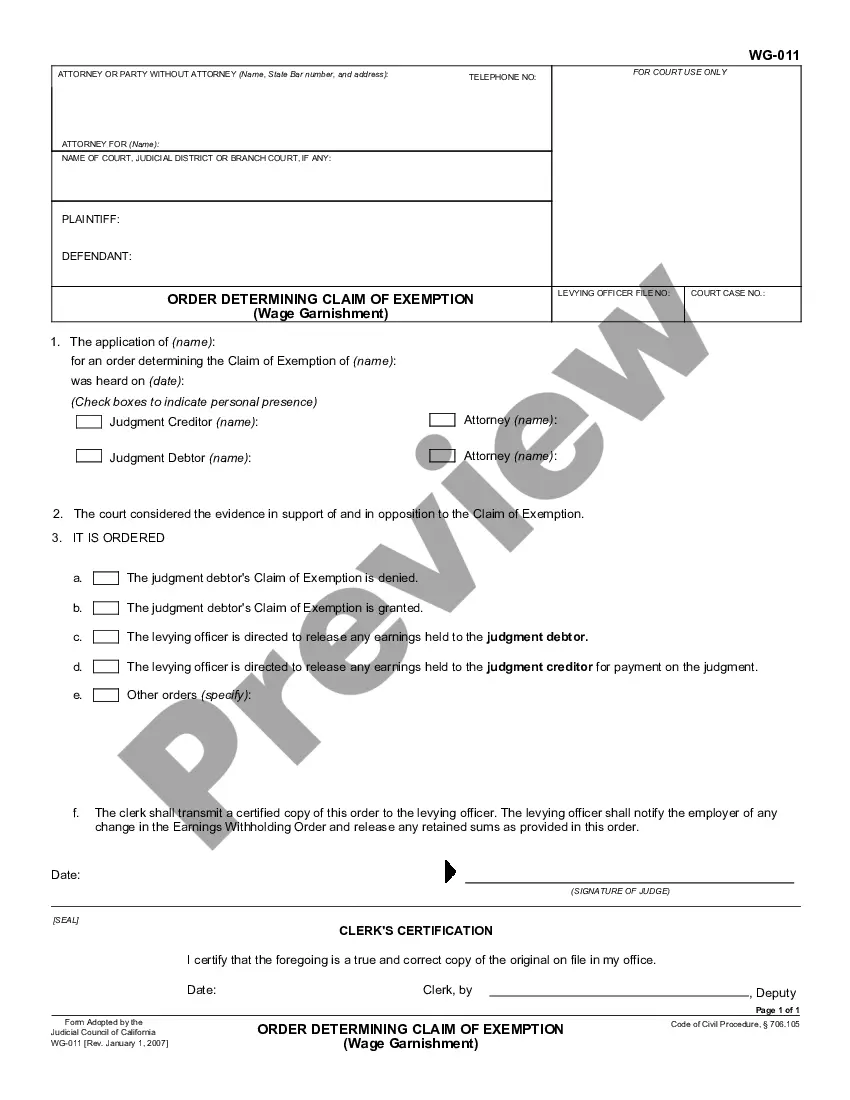

A claim to exemption is a request made to the court, allowing individuals to protect certain income or assets from being taken under a judgment, such as wage garnishments. In San Bernardino, California, this claim helps individuals argue that their financial situation warrants special considerations. It is important to provide a detailed financial declaration alongside the claim. Understanding your rights can significantly improve your financial circumstances.

To file a claim of exemption for wage garnishment in California, begin by completing the necessary forms, such as the EJ 160. Specify your financial situation clearly, demonstrating why garnishment is a burden. After filling out the claim, file it with the court where the judgment was issued and serve the creditor. It is advisable to keep copies of all documents submitted.

The claim of exemption on EJ 160 is a legal document that allows individuals in San Bernardino, California, to assert their rights against wage garnishments. By completing this form, you can declare that certain wages or assets should not be subject to garnishment due to financial hardship or other valid reasons. This claim is crucial for protecting your income and financial stability. Additionally, providing a financial declaration can further strengthen your case.

To fill out a challenge to garnishment form in San Bernardino, California, first obtain the appropriate form, usually available online or at the courthouse. Ensure you provide accurate details about your income, expenses, and assets that support your claim of exemption. Be specific in stating why the garnishment creates a financial hardship. Once completed, file the form with the court and serve a copy to the creditor.

To stop wage garnishment immediately in California, you can file a Claim of Exemption in the San Bernardino area. This legal action allows you to assert that your financial circumstances make the garnishment unreasonable. Complete the necessary forms, paying close attention to the San Bernardino California Claim of Exemption and Financial Declaration. For assistance, consider US Legal Forms, which offers resources and templates to guide you through the filing process.

To request a payment plan that stops wage garnishment, you should communicate directly with your creditor. Present your proposal for a manageable payment schedule while referencing the San Bernardino California Claim of Exemption and Financial Declaration to support your request. Clearly outline your income, expenses, and the necessity of this arrangement. Utilizing resources from US Legal Forms can help you draft a compelling payment plan request.

To write a letter that halts wage garnishment, start by addressing your creditor and clearly stating your intention to claim exemption under California law. Include essential information such as your account number and personal details. Refer specifically to the San Bernardino California Claim of Exemption and Financial Declaration, noting your financial situation and your reasons for the exemption. Consider using platforms like US Legal Forms to access templates that can streamline your letter-writing process.

Claiming exemption from California withholding requires you to submit Form W-4 or similar documentation to your employer. Through the San Bernardino California Claim of Exemption and Financial Declaration, you can clearly state your eligibility for exemption status based on your income and tax situation. Make sure to stay updated on tax regulations, as this ensures that you maintain compliance while reducing withholding amounts. Utilizing reliable platforms like uslegalforms can assist you in this process.