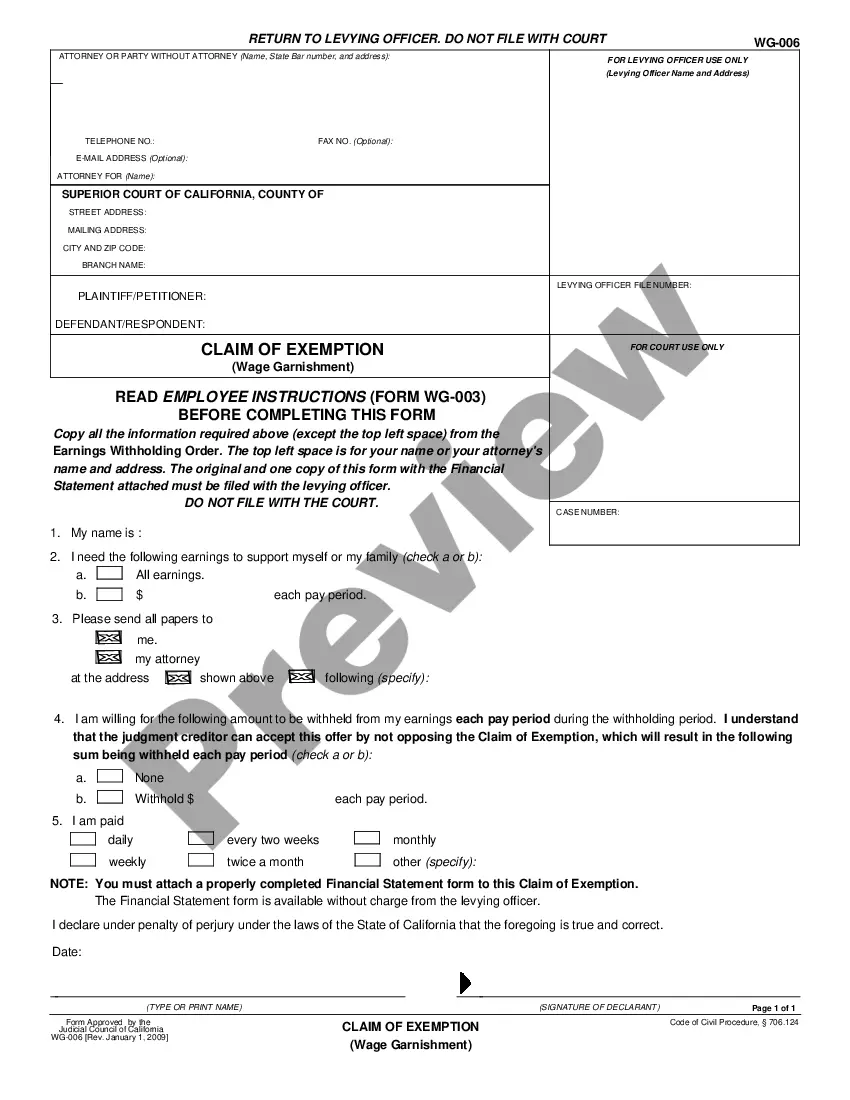

This form is a claim of exemption and financial statement. A garnishment debtor can use this form to explain the resources he or she needs to have exempted from a garnishment in order to pay basic living expenses.

Moreno Valley California Claim of Exemption and Financial Declaration

Description

How to fill out California Claim Of Exemption And Financial Declaration?

Irrespective of societal or occupational position, completing law-related documents is an unfortunate requirement in today’s working environment.

Frequently, it’s nearly unfeasible for an individual without legal training to create such documentation from scratch, primarily due to the intricate terminology and legal subtleties they entail.

This is where US Legal Forms proves to be beneficial.

Ensure the document you selected is applicable for your region since the regulations of one state or area may not be suitable for another.

Preview the document and review a brief summary (if available) of situations the paper may apply to.

- Our platform offers an extensive collection with over 85,000 ready-to-use state-specific documents that cater to almost any legal circumstance.

- US Legal Forms is also a valuable resource for associates or legal advisors who seek to be more time-efficient utilizing our DIY paperwork.

- Whether you need the Moreno Valley California Claim of Exemption and Financial Declaration or any other document that will be recognized in your state or locale, with US Legal Forms, everything is readily available.

- Here’s how to obtain the Moreno Valley California Claim of Exemption and Financial Declaration in just minutes using our reliable platform.

- If you are already a member, you can proceed to Log In to your account to retrieve the required form.

- However, if you are not acquainted with our collection, please follow these instructions before downloading the Moreno Valley California Claim of Exemption and Financial Declaration.

Form popularity

FAQ

California tax exemption allows eligible individuals to apply for reduced tax liabilities under specific conditions. In the context of a Moreno Valley California Claim of Exemption and Financial Declaration, this exemption helps protect certain assets from being seized or levied. By filing the appropriate documentation, such as a Claim of Exemption, you can potentially safeguard your essential possessions. The US Legal Forms platform provides resources and templates to help you navigate through this process smoothly.

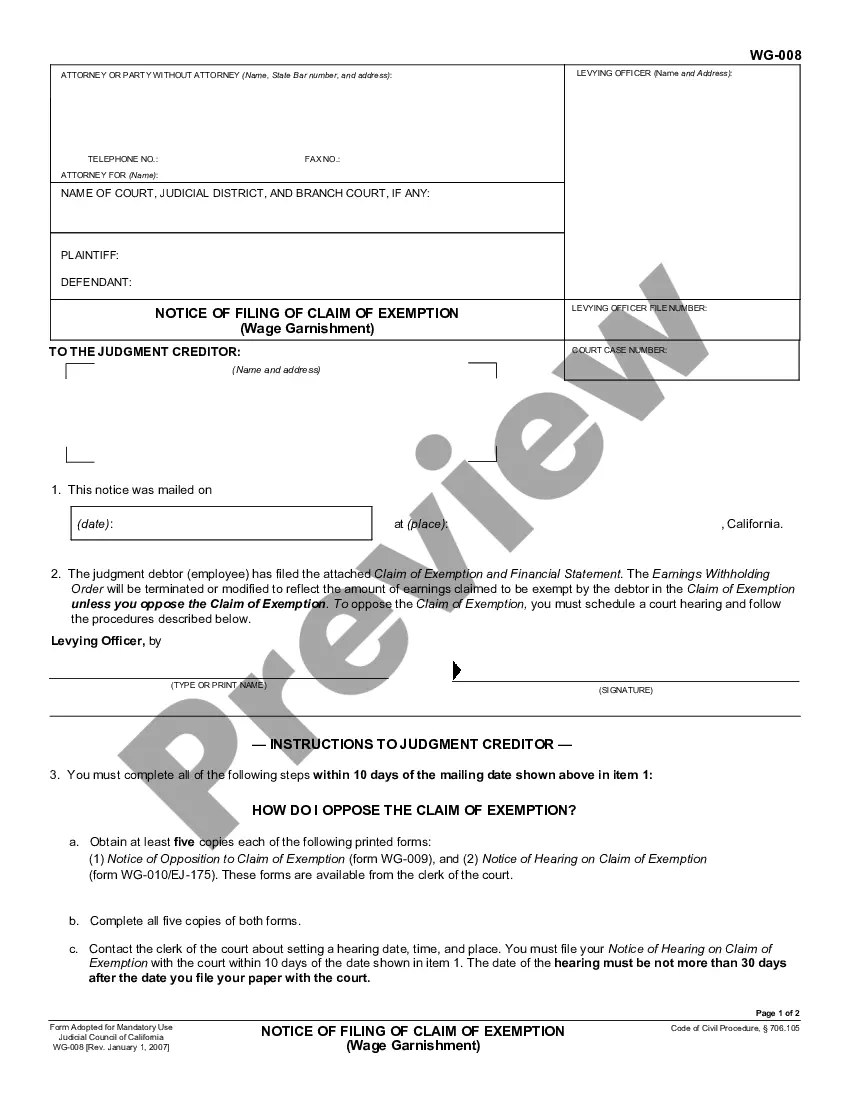

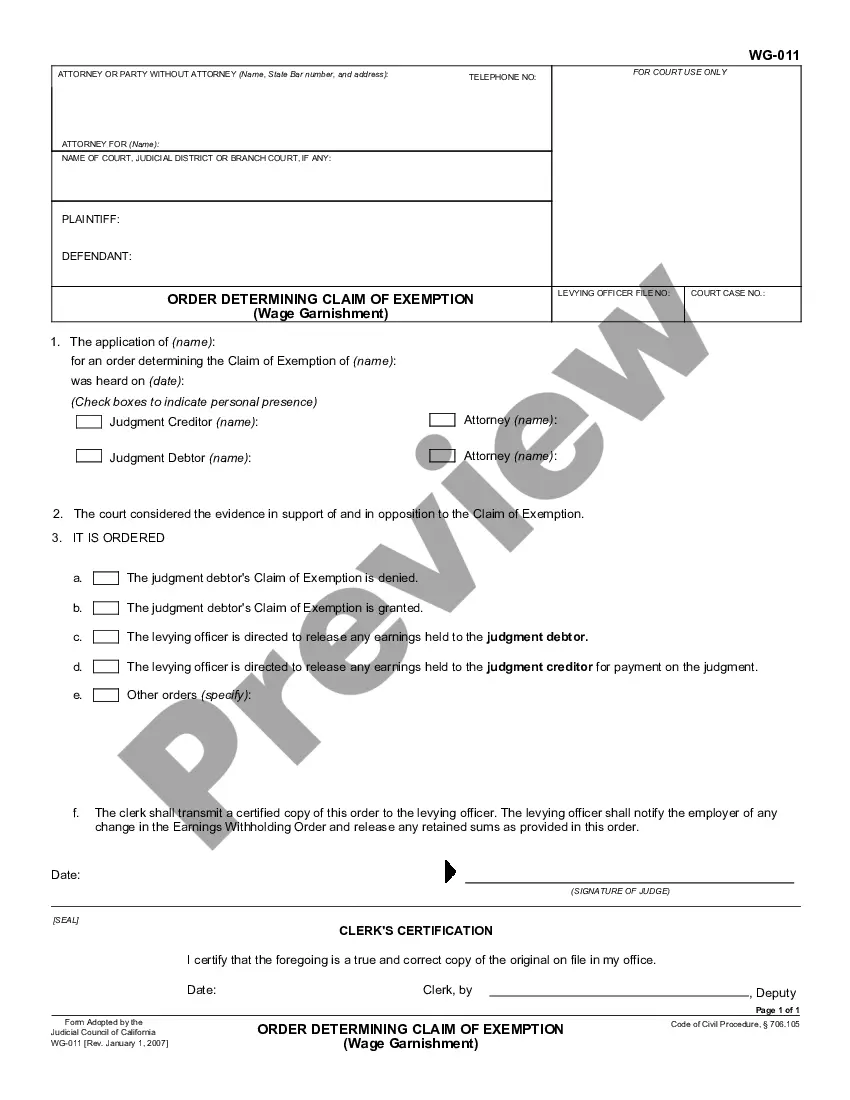

To stop a bank levy in California, it is essential to act quickly by filing a claim of exemption in court. This legal measure allows you to argue that specific funds in your account should not be subject to the levy. Your approach should include presenting a well-documented Moreno Valley California Claim of Exemption and Financial Declaration that outlines your financial circumstances. Should you need assistance navigating these complex legal waters, US Legal Forms provides helpful resources to guide you through the exemption process effectively.

Filing a California Exemption claim begins with gathering necessary documentation that supports your eligibility for exemption. You'll need to complete the required forms and submit them to the appropriate local agency or court. During this process, it is important to be thorough, as a well-prepared Moreno Valley California Claim of Exemption and Financial Declaration can greatly enhance your chances of approval. If you seek detailed guidance, US Legal Forms can assist you in preparing and filing your claim correctly.

To claim exempt on California state taxes, you must complete the appropriate forms, such as the California Employee Withholding Allowance Certificate, and indicate your exemption status. You will need to provide your reasons for claiming this exemption, ensuring they align with the guidelines set by the California tax authority. Understanding your financial situation is crucial, especially when dealing with a Moreno Valley California Claim of Exemption and Financial Declaration. If you need assistance, US Legal Forms offers resources to help you effectively navigate this process.

In California, funds exempt from garnishment typically include Social Security payments, unemployment benefits, child support payments, and certain retirement accounts. This means that these funds cannot be taken by creditors during garnishment processes. By understanding which funds are protected, you can better navigate your financial situation with the help of a resource like USLegalForms.

The conditions for exemption in California typically include factors such as income level, type of debt, and specific protections under state and federal laws. For instance, certain income types like Social Security or unemployment benefits may be exempt from garnishment. Familiarizing yourself with these conditions is essential for effectively filing your Moreno Valley California Claim of Exemption and Financial Declaration.

To stop a wage garnishment immediately in California, you should file a claim of exemption with the court. This form responds to the requirement and asserts that a portion of your wages is protected from garnishment. You may find the necessary forms and instructions on platforms like USLegalForms, where they can assist you through the process seamlessly.

Applying for tax exemption in California involves filling out specific forms that declare your eligibility based on financial or property status. You'll need to provide supporting documentation to justify your claim. For a thorough understanding and support, consider visiting USLegalForms, where you can find useful templates and information regarding the application process.

To file exempt in California, you must complete the appropriate claim of exemption forms, which can often be found online or through legal resources. Once you complete the forms, submit them to the court handling your case. For additional guidance, USLegalForms provides templates to simplify the filing process, making it smoother for you.

The duration for a claim of exemption in California can vary based on the complexity of the case and court schedules. Typically, it may take a few weeks to several months for a decision to be reached. Understanding this timeline can help you prepare better, especially if you are exploring the Moreno Valley California Claim of Exemption and Financial Declaration process.