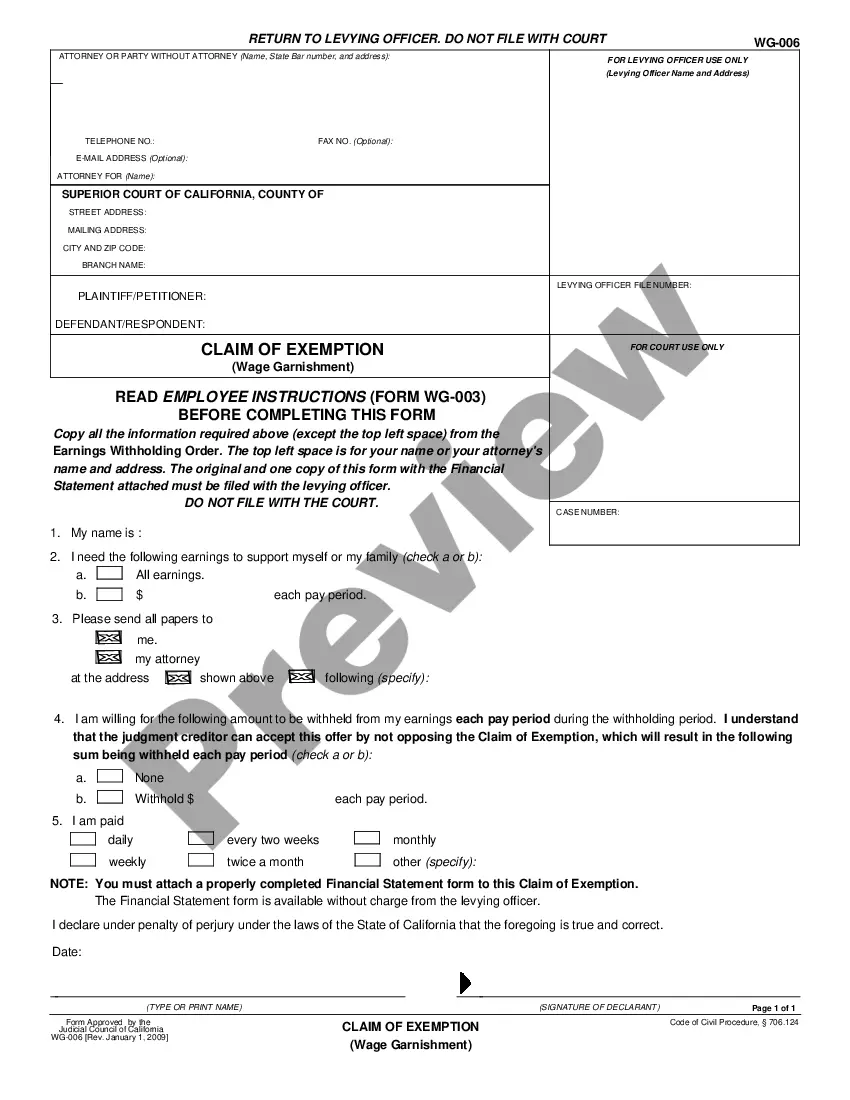

This form is a claim of exemption and financial statement. A garnishment debtor can use this form to explain the resources he or she needs to have exempted from a garnishment in order to pay basic living expenses.

Fontana California Claim of Exemption and Financial Declaration

Description

How to fill out California Claim Of Exemption And Financial Declaration?

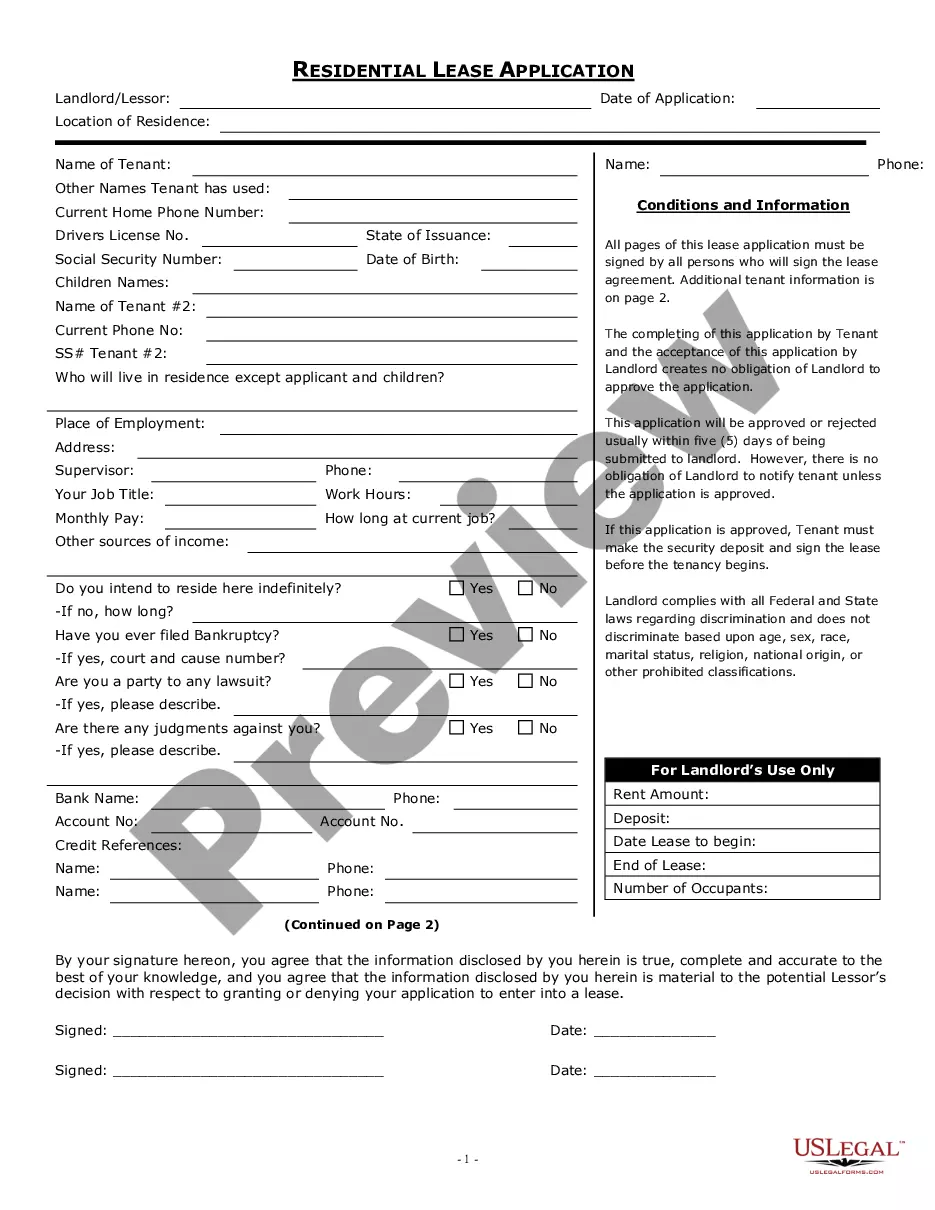

Obtaining validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms database.

It is an online collection of over 85,000 legal documents for both personal and business requirements and various real-world situations.

All the paperwork is appropriately organized by category of use and jurisdictional areas, making it simple to find the Fontana California Claim of Exemption and Financial Declaration.

Maintaining documents orderly and in accordance with legal standards is crucial. Take advantage of the US Legal Forms library to always have essential document templates readily available for any requirements!

- Verify the Preview mode and document description.

- Ensure you have selected the correct option that fulfills your requirements and fully complies with your local jurisdiction standards.

- Search for an alternative template, if necessary.

- If you discover any discrepancies, use the Search tab above to locate the accurate one.

- Once it meets your expectations, proceed to the following step.

Form popularity

FAQ

The conditions for exemption in California typically include criteria related to income, asset ownership, and residency status. Each exemption category has specific requirements that can change according to tax laws. To better understand your eligibility and the necessary conditions, consider consulting US Legal Forms, which can provide detailed explanations and forms tailored to your needs.

To file exempt in California, you need to fill out the Claim of Exemption and Financial Declaration form that corresponds with your specific case. This form gathers essential financial data that allows you to request an exemption. By using US Legal Forms, you can find all necessary resources and assistance, ensuring that your exemption filing is both thorough and compliant with California regulations.

To file for a homeowners exemption in California, you must complete the appropriate Claim of Exemption and Financial Declaration form specific to homeowners. This form will ask for details regarding your primary residence and related financial information. Utilizing resources on US Legal Forms can streamline this filing, providing a step-by-step guide to ensure your application is accurate and timely.

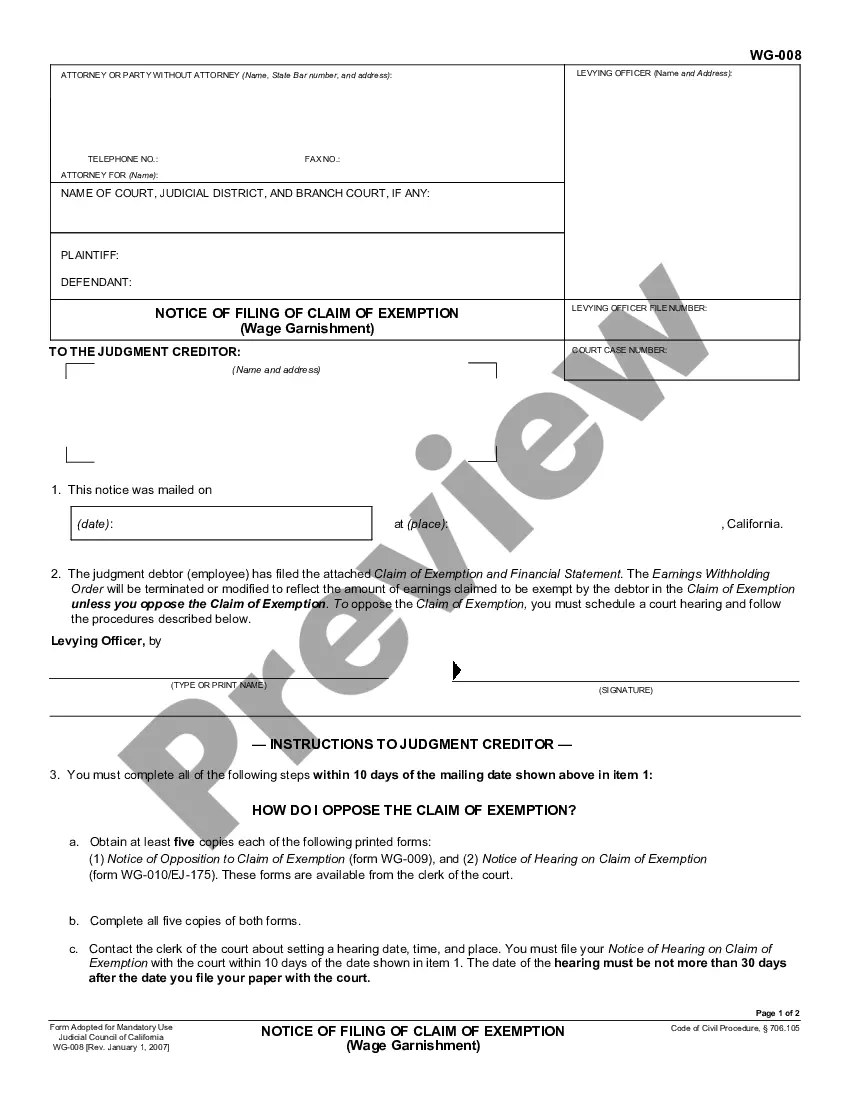

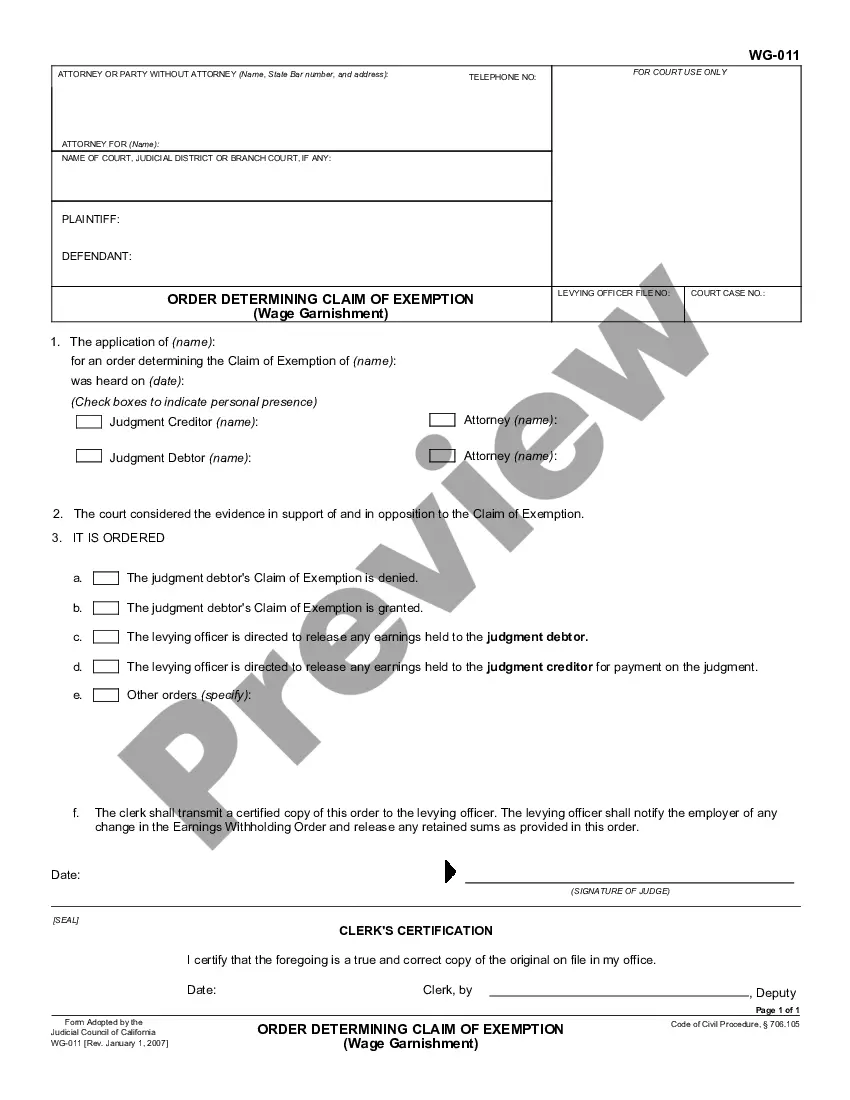

An opposition to a claim of exemption in California is a legal response filed by a creditor who disputes the claim of exemption. This process allows the creditor to present reasons why the exemption should not be granted. If you're facing this situation, it’s essential to understand your rights and perhaps seek assistance through platforms like US Legal Forms to navigate your response effectively.

To apply for a tax exemption in California, you must submit a Claim of Exemption and Financial Declaration form. This form is critical, as it details your financial situation and justifies your request for the exemption. You can easily find this form on the US Legal Forms platform, which simplifies the filing process. Remember to include all necessary documentation to support your claim.

To stop a wage garnishment immediately in California, your best option is to file a Fontana California Claim of Exemption and Financial Declaration with the appropriate court. This can provide immediate relief and suspend the garnishment while your claim is processed. Timely action and proper documentation can significantly enhance your chances of success.

In California, exemptions include sources of income such as child support payments, certain pension benefits, and some types of disability payments. These funds can be protected from creditors under state laws. If you think you qualify for an exemption, filing a Fontana California Claim of Exemption and Financial Declaration is a wise step to ensure your rights are upheld.

The quickest way to stop a wage garnishment is to file a Fontana California Claim of Exemption and Financial Declaration with the court. This process can halt the garnishment temporarily while your claim is reviewed. Gathering your financial documents and understanding your rights is critical for an effective resolution.

Filing a California Exemption claim requires you to complete specific forms and submit them to the court. You will need to provide a Fontana California Claim of Exemption and Financial Declaration, outlining the reasons why your funds should not be garnished. Ensure you meet all deadlines and provide accurate information to strengthen your case.

Applying for garnishment hardship in California involves filing a request with the court that issued the garnishment. You may need to submit a Fontana California Claim of Exemption and Financial Declaration, detailing how the garnishment adversely affects your financial situation. Providing clear evidence can enhance your chances of obtaining relief.