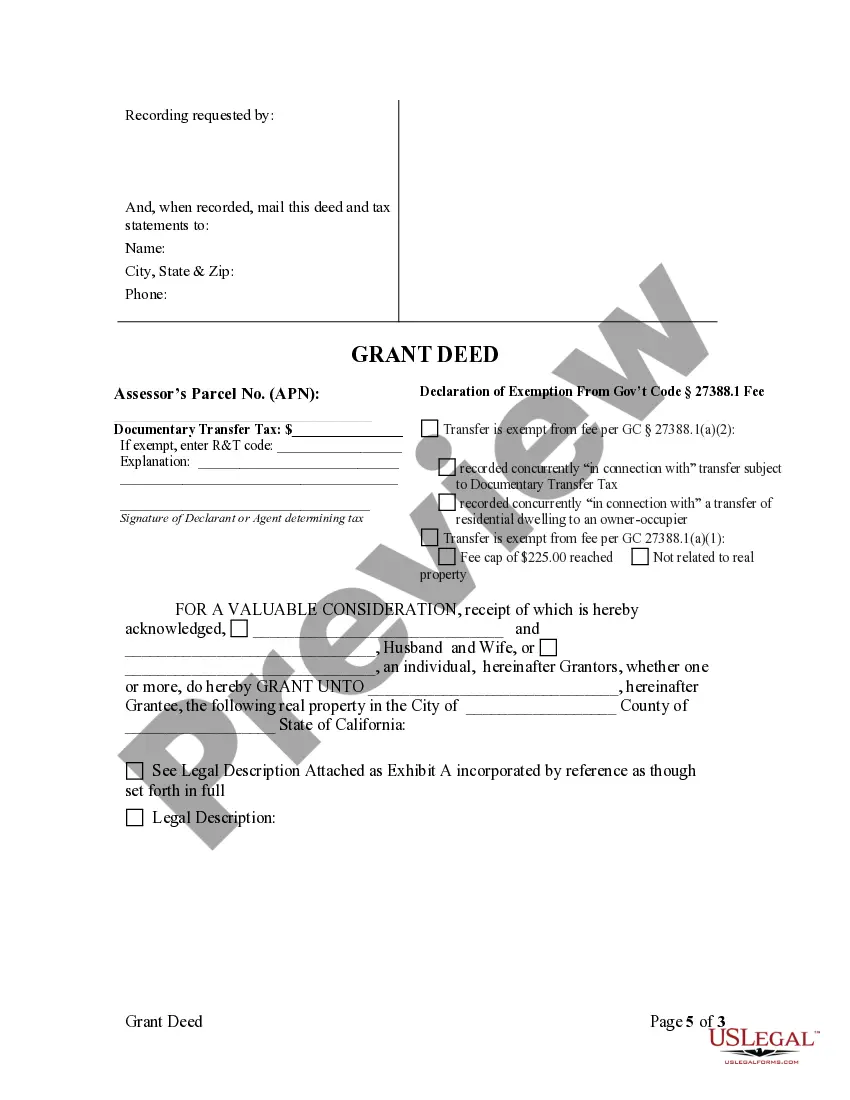

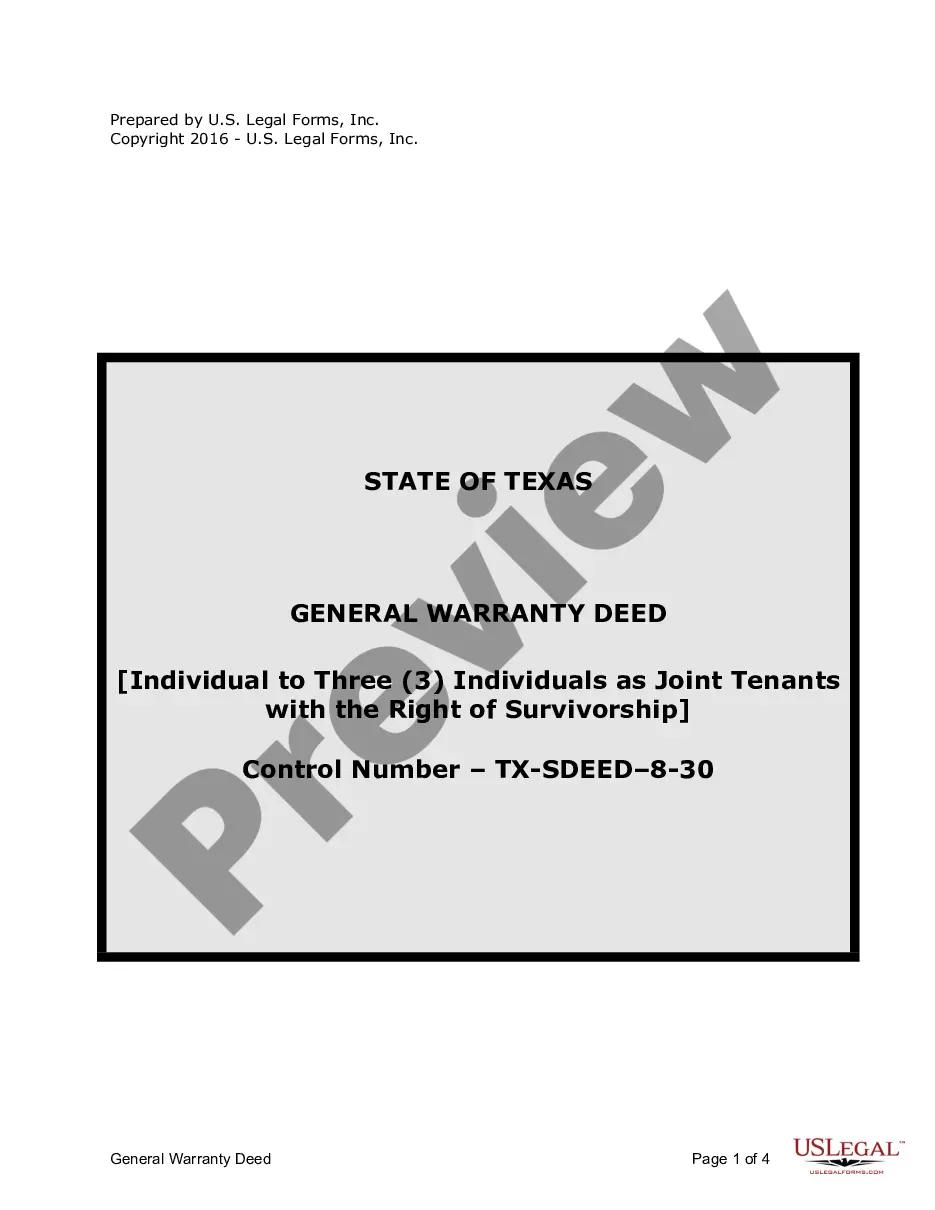

This form is a Grant Deed where the grantor(s) retains a life estate in the described property.

Anaheim California Grant Deed - Parents to Child with Reservation of Life Estate

Description

How to fill out California Grant Deed - Parents To Child With Reservation Of Life Estate?

Irrespective of personal or occupational standing, filling out legal documents is a regrettable necessity in today’s society.

Often, it is nearly unfeasible for someone without legal training to draft such documents from scratch, primarily due to the intricate terminology and legal nuances they involve.

This is where US Legal Forms proves useful.

Verify that the template you found is appropriate for your area, as the regulations of one state or county may not apply to another.

Review the document and read a brief summary (if available) of scenarios the document can be utilized for.

- Our service provides an extensive collection with over 85,000 ready-to-use state-specific documents suitable for nearly any legal situation.

- US Legal Forms is also a valuable asset for paralegals or legal advisors looking to enhance their efficiency by utilizing our DIY forms.

- Whether you need the Anaheim California Grant Deed - Parents to Child with Reservation of Life Estate or any other document valid in your region, with US Legal Forms, everything is within reach.

- Here’s how to acquire the Anaheim California Grant Deed - Parents to Child with Reservation of Life Estate in a matter of minutes using our dependable service.

- If you are currently a subscriber, you can proceed to Log In to your account to download the correct form.

- If you are new to our platform, follow these steps before obtaining the Anaheim California Grant Deed - Parents to Child with Reservation of Life Estate.

Form popularity

FAQ

A parent can transfer his or her primary residence to a child or children without reassessment. There is no limit on the value of the home that can be transferred. The children can live in the home, use it as a vacation home, or rent it.

A life estate vests the beneficial use of property in a person for their lifetime. The person who holds the life estate is the life tenant. The life tenant may have the right to occupy a residential property and/or the right to income from property that is rented or leased to others.

California mainly uses two types of deeds: the ?grant deed? and the ?quitclaim deed.? Most other deeds you will see, such as the common ?interspousal transfer deed,? are versions of grant or quitclaim deeds customized for specific circumstances.

Life estate cons The life tenant cannot change the remainder beneficiary without their consent. If the life tenant applies for any loans, they cannot use the life estate property as collateral. There's no creditor protection for the remainderman.You can't minimize estate tax.

All that is required to transfer title is that an affidavit of death of life tenant or surrender of life estate, as relevant, be recorded with the county recorder's office. During the period of the life estate, the life tenant has all the obligations of ownership, including paying the real property taxes and insurance.

You can arrange to legally transfer the deed to your house to your children before you die. To do so, you sign a deed transfer and record it with the county recorder's office. There are a few types of deeds that accomplish this in California, including a quitclaim deed, grant deed and transfer on death deed.

How to transfer property ownership Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

The individual holding the life estate ? the life tenant retains the legal right to possess and use the property during their lifetime. Upon the death of the life tenant, the property passes to the person or person who hold the remainder interest ? without the need for probate.

The two types of conventional life estate are the ordinary and the pur autre vie life estate. Ordinary life estate. An ordinary life estate ends with the death of the life estate owner and may pass back to the original owners or their heirs (reversion) or to a named third party (remainder).