This form is a Uniform Statutory Form of Power of Attorney for California for property, finances and other powers you specify. It also provides that it can be durable.

San Jose California Uniform Statutory Power of Attorney - Property - Finances - Section 4401

Description

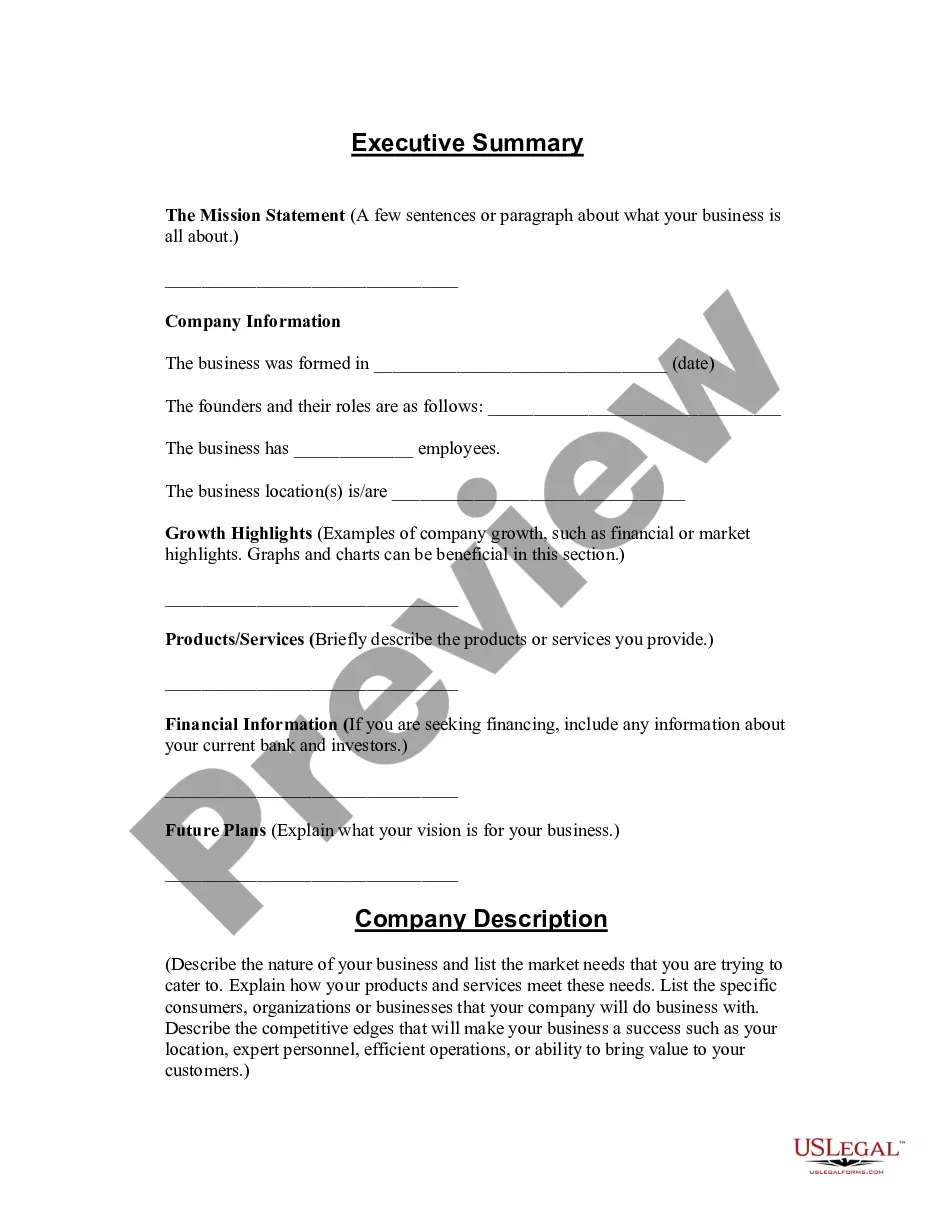

How to fill out California Uniform Statutory Power Of Attorney - Property - Finances - Section 4401?

Take advantage of the US Legal Forms and gain instant access to any form sample you desire.

Our advantageous website, featuring a multitude of templates, simplifies the process of locating and acquiring virtually any document sample you require.

You can download, complete, and authenticate the San Jose California Uniform Statutory Power of Attorney - Property - Finances - Section 4401 in mere minutes rather than spending hours searching the internet for a suitable template.

Using our collection is a fantastic method to enhance the security of your document submissions. Our knowledgeable attorneys routinely review all documents to ensure that the forms are suitable for a specific state and comply with updated laws and regulations.

If you haven’t created a profile yet, follow the steps below.

Navigate to the page with the template you need. Ensure that it is the specific template you were looking for: verify its title and description, and take advantage of the Preview feature if available. Otherwise, utilize the Search field to find the required one.

- How do you procure the San Jose California Uniform Statutory Power of Attorney - Property - Finances - Section 4401.

- If you possess a subscription, simply Log In to your account. The Download button will appear on all the samples you view.

- Furthermore, you can access all the previously saved documents in the My documents menu.

Form popularity

FAQ

Yes, California law requires that the Durable Power of Attorney must be notarized or signed by at least two witnesses. In California, a principal cannot act as one of the witnesses.

A power of attorney used by an individual residing in California to authorize a third party to manage the individual's property and financial matters.

Powers of attorney concerning real property must be acknowledged (notarized). There is no statutory requirement that the power of attorney be recorded with the County Recorder in the county where the real property is located.

Simply put, if you are given power of attorney, then you, as agent, are entitled and allowed by law to make decisions for the person who is giving you that power, the principal. This decision making power can encompass many things, or be limited to a specific issue.

Without any such specific designation, a POA terminates upon the grantor's death. This means that the person that you selected as your power of attorney would not be able to handle any financial matters on your behalf when you pass away.

(2022) A California Durable Power of Attorney is a document that authorizes your agent (a person you choose) to manage your financial affairs if you become unable (or unwilling) to manage them yourself.

California requires that the signature of the principal of the Power of Attorney must be acknowledged and recorded by a notary or acknowledged by two witnesses. Every witness to the power of attorney document must witness the principal signing the document or the notary's acknowledgment.

Where to Get a POA Form. In California, you must use the form created by the state for your POA. You can find financial POAs in California Probate Code Section 4401, called a Uniform Statutory Form Power of Attorney. This is used to create general or limited POAs.

Adams, ABFK306, Living Will/Power of Attorney Forms, 1 - Walmart.com.

(2022) A California Durable Power of Attorney is a document that authorizes your agent (a person you choose) to manage your financial affairs if you become unable (or unwilling) to manage them yourself.