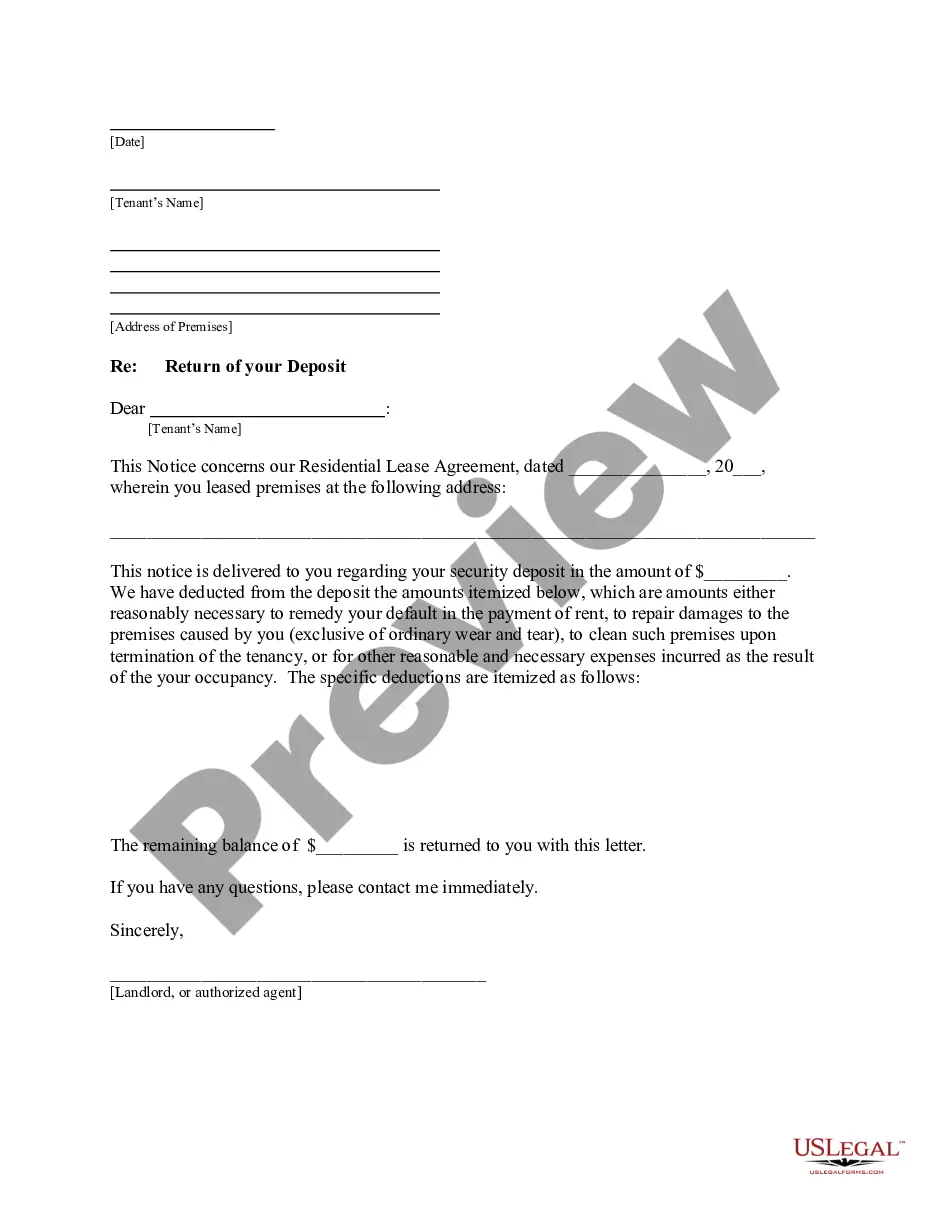

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Pomona California Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out California Unsecured Installment Payment Promissory Note For Fixed Rate?

Locating verified templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents catering to both personal and professional requirements along with various real-life situations.

All documents are appropriately categorized by their area of application and jurisdiction, making it as simple and straightforward to find the Pomona California Unsecured Installment Payment Promissory Note for Fixed Rate as one, two, three.

Upon making your purchase, provide your credit card information or utilize your PayPal account to settle the payment. Then, download the Pomona California Unsecured Installment Payment Promissory Note for Fixed Rate. Store the template on your device for completion and access it in the My documents section of your profile whenever you need it in the future. Maintaining organized paperwork that adheres to legal requirements is crucial. Leverage the US Legal Forms library to always have essential document templates readily available for any needs.

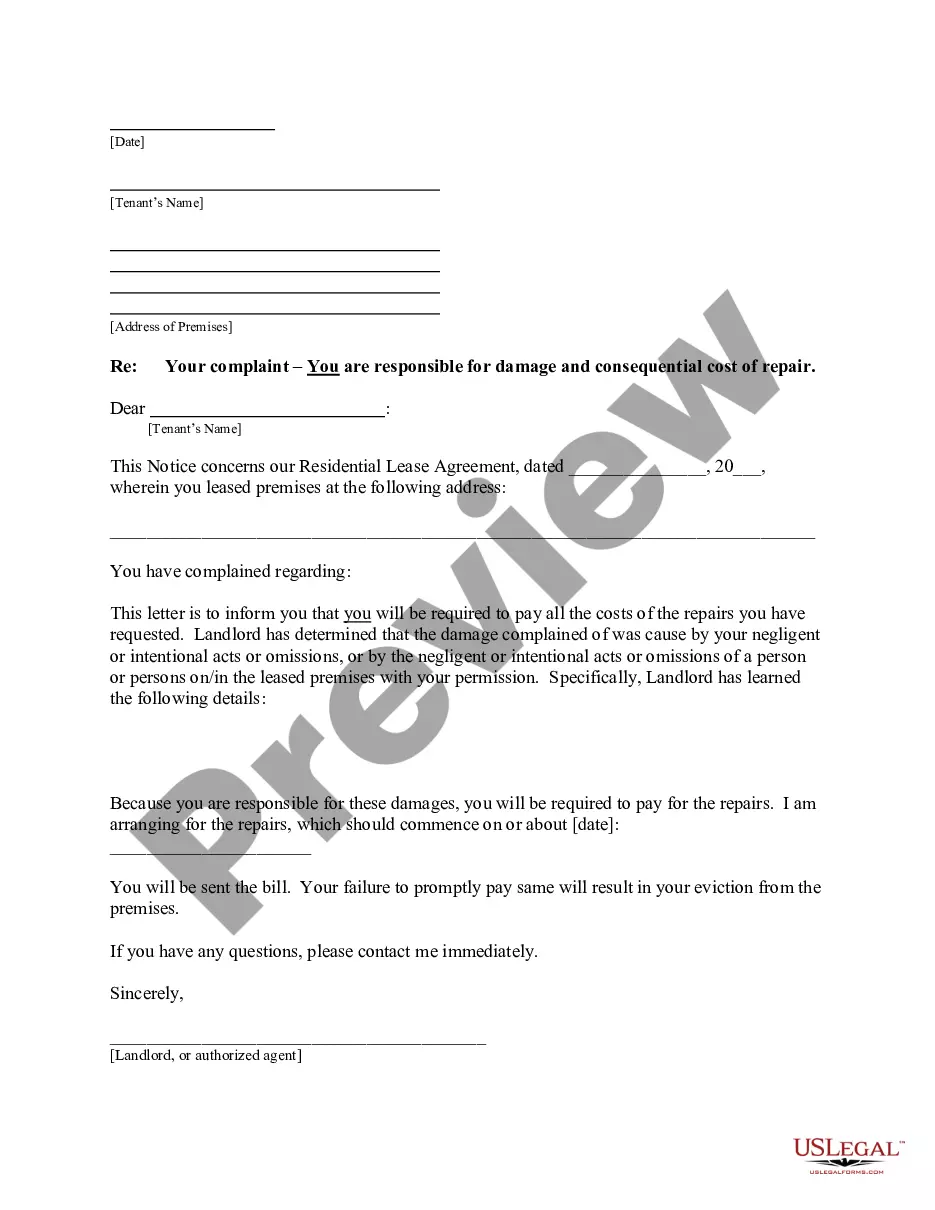

- Review the Preview mode and document description.

- Ensure you have chosen the correct template that fulfills your requirements and aligns with your local jurisdiction specifications.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the correct one. If it meets your needs, proceed to the next stage.

- Purchase the document.

- Click on the Buy Now button and select the subscription plan that suits you best. You will need to register an account to gain access to the library’s resources.

Form popularity

FAQ

Yes, promissory notes are legal in California and commonly used for personal and business transactions. A Pomona California Unsecured Installment Payment Promissory Note for Fixed Rate is just one example of how these financial tools are utilized. Ensure that your note complies with California laws to safeguard its legality.

You can obtain a promissory note through various means, including legal document providers, or by drafting one yourself using templates. For a Pomona California Unsecured Installment Payment Promissory Note for Fixed Rate, consider using platforms like uslegalforms to ensure compliance with local laws and regulations. This approach saves time and helps ensure all necessary terms are included.

A promissory note can be deemed invalid in California for several reasons. If it lacks essential details such as signatures, amounts, or terms, it may not be enforceable. Additionally, if the parties involved were coerced or did not have the legal capacity to enter the agreement, the Pomona California Unsecured Installment Payment Promissory Note for Fixed Rate could be challenged in court.

drafted promissory note, such as a Pomona California Unsecured Installment Payment Promissory Note for Fixed Rate, typically holds up in court. Courts generally enforce valid contracts, as long as both parties have agreed to its terms. To reduce disputes, ensure that the note is legally binding and includes all relevant details for clarity.

Yes, promissory notes are enforceable in California, including the Pomona California Unsecured Installment Payment Promissory Note for Fixed Rate. As long as the note meets the necessary legal requirements, it can serve as a valid contract between parties. Having clearly defined terms, such as repayment schedules and interest rates, strengthens its enforceability in court.

Yes, a promissory note can be unsecured if it is not backed by collateral. This means that in the event of default, the lender relies on the borrower's promise to repay. A Pomona California Unsecured Installment Payment Promissory Note for Fixed Rate allows you to borrow without putting up your assets as security.

To write a simple Pomona California Unsecured Installment Payment Promissory Note for Fixed Rate, start by clearly stating the amount owed, the names of the borrower and lender, and the repayment terms. Include the interest rate, payment schedule, and any collateral, if applicable. Clearly outline the consequences of non-payment, such as late fees or legal action. This clarity helps all parties understand their rights and obligations.

Yes, it is essential to record a Pomona California Unsecured Installment Payment Promissory Note for Fixed Rate to maintain detailed financial records. Recording the note provides clarity on your liabilities and prevents disputes regarding terms and payment history. Utilizing a reliable platform like uslegalforms can simplify the process of creating and managing promissory notes, ensuring compliance with legal requirements.

To report income from a Pomona California Unsecured Installment Payment Promissory Note for Fixed Rate, you should recognize interest received as income on your tax returns. Ensure you keep accurate records of the interest payments received, as these will support your declared income. If your business offers this type of note, consulting with a tax professional can provide clarity on reporting guidelines.

To record a Pomona California Unsecured Installment Payment Promissory Note for Fixed Rate in accounting, start by documenting the note's principal amount, interest rate, and terms of repayment. Record the note as a liability on your balance sheet, as it represents a debt owed. Also, recognize any interest expense over time, ensuring you update your records with each payment made.