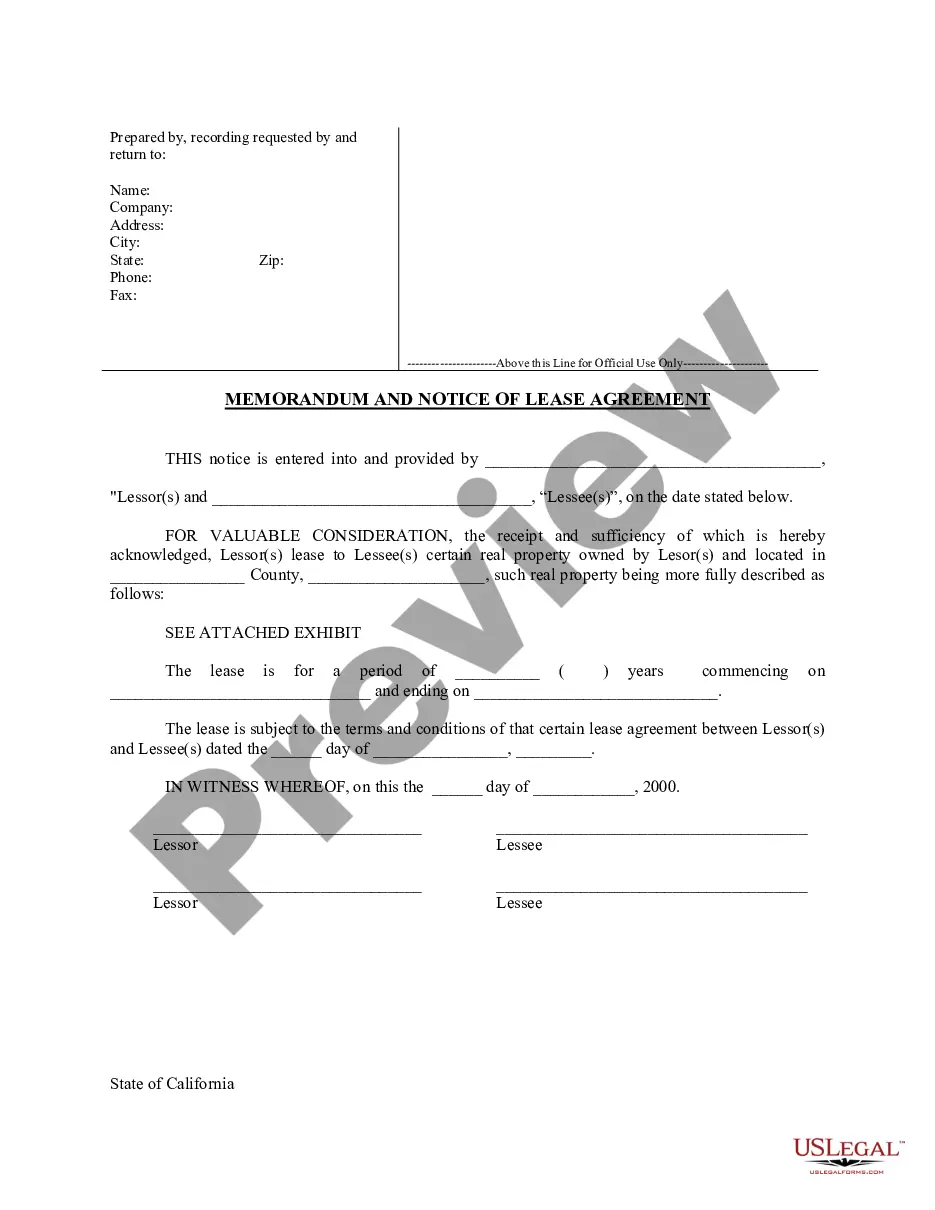

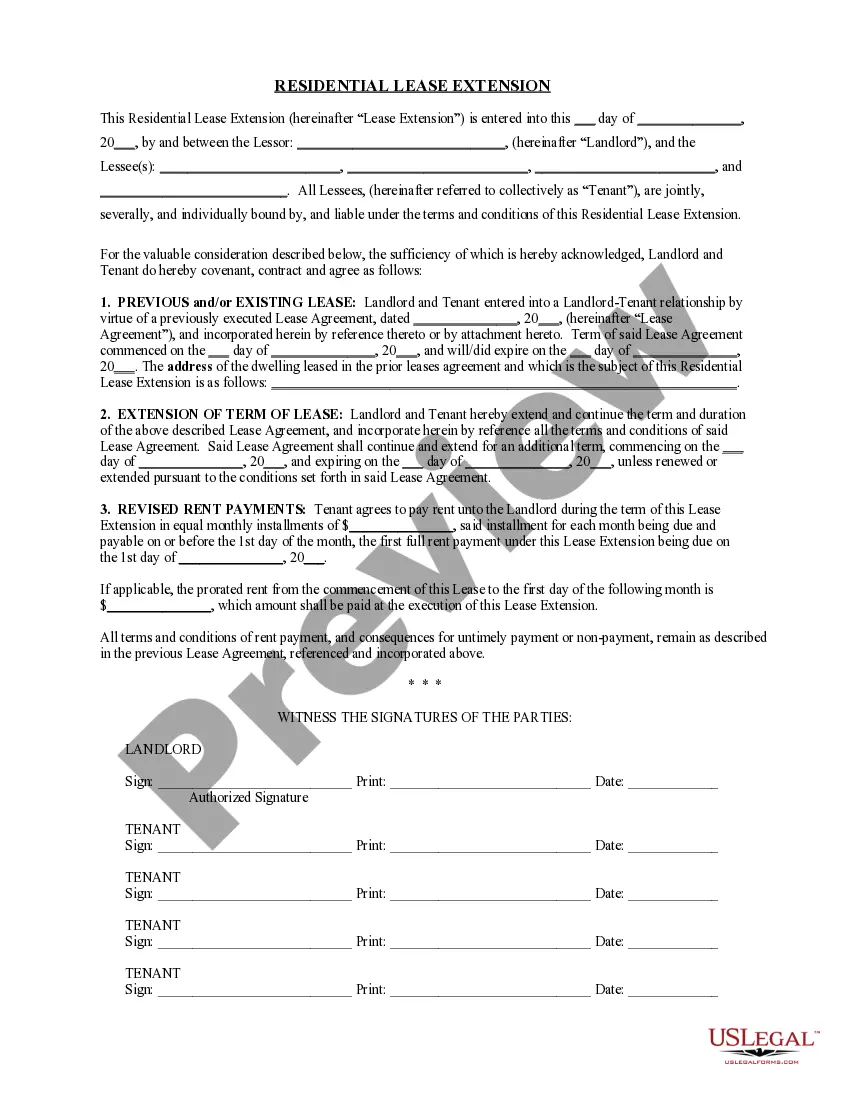

This Memorandum and Notice of Lease Agreement is designed to be recorded in the official records in order to provide notice that a lease exists on a certain parcel of real estate. It is used in lieu of recording the entire lease agreement.

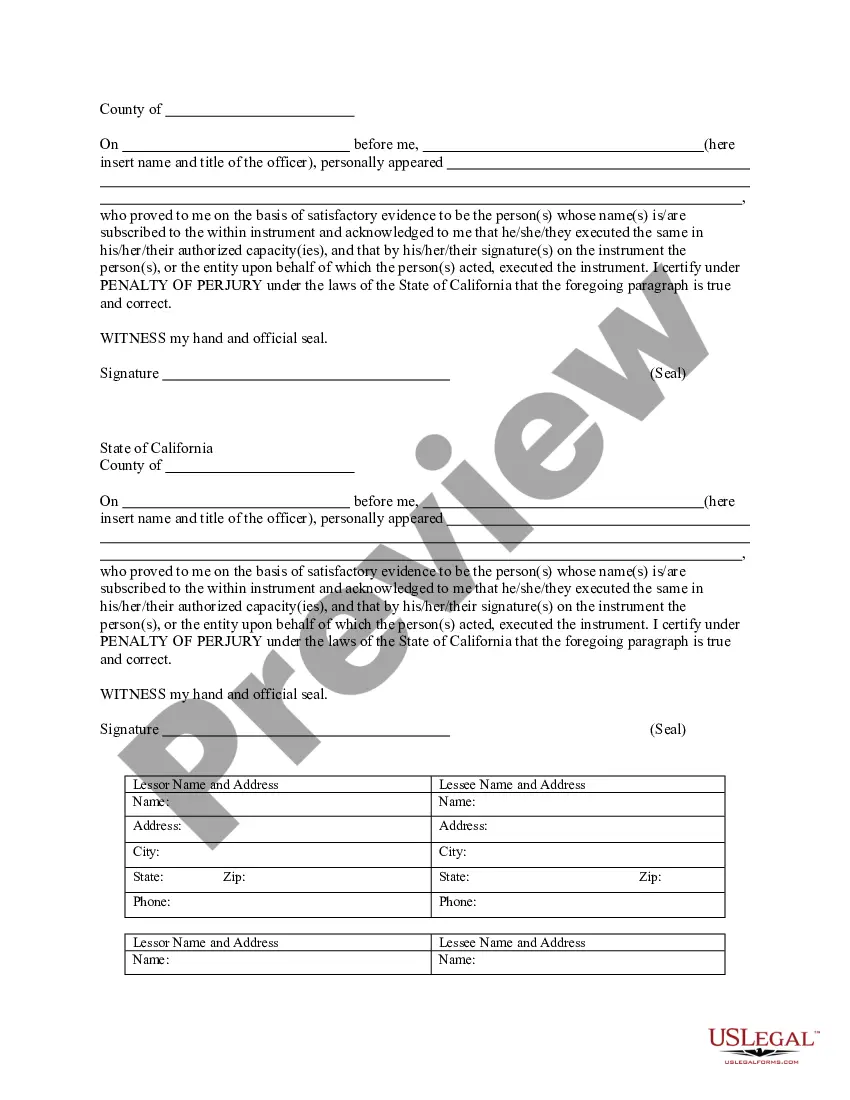

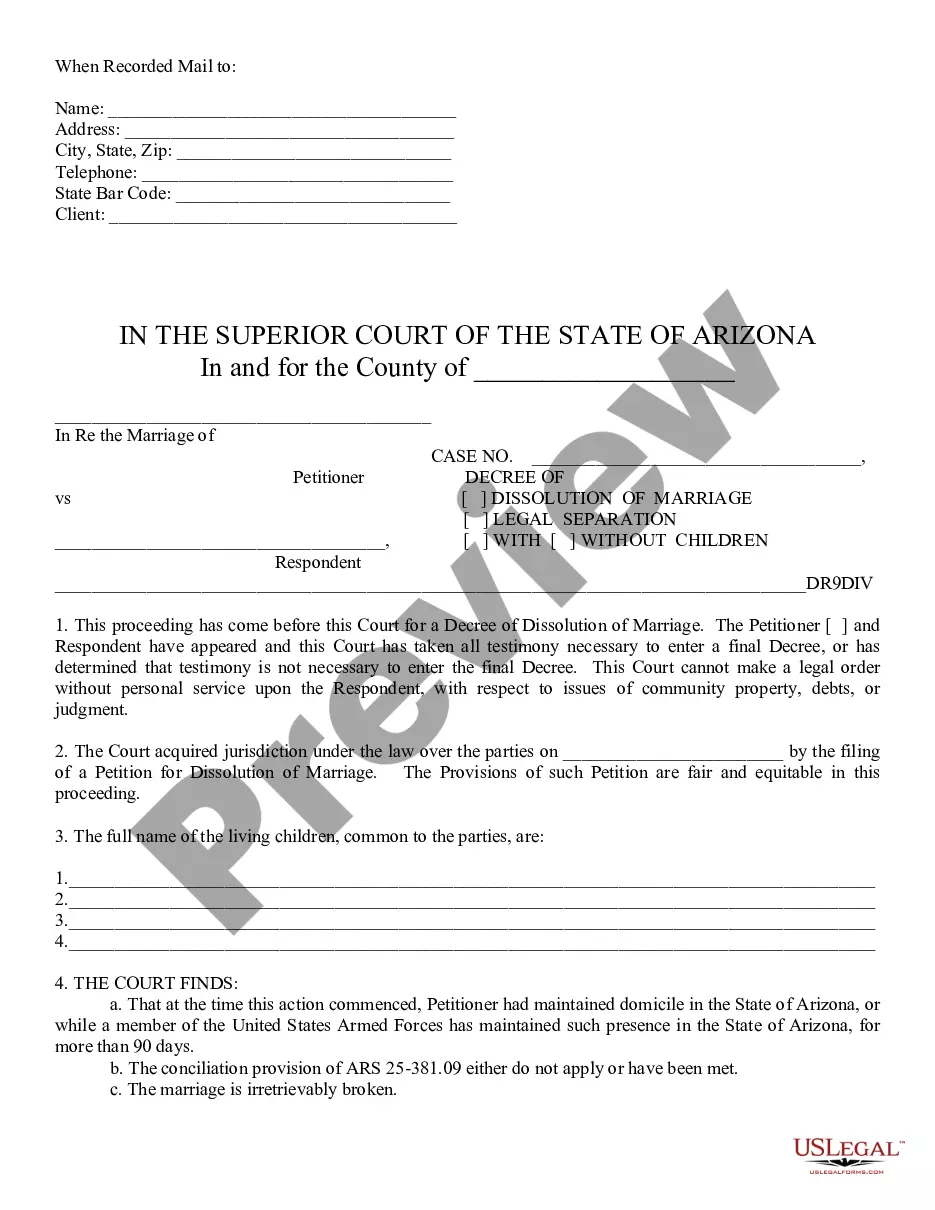

The United States Constitution provides every individual the freedom and right to own property in their own name. The Office of the Recorder protects that freedom by permanently recording all original documents pertaining to property ownership and real property transactions. Real property records can be examined to ensure good title, and recording of documents may entitle a person to a lien, security interest, or priority to stand in line ahead another creditor.