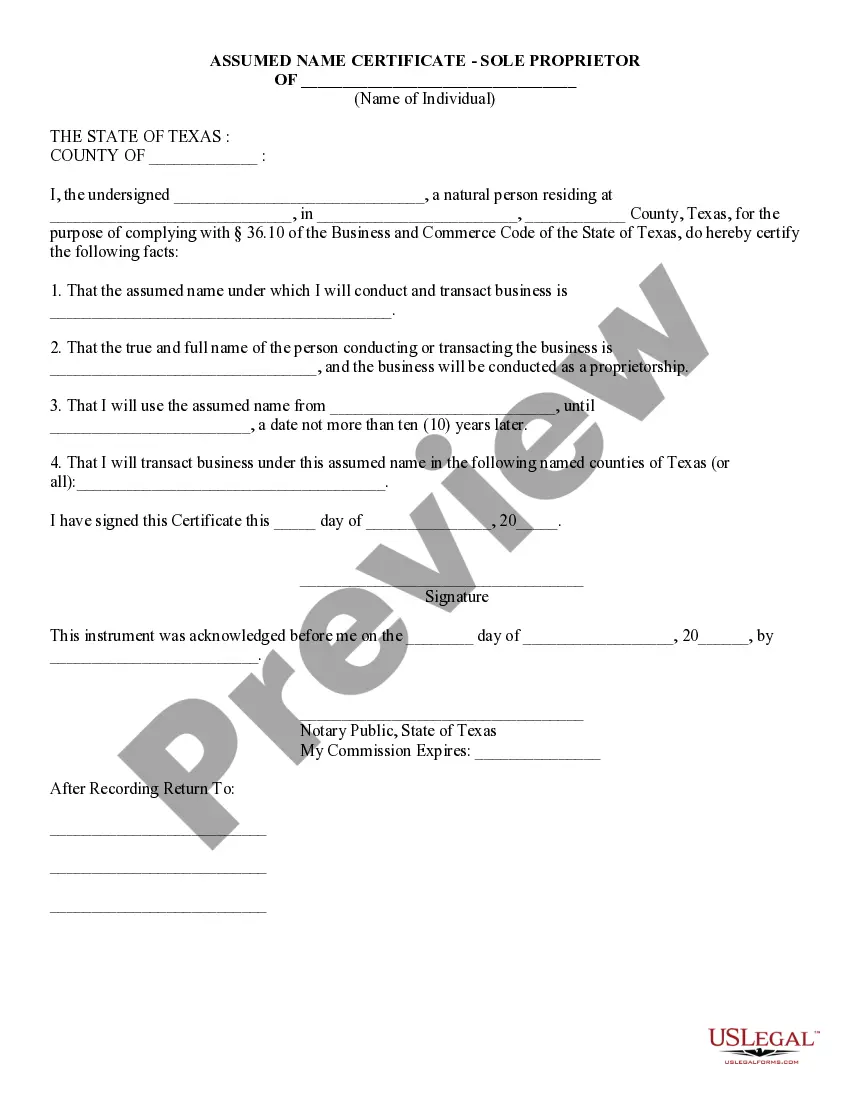

This detailed sample Assumed Name Certificate (Sole Proprietor) complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats. TX-1039

Texas Assumed Name Certificate - Sole Proprietor

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Texas Assumed Name Certificate - Sole Proprietor?

Get access to high quality Texas Assumed Name Certificate - Sole Proprietor forms online with US Legal Forms. Steer clear of hours of wasted time looking the internet and dropped money on files that aren’t updated. US Legal Forms offers you a solution to exactly that. Get more than 85,000 state-specific legal and tax templates that you can download and complete in clicks within the Forms library.

To receive the sample, log in to your account and then click Download. The document will be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide below to make getting started simpler:

- Find out if the Texas Assumed Name Certificate - Sole Proprietor you’re looking at is suitable for your state.

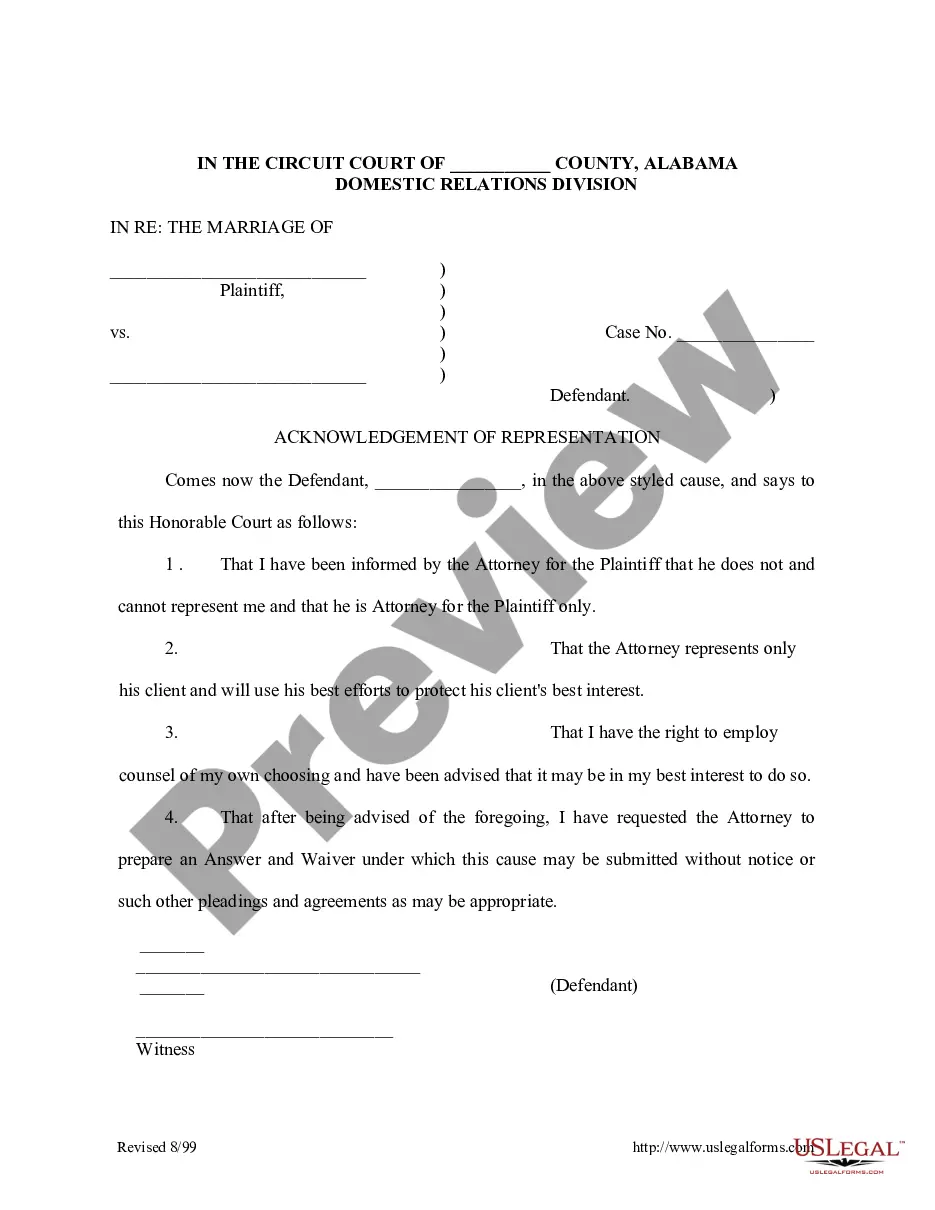

- Look at the form utilizing the Preview function and read its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay out by card or PayPal to complete making an account.

- Select a preferred file format to save the file (.pdf or .docx).

Now you can open up the Texas Assumed Name Certificate - Sole Proprietor example and fill it out online or print it and do it by hand. Consider giving the document to your legal counsel to be certain all things are filled out properly. If you make a mistake, print out and complete application once again (once you’ve made an account every document you download is reusable). Make your US Legal Forms account now and access far more templates.

Form popularity

FAQ

Do I need to file a DBA for a sole proprietorship? While a sole proprietor is required by law to use his legal name to conduct business, the use of a DBA, however, is optional. If a sole proprietor does want to use a DBA, he must obtain permission from local authorities first.

A DBA is always required in California when a sole proprietor, or any other business entity, wants to operate and sign legal documents under a different name.Many sole proprietors are required to file a DBA in the state of California. The only exception is when the owner's last name is part of the business name.

As a sole proprietor, by default, the legal name of your business is your own name. But you can choose to operate the business under another name, known as a fictitious business name or doing business as (DBA).

Your business may need to obtain business licenses or professional licenses depending on its business activities. Texas provides a comprehensive website of every profession and occupation that requires a license by any sole proprietorship.

In Texas, all corporations, limited liability companies (LLCs), limited partnerships (LPs), limited liability partnerships (LLPs), or out of state companies that regularly conduct business in Texas under a name other than its legal name, must file a DBA with the Secretary of State.

DBA Requirements in Texas Many Texas sole proprietorships use DBAs, but state law does not require it.If you are a sole proprietorship operating under an assumed name in Texas, you must register your name with the office of the county clerk in the county of your business's principal location.

Check the DBA's Name Availability. Submit an Application for the DBA. Obtain a State Business License. Obtain Necessary Licenses or Permits. Register with the State Tax Department. Apply for an Employer Identification Number.