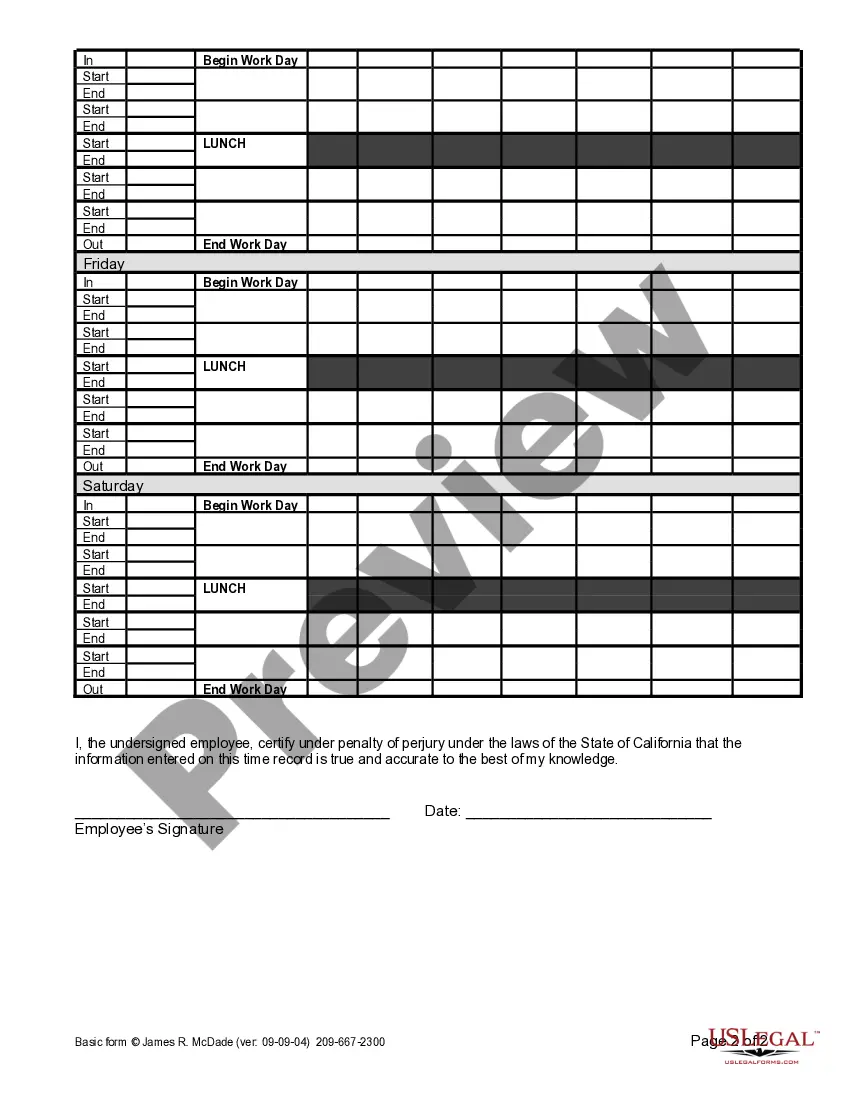

Employers use this form to keep track of an employee’s work time when the employee is paid different wage rates for different work.

Thousand Oaks California Weekly Time Sheet for Multiple Pay Rate

Description

How to fill out California Weekly Time Sheet For Multiple Pay Rate?

Take advantage of the US Legal Forms and gain immediate access to any form template you desire.

Our practical platform with a vast array of templates simplifies the process of locating and obtaining nearly any document sample you require.

You can save, complete, and validate the Thousand Oaks California Weekly Time Sheet for Multiple Pay Rate in just a few minutes instead of spending hours online searching for an appropriate template.

Using our collection is an excellent method to enhance the security of your form submissions.

The Download button will be visible on all the templates you view.

Additionally, you can access all the documents you have previously saved in the My documents section.

- Our knowledgeable attorneys routinely review all documents to ensure that the forms are suitable for a specific state and adhere to current laws and regulations.

- How can you acquire the Thousand Oaks California Weekly Time Sheet for Multiple Pay Rate.

- If you have an account, simply Log In to your profile.

Form popularity

FAQ

Effective January 1, 2021, the minimum wage increases to $14 per hour for employers with 26 or more employees and $13 per hour for employees with 25 or fewer employees.

No employer is legally obligated to provide shift pay as there are no wage and hour laws on the federal or state level that guarantee this right. However, if the company in question has promised you this premium wage as a condition of your employment, then they are entitled to pay it.

Can I pay employees a flat daily rate instead of hourly? Technically, yes because neither federal nor California law requires that you pay employees on an hourly or any other basis.

California's current statewide hourly minimum wage is $15 for employers with at least 26 employees and $14 for employers with fewer than 26 employees. The state minimum wage will rise to $15.50 for all employers effective Jan. 1, 2023.

Effective January 1, 2023, the California minimum wage will increase to $15.50 an hour for all employers. The rate reflects an adjustment to the large employer minimum wage (currently $15 an hour) based on inflation, as determined by the state Director of Finance.

Five states have not adopted a state minimum wage: Alabama, Louisiana, Mississippi, South Carolina and Tennessee. Two states, Georgia and Wyoming, have a minimum wage below $7.25 per hour. In all seven of these states, the federal minimum wage of $7.25 per hour applies.

The minimum wage in California is currently $15.00/hour for employers with 26 or more employees, and $14.00/hour for employers with 25 or less employees. Some cities and counties have higher minimum wages than the state's rate. UC Berkeley maintains a list of City and County minimum wages in California.

California's minimum wage rate will rise to $15.50 per hour, beginning on January 1, 2023, due to a cost-of-living increase provision found in the state's minimum wage law.

The Regional Tripartite Wages and Productivity Board ? NCR issued Wage Order No. NCR-23 on that granted a wage increase of PhP33 bringing the new minimum wage rate to PhP570 and PhP533 for workers in the non-agriculture and agriculture sectors, respectively.

The federal minimum wage is $7.25, but do you know the states that have higher or lower minimums? Highest: District of Columbia at $15.20/hour, California at $15/hour. Lowest: Georgia and Wyoming at $5.15/hour (only applies to some farm and seasonal workers)