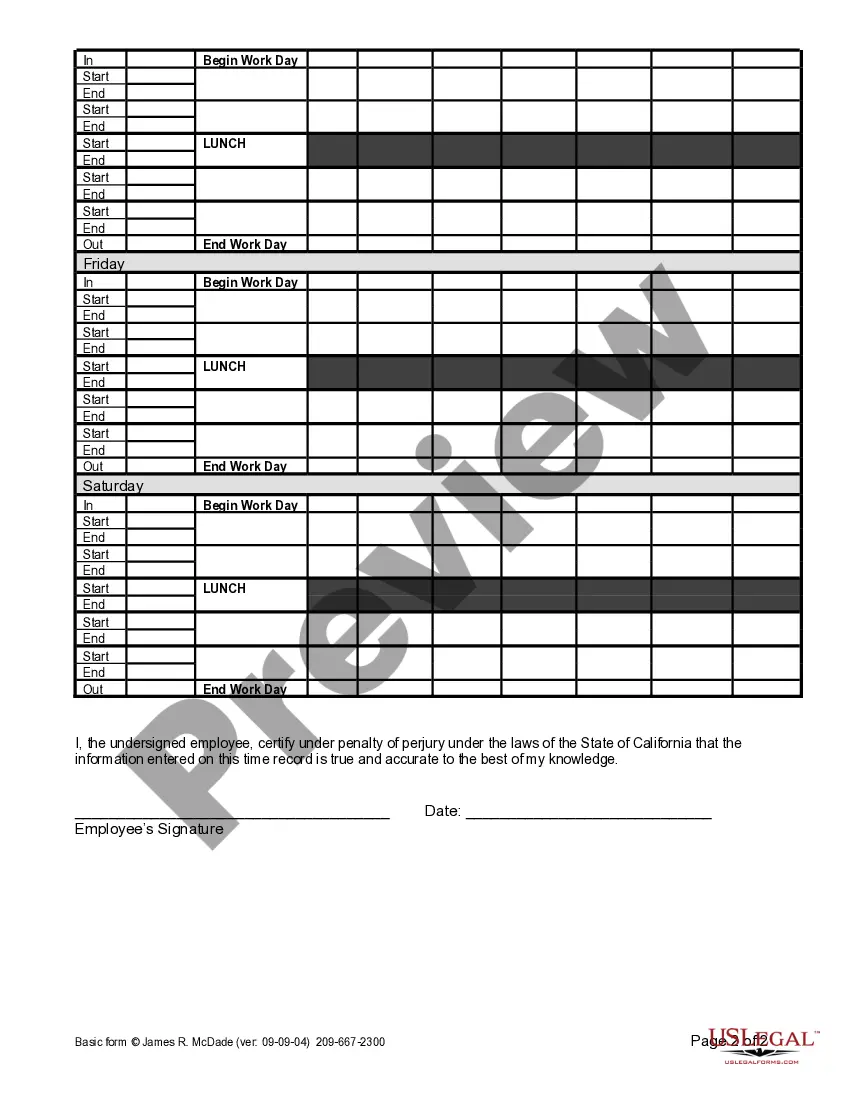

Employers use this form to keep track of an employee’s work time when the employee is paid different wage rates for different work.

San Diego California Weekly Time Sheet for Multiple Pay Rate

Description

How to fill out California Weekly Time Sheet For Multiple Pay Rate?

Are you searching for a trustworthy and affordable legal documents provider to obtain the San Diego California Weekly Time Sheet for Multiple Pay Rate? US Legal Forms is your best option.

Whether you need a straightforward agreement to establish guidelines for living together with your partner or a collection of forms to facilitate your separation or divorce through the courts, we have you covered. Our site offers more than 85,000 current legal document templates for personal and commercial use. All templates we provide are not generic and are crafted in compliance with the requirements of specific states and regions.

To download the document, you must Log In to your account, find the desired template, and click the Download button next to it. Please keep in mind that you can download your previously acquired document templates at any time in the My documents section.

Are you new to our site? No problem. You can set up an account in just a few minutes, but first, be sure to do the following: Check if the San Diego California Weekly Time Sheet for Multiple Pay Rate meets the regulations of your state and locality. Review the form’s description (if available) to understand who and what the document is appropriate for. Restart your search if the template isn’t suitable for your legal situation.

Try US Legal Forms now, and say goodbye to wasting hours searching for legal documents online.

- Now you can set up your account.

- Then select the subscription plan and proceed to payment.

- Once the payment is completed, download the San Diego California Weekly Time Sheet for Multiple Pay Rate in any available format.

- You can revisit the site whenever necessary and redownload the document without any additional fees.

- Finding current legal forms has never been simpler.

Form popularity

FAQ

Calculating overtime for multiple pay rates (35 hours x $12) + (10 hours x $15) = $570 base pay. $570 / 45 total hours = $12.67 regular rate of pay. $12.67 x 0.5 = $6.34 overtime premium rate. $6.34 x 5 overtime hours = $31.70 total overtime premium pay. $570 + $31.70 = $601.70 total pay due.

Multiply the weighted average pay rate by 0.5 to calculate the blended overtime pay rate. b. Multiply the overtime rate by the total overtime hours, which will give you the total bonus overtime pay.

A. There is nothing in state law that mandates an employer pay an employee a special premium for work performed on holidays, Saturdays, or Sundays, other than the overtime premium required for work in excess of eight hours in a workday or 40 hours in a workweek.

All the non-exempt employees who are qualified for overtime are paid 1.5 times the regular rate for all hours worked in excess of 8 hours in a workday, in excess of 40 hours in a workweek, or for the first eight hours worked on the 7th consecutive day worked in any workweek.

Yes, California law requires that employers pay overtime, whether authorized or not, at the rate of one and one-half times the employee's regular rate of pay for all hours worked in excess of eight up to and including 12 hours in any workday, and for the first eight hours of work on the seventh consecutive day of work

Double time is a rate of pay double the usual amount a person receives for normal hours worked. So, if your normal rate of pay was $11.00 an hour, double-time pay would be $22.00 per hour. Double time is sometimes paid for working on federal holidays or when hours work exceeding the normal workday.

In general, California overtime provisions require that all nonexempt employees (including domestic workers) receive overtime pay at a rate of 1.5 times their regular rate of pay for all hours worked in excess of 8 per day and 40 per week. These overtime rules apply to all nonexempt employees.

What is the overtime law in California? California overtime law requires employers to pay eligible employees twice their rate of pay when those employees have worked more than 12 hours in a workday or more than eight hours on their seventh consecutive day of work.

The FLSA requires the payment of overtime to non-exempt employees for all hours worked in excess of 40 hours in a work week. However, the FLSA does not require employers to pay double time or triple time for hours worked on the weekend or the employee's favorite holiday.

Find the employee's base pay Multiply the hours the employee worked in each position by the hourly rates. Add together the total wages from both positions to get the total compensation.