This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Irvine California Net Loss From a Trade or Business-Standard Account

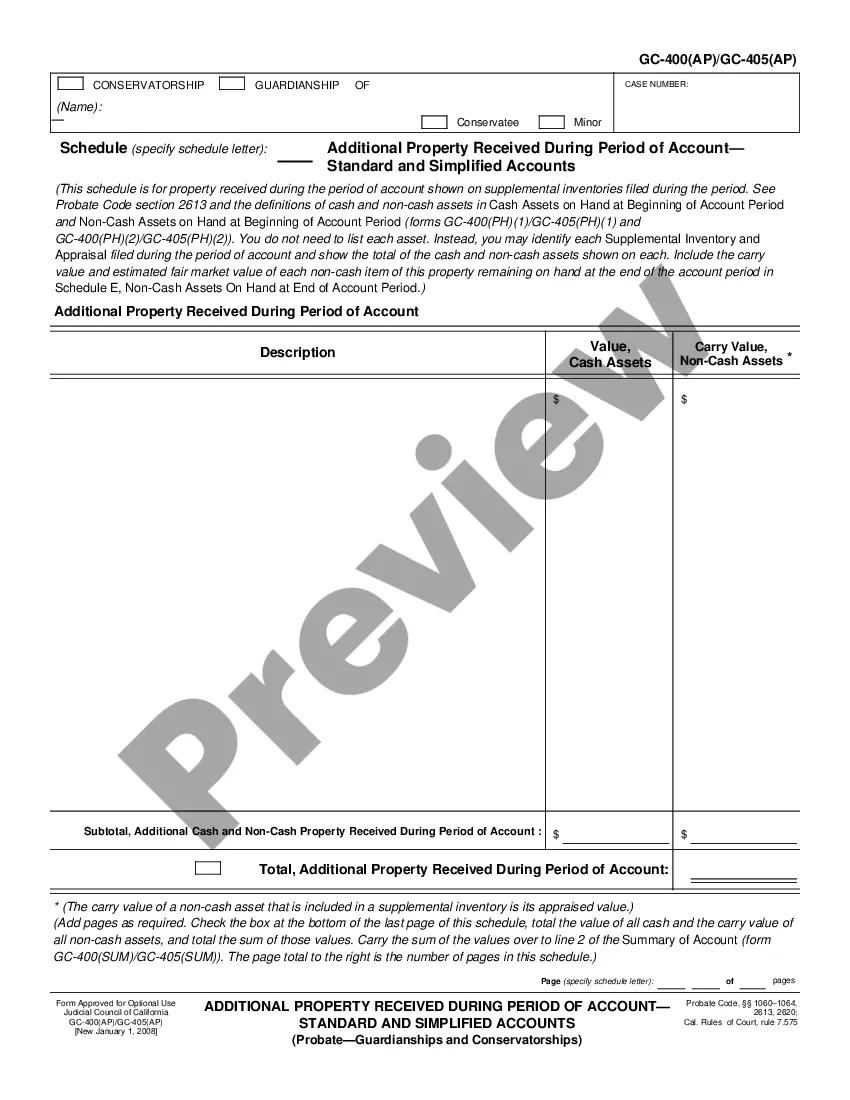

Description

How to fill out California Net Loss From A Trade Or Business-Standard Account?

If you’ve previously utilized our service, Log In to your account and retrieve the Irvine California Net Loss From a Trade or Business-Standard Account on your device by selecting the Download button. Ensure your subscription is active. If not, renew it per your payment plan.

If this is your initial interaction with our service, adhere to these straightforward instructions to acquire your file.

You have perpetual access to every document you have acquired: you can find it in your profile within the My documents section whenever you need to use it again. Utilize the US Legal Forms service to quickly find and download any template for your personal or business requirements!

- Confirm you’ve found a suitable document. Read the details and utilize the Preview feature, if available, to verify if it aligns with your needs. If it’s not suitable for you, use the Search tab above to find the correct one.

- Buy the template. Hit the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process payment. Enter your credit card information or opt for PayPal to finalize the transaction.

- Receive your Irvine California Net Loss From a Trade or Business-Standard Account. Choose the file type for your document and save it on your device.

- Finish your form. Print it out or utilize professional online editors to fill it in and sign it digitally.

Form popularity

FAQ

California's business loss limitation focuses on capping business losses that can be used to offset personal income, impacting individual tax returns. It is essential for taxpayers to be aware of these limitations to maximize benefits and comply with tax laws. By understanding these rules and leveraging tools from platforms like uslegalforms, you can effectively manage your Irvine California Net Loss From a Trade or Business-Standard Account.

The maximum business loss you can claim generally refers to the limits set by federal and state regulations, including the business interest loss limitations and NOL caps. This is particularly relevant when preparing your tax returns, as exceeding these limits can lead to lost deductions. Thus, keeping track of your Irvine California Net Loss From a Trade or Business-Standard Account is crucial for minimizing your tax liability.

Indeed, California's NOL can be limited to 80% of your taxable income for a given year, aligning with state tax codes. This limitation plays a significant role in how losses are applied in California, differing from federal guidelines. Understanding this context can provide clarity on your Irvine California Net Loss From a Trade or Business-Standard Account, making tax season less stressful.

An NOL deduction allows businesses to offset current year's income with previous year's losses, thus reducing taxable income. This deduction is essential for tax planning and can substantially influence your overall tax liability. It plays a vital role in defining your Irvine California Net Loss From a Trade or Business-Standard Account, enabling more effective financial strategies.

Yes, California imposes an 80% limitation on net operating losses (NOL) for taxpayers. This means that you can only deduct up to 80% of your taxable income when calculating your NOL deduction. Understanding this limitation can be critical for effectively managing your Irvine California Net Loss From a Trade or Business-Standard Account, as it influences your tax strategy.

A business loss typically includes expenses that exceed income from operations, such as operating costs, payroll, and depreciable assets. These losses directly impact your accounting and can define your Irvine California Net Loss From a Trade or Business-Standard Account. Accurate bookkeeping is essential for identifying and claiming these losses on your tax return.

In California, the business loss limitation applies similarly to federal guidelines but includes specific state modifications. Taxpayers may face restrictions on how much of a business loss they can claim when offsetting non-business income. This interplay can impact your Irvine California Net Loss From a Trade or Business-Standard Account significantly, so it's beneficial to stay informed on these regulations.

The limitation on business interest loss indicates that taxpayers can only deduct a certain amount of business interest on their tax returns. Specifically, it generally caps the interest expense deduction to the total business income, which can be crucial in calculating your Irvine California Net Loss From a Trade or Business-Standard Account. By understanding this limit, you can effectively manage your business's tax obligations and losses.

To report business investment losses, you need to include the losses on your tax return through the appropriate forms. Specifically, for California residents, this means using the CA 540. If you are dealing with an Irvine California Net Loss From a Trade or Business-Standard Account, accurately detail your losses to ensure you receive the tax benefits you're entitled to.

Filling out form 540 involves several key steps. Start by entering your general information and then move onto your income details, including any losses. If you have an Irvine California Net Loss From a Trade or Business-Standard Account, it's essential to include this in the financial summary, allowing you to address your tax obligations properly.