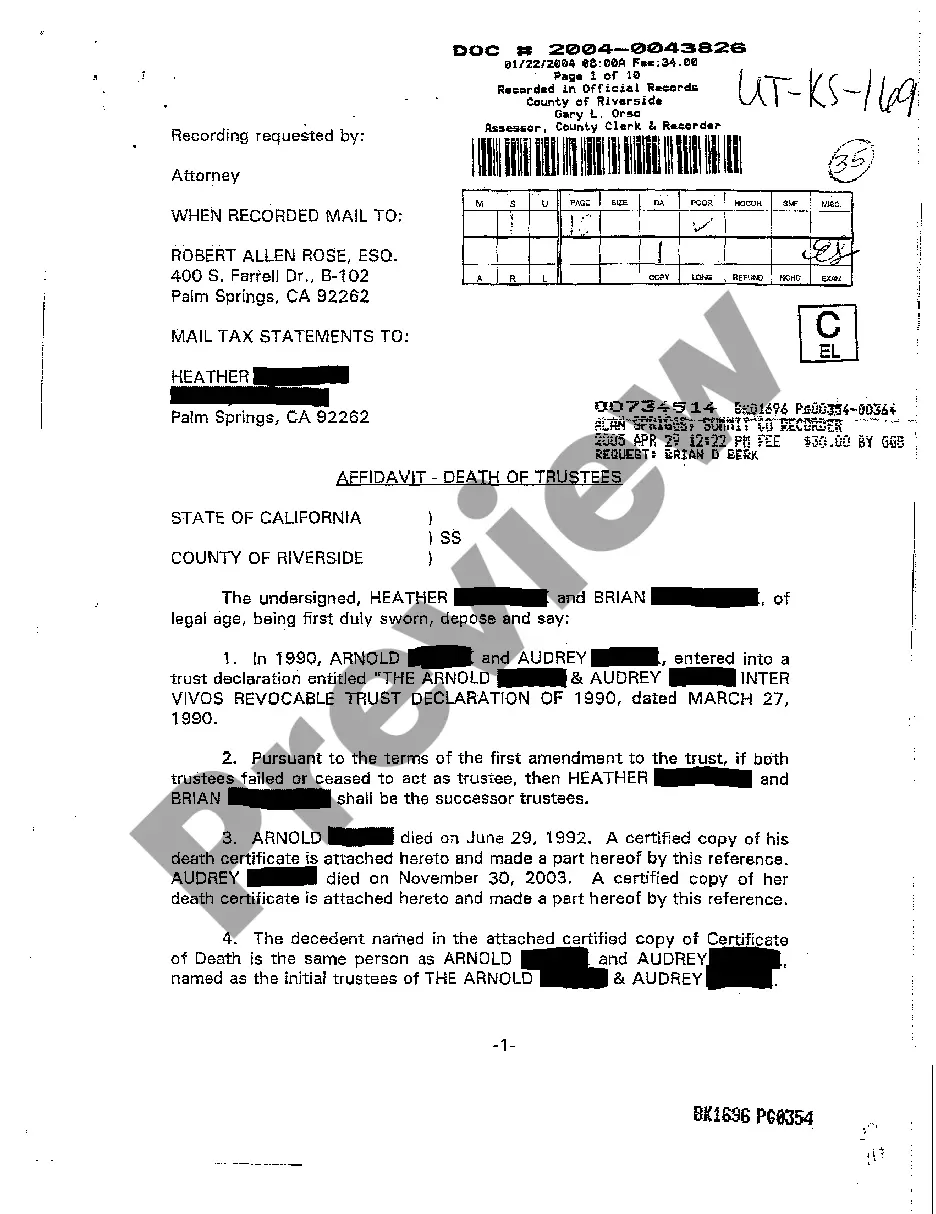

This form is a living trust form prepared for your state. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Irvine California Living Trust for Husband and Wife with Minor and or Adult Children

Description

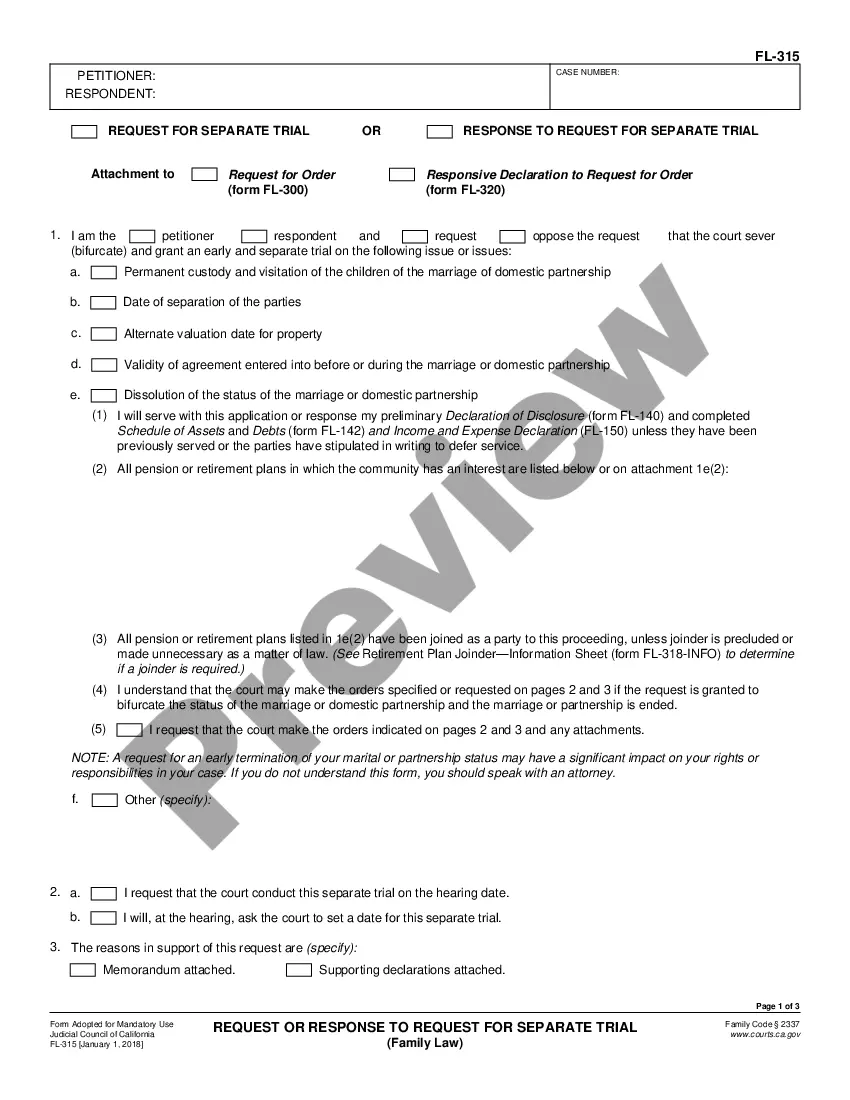

How to fill out California Living Trust For Husband And Wife With Minor And Or Adult Children?

If you have previously utilized our service, Log In to your account and download the Irvine California Living Trust for Husband and Wife with Minor and/or Adult Children onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment schedule.

If this is your initial experience with our service, follow these straightforward steps to obtain your document.

You will have unlimited access to all the documents you have purchased: you can find it in your profile under the My documents section whenever you need to retrieve it again. Utilize the US Legal Forms service to swiftly find and download any template for your personal or business purposes!

- Confirm you’ve identified a suitable document. Browse the description and use the Preview feature, if available, to verify if it satisfies your needs. If it doesn't meet your criteria, employ the Search option above to find the correct one.

- Acquire the template. Click the Buy Now button and select either a monthly or annual subscription option.

- Create an account and process the payment. Use your credit card information or the PayPal method to finalize the purchase.

- Obtain your Irvine California Living Trust for Husband and Wife with Minor and/or Adult Children. Choose the format for your document and save it to your device.

- Finalize your document. Print it out or make use of professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Whether or not to establish separate living trusts is a personal decision. An Irvine California Living Trust for Husband and Wife with Minor and or Adult Children can serve both partners effectively, but separate trusts may provide specific benefits for asset protection and individual control over properties. If you have unique assets or children from previous relationships, separate trusts may simplify the distribution of those assets. Consulting with a legal professional can help you determine the best approach for your situation.

Even if your children are adults, an Irvine California Living Trust for Husband and Wife with Minor and or Adult Children can be beneficial. It helps manage your estate efficiently, avoiding the lengthy probate process. Moreover, this trust can offer clear instructions on how to distribute assets, which can prevent disputes among siblings. It’s a proactive way to ensure your wishes are carried out seamlessly.

Yes, you can write your own living trust in California, including an Irvine California Living Trust for Husband and Wife with Minor and or Adult Children. However, crafting a legally enforceable trust requires understanding state laws and specific requirements. Websites like uslegalforms can help guide you through the process, ensuring your trust meets all legal criteria for protection and efficacy.

A family trust, such as an Irvine California Living Trust for Husband and Wife with Minor and or Adult Children, may limit flexibility in asset management. Once assets are transferred, the trust’s terms typically govern their use. This can lead to challenges if family dynamics change or if unforeseen circumstances arise.

One potential downside of an Irvine California Living Trust for Husband and Wife with Minor and or Adult Children is the complexity involved in transferring assets into the trust. This process requires attention to detail to ensure everything is correctly titled. If not managed properly, your loved ones might face complications and delays when accessing the assets.

While an Irvine California Living Trust for Husband and Wife with Minor and or Adult Children offers many advantages, it also has some drawbacks. Setting up the trust can involve initial costs and requires ongoing management. Moreover, if the trust is not properly funded, it may not provide the desired protection for assets upon death.

Creating an Irvine California Living Trust for Husband and Wife with Minor and or Adult Children can provide significant benefits for your parents. A trust helps manage their assets while ensuring a smoother transfer to heirs, simplifying the estate process. Additionally, it can protect their assets from probate, making the transition easier during difficult times.

One significant downside of an Irvine California Living Trust for Husband and Wife with Minor and or Adult Children is the complexity involved in managing and maintaining the trust. You must keep records up to date and ensure all assets are transferred into the trust. This ongoing management may not be suitable for everyone, especially if you want a more straightforward estate plan. Utilizing platforms like uslegalforms can help simplify this process, ensuring you meet all legal requirements.

A common mistake parents make when creating a trust fund is failing to clearly specify the distribution terms. With an Irvine California Living Trust for Husband and Wife with Minor and or Adult Children, clarity is vital to prevent conflicts among heirs. If the conditions for accessing the funds are vague, it can lead to confusion and disputes later on. It's always wise to consult a professional to ensure your intentions are documented correctly.

While an Irvine California Living Trust for Husband and Wife with Minor and or Adult Children provides many benefits, it also has downsides. For instance, a living trust does not provide tax benefits like a will might offer in certain situations. Moreover, if you do not fund the trust properly, your assets may still go through probate, which undermines one of the primary purposes of establishing the trust in the first place.