This form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with one or more children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Riverside California Living Trust for individual, Who is Single, Divorced or Widow (or Widower) with Children

Description

How to fill out California Living Trust For Individual, Who Is Single, Divorced Or Widow (or Widower) With Children?

If you’ve previously utilized our service, sign in to your account and retrieve the Riverside California Living Trust for individuals who are Single, Divorced, or Widowed (or Widower) with Children onto your device by selecting the Download button. Ensure your subscription is current. Otherwise, renew it in accordance with your payment schedule.

If this is your initial engagement with our service, adhere to these straightforward steps to acquire your document.

You have ongoing access to every document you have acquired: you can locate it in your profile under the My documents section whenever you need to use it again. Take advantage of the US Legal Forms service to efficiently find and store any template for your personal or professional requirements!

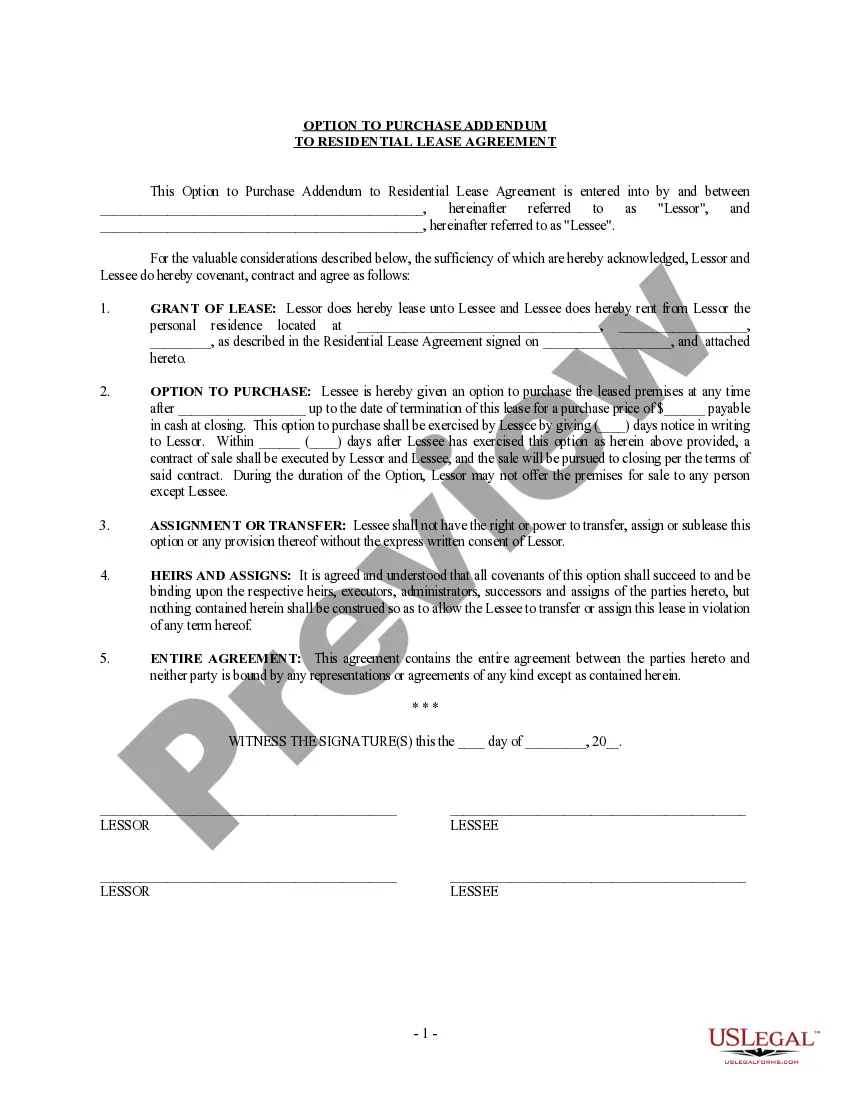

- Confirm you’ve found an appropriate document. Review the description and utilize the Preview option, if available, to verify if it fulfills your requirements. If it does not suit you, employ the Search tab above to discover the suitable one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal alternative to finalize the purchase.

- Obtain your Riverside California Living Trust for individuals who are Single, Divorced, or Widowed (or Widower) with Children. Select the file format for your document and save it to your device.

- Finalize your template. Print it out or use professional online editors to complete and sign it electronically.

Form popularity

FAQ

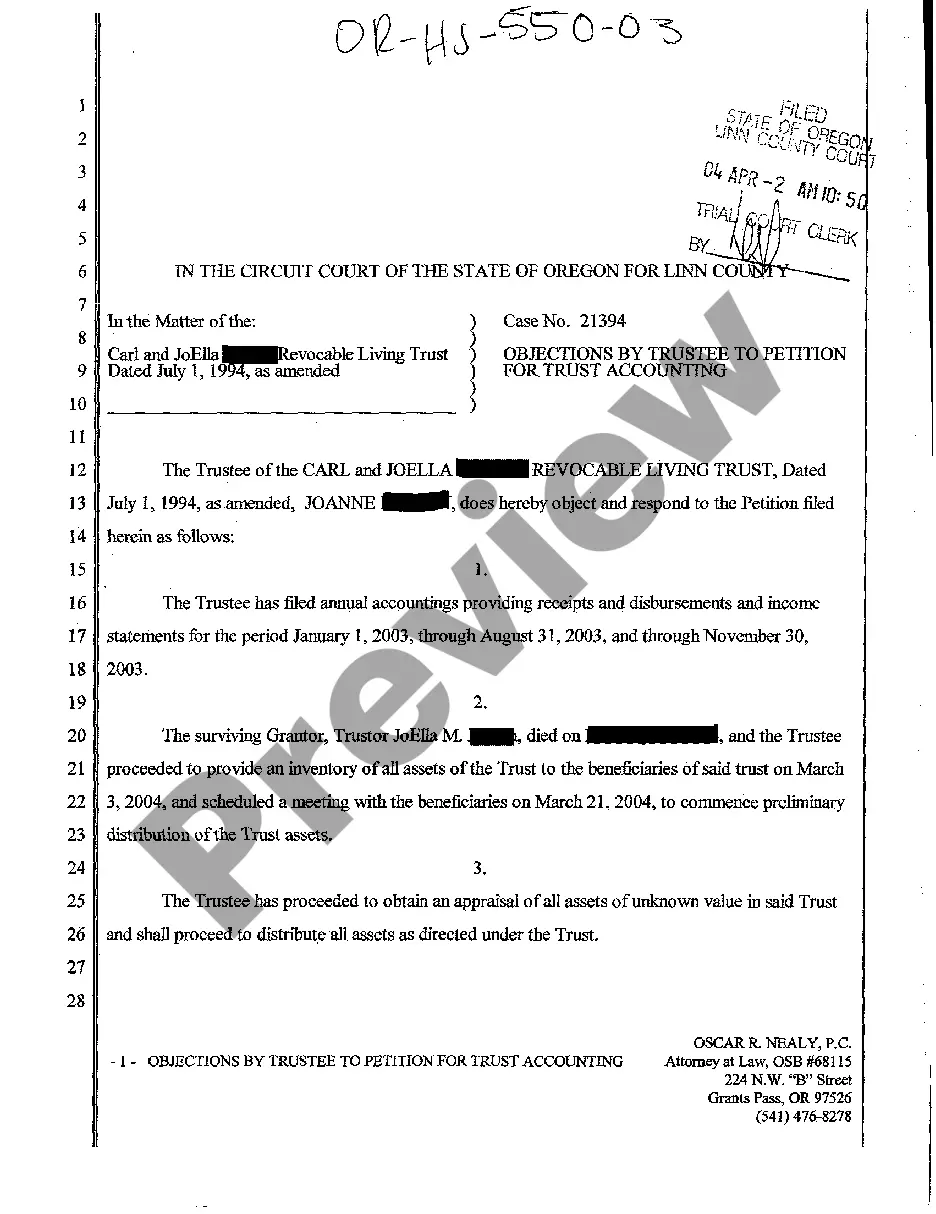

When a spouse dies with a living trust in place, the assets are managed and allocated as specified in the trust document. This process allows for a seamless transfer of ownership without going through probate, which can save time and legal costs. For individuals who are single, divorced, or widowed with children, ensuring your Riverside California Living Trust reflects your current wishes is crucial. Consulting with an estate planning expert can provide clarity and ensure that your intentions are honored.

When a person with a trust dies in California, the assets in the trust are distributed according to the terms set out in the trust document. This process bypasses the lengthy probate court proceedings typically associated with wills, providing a more efficient solution. For individuals considering a Riverside California Living Trust, especially those who are single, divorced, or widowed with children, it's wise to explore how this can facilitate smoother asset transfer. Legal professionals can be a valuable resource during this phase.

When one spouse dies in California, the provisions of the living trust dictate the management and distribution of trust assets. Generally, the surviving spouse can continue managing the trust if they are named as the successor trustee. It's important to review how your Riverside California Living Trust supports your wishes for your children, especially if you're a single, divorced, or widowed parent. Consulting an attorney may ensure your plans remain effective.

A surviving spouse may have the ability to change or revoke a living trust in California, but this can depend on the specific terms of the trust agreement. If the trust was established solely by the deceased spouse, modifications may be limited. It's wise for a surviving spouse to analyze the Riverside California Living Trust thoroughly, especially when children are involved. Professional legal assistance can simplify this process and clarify options.

After the death of a spouse, it's crucial to avoid making hasty decisions regarding assets and trusts. Taking time to mourn and process the loss is important before making any changes. Avoid rushing to alter or dissolve your Riverside California Living Trust for individuals who are single, divorced, or widowed with children. Engaging with professionals who understand estate planning can guide you through this delicate process.

In California, a living trust may be affected during a divorce process. Assets within the trust could be subject to division among spouses, depending on whether they are deemed community property or separate property. It's essential for individuals navigating a divorce to review their Riverside California Living Trust to ensure it aligns with their new circumstances. Consulting with a legal expert can help in making necessary adjustments.

Yes, you can write your own living trust in California. This option appeals to individuals looking for a Riverside California Living Trust, especially those who are single, divorced, or widowed with children, as it offers a degree of control. It’s important to ensure the document is legally compliant, so consider consulting platforms like US Legal Forms, which provide templates and guidance tailored to your specific needs. This ensures you create a trustworthy document that reflects your wishes accurately.

You can create your own living trust in California, and many individuals choose to do this for their Riverside California Living Trust, especially those who are single, divorced, or widowed with children. By using online resources or templates, you can draft a format that suits your specific needs. However, it is wise to seek guidance from legal experts to ensure the trust complies with state laws and effectively addresses your family's needs. This way, you can protect your children’s inheritance with confidence.

Yes, a handwritten living trust, also known as a holographic trust, is legal in California, provided it meets certain requirements. It must be written in the individual’s handwriting, signed, and clearly state the individual's intentions. However, for individuals seeking a Riverside California Living Trust for those who are single, divorced, or widowed with children, it's often recommended to work with a legal professional. This approach ensures compliance with all legal standards and minimizes confusion or disputes among heirs.

In a Riverside California Living Trust for individuals who are single, divorced, or widowed with children, a living trust can help streamline the transfer of assets after one spouse passes away. When one spouse dies, the living trust remains intact, allowing for the automatic transfer of assets to the surviving spouse without the lengthy probate process. This arrangement can provide peace of mind, knowing that your children will inherit their share seamlessly. Additionally, your loved ones can manage the trust more easily during a difficult time.