Use this form to an abandon a declared homestead. File it at the County Recorder's Office in the county where your property is located.

Temecula California Declaration of Abandonment of Homestead Declaration

Description

How to fill out California Declaration Of Abandonment Of Homestead Declaration?

If you have utilized our service previously, Log In to your account and retrieve the Temecula California Declaration of Abandonment of Homestead Declaration onto your device by clicking the Download button. Ensure your subscription is current. If it is not, renew it in line with your payment plan.

If this is your initial interaction with our service, adhere to these straightforward steps to acquire your document.

You have lifelong access to all documents you have acquired: you can locate them in your profile under the My documents section whenever you wish to access them again. Leverage the US Legal Forms service to effortlessly find and preserve any template for your personal or professional requirements!

- Verify you’ve found a suitable document. Review the description and utilize the Preview feature, if available, to determine if it fulfills your needs. If it does not cater to your requirements, use the Search tab above to discover the right one.

- Acquire the template. Hit the Buy Now button and select a monthly or yearly subscription option.

- Establish an account and process your payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Temecula California Declaration of Abandonment of Homestead Declaration. Choose the file format for your document and store it on your device.

- Complete your document. Print it or utilize professional online editors to fill it and sign it digitally.

Form popularity

FAQ

In California, abandonment of homesteads refers to the process by which homeowners formally declare that they have vacated their primary residence. To complete this process, individuals can use the Temecula California Declaration of Abandonment of Homestead Declaration. This declaration serves to protect the property from claims by creditors and simplifies the handling of taxes and legal matters. If you need assistance with this declaration, you can rely on US Legal Forms to provide the necessary documents and guidance.

Filing for a California homestead exemption involves submitting a claim to your local county assessor. This exemption can reduce your property taxes, and it’s a great way to protect your home from certain creditors. When considering a Temecula California Declaration of Abandonment of Homestead Declaration, it's essential to understand how these exemptions work. You can leverage platforms such as US Legal Forms to find step-by-step instructions and necessary forms for both declarations and exemptions.

To record a homestead declaration in California, you must complete the appropriate form and file it with your local county recorder's office. The Temecula California Declaration of Abandonment of Homestead Declaration must include specific details about your property and your declaration intentions. After filing, the declaration becomes part of the public record, providing clarity regarding your ownership status. Using platforms like US Legal Forms can simplify this process, offering guidance and ready-to-use forms.

A homestead declaration in California serves to protect a homeowner's primary residence from creditors. By filing a Temecula California Declaration of Abandonment of Homestead Declaration, you affirm your intent to abandon a previously declared homestead, which can help clarify your property rights. This process can also safeguard your equity in the home, ensuring that it remains your refuge in challenging financial times. It's an important legal step for homeowners looking to manage their property effectively.

To file a homestead declaration in California, you need to complete a Declaration of Abandonment of Homestead Declaration form. This document must be filed with the county recorder's office where your property is located. In Temecula, California, you can also utilize US Legal Forms to ensure that you access the correct paperwork and follow the appropriate filing procedures. This streamlined process helps protect your home and property from creditors.

If you are sued in court and lose, the person who sued you may try to force the sale of your home to collect their money. A homestead makes it harder for them to do this. A homestead protects some of the equity in your home. If your home is worth more money than you owe on it, you have equity.

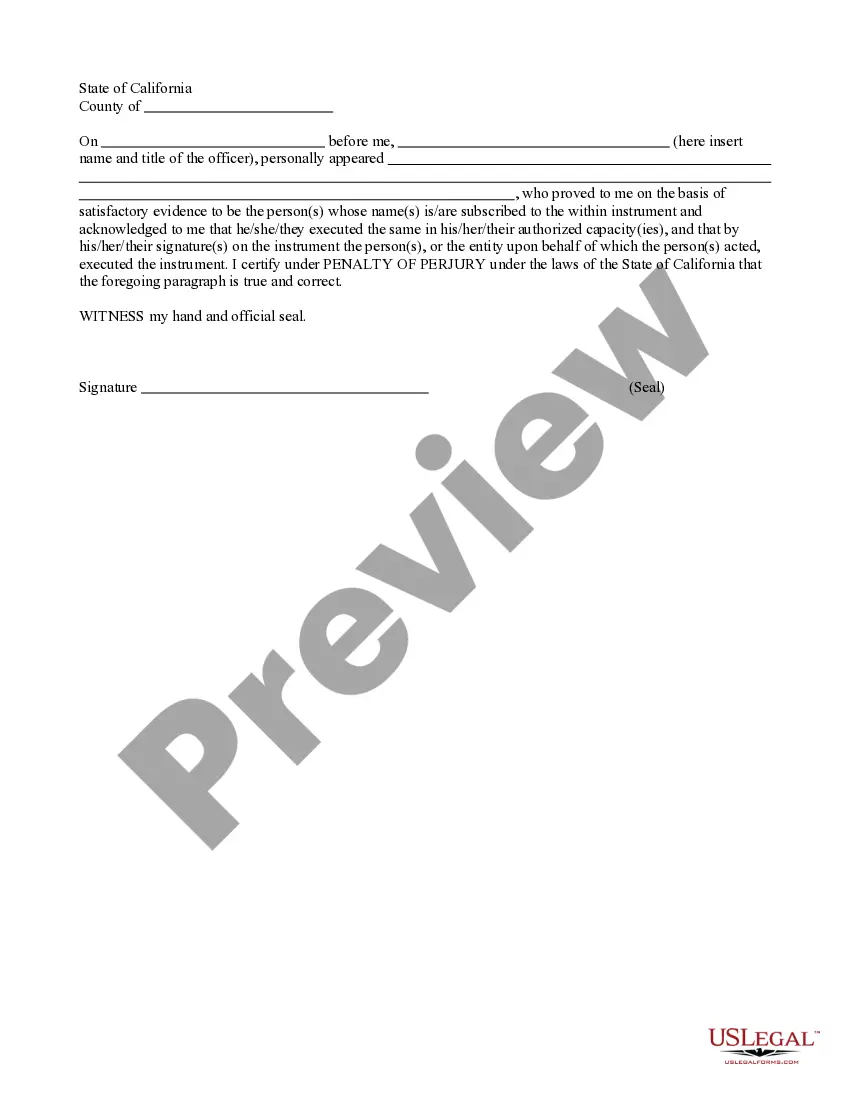

When terminating a declared Homestead, you can record a Declaration of Abandonment of Declared Homestead. The Abandonment of Homestead is completed and signed by the declared owner(s), whose signature(s) must be notarized.

In California's System 1, homeowners can exempt up to $600,000 of equity in a house. In California's System 2, homeowners can exempt up to $31,950 of home equity. The California Judicial Council updates the amounts every three years. The last changes reflected in this article occurred on April 1, 2022.

A homestead protects some of the equity in your home. If your home is worth more money than you owe on it, you have equity. For example, if your home is worth $350,000 and you owe $300,000, you have $50,000 in equity. A homestead can protect the $50,000.

Currently, the California homestead exemption is automatic, meaning that a homestead declaration does not need to be filed with the county clerk. Under the new 2021 law, $300,000?$600,000 of a home's equity cannot be touched by judgment creditors.