Use this form to an abandon a declared homestead. File it at the County Recorder's Office in the county where your property is located.

Long Beach California Declaration of Abandonment of Homestead Declaration

Description

How to fill out California Declaration Of Abandonment Of Homestead Declaration?

Utilize the US Legal Forms and gain instant access to any form sample you require.

Our helpful platform with thousands of templates enables you to locate and acquire almost any document sample you desire.

You can download, complete, and sign the Long Beach California Declaration of Abandonment of Homestead Declaration in just a few minutes instead of spending hours searching online for a suitable template.

Using our catalog is a fantastic way to enhance the security of your document filing.

Access the page with the form you require. Ensure it is the template you intended to find: review its title and summary, and utilize the Preview function if available. Otherwise, utilize the Search field to locate the necessary one.

Initiate the saving process. Choose Buy Now and select the pricing plan you wish. Then, register for an account and complete your order using a credit card or PayPal.

- Our expert attorneys routinely evaluate all the documents to verify that the templates are applicable for a specific state and adhere to updated laws and regulations.

- How do you access the Long Beach California Declaration of Abandonment of Homestead Declaration.

- If you have a subscription, simply Log In to your account. The Download feature will be activated for all the samples you view.

- Additionally, you can retrieve all previously saved documents from the My documents section.

- If you don’t possess an account yet, follow the instructions outlined below.

Form popularity

FAQ

In California's System 1, homeowners can exempt up to $600,000 of equity in a house. In California's System 2, homeowners can exempt up to $31,950 of home equity. The California Judicial Council updates the amounts every three years. The last changes reflected in this article occurred on April 1, 2022.

(a) A declared homestead is abandoned by operation of law as to a declared homestead owner if the declared homestead owner or a person authorized to act on behalf of the declared homestead owner executes, acknowledges, and records a new homestead declaration for the declared homestead owner on different property.

A declared homestead protects some of your equity for six months after you sell your home if the following three conditions are all true: You sell your home and buy another home within six months; The protected amount is used to buy another home; You record a homestead on the new home.

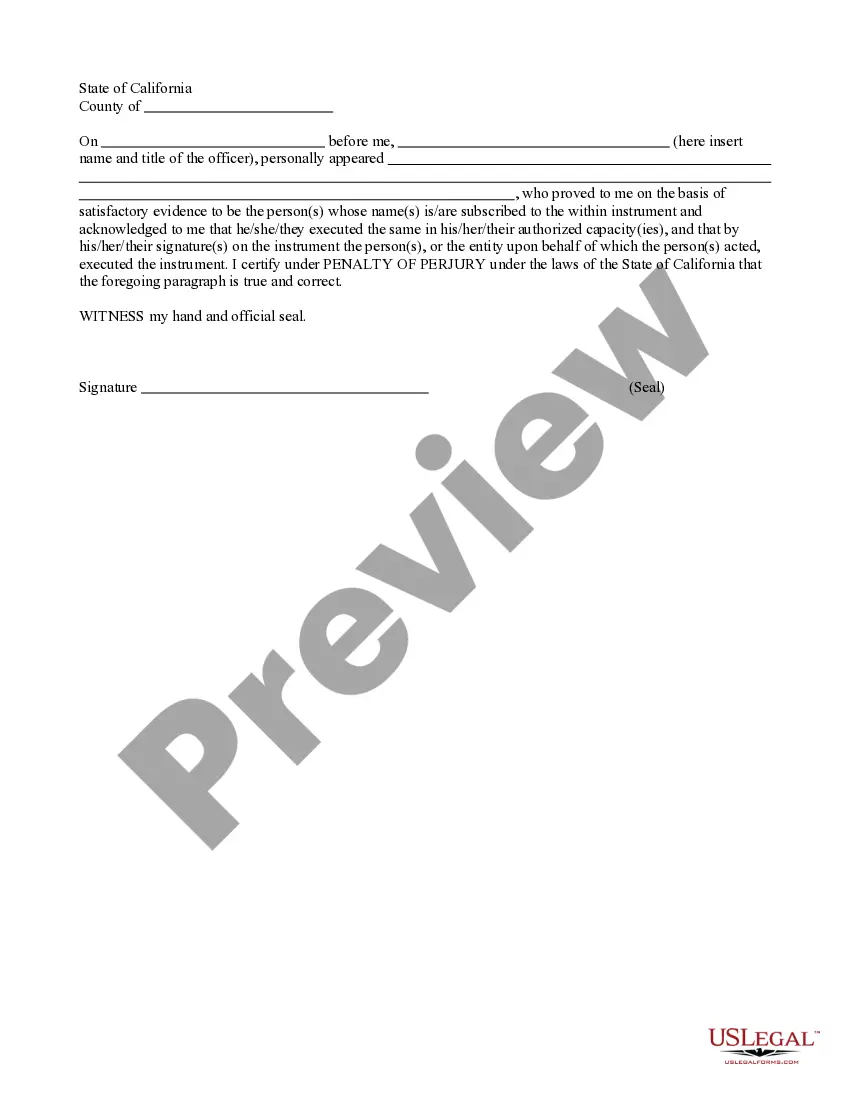

How do I file a declared homestead? Buy a declared homestead form from an office-supply store, or download a form from the Registrar-Recorder's website. Fill out the form. Sign the form and have it notarized.

Homestead protection not absolute The California homestead does not guarantee you that a creditor can't force a sale of your home to pay a debt. Instead, it guarantees that you get the dollar value of your homestead from the forced sale of your home before the creditor forcing the sale gets any money.

In California, everyone who owns a home and lives in it is allowed to claim a homestead exemption, as SFGate reports: Single homeowners receive a $75,000 equity exemption. A head of household receives a $100,000 equity exemption.

A homestead declaration is a legal document that claims and registers a particular house as the owner's homestead or principle dwelling. This document helps to protect the house against loss to creditors.

Now, in case you're wondering how you can ensure a homestead exemption applies to your home, you should know that there are two types: automatic and declared homestead exemptions.

Filing a declaration is a good idea if you have equity in your home and experience financial trouble. Your homestead won't be lost after a property sale and the proceeds will be protected for a full six months. The California homestead exemption also has two different systems.