Use this form to file a declared homestead as a married couple at the County Recorder's Office in the county where the property is located.

Bakersfield California Homestead Declaration for Husband and Wife

Description

How to fill out California Homestead Declaration For Husband And Wife?

Finding authentic templates tailored to your local laws can be challenging unless you access the US Legal Forms repository.

It’s a digital compilation of over 85,000 legal documents catering to both personal and professional requirements and various real-life situations.

All the files are correctly organized by category of use and jurisdiction areas, so finding the Bakersfield California Homestead Declaration for Husband and Wife is as simple as pie.

Organizing paperwork efficiently and in accordance with legal requirements is crucial. Utilize the US Legal Forms library to have vital document templates for any needs readily available at your fingertips!

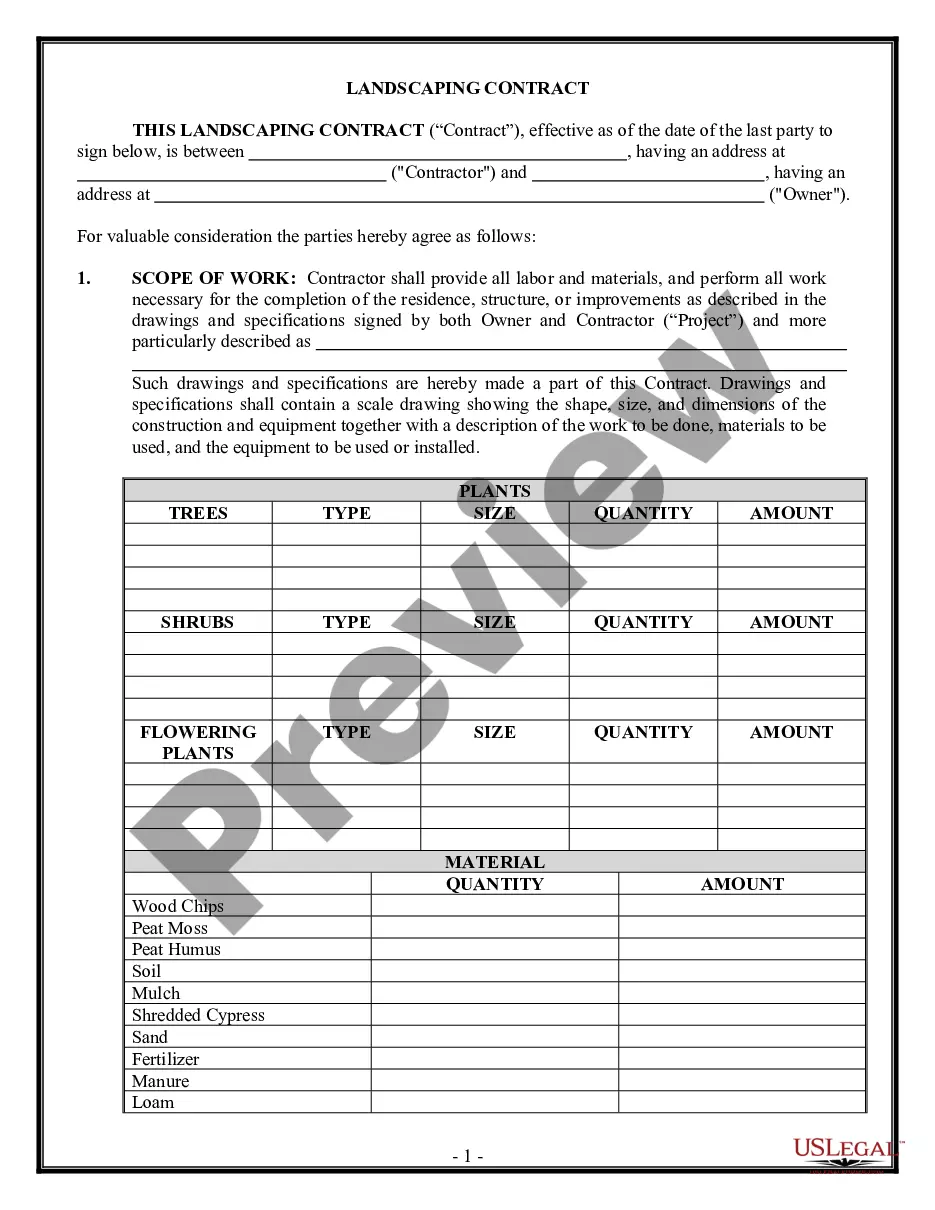

- Examine the Preview mode and form description.

- Ensure you’ve selected the correct one that fulfills your needs and aligns perfectly with your local jurisdiction specifications.

- Search for another template, if required.

- If you perceive any discrepancies, utilize the Search tab above to find the appropriate one. If it fits your requirements, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

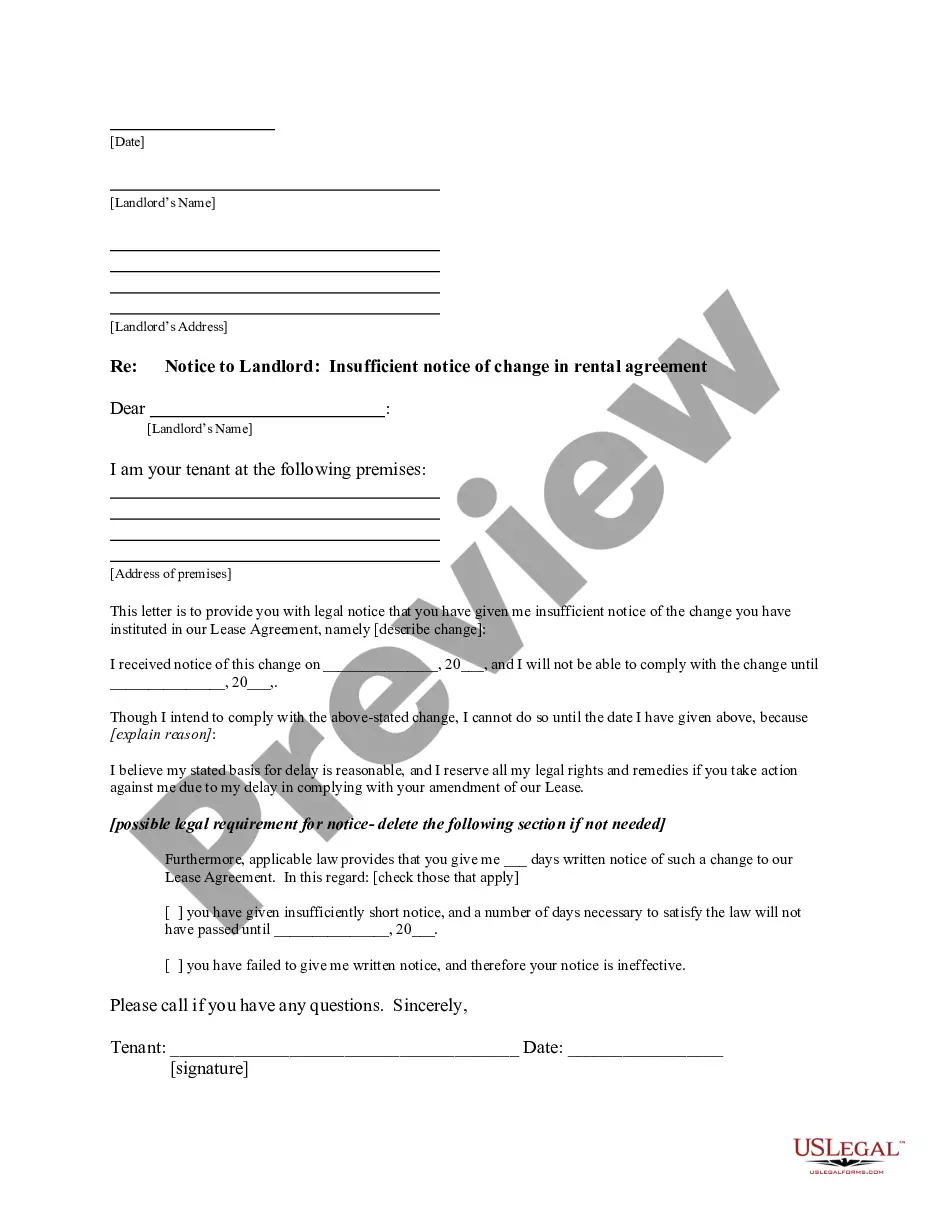

Releasing homestead rights means that a homeowner is relinquishing their legal claim to certain protections on their homestead property. This can happen for various reasons, such as selling the property or refinancing. Once you release these rights, you may lose some of the legal protections provided under the Bakersfield California Homestead Declaration for Husband and Wife. It's advisable to understand the implications fully, and using resources like USLegalForms can help clarify the process.

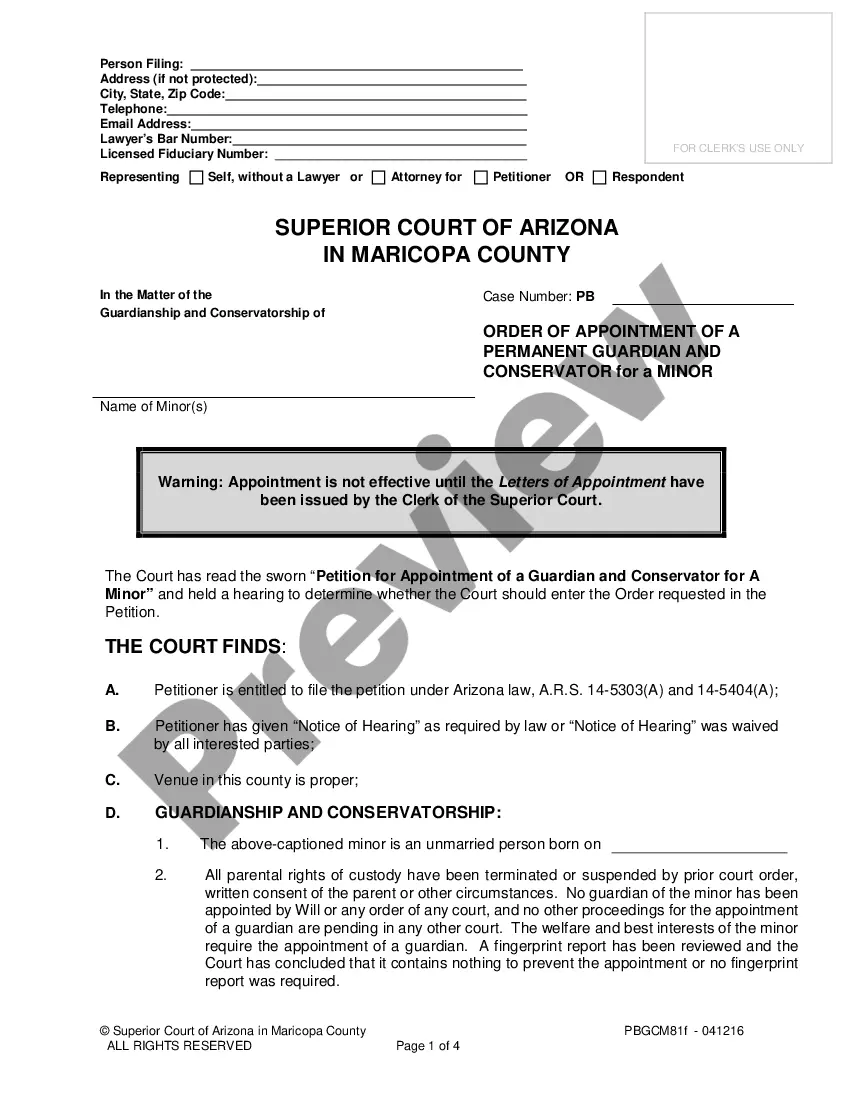

To file a homestead exemption in California, you need to complete a homestead declaration form, specifically designed for properties in your state. You can find the appropriate form on the USLegalForms website, which provides easy access to necessary legal documents. After completing the form, submit it to your local county recorder's office. This process helps protect your equity in your home under the Bakersfield California Homestead Declaration for Husband and Wife.

To record a homestead declaration in California, specifically for your Bakersfield California Homestead Declaration for Husband and Wife, you begin by obtaining the correct declaration form. Complete the form carefully, and make sure it meets all requirements set by state law. Then, visit your local county recorder’s office with the document to submit your filing. This action officially recognizes your homestead protections, completing your declaration process.

Once you receive approval for your Bakersfield California Homestead Declaration for Husband and Wife, your home gains essential protections against creditors. This essentially means that in most situations, your property cannot be seized to satisfy debts. Additionally, your homestead may offer potential tax benefits and stability for your family. It's a crucial step in securing your assets and ensuring peace of mind.

To record a Bakersfield California Homestead Declaration for Husband and Wife, you first need to complete the appropriate form, which is typically available from local government offices or online platforms. Once filled out, you should submit the declaration to the county recorder's office in Bakersfield. This will officially document your homestead status. After successful filing, you will receive a confirmation, ensuring your property is protected.

In California, homestead protection is not automatic. Homeowners must formally file a Bakersfield California Homestead Declaration for Husband and Wife to claim homestead benefits. This declaration provides valuable protections against creditors and can affect property taxes. For those looking to navigate this process smoothly, uslegalforms offers well-defined solutions to guide you.

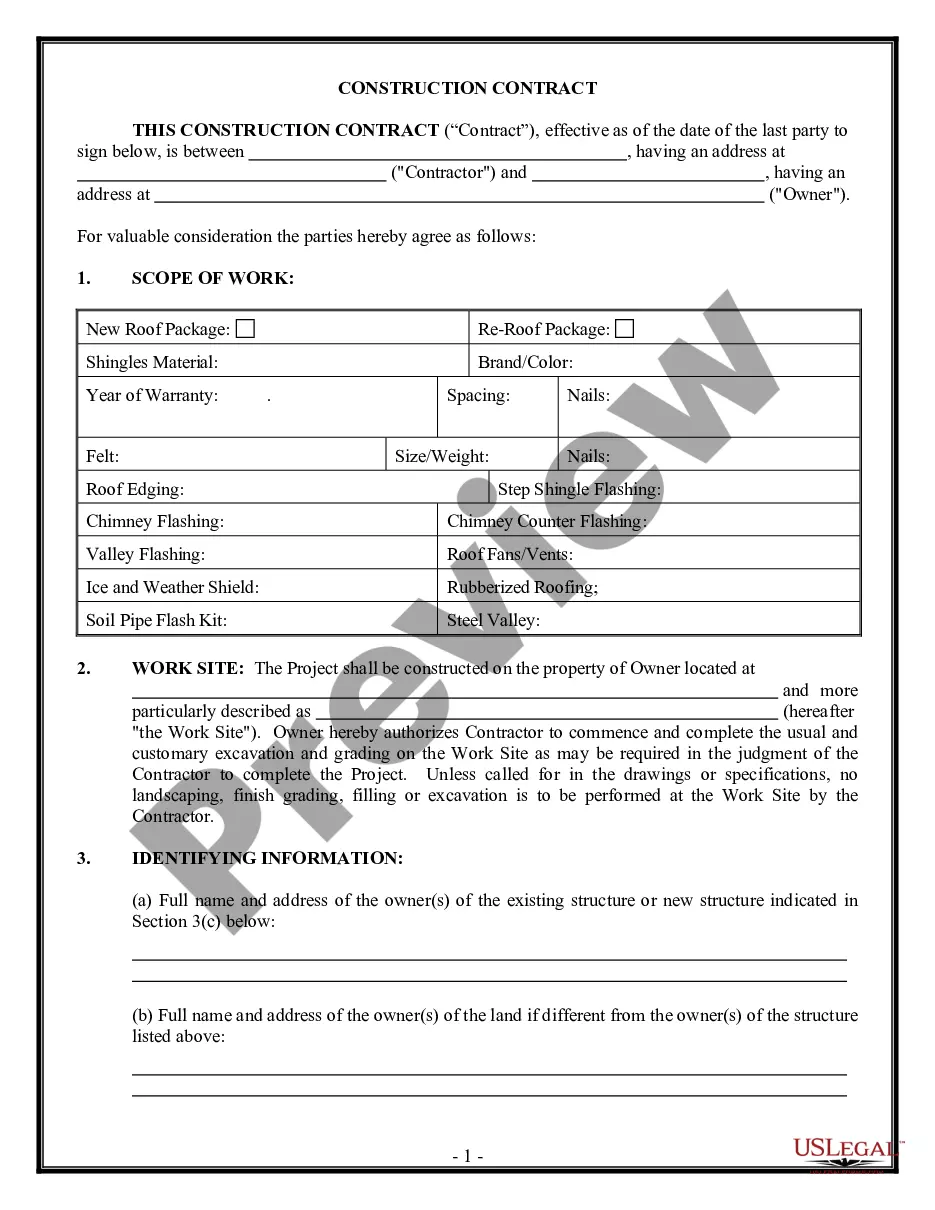

Yes, a husband and wife can declare homesteads in different states, but it requires a clear understanding of the laws governing those states. Each state addresses homesteading differently, which affects tax benefits. The Bakersfield California Homestead Declaration for Husband and Wife offers a specific framework to follow, ensuring you maximize your rights. Consulting uslegalforms can simplify this process.

The rights of a marital homestead typically include protection from creditors and the right to reside in the home. These rights can vary by state, so familiarity with your local laws is crucial. In the context of the Bakersfield California Homestead Declaration for Husband and Wife, these rights can enhance your financial security and peace of mind. Utilizing uslegalforms can assist in properly declaring your homestead.

Yes, a married couple can homestead two properties in different states, but this can depend on state laws. Each state has its own rules regarding homesteading. Therefore, understanding the specifics of the Bakersfield California Homestead Declaration for Husband and Wife can help you make informed choices about your properties and any tax advantages available.

Yes, a husband and wife can be residents of different states. This situation can arise due to work, education, or personal choices. However, when it comes to the Bakersfield California Homestead Declaration for Husband and Wife, it may create complexities in filing status and property taxes. It’s advisable to seek guidance on how to navigate these issues effectively.