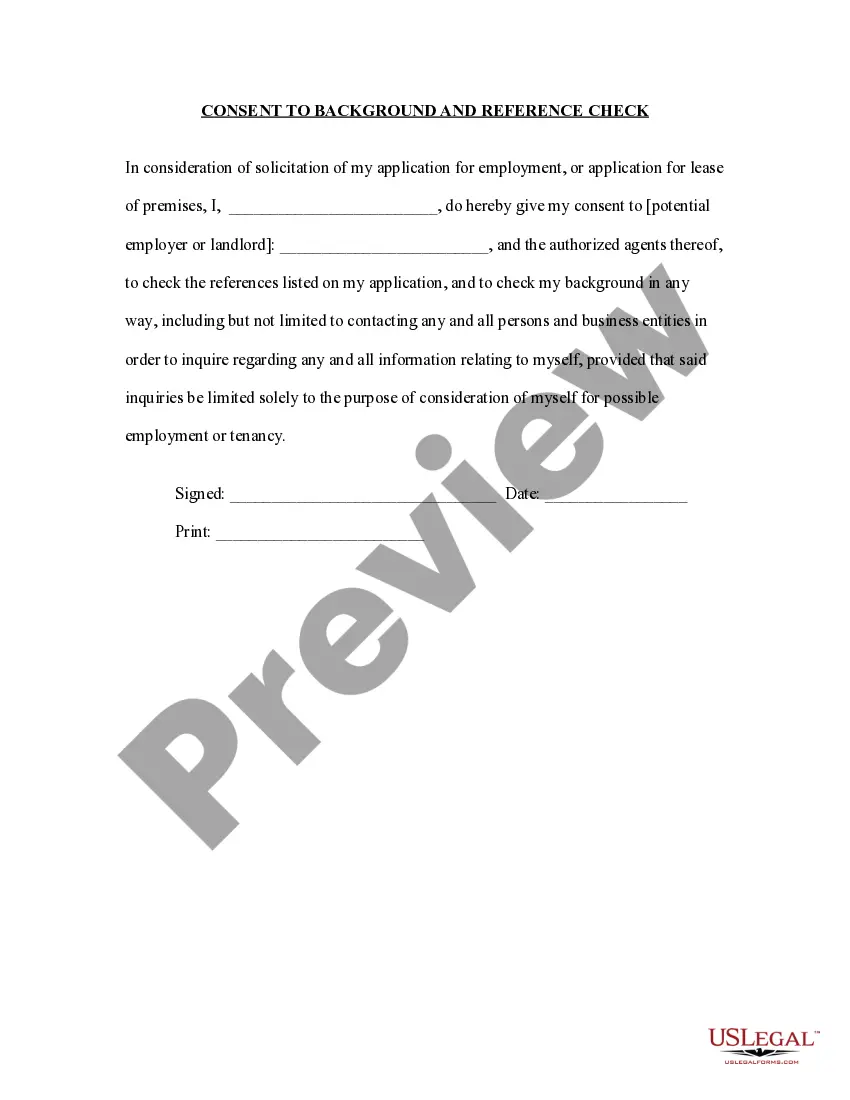

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Alameda California Non-Foreign Affidavit Under IRC 1445

Description

How to fill out California Non-Foreign Affidavit Under IRC 1445?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms database.

It’s a digital compilation of over 85,000 legal documents catering to both personal and professional requirements as well as various real-life scenarios.

All the files are accurately organized by usage area and jurisdiction, making the search for the Alameda California Non-Foreign Affidavit Under IRC 1445 as swift and straightforward as ABC.

Maintaining documentation organized and compliant with legal standards is crucial. Take advantage of the US Legal Forms library to always have key document templates readily available for any requirements!

- Verify the Preview mode and document description.

- Ensure you’ve chosen the correct one that fulfills your needs and completely aligns with your regional jurisdiction stipulations.

- Look for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the appropriate one.

- If it meets your requirements, proceed to the next phase.

Form popularity

FAQ

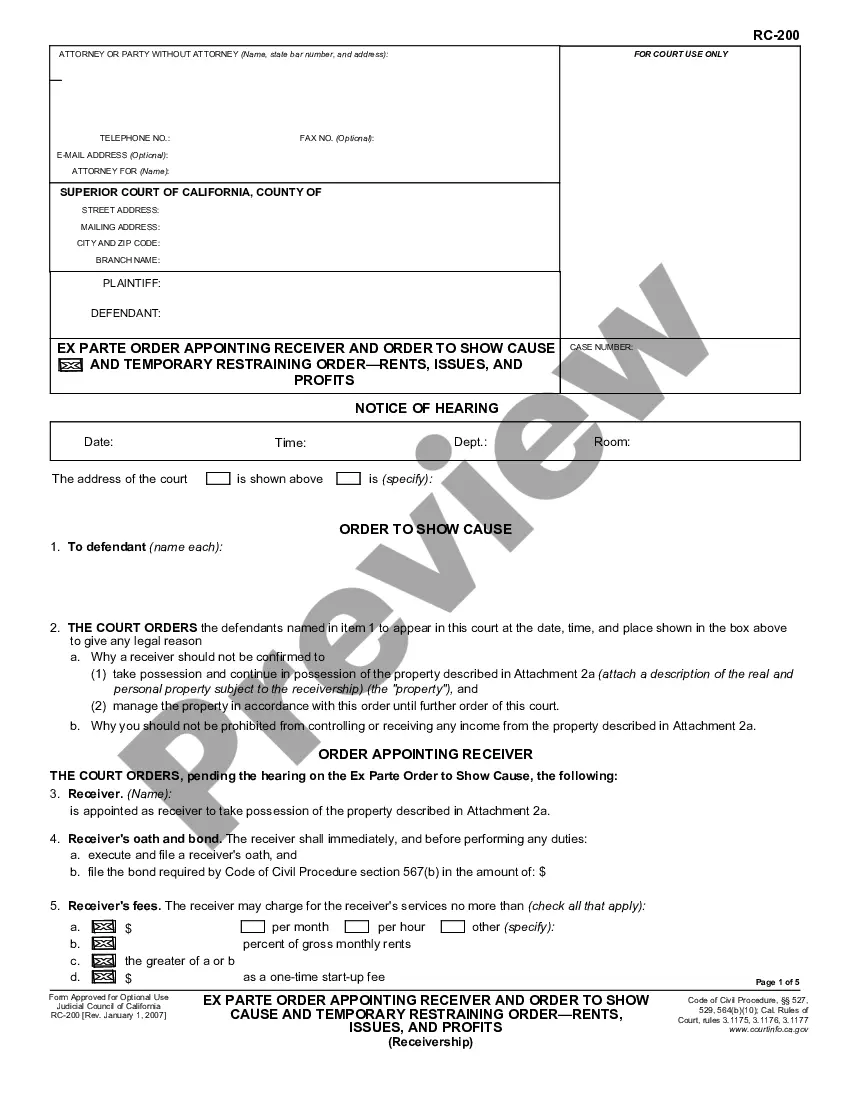

To navigate the Foreign Investment in Real Property Tax Act (FIRPTA), you can utilize an Alameda California Non-Foreign Affidavit Under IRC 1445. This affidavit certifies that you are not a foreign entity, exempting you from the usual withholding tax on the sale of real estate. Engaging with qualified professionals or using platforms like US Legal Forms can simplify this process, ensuring you complete the necessary documents correctly. By taking these steps, you can efficiently handle FIRPTA requirements, maximizing your real estate investment potential.

For buyers, FIRPTA means potential withholding taxes when purchasing property from a foreign seller in the U.S. Buyers often need to verify the seller's status to determine their tax obligations. By utilizing the Alameda California Non-Foreign Affidavit Under IRC 1445, buyers can often avoid unnecessary withholding, making real estate transactions smoother and more efficient.

An Affidavit of non-foreign status is a document confirming that the seller is not a foreign person under IRS guidelines. This affidavit protects buyers from FIRPTA withholding requirements. In Alameda, California, using this affidavit along with the Alameda California Non-Foreign Affidavit Under IRC 1445 simplifies the transaction process and reduces tax burdens.

To file a FIRPTA certificate, a buyer should collect the necessary documentation, including the Alameda California Non-Foreign Affidavit Under IRC 1445. They must submit the completed forms to the IRS, typically through a tax professional. This step ensures proper withholding of tax and complies with FIRPTA requirements.

A FIRPTA statement is a declaration confirming whether the seller is a foreign person. For instance, a buyer in Alameda might receive a statement from the seller affirming their non-foreign status per the Alameda California Non-Foreign Affidavit Under IRC 1445. This statement helps clarify tax responsibilities and ensures compliance with the IRS regulations.

IRS Notice 1445 pertains to the Foreign Investment in Real Property Tax Act (FIRPTA). It indicates that buyers must withhold taxes when purchasing property from foreign sellers. For those involved in real estate transactions in Alameda, California, understanding this notice is crucial for compliance. Utilizing the Alameda California Non-Foreign Affidavit Under IRC 1445 can streamline the process.

When mailing a FIRPTA certificate, also known as the Alameda California Non-Foreign Affidavit Under IRC 1445, it is essential to send it to the correct address to ensure prompt processing. Typically, the certificate should be sent to the Internal Revenue Service (IRS) at the address specified on the form instructions or your tax return. If you are unsure about the details, consider seeking assistance through uslegalforms, where you can find the necessary guidance for filing your documents accurately. By following these steps, you help prevent delays in your tax matters.

foreign affidavit is a declaration that certifies a seller's status as a nonforeign person under U.S. tax law. This affidavit helps real estate transactions proceed without the hindrance of FIRPTA withholding taxes, which typically apply to foreign sellers. The Alameda California NonForeign Affidavit Under IRC 1445 simplifies this process, assuring buyers and providing clear documentation. By securing this affidavit, sellers can foster greater trust and efficiency in their transactions.

The FIRPTA affidavit is generally provided by the seller of a property. Real estate professionals, such as agents or attorneys, may assist in preparing and submitting this document. Using the Alameda California Non-Foreign Affidavit Under IRC 1445 can streamline this process, ensuring that proper documentation is in place to avoid unnecessary tax withholdings. Professionals can guide sellers in completing this affidavit accurately to facilitate a smooth transaction.

An affidavit in the USA is a written statement that is confirmed by oath or affirmation, used as evidence in legal matters. It often serves to assert the truth of a particular fact or set of facts, especially in transactions like property sales. The Alameda California Non-Foreign Affidavit Under IRC 1445 exemplifies such a legal document, affirming a seller's status to satisfy tax regulations. These affidavits play an important role in facilitating transparent and trustworthy transactions.