Stockton California Stipulations for Award for Workers' Compensation

Description

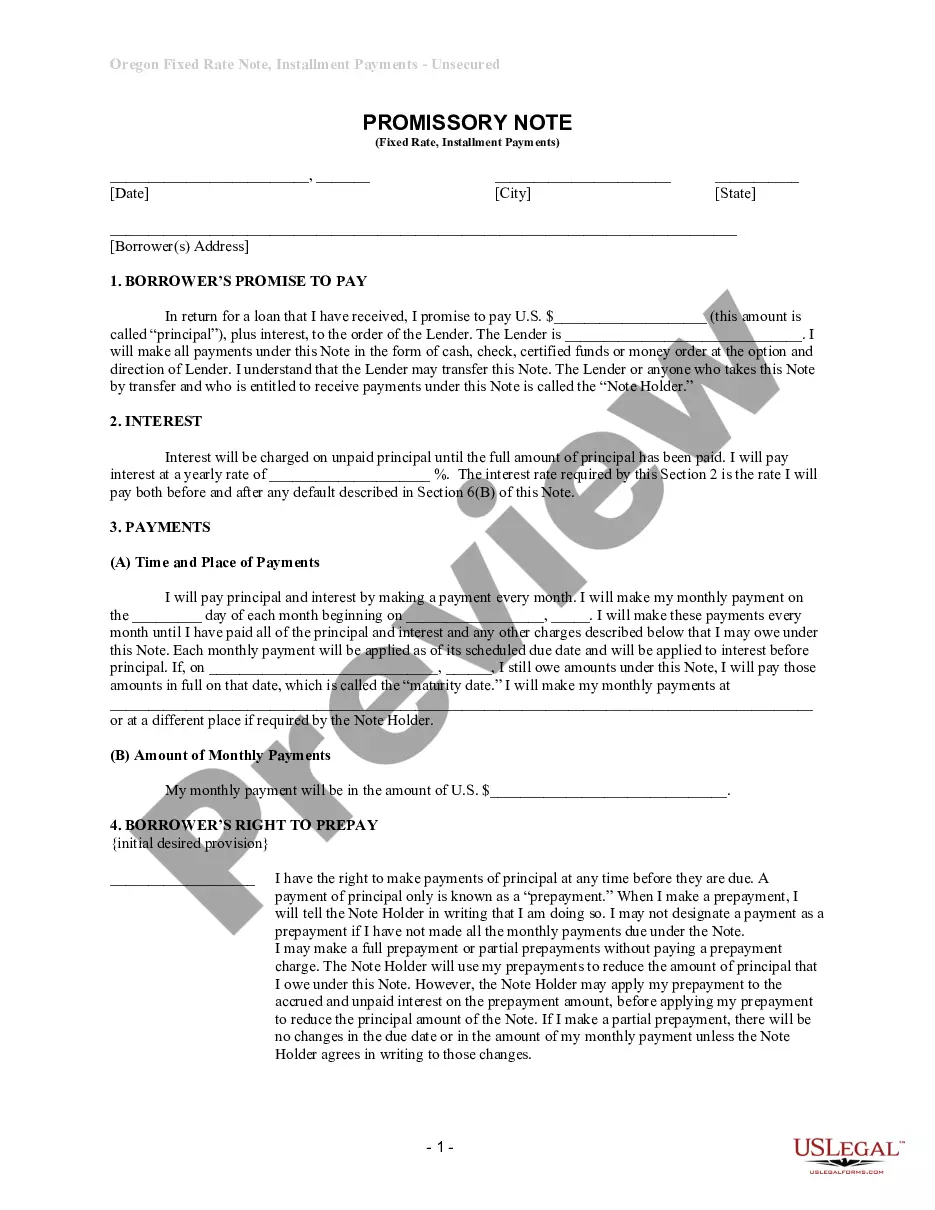

How to fill out California Stipulations For Award For Workers' Compensation?

Finding authenticated templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms collection.

It’s a digital resource of over 85,000 legal documents catering to both personal and professional requirements and various real-life scenarios.

All the files are appropriately organized by area of use and jurisdiction, making it straightforward to find the Stockton California Stipulations for Award for Workers' Compensation.

Maintaining organized records in compliance with legal requirements is crucial. Take advantage of the US Legal Forms library to have vital document templates for any needs readily available!

- Verify the Preview mode and form description.

- Ensure you’ve selected the correct document that fulfills your needs and completely aligns with your local jurisdiction criteria.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the correct one. If it meets your criteria, proceed to the next step.

- Complete the document purchase.

Form popularity

FAQ

The Average Workers' Comp Settlement In California, the average workers' compensation settlement is two-thirds of your pre-tax wages. Research shows that the typical amount is between $2,000 and $20,000.

If it is simply impossible for the duties to be changed, or if all the spots for changed duty have been filled, the employer would be within their rights to deny the employee's request.

If your employer refuses to make reasonable accommodations, you may not be able to return to work. In that situation, you may have to seek disability benefits or file a lawsuit against your employer for lost wages related to discrimination because of your injury.

In California, these benefits are calculated at two-thirds of your average weekly wages before the accident. However, there is a legal maximum and minimum that changes every year, depending on the statewide average wages. For 2022, the weekly maximum is $1,539.71, and the minimum is $230.95.

Calculating California Workers' Compensation Benefits In California, if you are injured on the job, you are entitled to receive two-thirds of your pretax gross wage. This is set by state law and also has a maximum allowable amount.

Yes. A California workers' compensation case will end either with a trial and judicial decision or a voluntary settlement between the injured worker and the insurance company.

A Stipulation and Award pays the injured worker for permanent disability. This must be paid at a specific dollar amount every week. A check is sent to the injured worker every other week. There is no lump sum payment.

Do employers have to offer light duty work? No.

If your employer cannot give you work that meets the work restrictions, the claims administrator must pay temporary total disability benefits (see Chapter 5). If you have questions or need help, use the resources in Chapter 10. Don't delay, because there are deadlines for taking action to protect your rights.

A Stipulation with Request for Award is an agreement between the injured worker and the insurance company as to the benefits that will be provided. It results in a Stipulated Award. A Compromise and Release is an agreement between the injured worker and the insurance company to end the case for a lump sum payment.