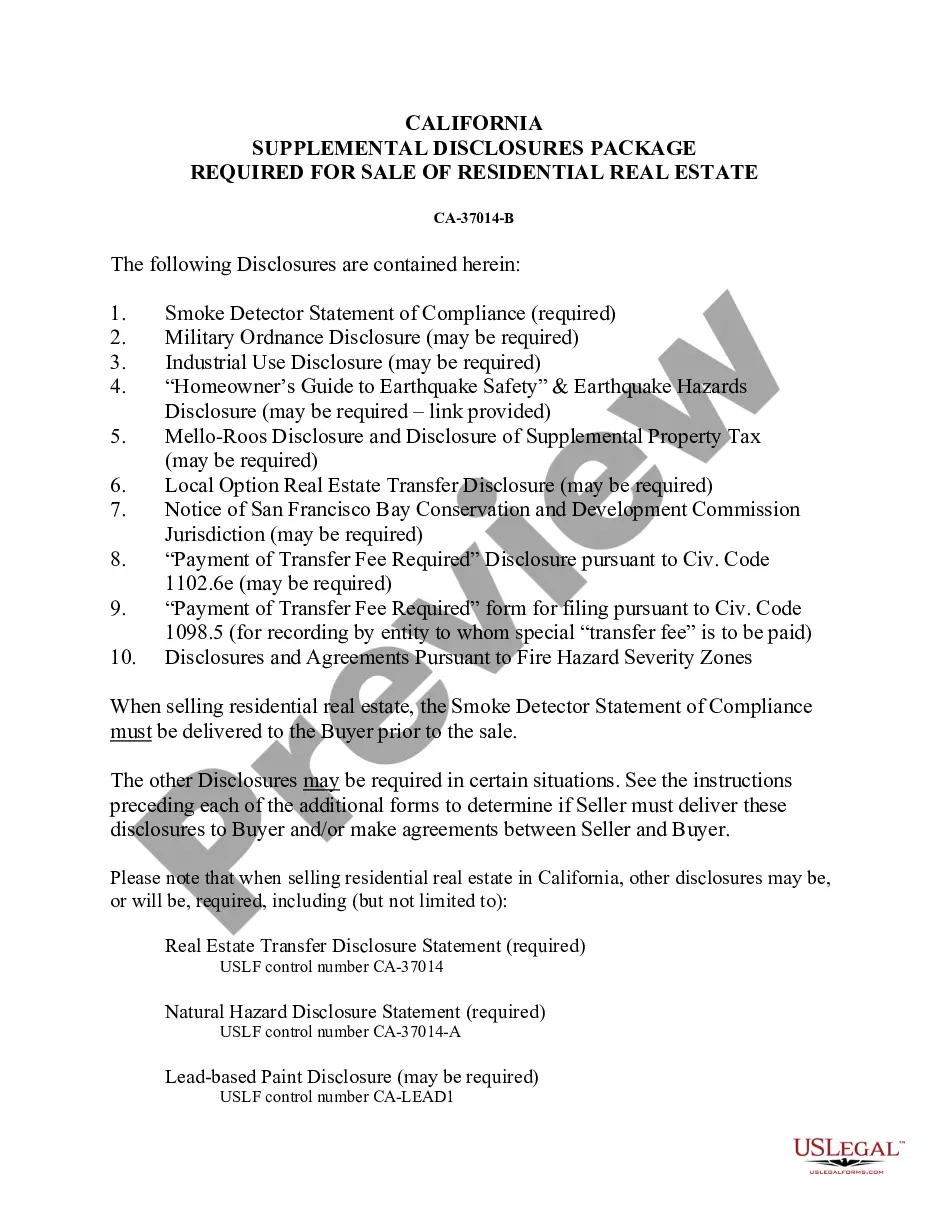

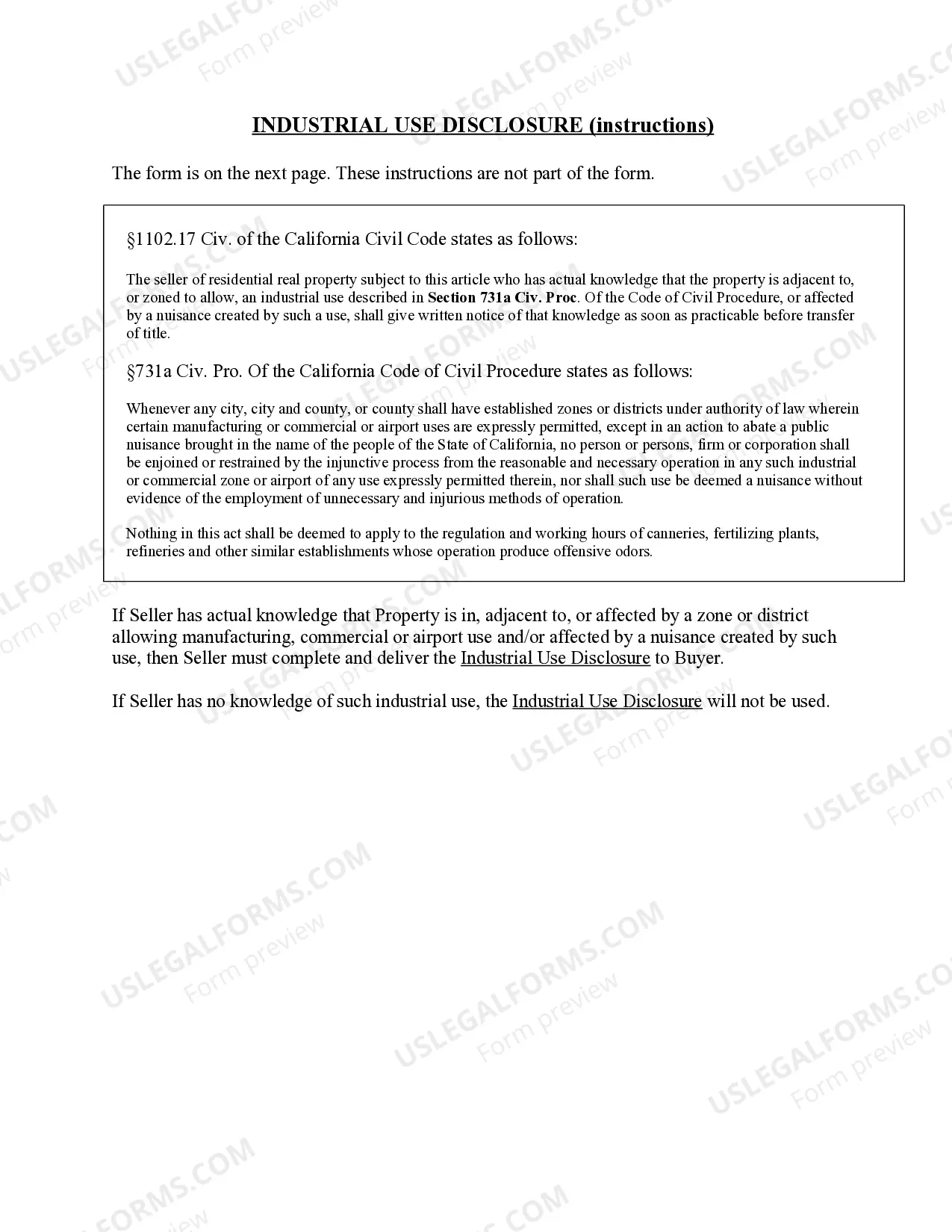

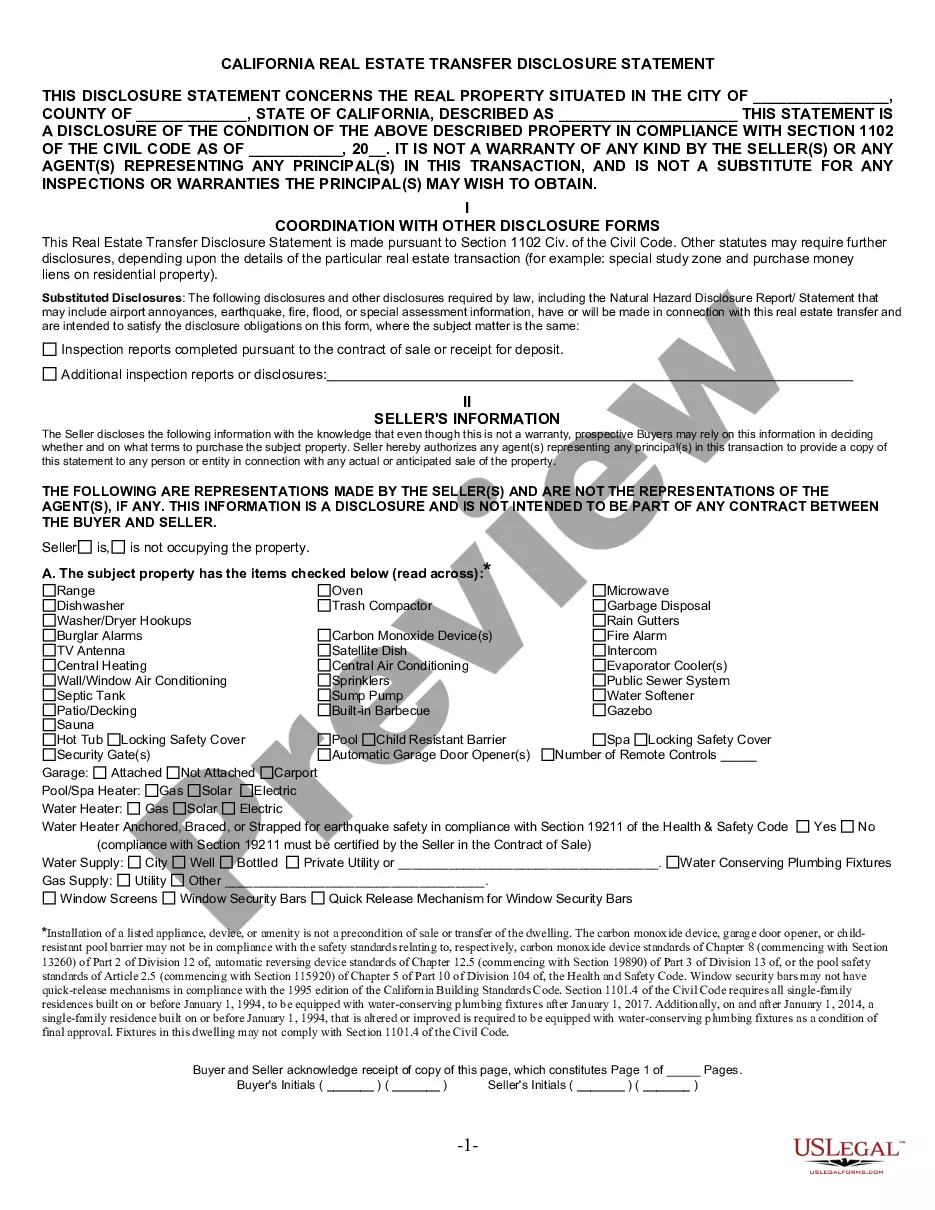

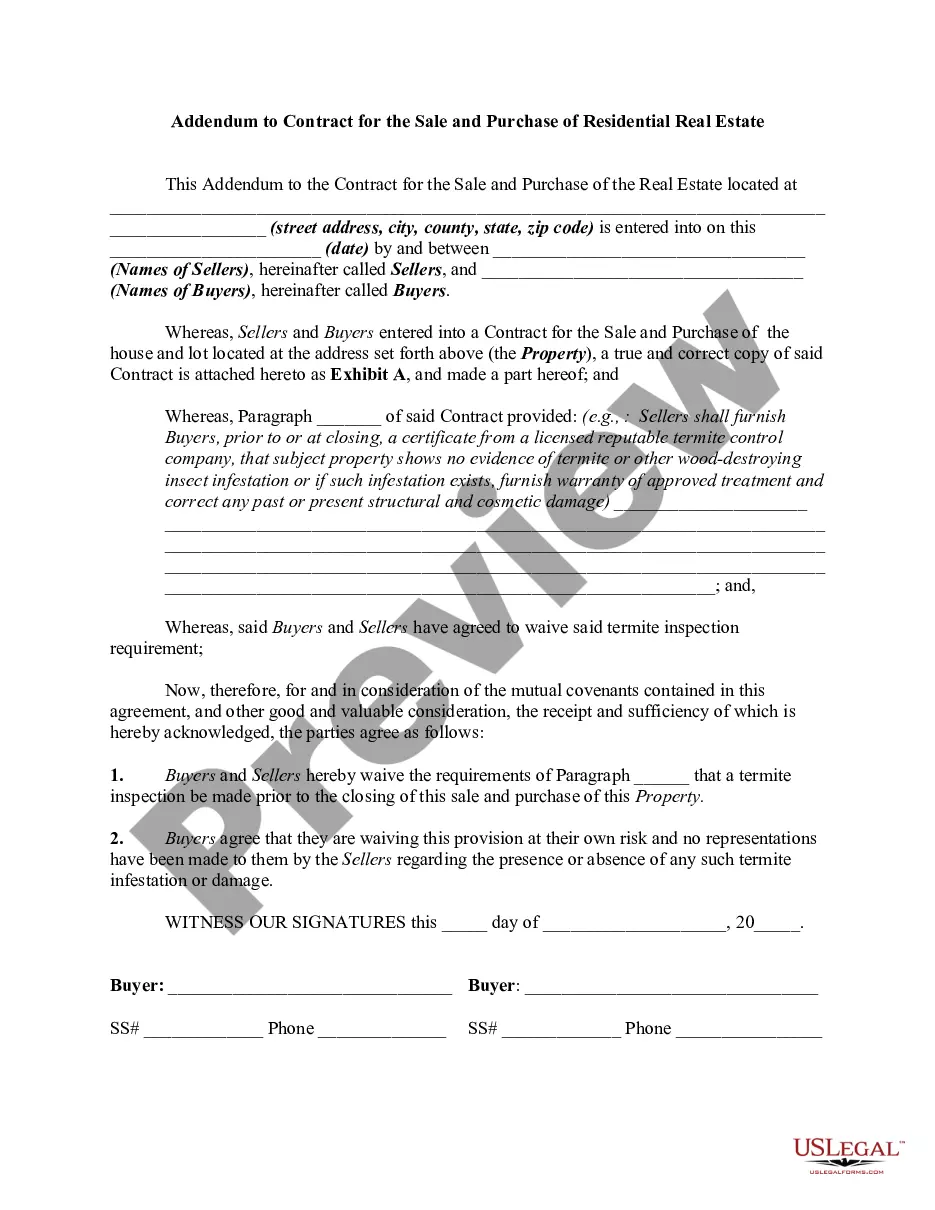

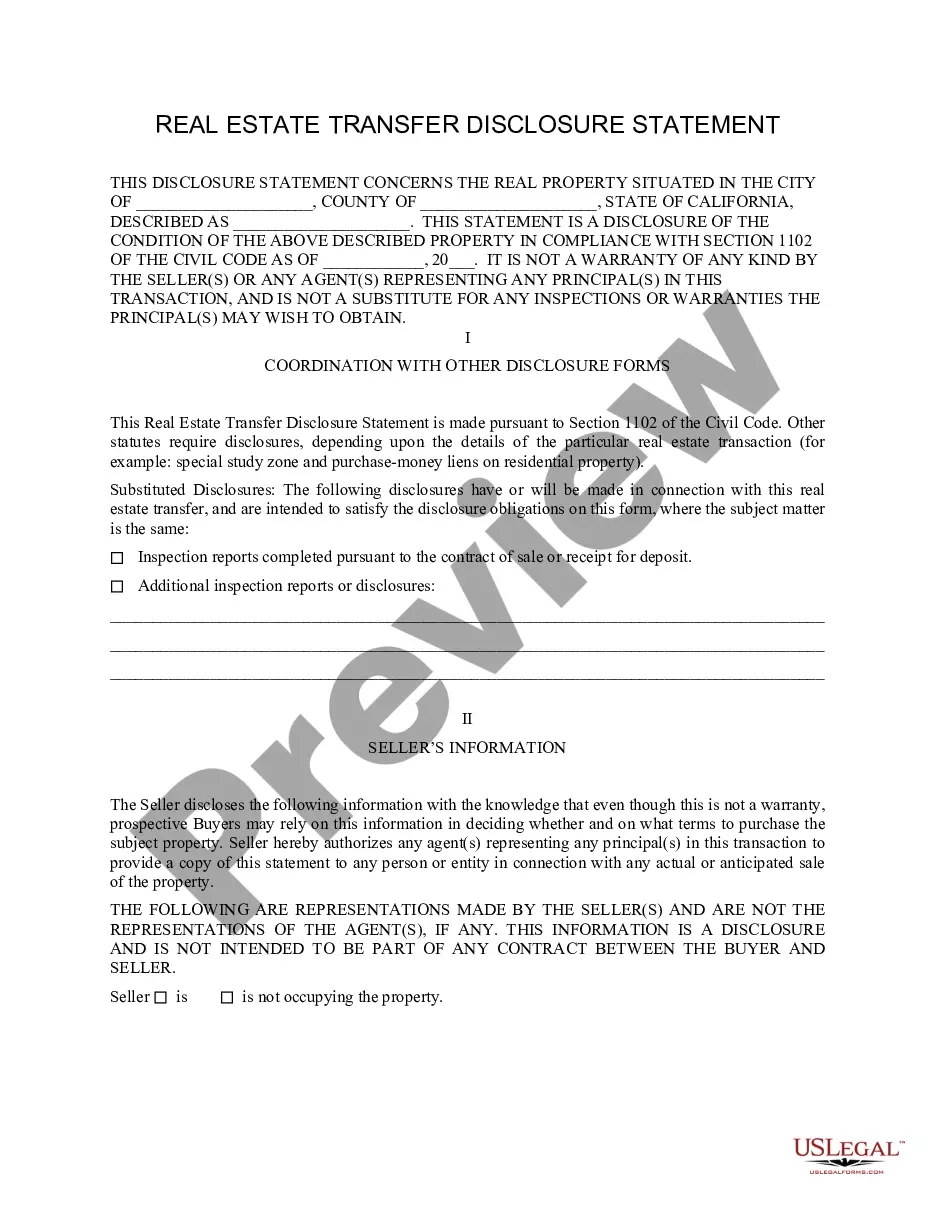

The following Disclosures are contained herein:

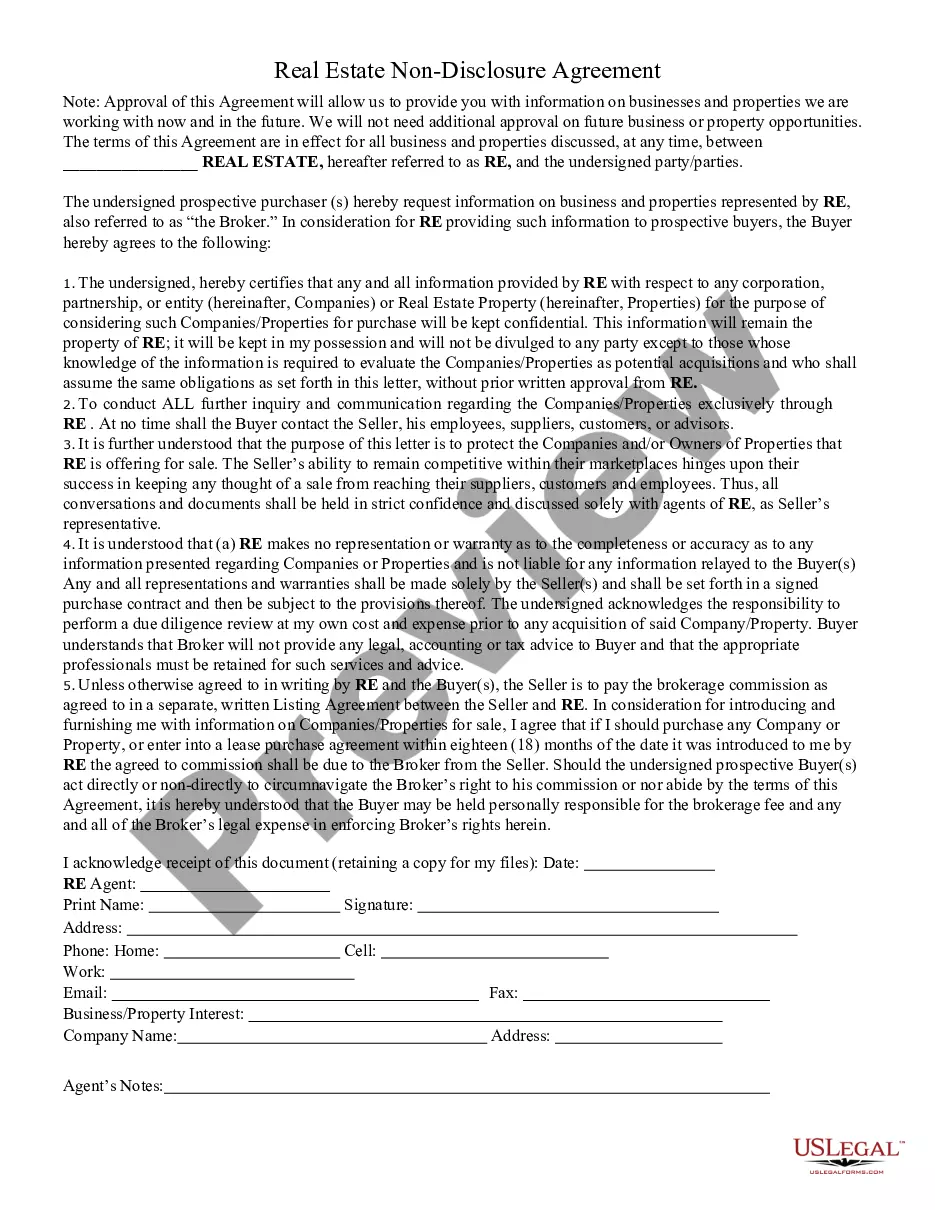

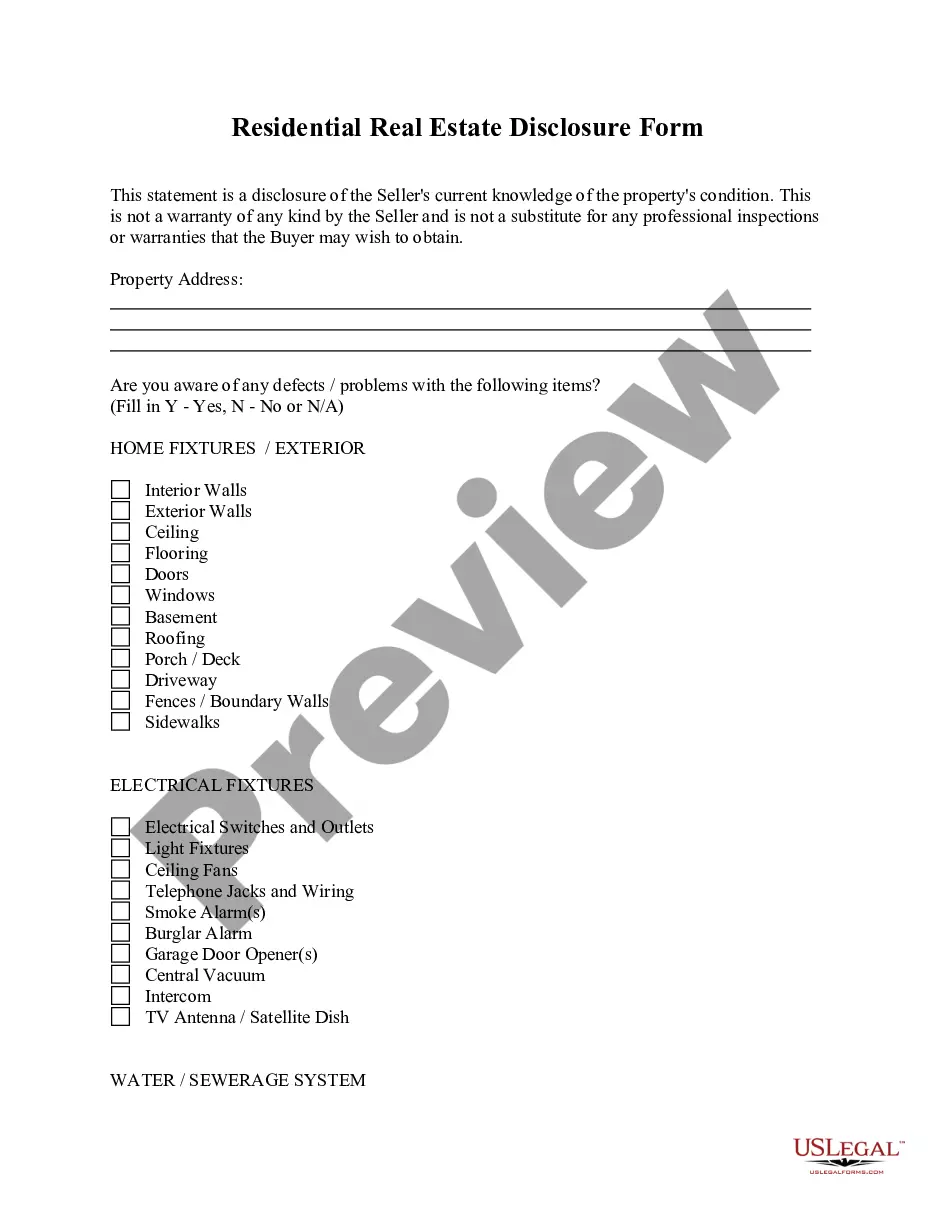

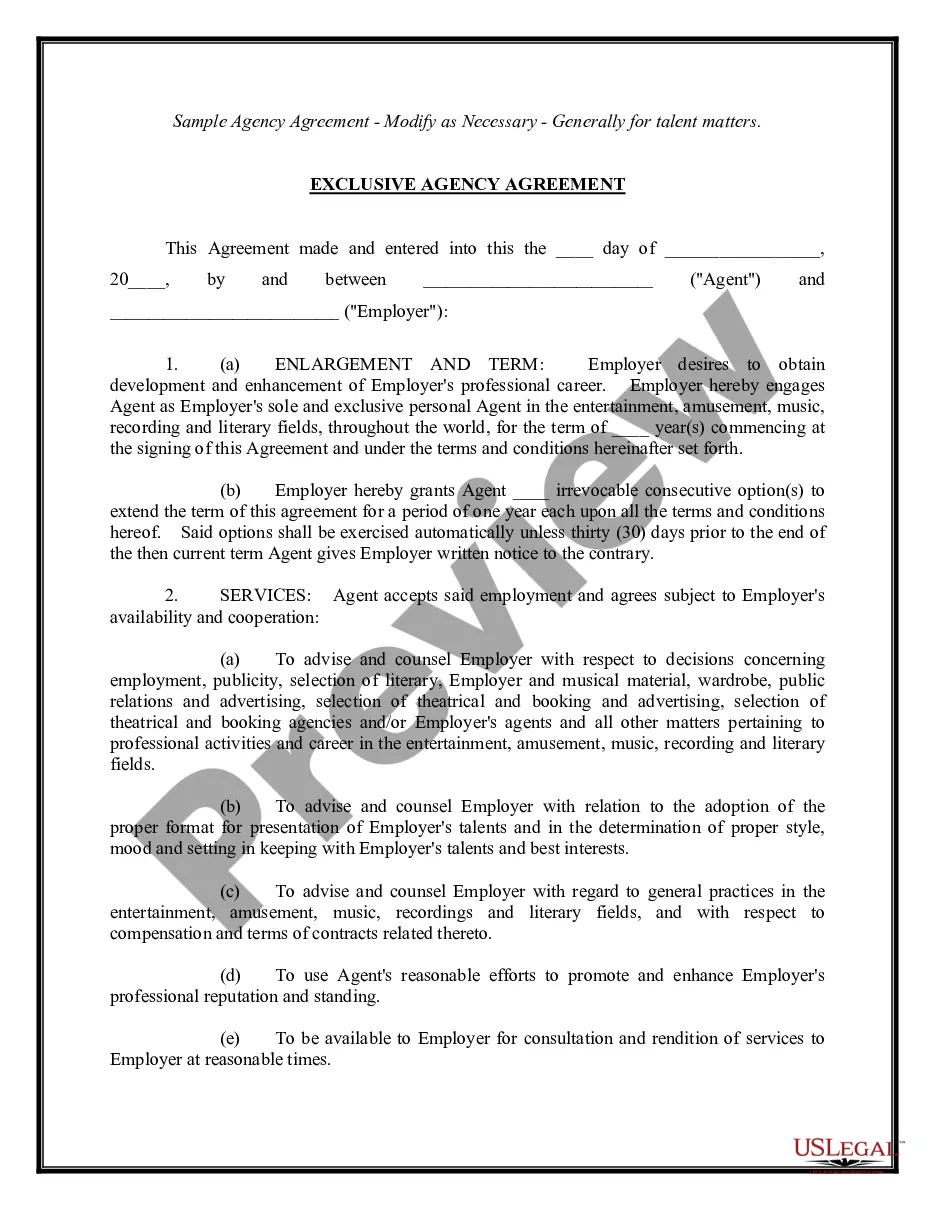

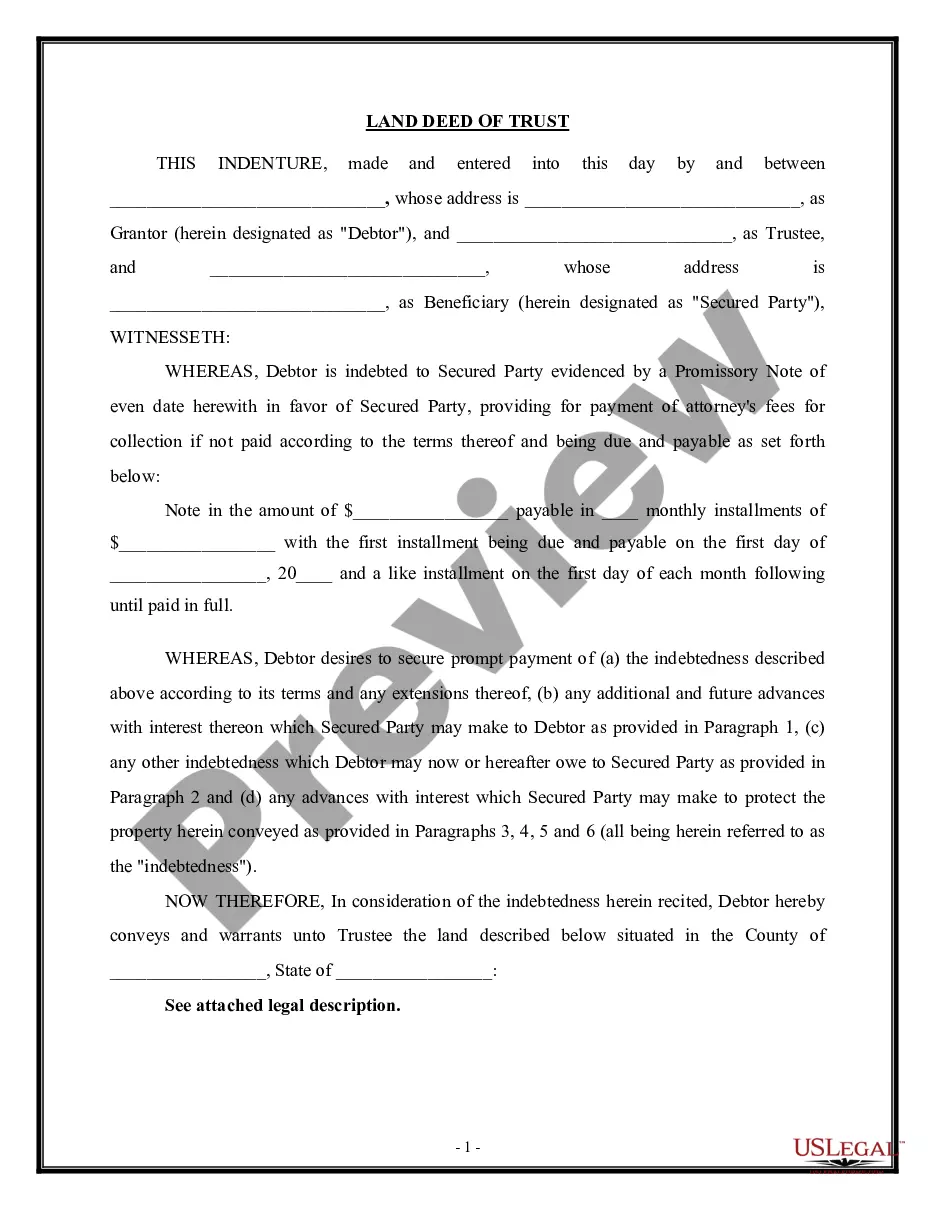

Riverside California Supplemental Disclosure Package for Residential Real Estate Sale

Description

How to fill out California Supplemental Disclosure Package For Residential Real Estate Sale?

Utilize the US Legal Forms and gain immediate access to any document template you need.

Our useful platform with a vast selection of templates makes it easy to locate and acquire nearly any document sample you require.

You can save, complete, and sign the Riverside California Supplemental Disclosure Package for Residential Real Estate Sale in just a few minutes instead of searching the internet for hours for the correct template.

Using our collection is an excellent way to enhance the security of your document submissions.

If you haven’t created an account yet, follow the instructions below.

Open the page with the template you need. Ensure that it is the document you were seeking: verify its title and description, and use the Preview option if it is available. Otherwise, utilize the Search feature to find the required one.

- Our experienced attorneys routinely review all the documents to ensure that the forms are suitable for a specific state and comply with current laws and regulations.

- How do you obtain the Riverside California Supplemental Disclosure Package for Residential Real Estate Sale.

- If you have an account, simply Log In to your profile.

- The Download button will be activated on all the documents you view.

- Additionally, you can access all the previously saved documents in the My documents section.

Form popularity

FAQ

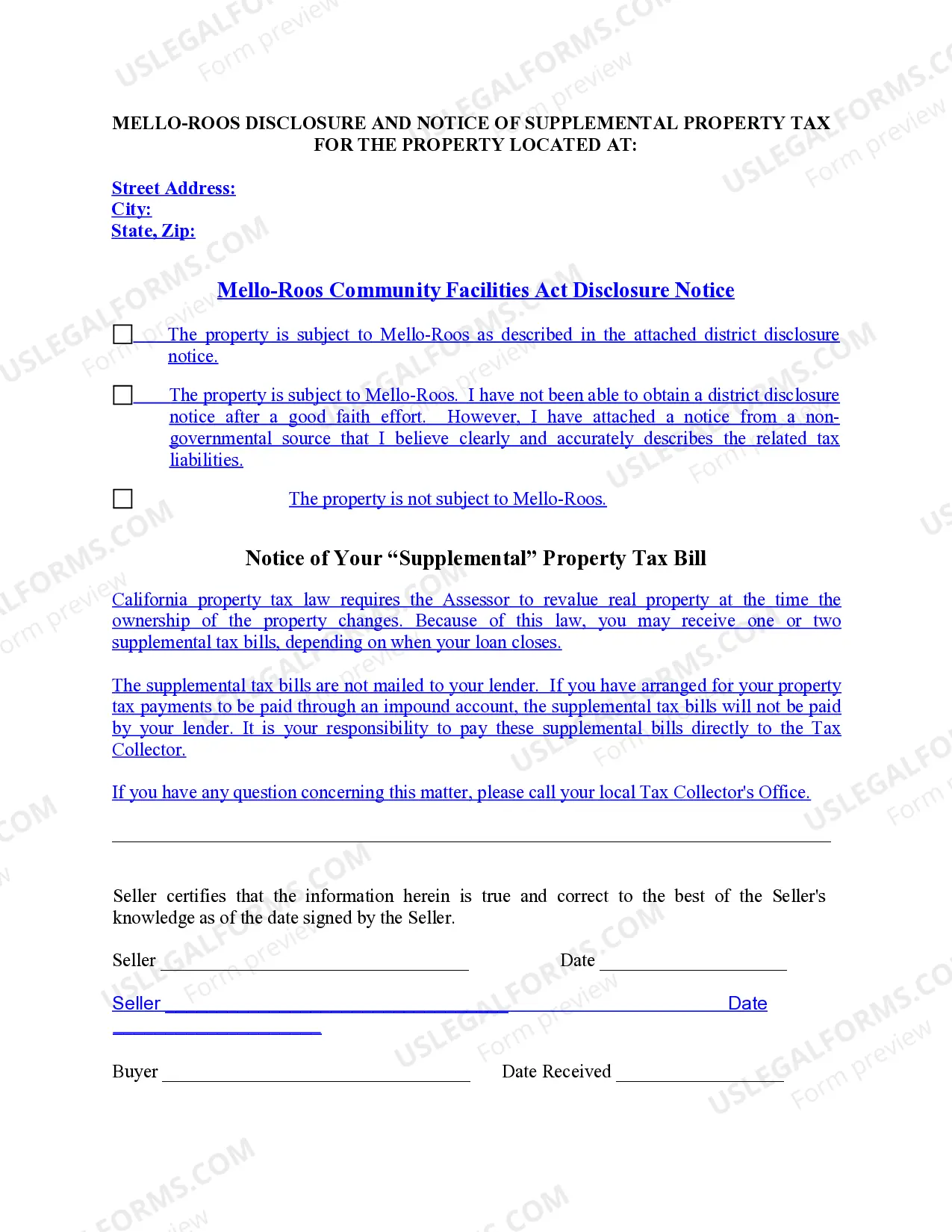

The property tax rate in Riverside County, CA, generally hovers around 1% of the assessed value, plus additional local assessments. This can vary slightly based on special assessments or voter-approved measures, so be aware of any specifics when discussing the Riverside California Supplemental Disclosure Package for Residential Real Estate Sale. For accurate figures, it's wise to consult the Riverside County Assessor's Office. They provide valuable insights that can enhance your real estate transactions.

The $7000 property tax exemption in California benefits homeowners by reducing their assessed value, thus lowering their tax bill. It applies to the first $7,000 of the market value of a qualifying owner's primary residence. If you are preparing your Riverside California Supplemental Disclosure Package for Residential Real Estate Sale, understanding this exemption can help inform potential buyers about tax benefits. Be sure to include pertinent details in your disclosures to give buyers a complete picture.

In California, property taxes continue for all property owners regardless of age. However, if you are 55 years or older, you may qualify for specific benefits like the Proposition 60 or Proposition 90, which allow you to transfer your assessed value to a new home. This means you can make the most of your Riverside California Supplemental Disclosure Package for Residential Real Estate Sale while enjoying potential savings. Always consult a local expert to navigate these options effectively.

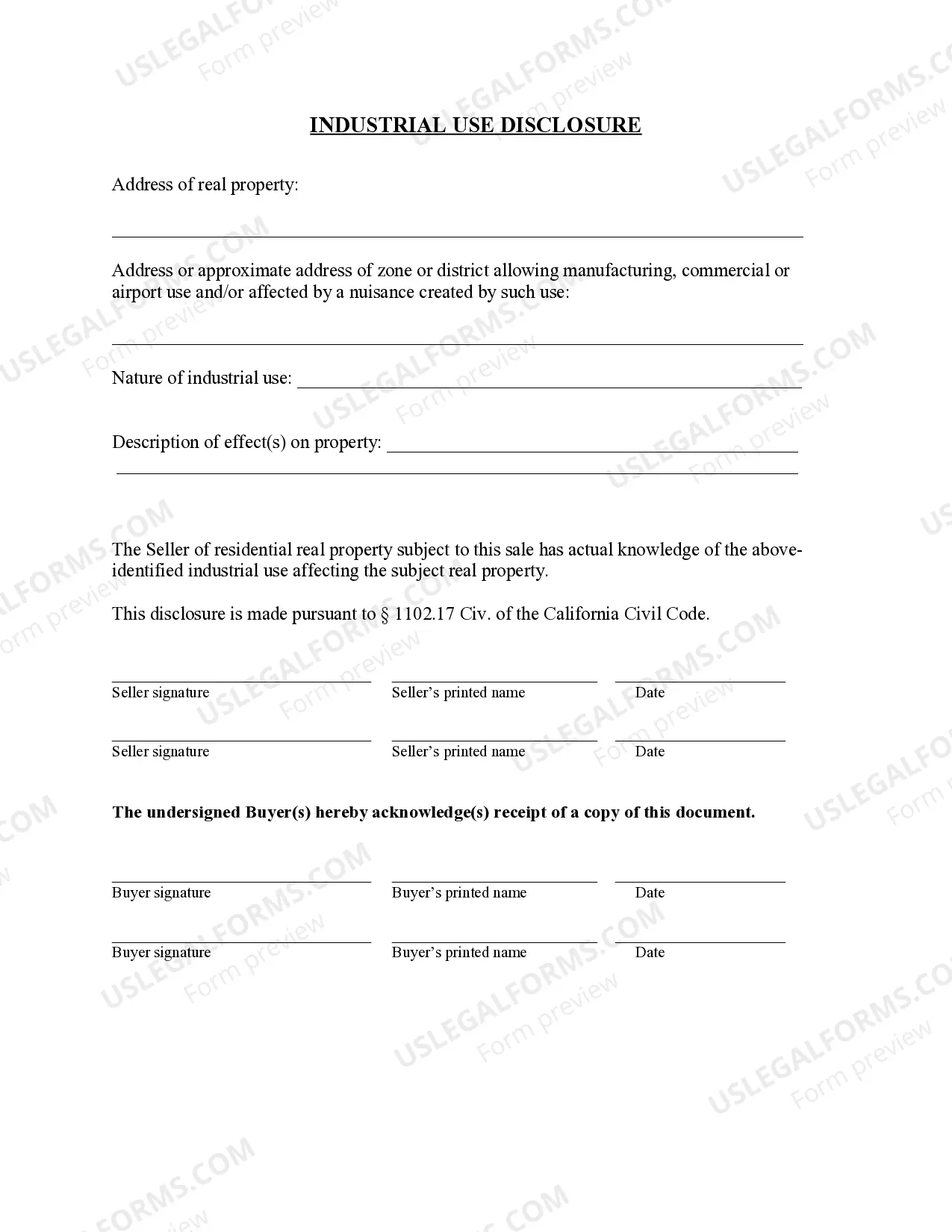

When selling vacant land in California, sellers must provide specific disclosures such as information about the property’s zoning, access, and any existing easements. Additionally, sellers should disclose any known environmental hazards or physical defects. Using the Riverside California Supplemental Disclosure Package for Residential Real Estate Sale can guide you through these disclosure requirements, ensuring compliance and transparency during your sale.

The supplemental tax exemption in California allows certain homeowners to reduce their property tax burden after purchasing a new home. This exemption applies if you qualify based on specific income requirements and if your new property meets the necessary criteria. Leveraging the Riverside California Supplemental Disclosure Package for Residential Real Estate Sale may help you understand how to navigate this exemption effectively.

To avoid property tax reassessment in California, property owners can utilize various exclusions and exemptions available in the law. This includes strategies like transferring property between family members under specific conditions. Residents in Riverside can refer to the Riverside California Supplemental Disclosure Package for Residential Real Estate Sale to identify steps they can take to safeguard themselves against unexpected tax increases.

The property tax loophole in California often refers to specific exemptions and the provisions that can limit tax reassessment. For example, Proposition 60 allows homeowners over 55 to transfer their tax basis to a new home. Understanding these loopholes is vital for Riverside homeowners, and the Riverside California Supplemental Disclosure Package for Residential Real Estate Sale elaborates on strategies to take advantage of them.

California real estate law mandates full disclosure of any material facts related to a property. Sellers must provide potential buyers with any known issues, defects, or factors that could affect the property's value. This disclosure is crucial in Riverside, as outlined in the Riverside California Supplemental Disclosure Package for Residential Real Estate Sale, ensuring buyers make informed decisions.

You can avoid property tax reassessment in California by ensuring that certain exemptions apply, such as the Parent-Child Exemption. This allows families to transfer property without triggering a reassessment. Knowing this, property owners in Riverside should explore options included in the Riverside California Supplemental Disclosure Package for Residential Real Estate Sale to secure potential savings.

Receiving a property tax bill while in escrow can be confusing. It often happens because property taxes are based on the property's assessed value and the due dates may not align perfectly with your escrow process. This can affect the final settlement, making it crucial for buyers in Riverside to refer to the Riverside California Supplemental Disclosure Package for Residential Real Estate Sale for clarity on tax responsibilities.