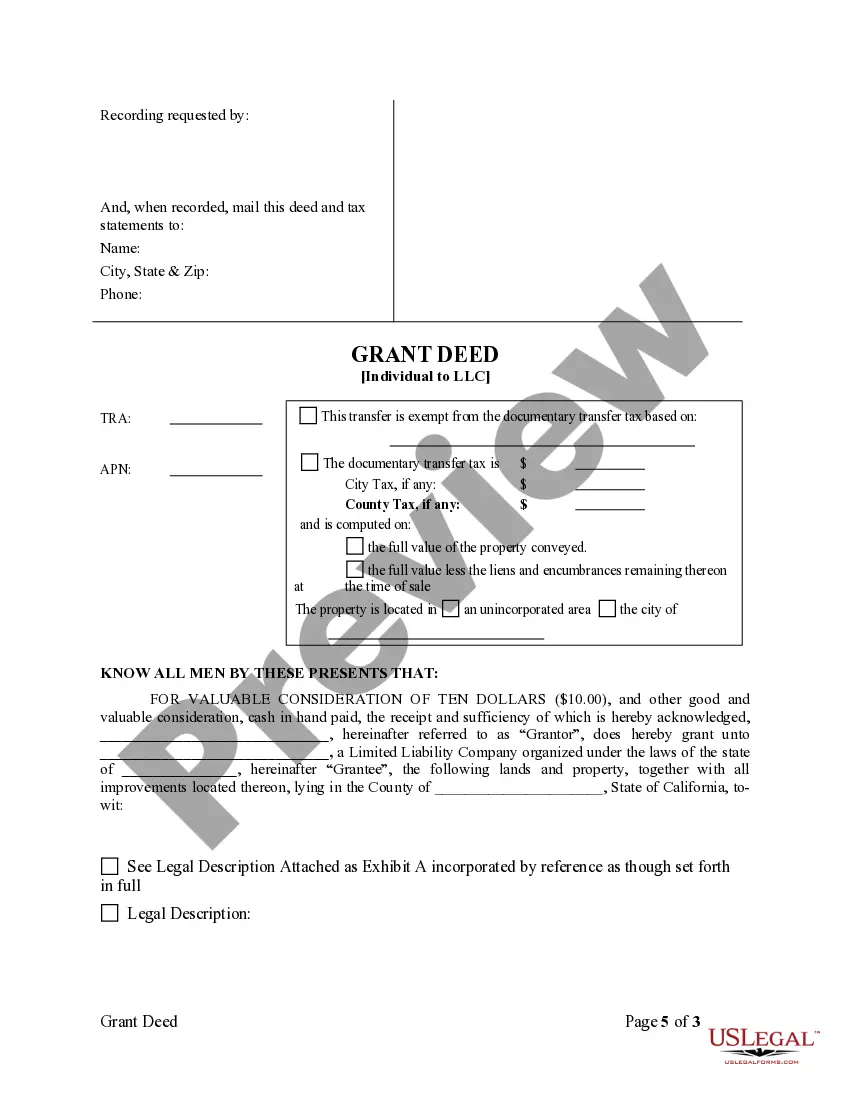

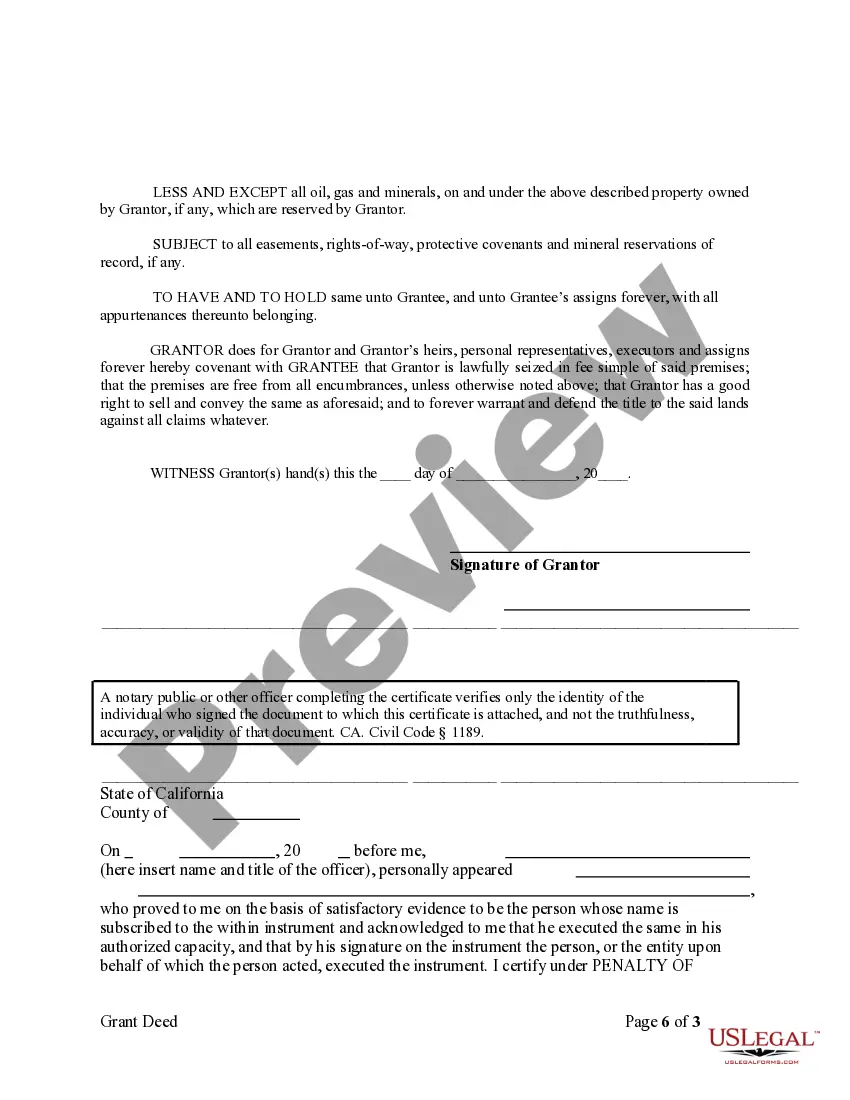

This Warranty Deed from Individual to LLC form is a Warranty Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and warrants the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Thousand Oaks California Grant Deed from Individual to LLC

Description

How to fill out California Grant Deed From Individual To LLC?

If you have previously utilized our service, Log In to your account and download the Thousand Oaks California Grant Deed from Individual to LLC onto your device by clicking the Download button. Ensure your subscription is active. If it isn’t, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You maintain continuous access to every document you have purchased: you can find it in your profile within the My documents section whenever you need to reuse it. Utilize the US Legal Forms service to quickly find and download any template for your personal or professional use!

- Confirm you’ve found the correct document. Review the description and use the Preview option, if present, to verify if it aligns with your requirements. If it does not fit your needs, employ the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and finalize your payment. Utilize your credit card information or the PayPal option to complete the payment process.

- Receive your Thousand Oaks California Grant Deed from Individual to LLC. Choose the file format for your document and save it onto your device.

- Finalize your document. Print it out or use professional online tools to complete it and sign it electronically.

Form popularity

FAQ

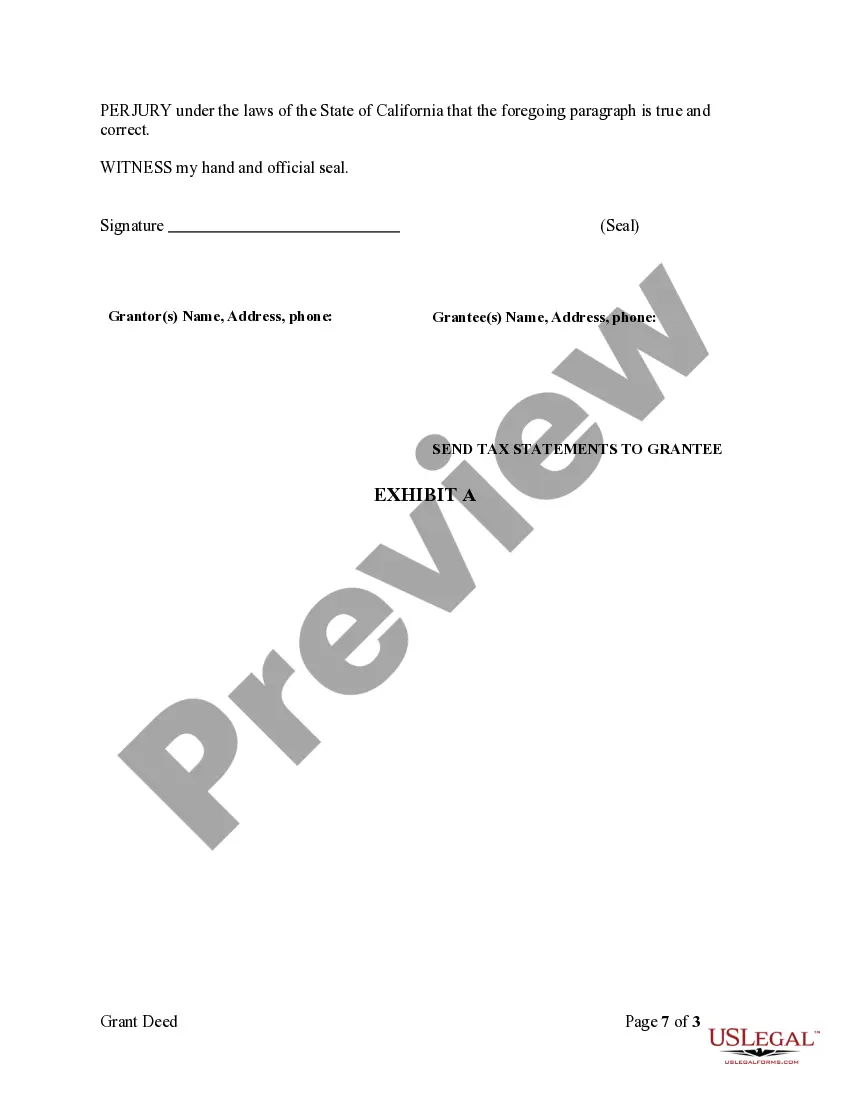

Filling out a grant deed form in California requires attention to detail. Begin by clearly stating the names of the grantor and grantee, which is essential when transferring property rights. Make sure to include a legal description of the property, and ensure compliance with local laws, especially for a Thousand Oaks California Grant Deed from Individual to LLC. For added ease, consider using a platform like US Legal Forms, which provides templates and guidance to help you complete the process accurately.

Yes, a single member LLC can own property, just like any other type of business entity. This structure allows for personal asset protection and can simplify the property management process. Specifically, you can use a Thousand Oaks California Grant Deed from Individual to LLC to ensure the property's ownership is clear and legally established. For guidance in managing this transfer, consider using USLegalForms for comprehensive support.

Yes, you can transfer personal assets to your LLC through a formal process. This typically involves creating a Thousand Oaks California Grant Deed from Individual to LLC, which legally documents the transfer. Keeping clear records of this transfer is important for tax implications and asset protection. USLegalForms offers resources to help you through this process, ensuring everything is completed correctly.

Putting your personal assets in an LLC can provide liability protection, separating your personal and business finances. However, before making this decision, assess your specific needs and consult with a professional. A Thousand Oaks California Grant Deed from Individual to LLC can effectively transfer these assets, helping secure your investment. Consider platforms like USLegalForms to navigate the paperwork involved smoothly.

Yes, you can transfer personal funds to your LLC. This process may involve treating the funds as a capital contribution to the business. However, maintaining clear records of these transactions is crucial for tax purposes. Securely managing your funds supports your LLC's growth and protects your personal assets, especially when done through methods like a Thousand Oaks California Grant Deed from Individual to LLC.

To transfer assets from personal to business, you can create a Thousand Oaks California Grant Deed from Individual to LLC. This legal document shifts ownership of your assets to the LLC, ensuring proper record-keeping and liability protection. It is essential to document this transfer to make tax filings easier and protect your interests. Using a platform like USLegalForms can simplify this process, providing you with the necessary forms and guidance.

Transferring property to an LLC in California may have tax implications, such as capital gains taxes and reassessment of property value. Utilizing a Thousand Oaks California Grant Deed from Individual to LLC can aid in understanding how to mitigate these tax consequences. Always consult with a tax professional to navigate the specifics of your situation effectively.

To transfer your property to an LLC in California, start by preparing a Thousand Oaks California Grant Deed from Individual to LLC. This deed must be properly filled out and filed with the county recorder’s office. Consulting with a legal expert can help ensure that the transfer meets all legal requirements and offers the desired protections.

Transferring a deed from an individual to an LLC involves creating and recording a Thousand Oaks California Grant Deed from Individual to LLC. This process legally changes the ownership from the individual to the LLC. Make sure to follow local guidelines and consider using a service like uslegalforms to simplify the process.

To transfer property title to an LLC in California, you’ll need to complete a Thousand Oaks California Grant Deed from Individual to LLC. Ensure that the deed contains the necessary information, including the legal description of the property and the names of the parties involved. After completing this step, file the deed with the county recorder’s office.