This Warranty Deed from Individual to LLC form is a Warranty Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and warrants the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

San Diego California Grant Deed from Individual to LLC

Description

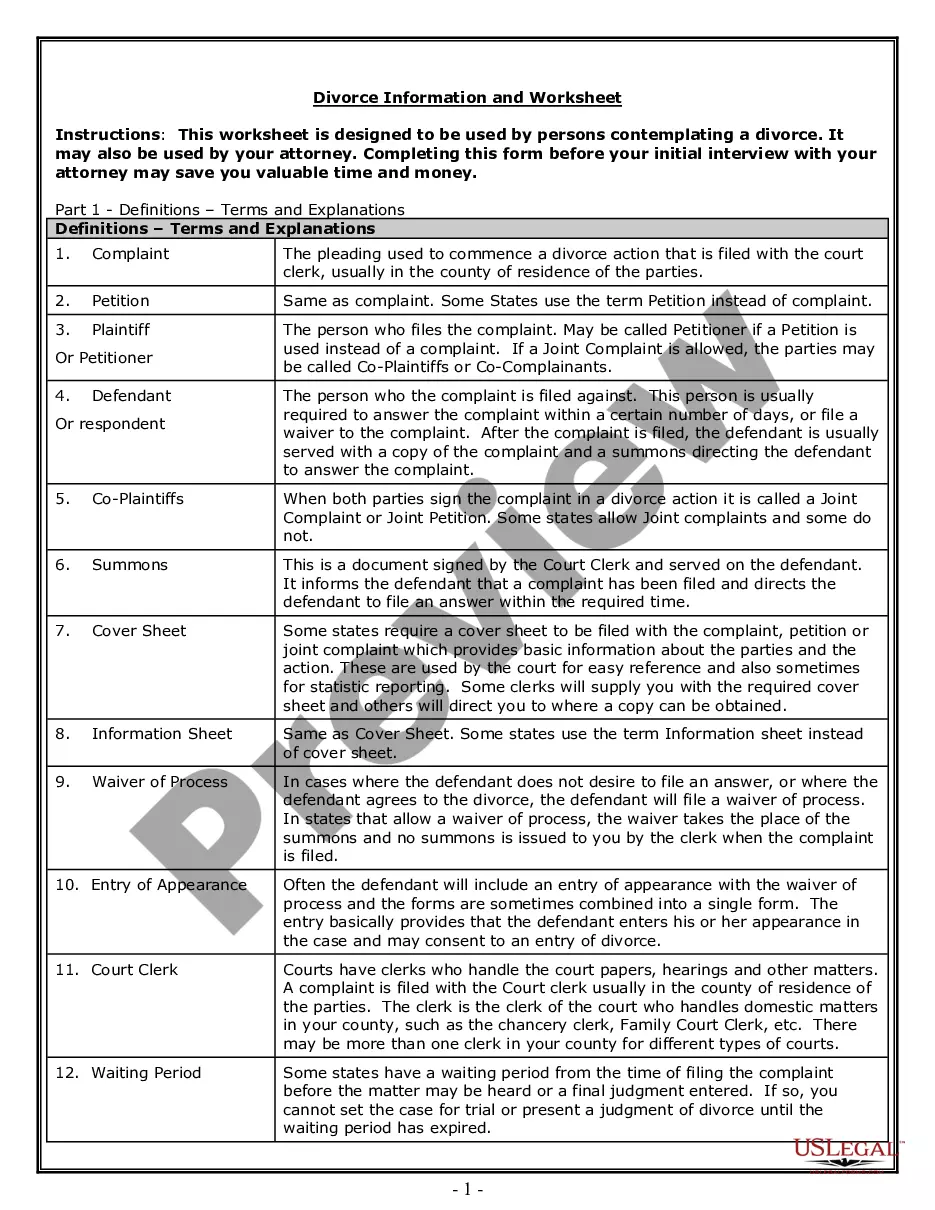

How to fill out California Grant Deed From Individual To LLC?

Regardless of social or occupational rank, completing legal forms is a regrettable necessity in the current professional landscape.

Frequently, it’s nearly impossible for individuals lacking legal expertise to create such documents from scratch, primarily due to the intricate terminology and legal subtleties they entail.

This is where US Legal Forms can assist.

Confirm the form you’ve found is applicable in your area since the regulations of one state or county do not apply universally.

Evaluate the document and review a brief description (if provided) of scenarios applicable to the document. If the choice you made does not satisfy your requirements, you can restart and search for the necessary document.

- Our platform provides a vast array of over 85,000 state-specific forms that can cater to virtually any legal scenario.

- US Legal Forms acts as a resourceful tool for associates or legal advisors keen on conserving time through our DIY forms.

- Whether you need the San Diego California Grant Deed from Individual to LLC or any other suitable document for your state or county, US Legal Forms places everything within reach.

- Here’s how you can acquire the San Diego California Grant Deed from Individual to LLC swiftly with our reliable service.

- If you are already a customer, you may proceed to Log In to your account to retrieve the appropriate form.

- However, if you are new to our service, please ensure to follow these guidelines before downloading the San Diego California Grant Deed from Individual to LLC.

Form popularity

FAQ

Yes, you can change a deed without a lawyer in California, but it is crucial to follow the correct legal procedures. You must prepare and file the necessary documents, such as a new grant deed. While legal advice can be beneficial, platforms like UsLegalForms can offer templates and instructions to facilitate the process, ensuring you stay compliant and informed.

To remove someone from a grant deed in California, you will need to prepare a new grant deed that excludes the person you wish to remove. This deed must be signed and notarized, then filed with the county recorder's office. It is essential to ensure that all legal avenues are followed to avoid complications. UsLegalForms provides valuable resources to guide you through this process smoothly.

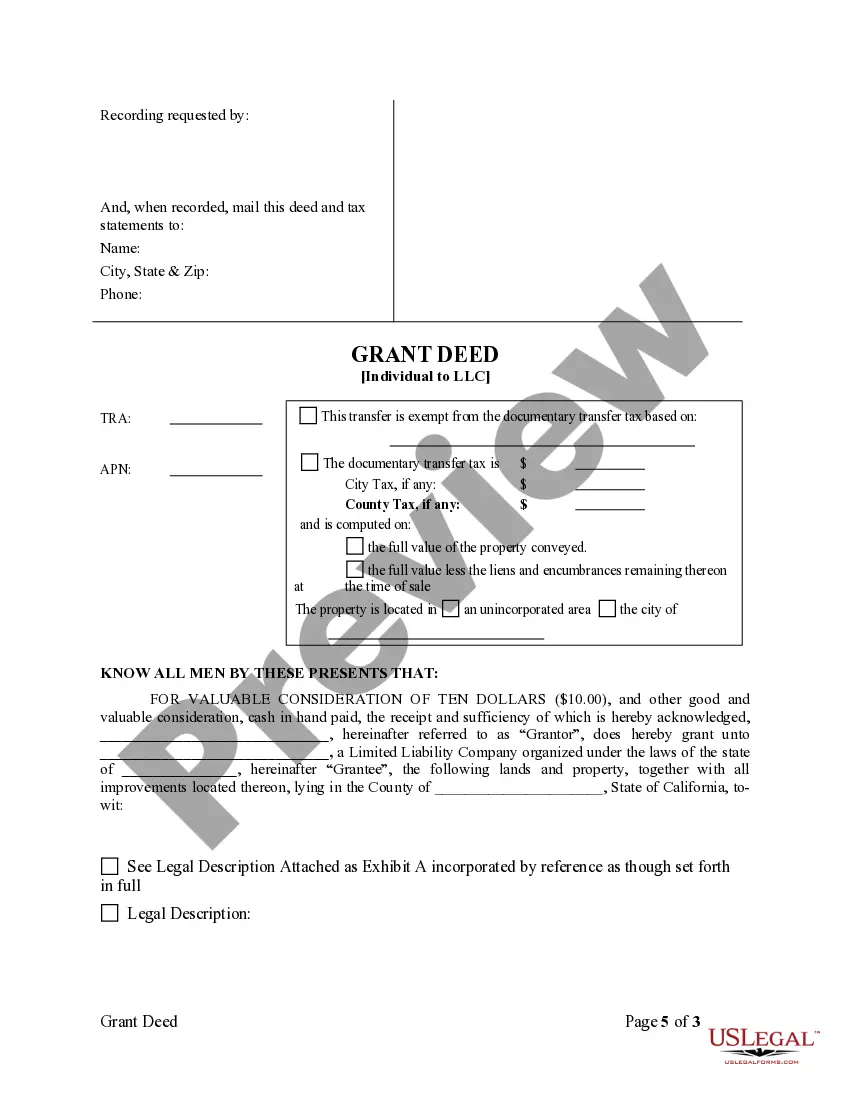

Filling out a California grant deed requires clear identification of the grantor and grantee, as well as a legal description of the property. You should correctly input all pertinent details, ensuring accuracy to avoid issues. Once the deed is filled out, a notary must witness the signing. For assistance in completing the deed, consider UsLegalForms, which offers user-friendly templates tailored for your needs.

Changing a grant deed in California involves drafting a new deed that reflects the desired changes. This new deed must include all relevant details and be signed in front of a notary. Once completed, file the new deed with your local county recorder. Using UsLegalForms can simplify creating and filing the necessary documents.

To correct a grant deed in California, you must prepare a new deed that explicitly states the corrections. It is essential to sign the new deed and have it notarized. After that, you need to file the corrected deed with the county recorder's office. Utilizing resources like UsLegalForms can help streamline this process, ensuring compliance with state requirements.

Many individuals choose to place their houses under an LLC to protect their personal assets from liability and lawsuits associated with rental properties or business ventures. This approach also offers privacy benefits, as an LLC can shield the owner's name in public records. Furthermore, it may simplify the process of transferring the property to heirs. Thus, engaging in a San Diego California Grant Deed from Individual to LLC offers various strategic advantages.

An LLC owning property can enjoy several tax benefits, including the ability to deduct property-related expenses from its income. Additionally, LLCs offer pass-through taxation, which means that profits and losses are reported on the owners' personal tax returns, avoiding double taxation. Owners may also benefit from asset protection, safeguarding personal assets from claims against the LLC. Therefore, a San Diego California Grant Deed from Individual to LLC can provide substantial financial advantages.

To change a grant deed in California, you must first complete a new deed form, specifying the new owner’s details. Next, you'll need to sign the deed, ideally in front of a notary. After that, record the new deed with the local county recorder's office to finalize the process. This is crucial if you plan a San Diego California Grant Deed from Individual to LLC since it ensures proper legal recognition.

Using an LLC to hold property can lead to complications in estate planning since transferring ownership upon death may become more complex. Moreover, if the LLC faces financial difficulties, the property may be subject to creditor claims. This situation can make holding property in an LLC less attractive for some individuals. Therefore, when executing a San Diego California Grant Deed from Individual to LLC, it's wise to think about these possible challenges.

One notable disadvantage of transferring a property to an LLC is the potential loss of certain tax benefits. Homeowners may also lose out on exemptions like the capital gains exclusion when selling their property. Additionally, setting up an LLC incurs costs for formation and maintenance, which individuals should consider. Thus, when considering a San Diego California Grant Deed from Individual to LLC, it's essential to weigh these factors carefully.